- Ethereum whales have accumulated over 126,000 ETH in just 48 hours, which is worth $440 million.

- However, indicators showed that a reversal was possible.

Ethereum (ETH) whales have been shopping in the past 48 hours. These large holders have bought over 126,000 ETH, worth about $440 million, according to analyst ali_charts.

This has led to a massive influx of buying pressure at a time when the entire cryptocurrency market is showing mixed signals.

Exchange activities become more active

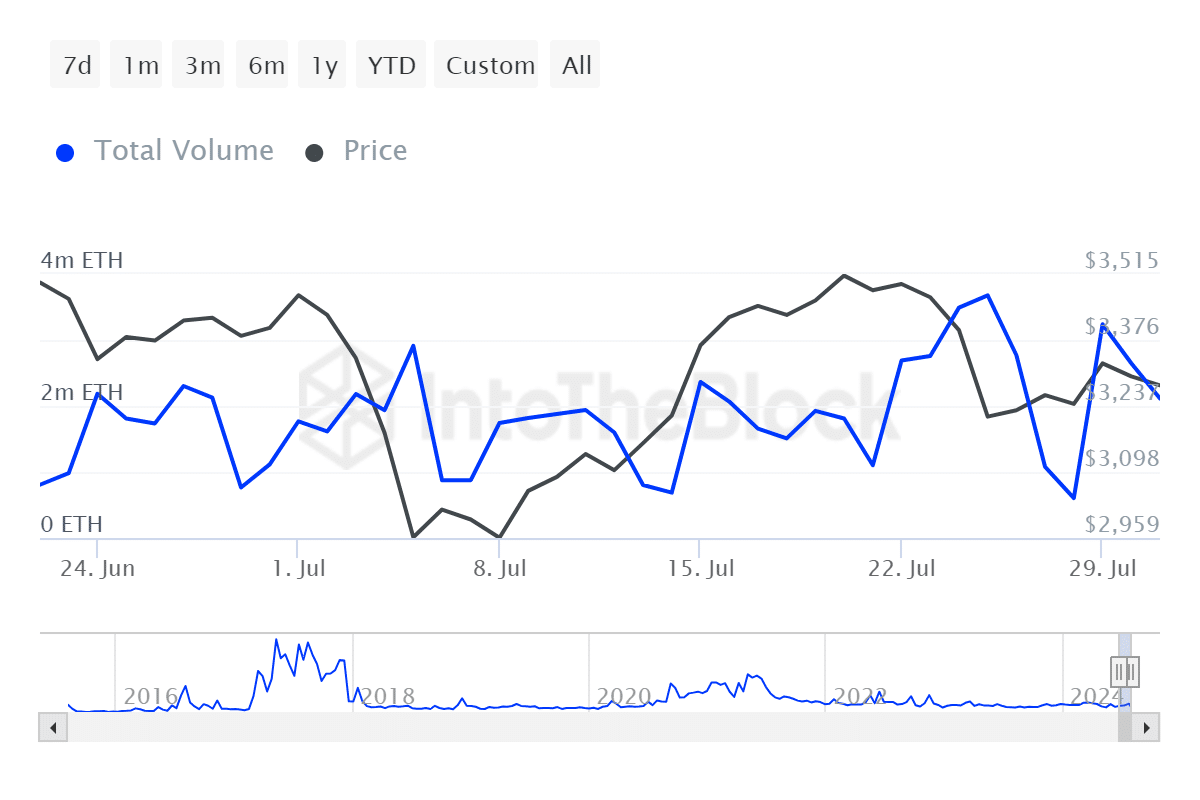

Accompanying the whale accumulation, exchanges have seen an increase in activity. According to IntoTheBlock data, major platforms have seen an increase in ETH trading volumes.

These surges in exchange rates typically occur before major price movements, as traders prepare in advance for potential market changes.

Source: IntoTheBlock

Despite significant whale accumulation in Ethereum, the price has yet to see a significant surge. After a 10% surge in the week of ETF approval, ETH has crashed 6.83% to $31.73 at the time of writing.

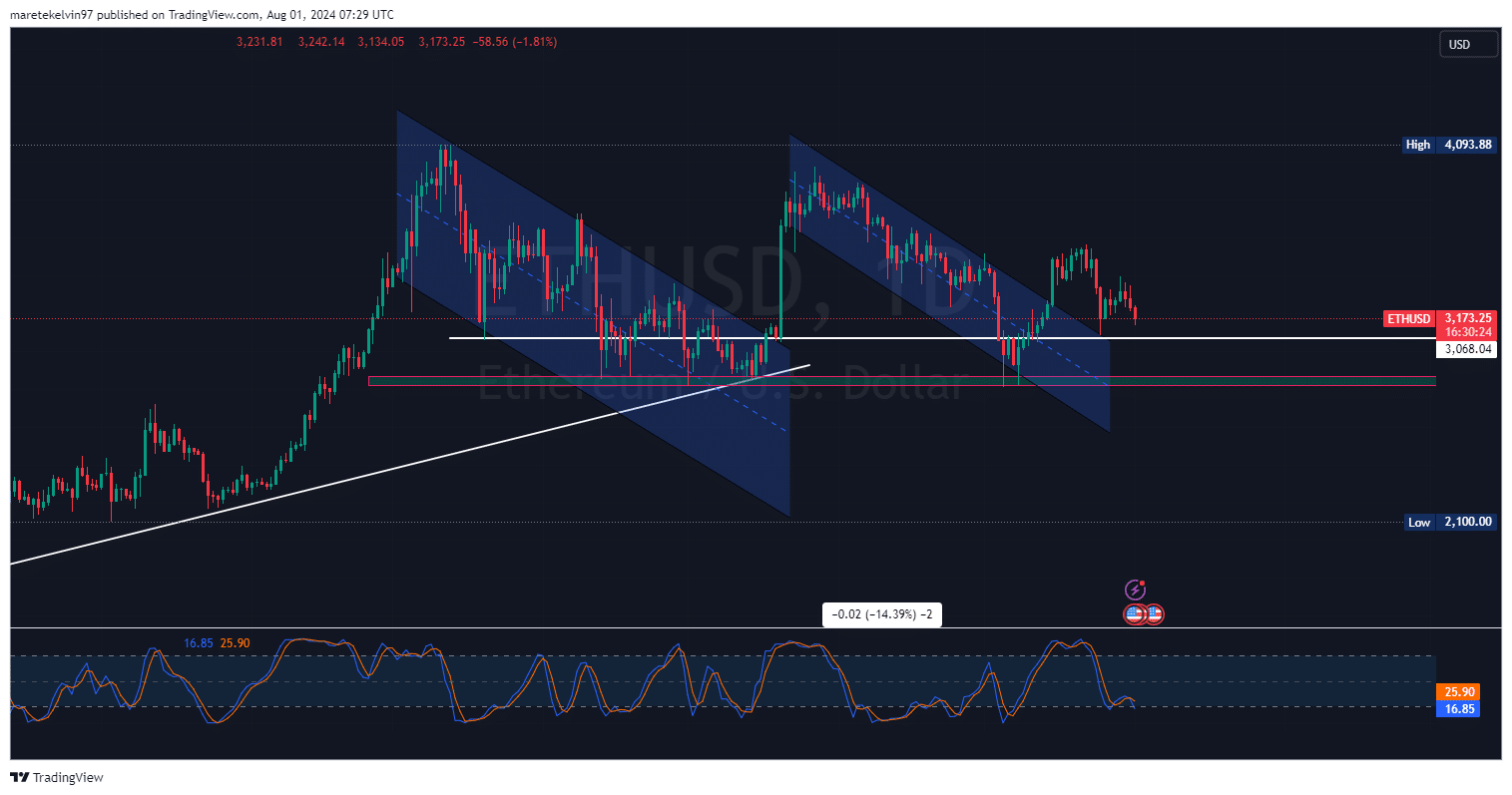

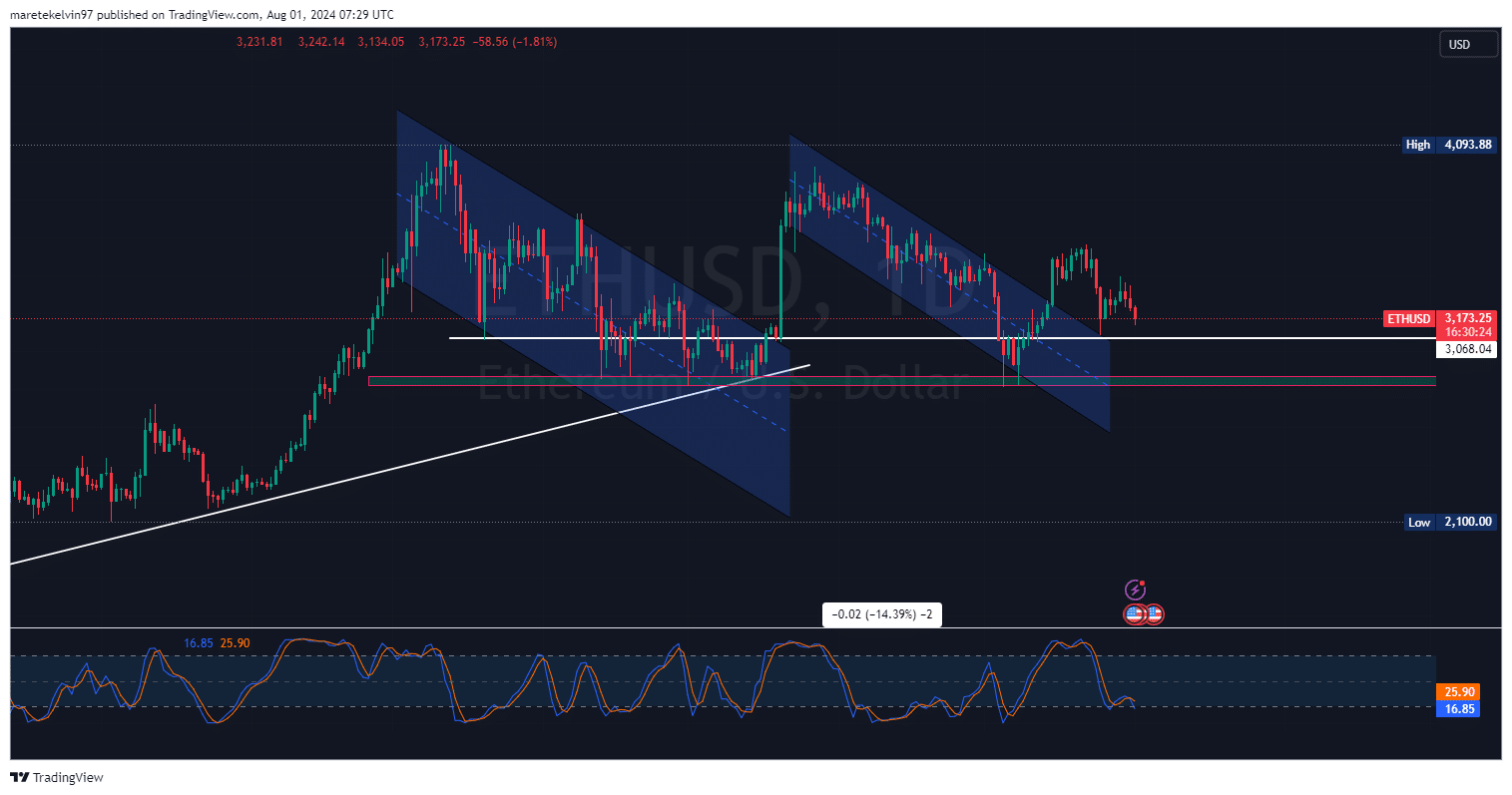

Recently, ETH was approaching the key support level of $3068. As it approached this level, the bearish pressure eased. This indicates a reversal as big players may push the price up for a bullish rally.

The RSI (Relative Strength Index) indicator is approaching the overheated sell zone at 16.85 at the time of writing, which is a potential signal that the price reversal could turn bullish.

Source: TradingView

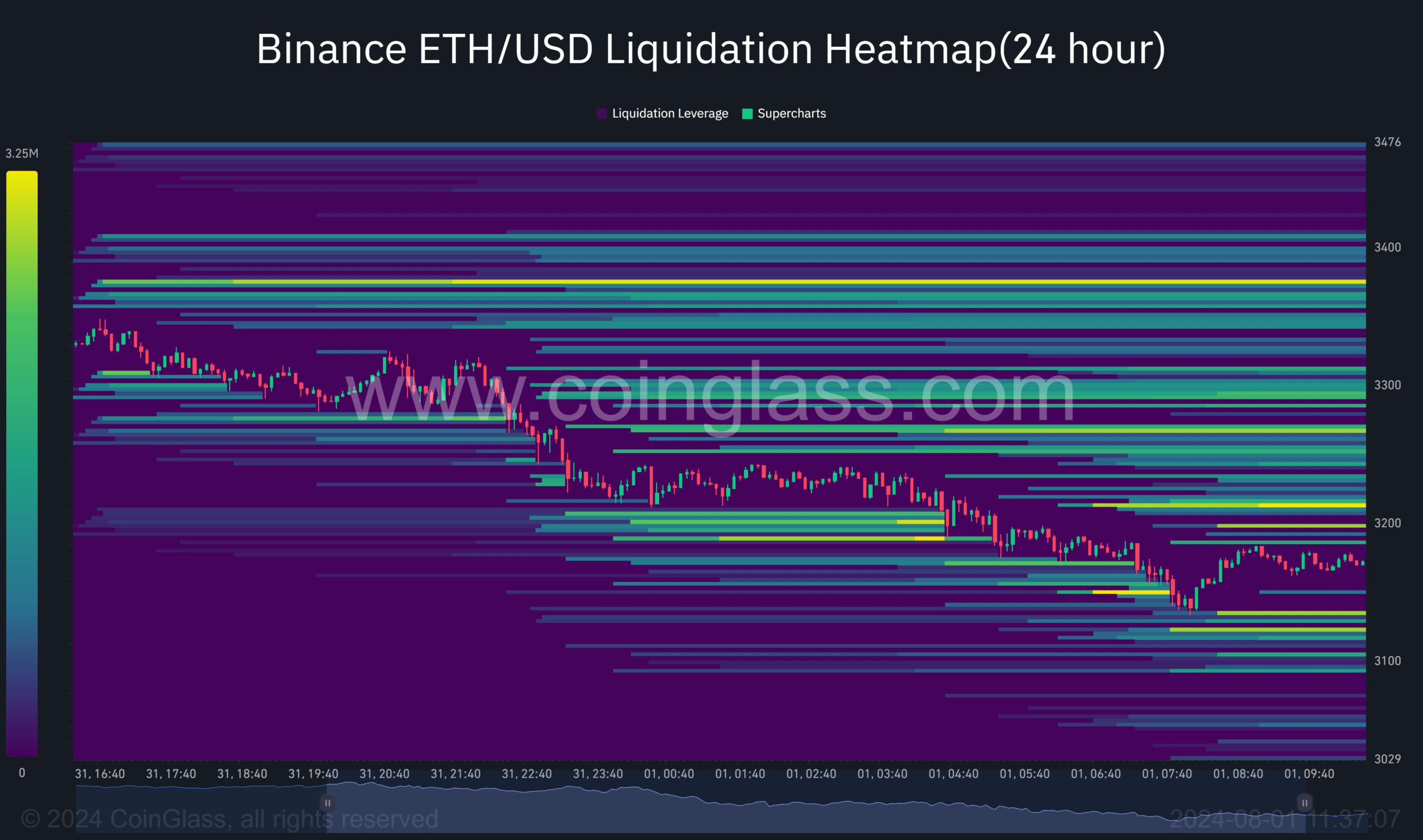

AMBCrypto’s analysis of Coinglass’ liquidity heatmap data shows that liquidity pools are densely concentrated above and below key support levels.

Any sudden price movement in either direction can trigger a series of liquidations, potentially accelerating price movements.

Source: Coinglass

Will Whale Activity Trigger a Rebound?

Historical data shows that significant concentrations of whales often precede price increases. However, market dynamics are also complex.

Read our Ethereum (ETH) Price Prediction 2024-25

Increased trading activity on the exchange may indicate that small investors are taking profits, which may neutralize the bullish pressure caused by whale buyers.

While significant buying pressure from large holders is closely tied to price action, the market outlook over the next few days will be important in determining whether whale activity will lead to a bullish trend.