- ETH short-term holders profit.

- ETH breaks through resistance line for the first time in weeks.

Ethereum (ETH) garnered attention as one of the most notable cryptocurrencies of the past week, with its market cap increasing by more than 14%.

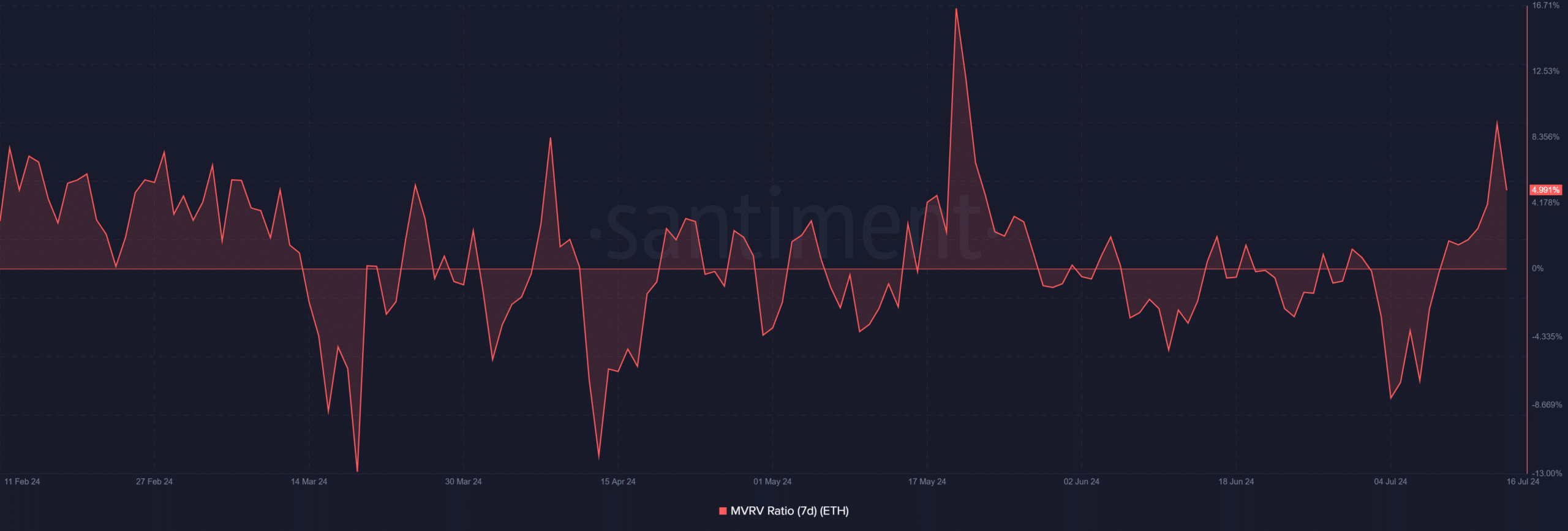

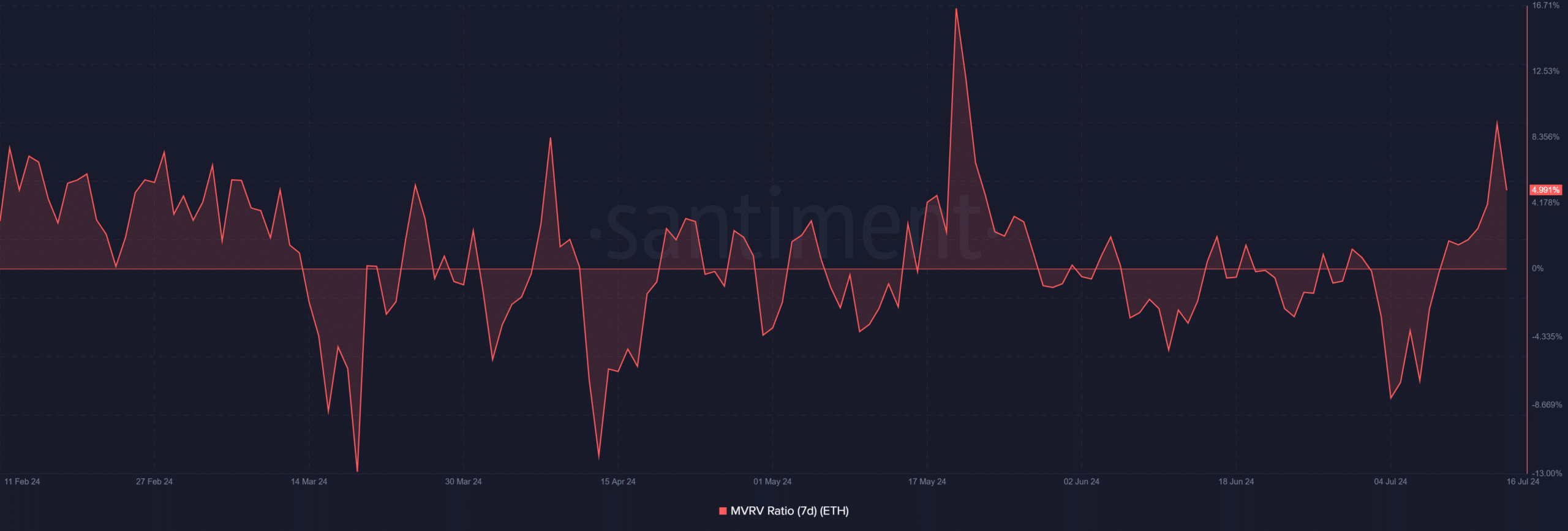

Additionally, the 7-day Market Value to Realized Value (MVRV) ratio indicates that buyers who entered the market during this period are holding their investments profitably.

Ethereum Shows Attractive Trend

According to data analysis from Santiment, investors who bought Ethereum during the recent crash are now seeing significant gains. According to the data, ETH and several other assets have seen significant increases in market capitalization.

Specifically, ETH’s market cap increased by more than 14%, increasing value for holders. This increase highlighted the profitability of those who bought at a low price.

It is also attractive as an investment during volatile market periods.

ETH Trends

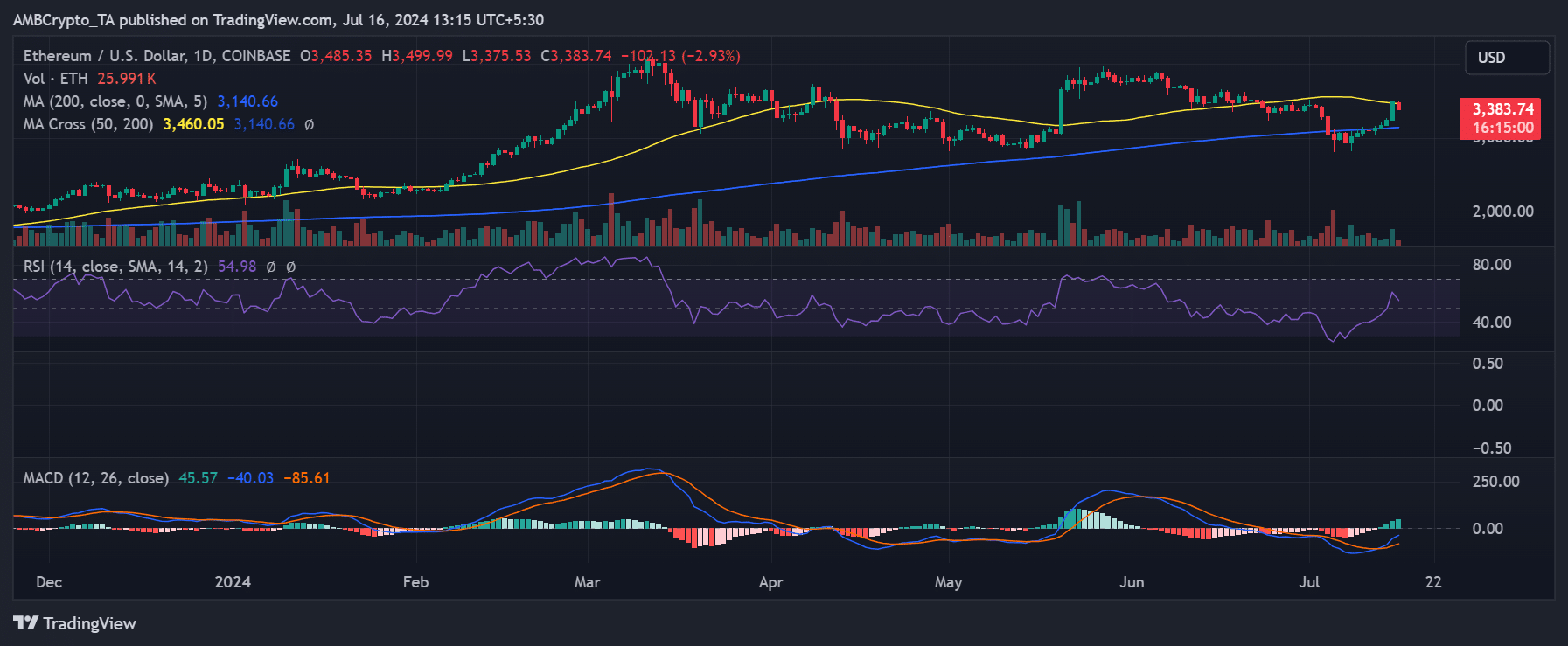

According to a report by AMBCrypto, a daily analysis of Ethereum showed a clear upward trend on July 15.

ETH price rose 8% to close at $3,485 from around $3,246. The surge took the price just above the short-term moving average (yellow line), which previously acted as resistance.

Source: TradingView

The breakout of this short-term moving average is significant as it indicates that Ethereum has been able to overcome immediate resistance and suggests further upside is possible.

However, recent observations show it trading at $3,380, down about 3%.

It is slightly above the yellow line, but if it continues to decline, it could push back below this important resistance-turned-support level. The ongoing trading activity around this important point will determine the short-term price trajectory.

Short term holders see profits

An analysis of Ethereum’s 7-day Market Value to Realized Value (MVRV) ratio shows that short-term holders are realizing significant profits.

According to Santiment data, the MVRV ratio was around 5.6% at the time of writing. However, this ratio has been on a downward trend since the 9% mark recorded on July 15, which coincides with the ETH price decline.

Source: Santiment

Despite the recent decline, the MVRV ratio has been profitable for holders, indicating that those who invested recently are still making profits despite the price crash.

Ethereum (ETH) Price Prediction 2024-25 Read

The MVRV ratio first moved into the gains zone around July 9th and continued to rise until the recent decline. This move suggests a generally bullish sentiment among recent buyers.

However, the current downturn requires monitoring to gauge continued profitability or the possibility of further adjustments.