- ETH may be nearing bottom after failing to surge in transaction volume.

- Prices may fall, but traders are confident of a quick recovery.

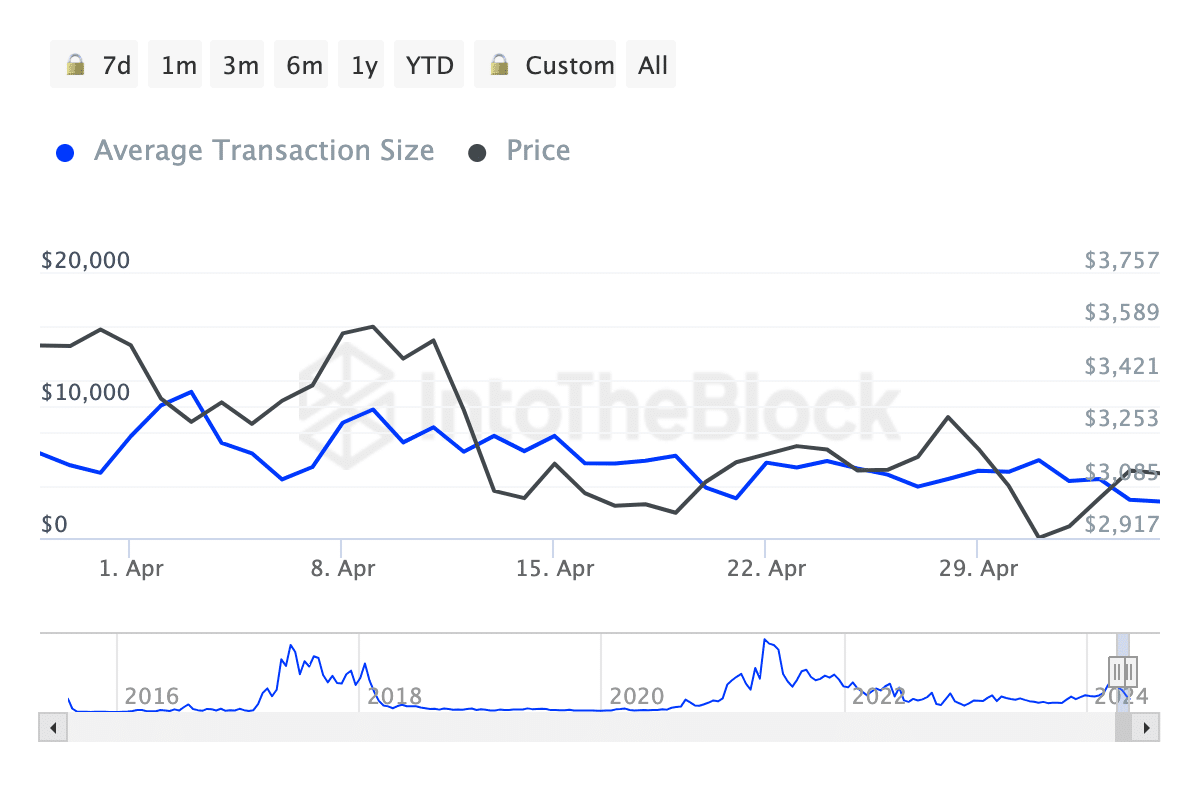

On May 19, AMBCrypto observed that the average transaction size for Ethereum (ETH) had fallen to $2,767. This is a 54.13% decrease from the metric when the month began.

The average transaction size at the time was $5,893, according to data from IntoTheBlock.

For beginners, average trade size determines the average trade value in dollars for an asset on a particular day.

Historically, spikes in this metric signal high user activity, especially from large investors and institutions. However, if it decreases it means there is no institutional interaction.

Institutions out, retail in.

This recent state of Ethereum means the presence of more retail users. Besides that, this indicator identifies potential highs and lows.

Looking at the values mentioned, it was clear that ETH appears to be closer to the bottom than the top. At press time, the price of ETH was $3,106, indicating that it has fluctuated in the same range over the past 24 hours.

Source: IntoTheBlock

Based on the above analysis, the price of the cryptocurrency may be set to achieve higher values in the short term. However, other indicators should also be considered.

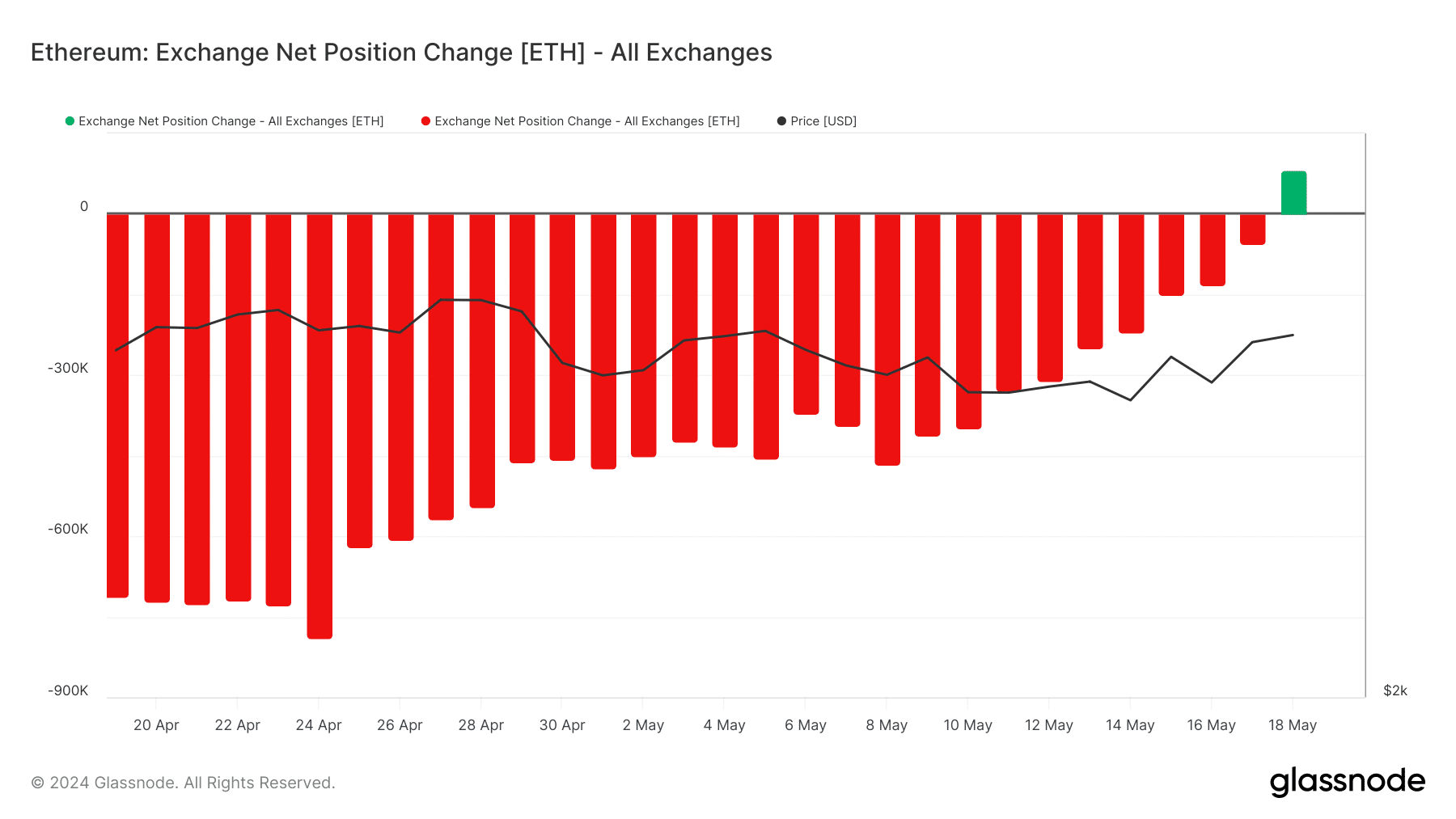

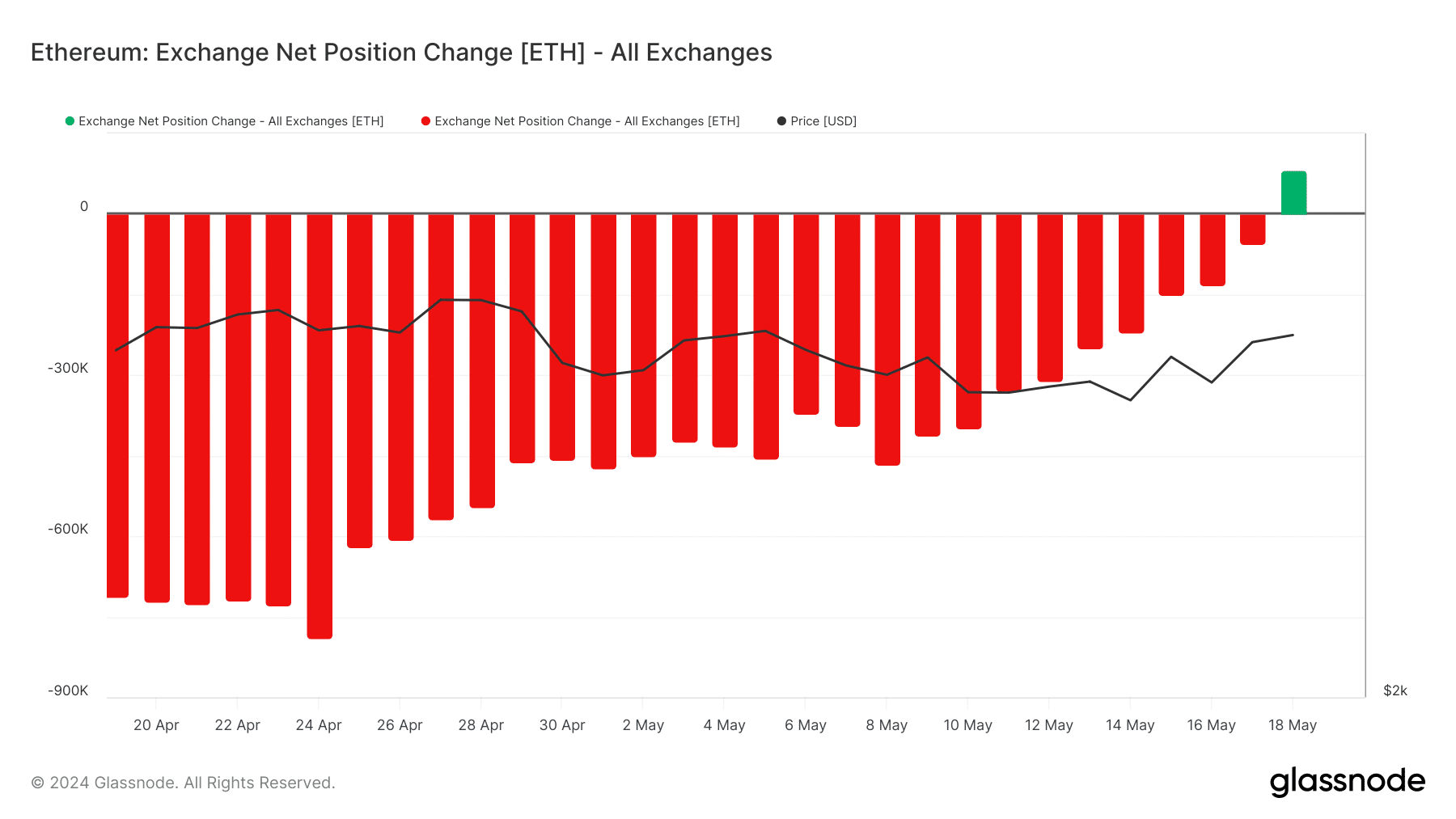

Accordingly, AMBCrypto looked at the change in net position on the Ethereum exchange. Exchange net position changes have been in negative territory for most of the past 30 days, according to data obtained from Glassnode.

ETH is preparing for a big move

This indicator tracks the 30-day change in supply held in exchange wallets. Positive values indicate that more coins are being exchanged.

On the other hand, negative values indicate an increase in withdrawals from the exchange.

One thing we noticed is that the metric suddenly turned positive on May 18th. At the time of writing, the ETH net position change was 81,715.

This increase could be a sign that Ethereum participants are benefiting from last week’s 6.50% increase.

If this number continues to increase, the price of ETH could fall below $3,000 before a potential rally occurs.

Source: Santiment

However, if exchange withdrawals strengthen once again, the price may begin to slowly rise towards $3,500. In very optimistic circumstances, an increase to $4,000 could be an option.

On Friday, May 17, AMBCrypto reported that options traders expect the price of ETH to reach $3,600 between May and the end of June.

At press time, Glassnode data showed that this sentiment has not changed. This is due to the signal of Put/Call Ratio (PCR).

Is your portfolio green? Check out our Ethereum Profit Calculator

When PCR is above 0.70, it indicates bearish sentiment and there are more put options than call options.

However, numbers below 0.50 mean this is not the case. At press time, Ethereum’s put/call ratio was 0.35, meaning most traders expect the cryptocurrency’s value to increase in the coming weeks.