- Ether Lee’s stable supply has reached a new highest growth of the network of networks.

- In addition to the Etherum Protocol, the additional $ 5 billion has been added, as trading activities have soared to a new level.

After the rapid 26% decrease in the last month, Ether Lee (ETH) has taken a different path with 8.44% rally over the last 24 hours. As the activity increases, the market interest will continue, and these upward movements will continue.

Currently, the main indicators show significant growth, suggesting that market participants can accumulate ETH and increase prices in the next few weeks. AmbCrypto analyzed some of the factors that contributed to ETH’s potential rally.

Ether Lee’s stablecoin supply reaches the new high.

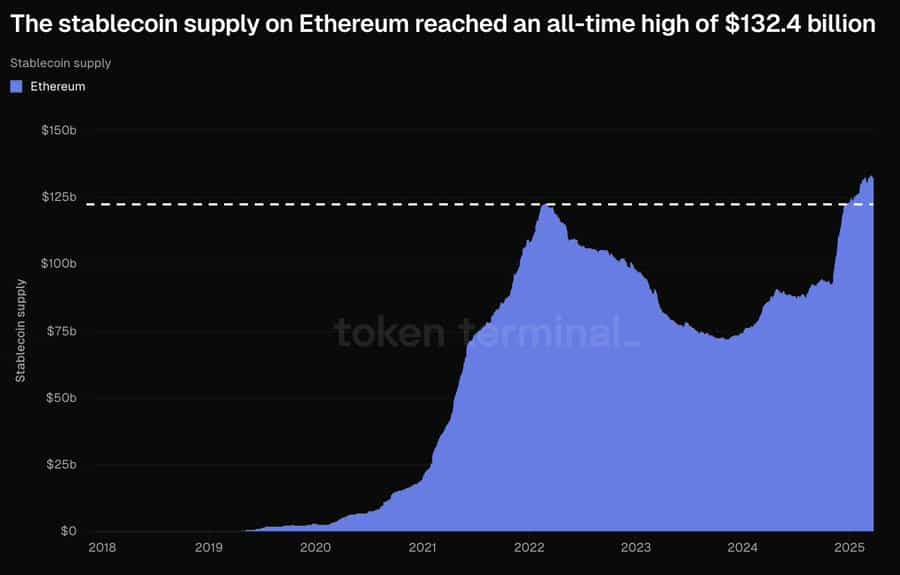

Ether Leeum, famous for its innovative ecosystem, continues to attract stable arrangements. The total stable coin supply has recently reached a record high of $ 132.4 billion. The highest level since its founding.

Source: Tokenterminal

STABLECOINS is a cryptocurrency designed to maintain a 1: 1 peg with the same assets as the US dollar, providing hedging for market volatility to traders and investors. They have become a preferred option for storing assets and promoting cryptocurrency transactions.

Increasing stable supply in the blockchain increases demand as the trader is for higher purchasing activities. AmbCrypto has explored additional factors to assess the potential impact on these assets.

Inflow of liquidity to the surge in Ether Leeum

Ether Lee Riium has significantly surged after the stable coin supply has reached a record high level.

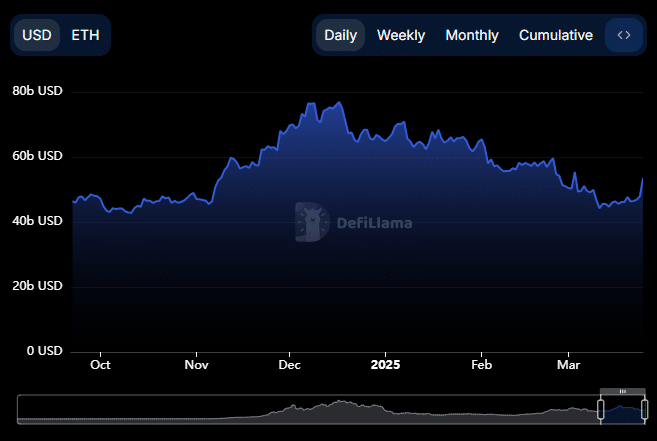

Defillama’s total value lock (TVL), which evaluates ecosystem growth, shows that Ether Lee’s TVL has increased from $ 47.2 billion to $ 5.5 billion in $ 54.4 billion in the last 24 hours.

Source: Defillama

Such growth suggests an increase in Ether Leeum’s accumulation, and assets are locked across several protocols, increasing interest in investors.

AMBCRYPTO also increased the Netflow of Ethereum and ranked the second highest chain in liquidity inflow just after Berachain for the last 24 hours.

According to ARTEMIS’s data, $ 22.2 million was added to the Etherrium network to strengthen continuous positive development.

Long -term ETH is increasing

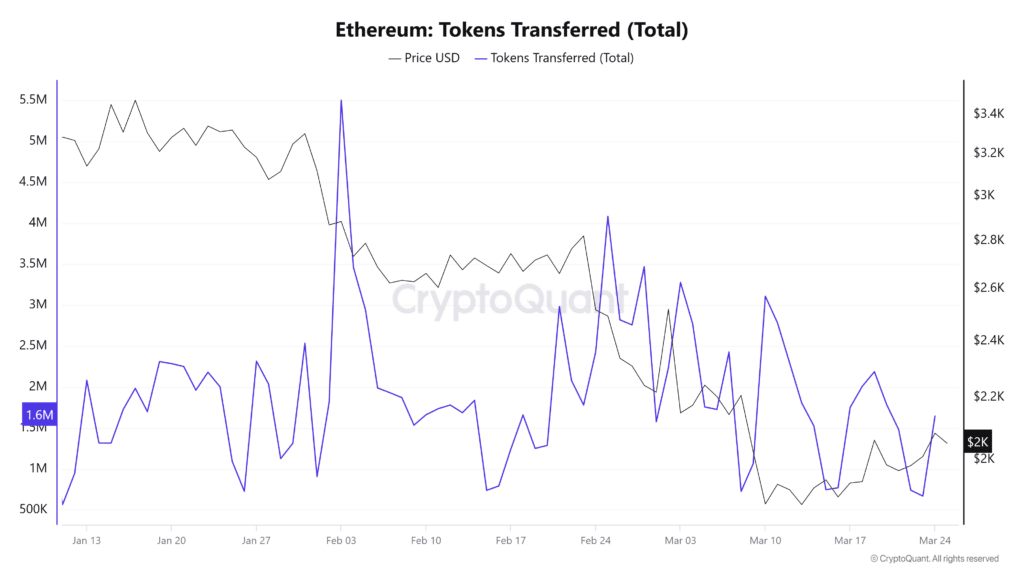

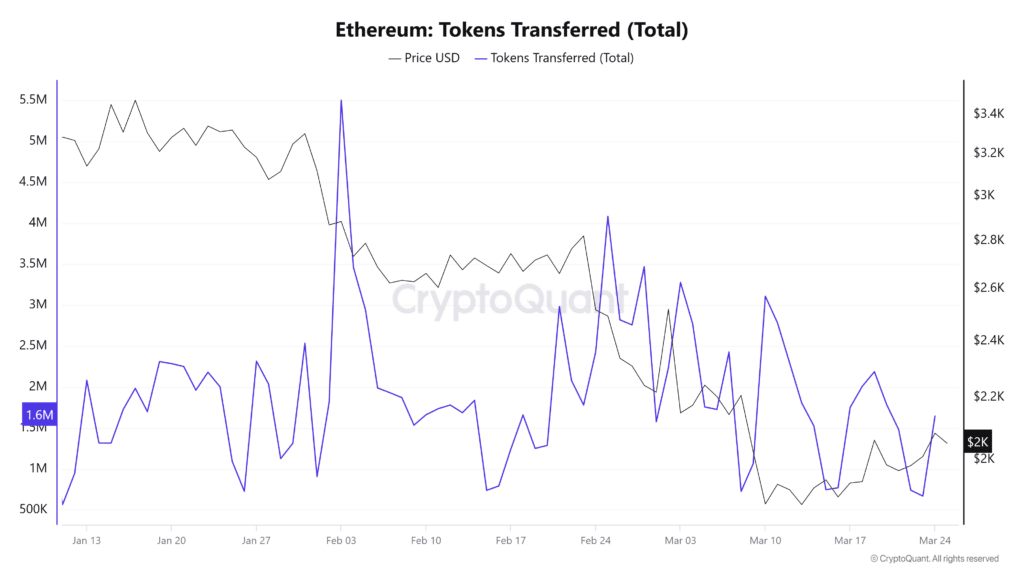

Ether Lee’s total token transfer has increased by about 9.33% over the last 24 hours, increasing market activities. This exercise can indicate purchases or sales pressure.

Source: cryptoquant

To clarify AmbCrypto analyzed Ethereum’s Exchange Reserves and concluded that the recent transmission supports positive prospects for ETH.

Exchange Reserves represents the amount of ETH available for transactions. More reserves generally show an increase in sales pressure, and low reserves suggest long -term retention.

Recently, the reduction of ETH reserves means that traders are relocating their assets to their personal wallets for long -term storage, which can have a favorable effect on ETH’s price over time.