- The Ethereum consolidation shows a decline in whale interest as the market struggles with uncertainty.

- Assess the state of demand as exchange flows fall to 2024 lows.

Ethereum (ETH) has been stuck in a consolidation phase for the past three months. But is there any chance of a breakout from the flat zone in November? Let’s take a look at how ETH has been paired so far.

Ethereum has dashed bullish expectations since August after its price failed to make a significant recovery after slumping since May. However, the lower highs since August suggest significant accumulation over the past three months.

Source: TradingView

Despite the low price, the price has struggled to break above $2,800 over the past three months. These results reflect the current state of demand in the market, particularly the whale category.

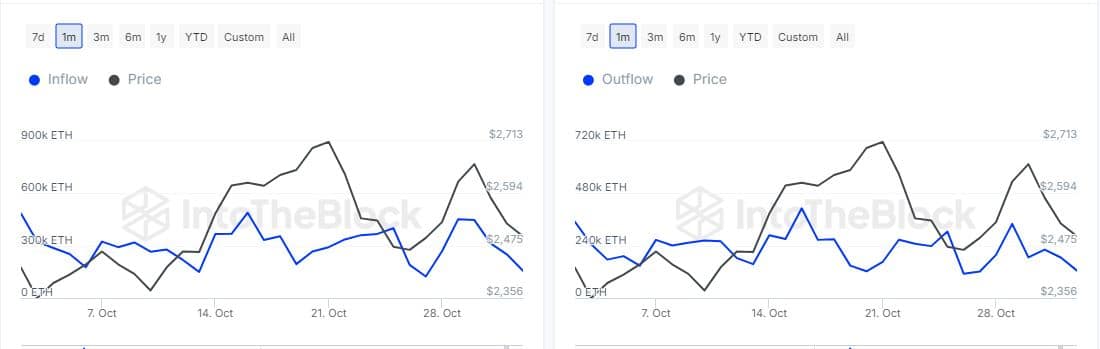

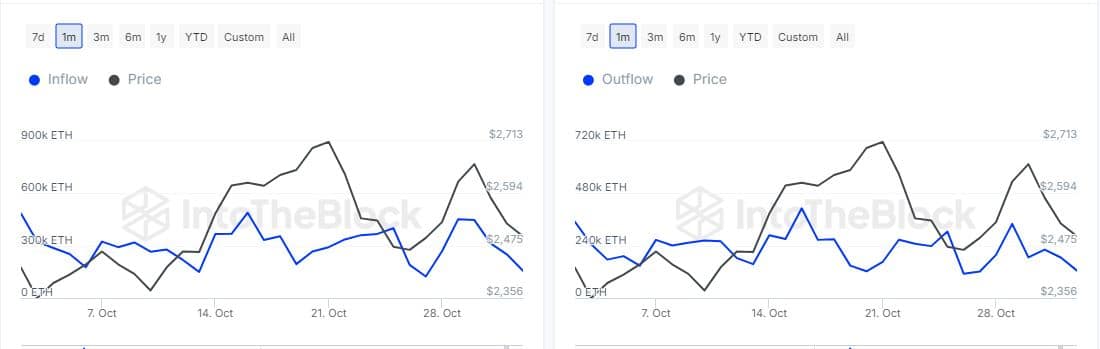

Ethereum large holder flows have been decreasing since late October. However, outflows were noticeably lower than inflows, suggesting demand could soon reverse selling pressure.

The main reason for this is that the selling pressure over the past few days has led to a retest of ETH’s upward support over the past few days.

Source: IntoTheBlock

The decline in outflows from large holders suggests that selling pressure from whales is waning. This could pave the way for a potential pivot. But the decline in the influx of large holders also means less interest in the whales.

Is Ethereum demand recovering?

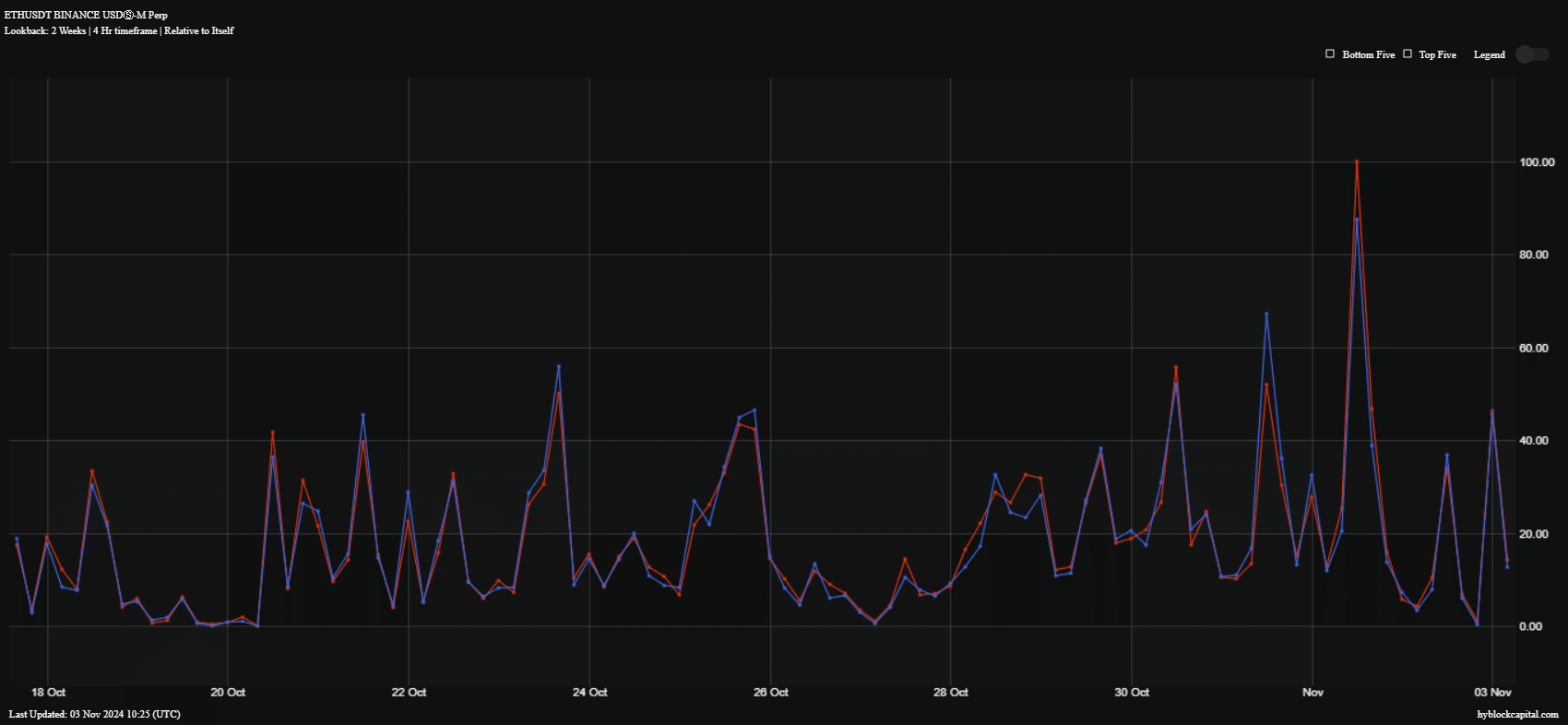

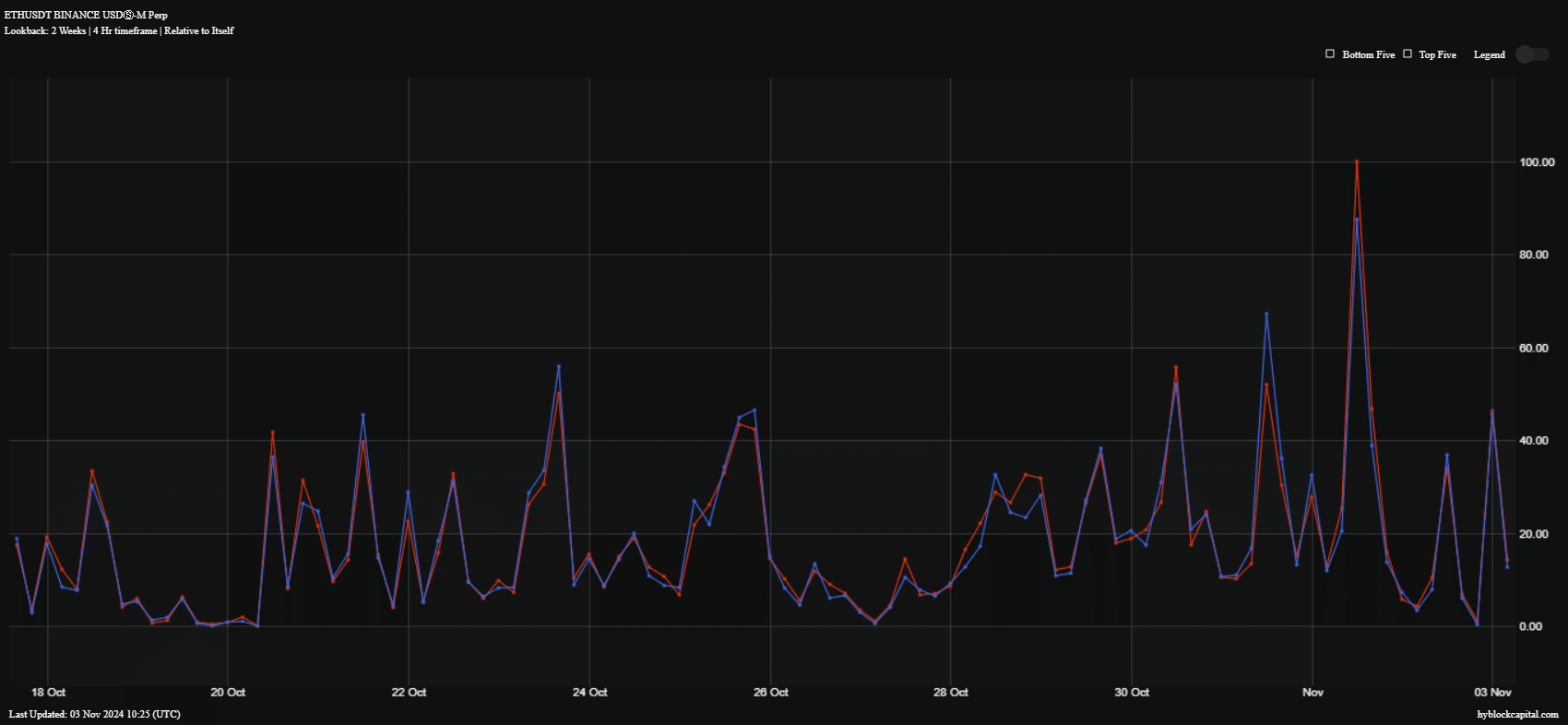

While large holder flows don’t necessarily mean a resurgence of excitement, buying and selling volumes reveal something interesting. Ethereum buying and selling volume recorded a huge surge on November 1, with buying volume dominating.

Source: HyblockCapital

The surge in buying volume is yet to be confirmed, but could indicate a potential renewed interest in ETH this month. One reason for this observation could be that investors are hesitant due to the uncertainty of the election period.

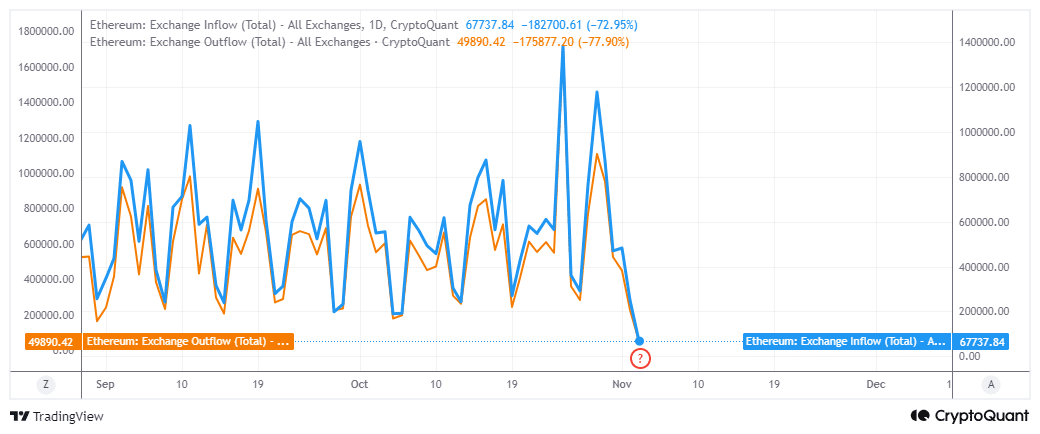

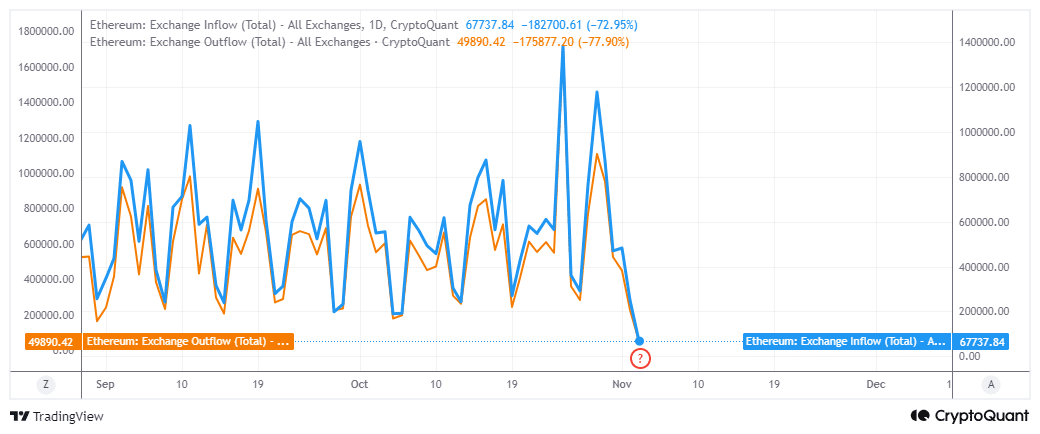

Exchange flows have responded to the current level of uncertainty by falling to the lowest levels seen to date in 2024.

Source: CryptoQuant

Foreign exchange inflow was noticeably higher than level foreign exchange outflow. The latter stands at 49,890 ETH in the last 24 hours as of this writing, while the former holds 67,737 ETH.

Read Ethereum (ETH) price prediction for 2024-2025

Based on all the above observations, it was clear that Ethereum price movements reflected depressed investor sentiment. However, consolidation suggests we may see renewed interest after the US election.

However, election results can have a negative or positive impact depending on which candidate wins.