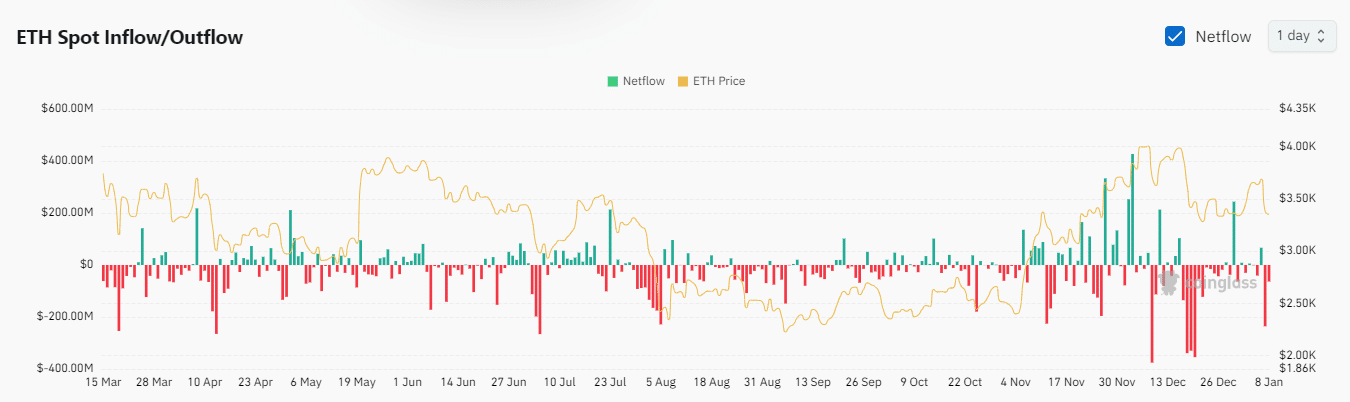

- Spot flows, including ETFs, turned negative, canceling out all recent gains.

- Why the recent short-term leverage fluctuations and what’s next as whales make a comeback?

Unexpected selling pressure erased the recent gains that Ethereum (ETH) achieved in the first few days of January.

There were several reasons for the selling pressure, including leverage reduction and spot outflow.

The ETH spot ETF outflows were arguably the most notable sign of selling pressure. It started this week with $128.7 million worth of inflows on January 6, building on the January 3 inflows.

This may have created a false sense of security and led to a FUD-filled selloff after the ETF pivoted on January 7th.

In contrast, the Bitcoin ETF has remained positive over the past 24 hours despite the opposing results on the ETH side. This was a reflection of the prevailing situation.

As of January 7, ETH ETF outflows reached $86.8 million. This was consistent with the total negative spot flows observed on exchanges over the same period. On this day, the outflow reached a record high of $235.66 million.

Source: Coinglass

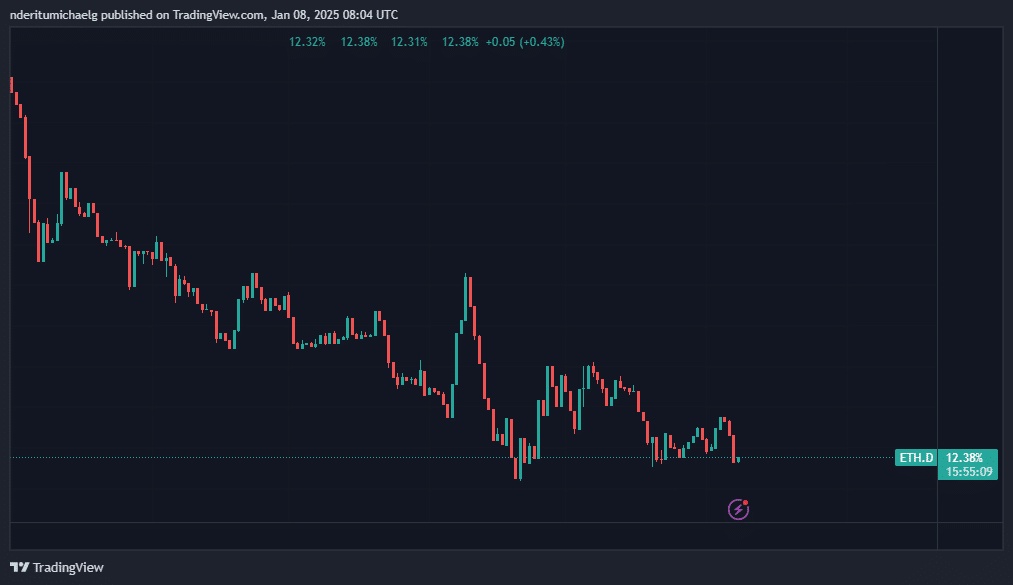

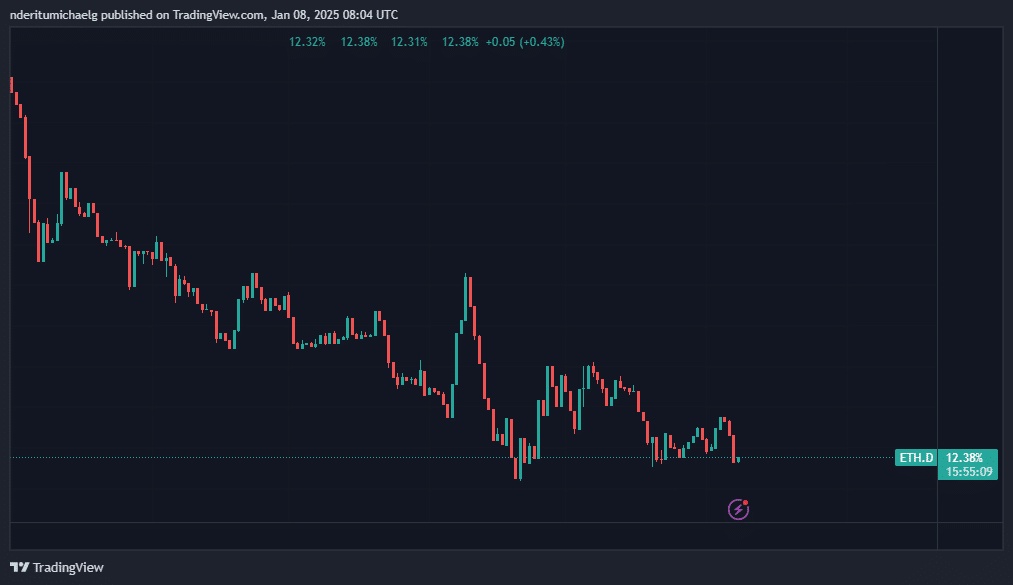

ETH Dominance Has Declined, but Could Be Ready for a Turnover

Recent selling pressure has shattered ETH’s dominance, which had previously surged as high as 12.87% over the weekend. However, recent events have brought it down to 12.32%.

ETH may attempt another crack at current levels to secure higher dominance. This is because the same areas have previously demonstrated support.

Source: TradingView

The same ETH dominance support also coincides with a retest of support for ETH price action. But is the recent decline over, or will prices go lower?

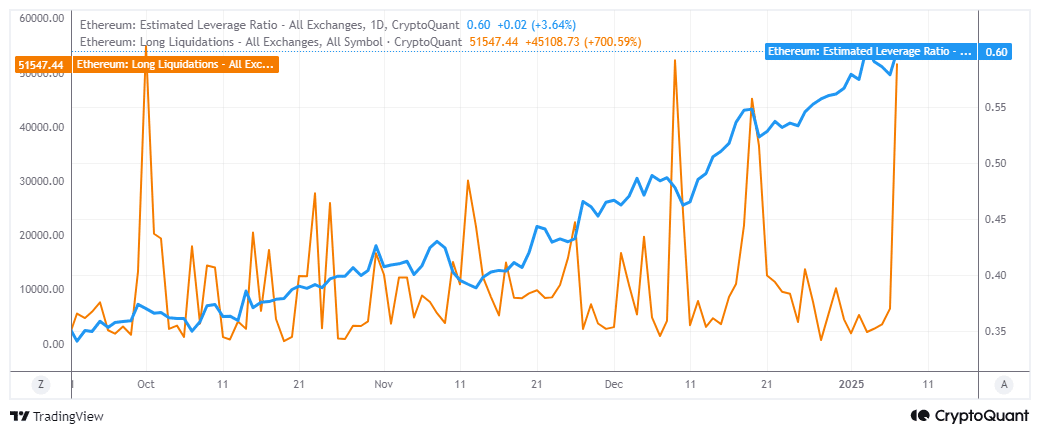

Liquidation of leveraged buys likely contributed to the latest selling pressure observed over the past two days.

The appetite for leverage has been increasing over the past few months. Long-term liquidations have increased by more than 700% since January 3.

Source: CryptoQuant

Over $173 million worth of liquidations were observed in the last 24 hours. This suggests that the recent rally in the first week of January may have been a preparation for deleveraging.

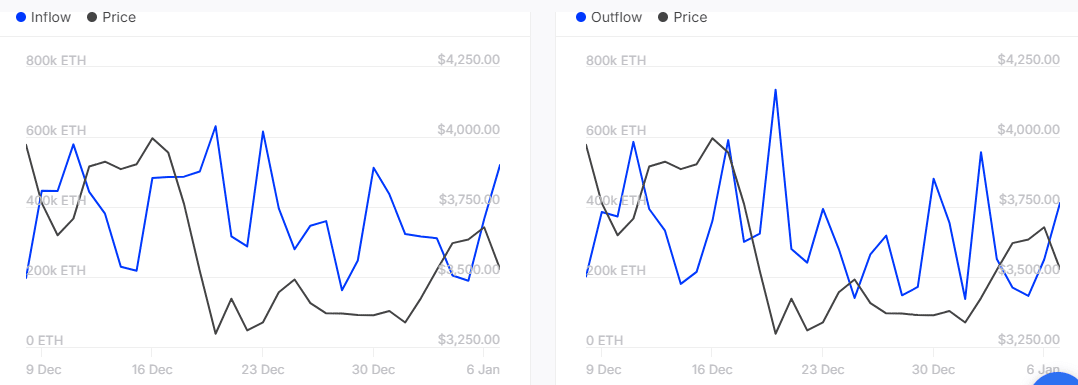

Will ETH rebound later this week? This is plausible because of one key observation that may provide insight into the next move. Whales have been on sale since early January.

Read Ethereum (ETH) price prediction for 2025-2026

However, recent data shows that it has been accumulating during the recent downturn.

Source: IntoTheBlock

ETH whales accumulated 519,620 ETH on January 7, while outflows on the same day decreased to 411,300 ETH. This confirms that whales have been buying dips and could potentially aid in a mid-week recovery.