- Ethereum trading volume increased 85% in two weeks, reaching $7.3 billion.

- However, it is more likely that we will see a consolidation phase before the ETH bulls target $4,000.

Ethereum (ETH)’s on-chain trading volume in 2024 largely followed the pattern of the broader cryptocurrency market, with a steady decline, but intermittent spikes in activity in the second and third quarters.

But November marked an important turning point. The change was triggered by a combination of factors, including large inflows into Bitcoin (BTC) and Ethereum ETFs and Trump’s unexpected victory in the US presidential election.

In just two weeks, Ethereum’s on-chain trading volume surged 85%, from $3.84 billion on November 1 to $7.13 billion on November 15, signaling a possible reversal of the previous decline.

Suppressing volatility is the first step.

Just a week into the election rally, ETH has already surpassed $3,300, hitting a daily high of 5%. However, on the day of the election results, it soared by 12%.

Historically, such sharp rises over a short period of time have often been warning signs of a potential correction ahead.

Over the next seven trading days, ETH experienced a reversal, sending the price back to around $3,000, wiping out much of the significant gains made during the rally.

However, as the cryptocurrency industry often dictates, every recession presents an opportunity for investors to target local bottoms and buy dips. ETH bulls seized this opportunity and surged nearly 10% the next day, pushing the price of the token to $3,357 (at the time of writing).

Although this seems optimistic, Ethereum has shown greater volatility due to erratic price fluctuations compared to other altcoins.

In contrast, major assets such as Ripple (XRP) and Cardano (ADA) have shown much stronger resilience, making them standout “Tokens of the Month.”

Interestingly, this change occurred while Bitcoin was consolidating in the $90,000 range over the past five days.

In general, this consolidation at a psychological level in BTC has led to capital inflows into Ethereum, the largest altcoin.

However, ETH’s underperformance compared to its peers could signal the beginning of a fundamental shift, potentially threatening its ability to break the historically important key resistance level of $3,400.

A surge in Ethereum size alone may not be enough

On the daily price chart, Ethereum last tested the $3,400 range about four months ago, in mid-July. It has been in a slump since then, trading between $2,200 and $2,600.

Certainly, the post-election cycle has put ETH out of its tug-of-war and in a position to break $3,000, aided by a massive surge in Ethereum volume, as mentioned earlier.

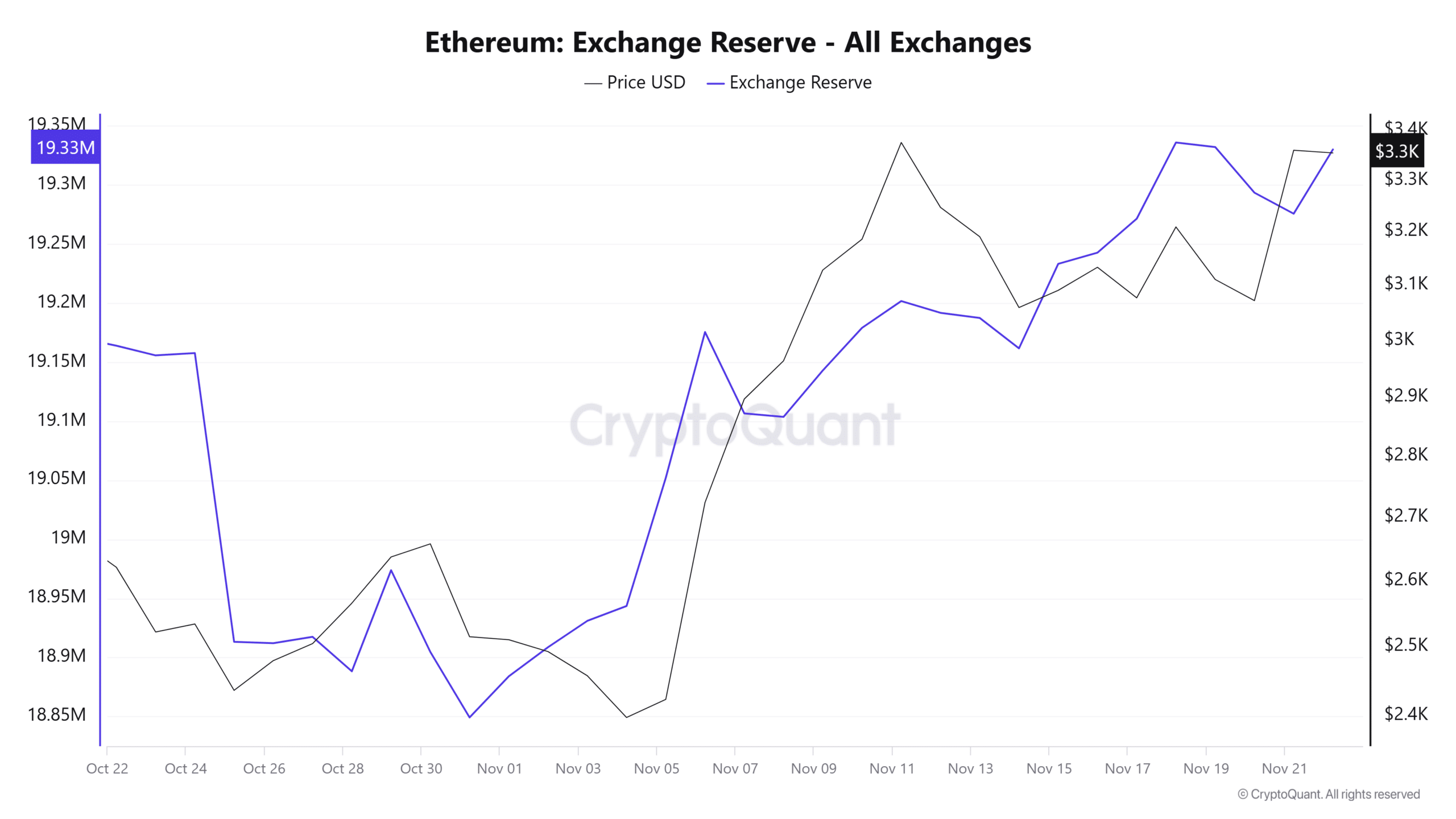

However, despite this momentum, Ethereum’s exchange holdings are steadily increasing, suggesting that selling pressure is increasing. This could lead to a period of consolidation going forward.

Source: CryptoQuant

The reason is clear. Consolidation occurs when buying and selling activity balances each other out, often pushing a coin into neutral territory.

With on-chain trading volume reaching $7.3 billion in just two weeks and selling pressure starting to build, Ethereum could be entering that phase.

Read Ethereum (ETH) price prediction for 2024-2025

Therefore, a consolidation phase before a potential breakthrough seems like the ideal setup for Ethereum, unless a few key conditions are met.

First, large HODLers must enter an accumulation phase to absorb selling pressure. Second, Bitcoin needs to break the $100,000 resistance level to restore broader market confidence.

A surge in volume signals has increased network activity, but if demand continues to grow, ETH could climb towards the $3,400 level.

However, unless these conditions are met, a consolidation phase before a breakout to $4,000 seems more likely.