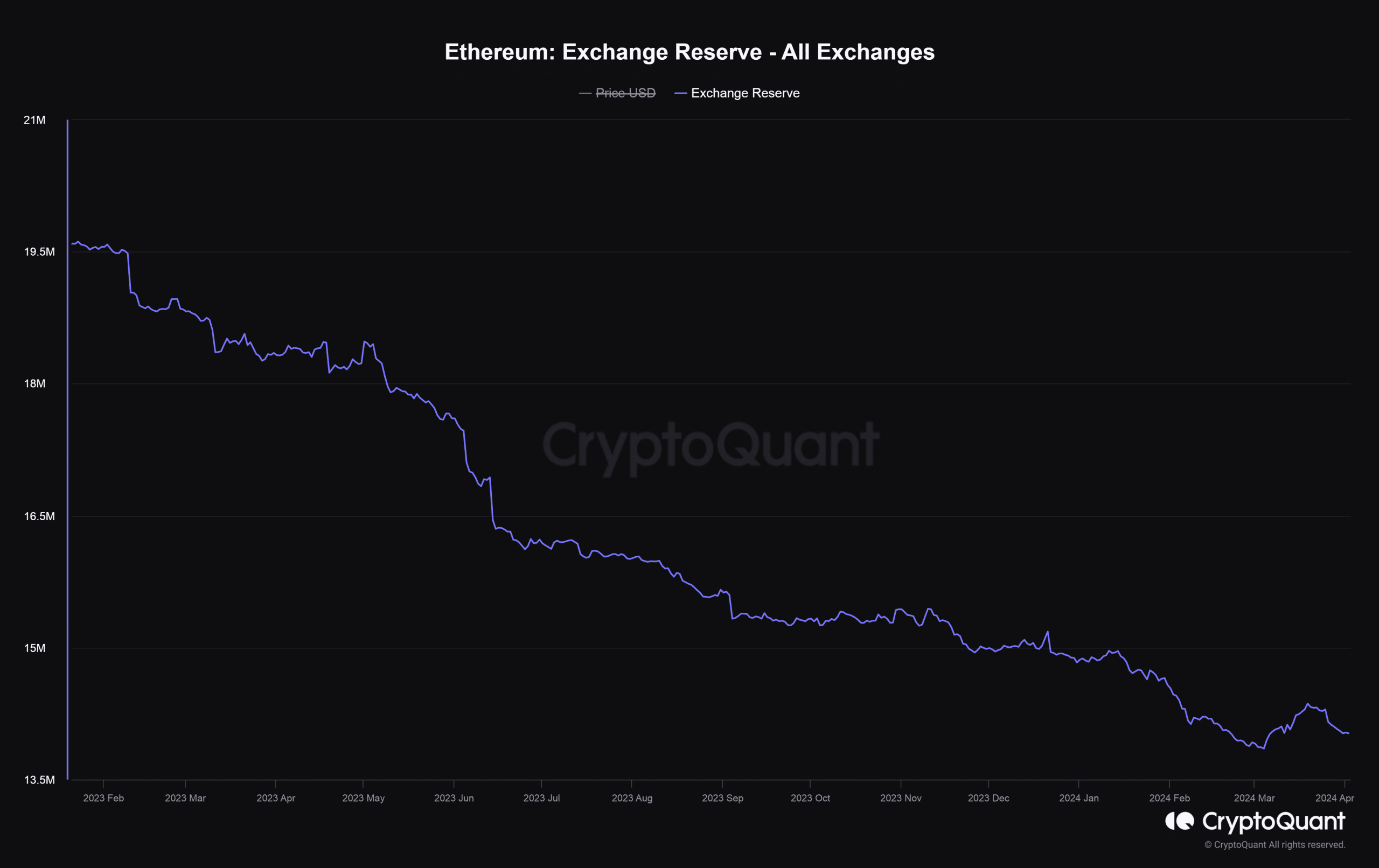

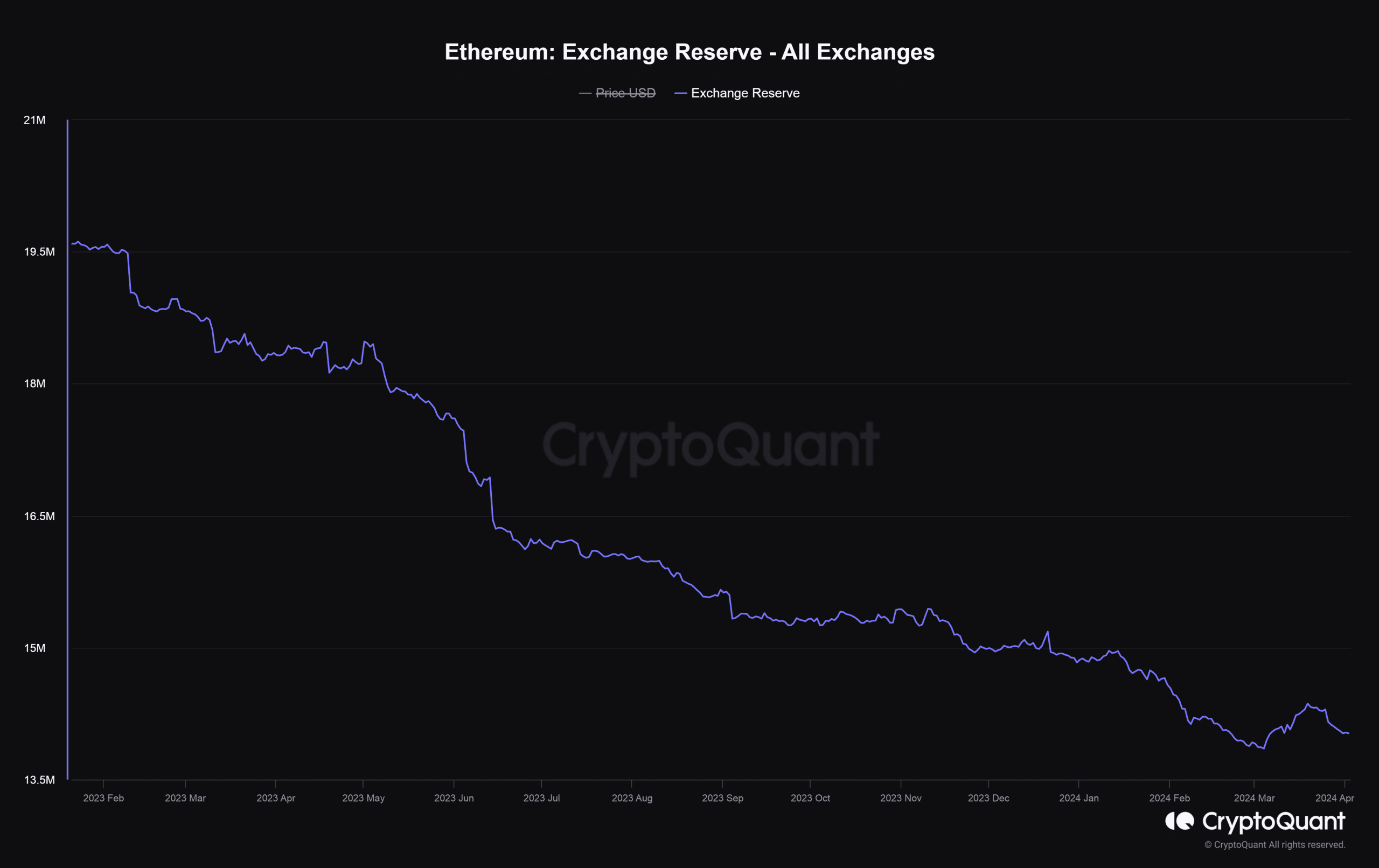

- The increase in staked supply represents a shift from risky market trading to guaranteed and stable returns.

- ETH has fallen 6.5% in the last 24 hours, putting it at risk of a further plunge.

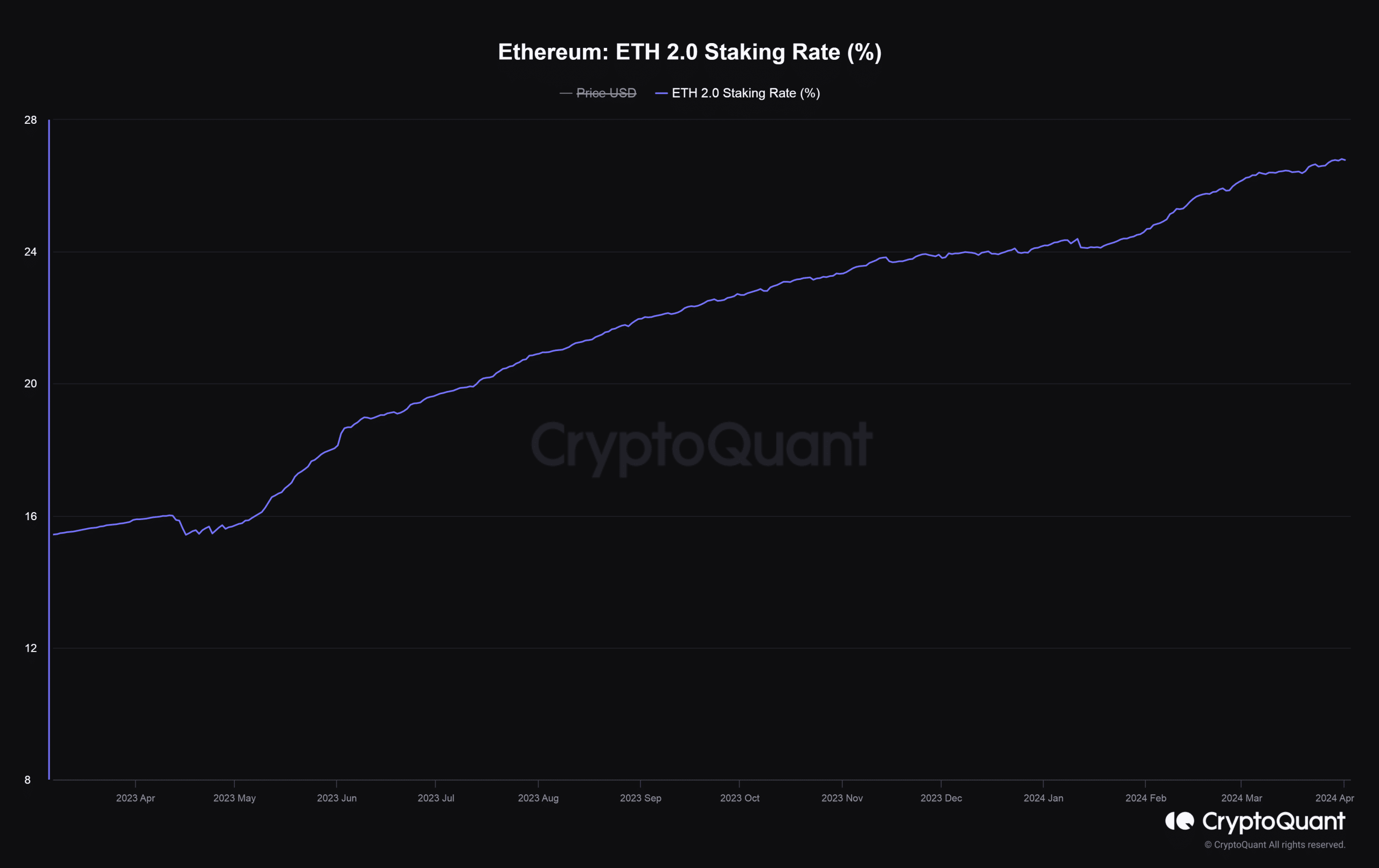

Interest in Ethereum (ETH) staking continues as users see more value in storing their assets through smart contract blockchains to earn passive returns.

ETH staking fever continues

According to AMBCrypto’s analysis of CryptoQuant data, as of April 1, staking participation rate was close to 27%. This means that 27% of the total circulating supply of ETH has been deposited to secure the network. Just a year ago, the participation rate was only 15.89%.

In general, the larger your ETH deposit, the more secure and decentralized the network tends to be.

Source: CryptoQuant

Since the Shapella upgrade last year, staking supply has increased significantly, allowing stakers to withdraw their assets. As uncertainty about the process is removed, more users decide to lock their ETH on the network.

At the same time, ETH supply on exchanges has plummeted to its lowest level in years, accounting for just 11.6% of total supply at the time of this writing.

Source: CryptoQuant

What does this mean?

This trend demonstrated a clear change in the Ethereum investment landscape. One is towards guaranteed and stable returns compared to risk-filled market trading. They also expressed confidence in the long-term prospects of the Ethereum blockchain.

ETH was struggling on the price chart.

The future looked green, but the present was red. ETH is down 6.5% in the past 24 hours as the broader markets fell on Bitcoin spot ETF outflows and US macroeconomic data.

At the time of writing, it was the second largest cryptocurrency being traded. $3,307 per CoinMarketCap.

On-chain analyst Ali Martinez took note of these developments and sounded the alarm, predicting a further decline to $2,850.

Is your portfolio green? Check out our ETH Profit Calculator

ETH’s woes could be further compounded by negative sentiment towards the outlook for spot ETFs. Developments in recent weeks have led analysts to significantly lower the odds of approval.

According to Polymarket, a leading prediction market platform, the odds of approval were only 19% at the time of this writing.