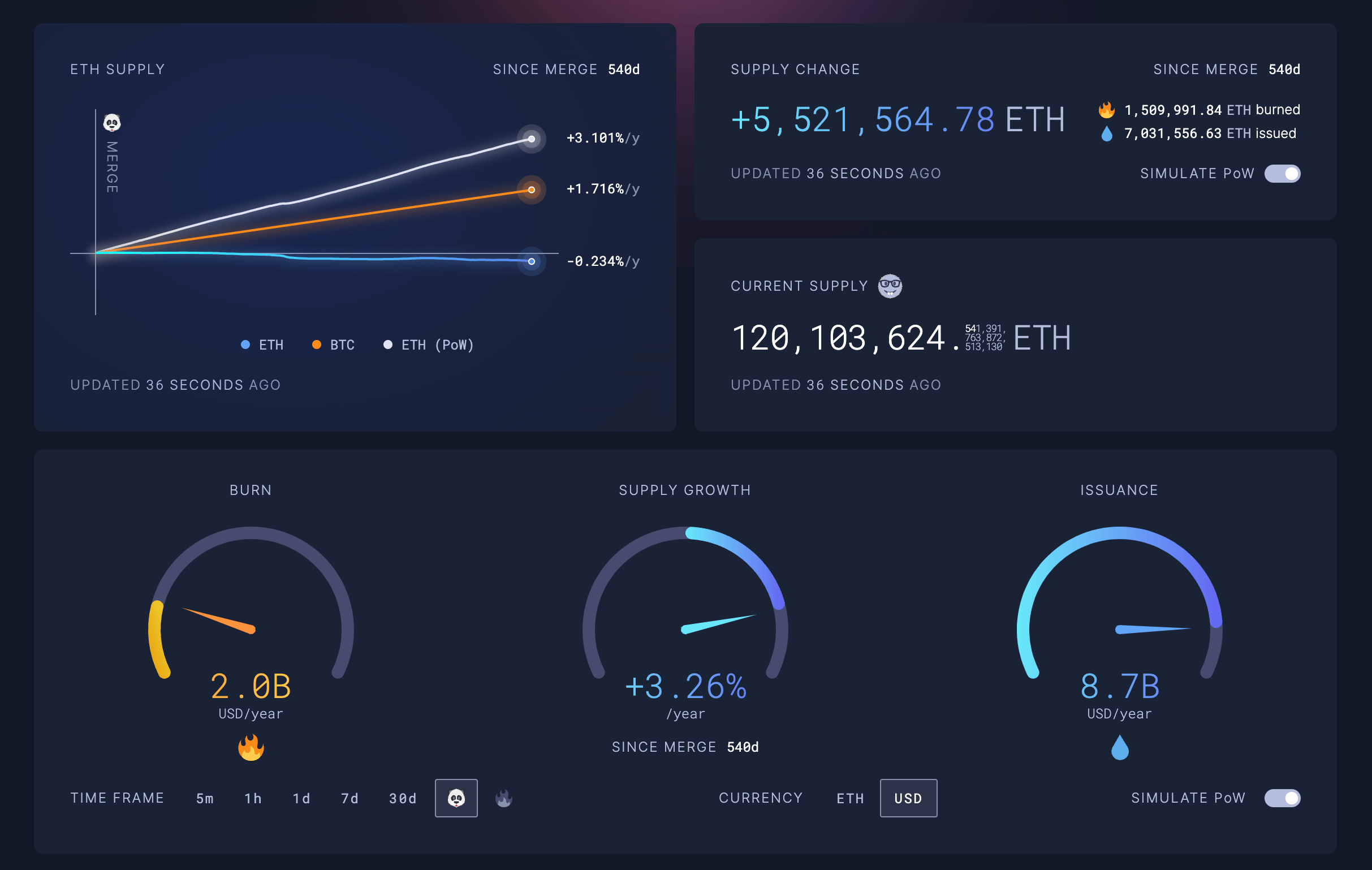

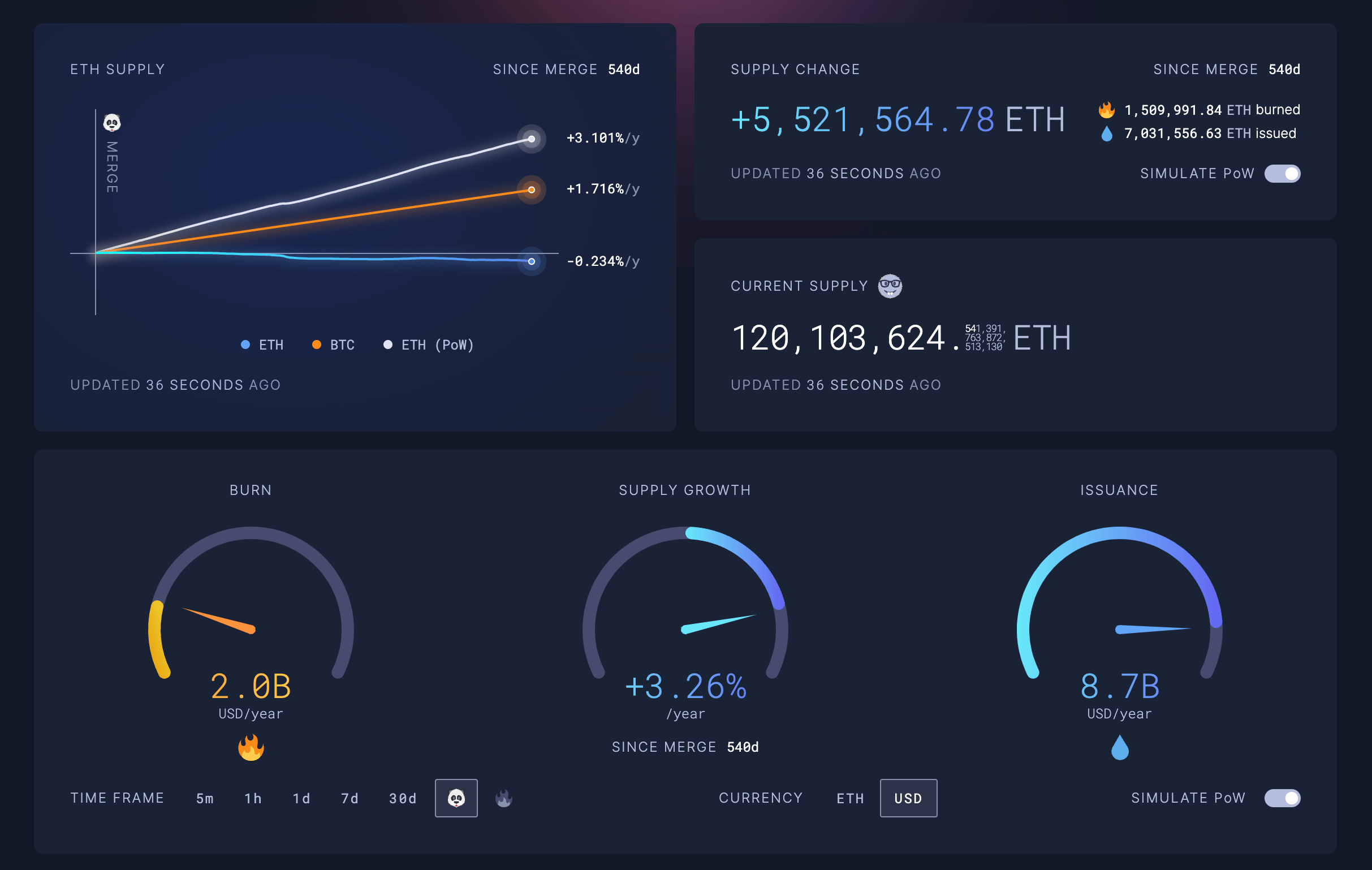

According to data from ultrasonic.money, the Ethereum network has seen its supply drop by 417,413 ETH since switching to a proof-of-stake (PoS) consensus mechanism in September 2022. In the 540 days following The Merge, 1,509,991 ETH was burned and the network minted 1,092,578 new ETH, a net decrease.

As of press time, the market value of ETH removed from supply is $1,653,797,635, representing an annual inflation rate of -0.23%.

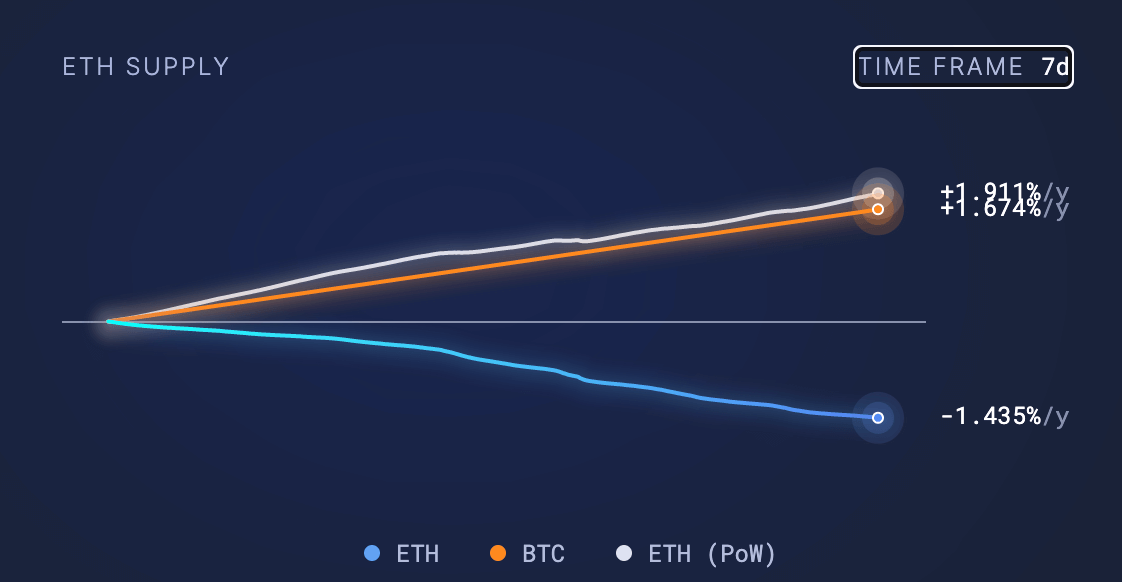

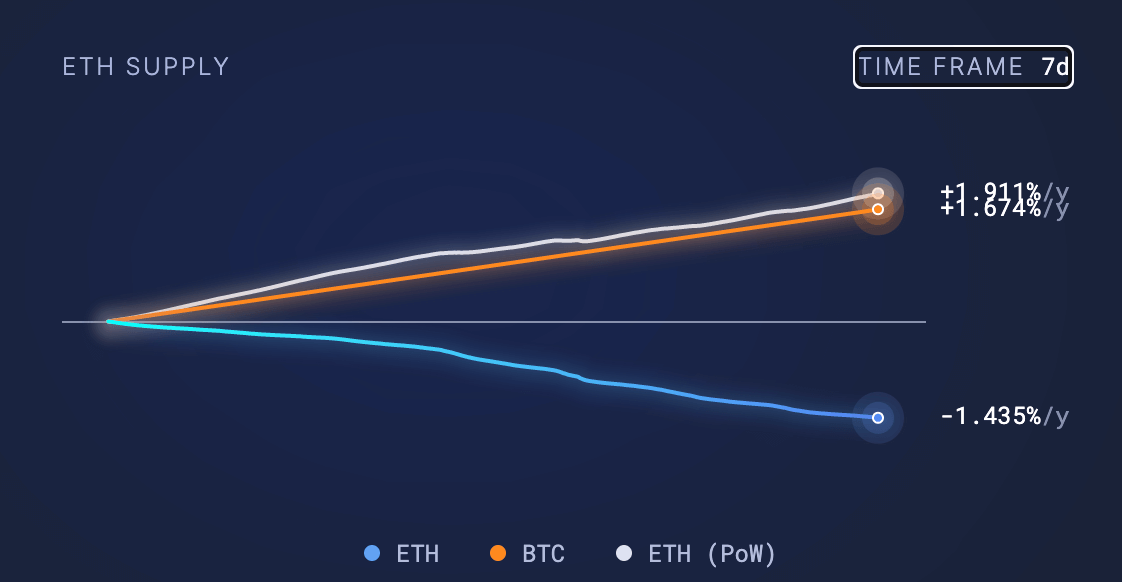

On the other hand, Bitcoin supply increased by 1.716% during the same period. This highlights the different monetary policies of the two largest cryptocurrencies, as Bitcoin maintains a predictable issuance schedule. At the same time, the balance between staking rewards and trading fee burnout now determines changes in Ethereum’s supply.

A proof-of-work (PoW) simulation on the Ultrasound.Money dashboard shows that Ethereum’s supply would have increased by more than 5.5 million ETH over the same period if the network had not switched to PoS. In the PoW model, the simulation shows that 7,031,556 ETH would be minted at the same 1.5 million ETH burn rate, leading to a net increase of 5,521,564 ETH after The Merge. According to this simulation, the value of minted ETH amounts to $21,865,393,440, which represents a theoretical inflation rate of 3.26%.

These stark differences highlight the deflationary impact of Ethereum’s new consensus design compared to previous mining-based systems. The transition to PoS has led to a significant decline in new ETH issuance. This is because validators staking ETH now secure the network instead of PoW miners. These changes, combined with the continuous burn mechanism introduced in EIP-1559, are putting downward pressure on Ethereum’s supply growth.

According to real-time data, the total circulating supply of Ethereum is currently 120,103,624 ETH. Meanwhile, PoW simulations estimate that if miners were still powering the network under the previous model, the supply would have reached 125,625,188 ETH.

The decline in supply following The Merge is consistent with the Ethereum community’s vision of moving away from Bitcoin’s fixed inflation schedule and making ETH a deflationary asset over time. Proponents believe that the combination of staking rewards and fee burns will continue to offset new issuance, potentially leading to a period of net negative supply change.

Over the past 7 days, deflation has risen to -1.435% due to the increase in ETH network fees. Moreover, even under PoW, the inflation rate would have dropped to 1.911% due to the surge in network activity and its correlation with the burn mechanism.

However, critics argue that the shift to PoS has led major staking institutions and exchanges to centralize their networks. Some warn that, unlike Bitcoin’s decentralized mining network, the concentration of staked ETH could undermine Ethereum’s decentralization and security guarantees.

As Ethereum continues to evolve under its new PoS framework and Bitcoin maintains its established PoW model, observers will closely watch how their respective supply dynamics and security trade-offs unfold. Due to the upcoming halving, Bitcoin issuance will be reduced by about half, causing the inflation rate to drop to 0.8%, within 1% of Ethereum. However, Bitcoin has a fixed supply, so the inflation rate will eventually be 0. Ethereum’s inflation rate is related to network activity and the amount of money consumed through network transactions.

Nonetheless, ETH’s deflationary trend over the past 540 days offers an early glimpse into the potential future of the two largest cryptocurrencies ahead of the first Bitcoin halving since The Merge. Bitcoin is currently thriving with a market capitalization of $1.3 trillion, while Ethereum is next in line with $478 billion.

Mentioned in this article