Summary: Ethereum uses at least 99.95% less energy after merging.

Ethereum is set to complete its transition to Proof-of-Stake in the coming months, bringing with it numerous improvements that have been theorized for years. But now that the beacon chain has been running for a few months, we can actually dig into the numbers. One interesting area we get to explore involves estimating new energy use as we conclude the process of spending the country’s energy value as agreed.

Since there are no concrete statistics yet on energy consumption (or what hardware is used), the following is a rough estimate of Ethereum’s future energy consumption.

Since many people run multiple validators, I decided to use the number of unique addresses that have made deposits as a proxy for the number of servers currently present. Many stakers may use multiple eth1 addresses, but this is greatly offset by those using redundant setups.

At the time of this writing, there are 140,592 validators across 16,405 unique addresses. Obviously this is heavily skewed by exchanges and staking services, so removing this assumes 87,897 validators are staking at home. As a sanity check, this means that the average home staker runs 5.4 validators, which seems like a reasonable estimate to me.

power requirements

How much power do I need to run a beacon node (BN), 5.4 validator client (VC) and eth1 full node? Using my personal settings as default, it’s about 15 watts. Joe Clapis (Rocket Pool developer) recently ran 10 VC, Nimbus BN, and Geth full nodes for 10 hours on a 10Ah USB battery bank, which means this setup averages 5W. It’s unlikely that the average staker will run such an optimized setup, so let’s call it 100W all-in.

Multiplying this by the previous 87,000 validators means that home stakers consume ~1.64 megawatts. Estimating the power consumed by managed stakers is a little more difficult. They run tens of thousands of validator clients with redundancy and backups.

To make life easier, let’s assume you use 100W per 5.5 verifiers. Based on the staking infrastructure team I spoke to, this is venomous overestimate The real answer is 50 times less. (And if you’re a managed staking team consuming more than 5W per validator, I’m sure I can help.)

So overall, Proof-of-Stake Ethereum consumes around 2.62 megawatts. This is not on a national, provincial or even city scale, but on the scale of a small town (about 2100 American homes).

For reference, Ethereum’s proof-of-work (PoW) consensus currently consumes the energy of a mid-sized country, but this is actually necessary to keep the PoW chain secure. As the name suggests, PoW reaches consensus based on which fork has done the most “work”. There are two ways to speed up your “job”, to make your mining hardware more efficient, and to use more hardware at the same time. To prevent a chain from being successfully attacked, miners must perform “operations” at a faster rate than the attacker can. Since attackers are likely to have similar hardware, miners need to run large amounts of efficient hardware to prevent attackers from mining their hardware, and all of this hardware uses a lot of power.

In PoW, ETH price and hash rate are positively correlated. Therefore, as the price increases, the power consumed by the network at equilibrium also increases. In Proof-of-Stake, as the price of ETH increases, network security also increases (the staked ETH becomes more valuable), but the energy requirements remain the same.

Some comparisons

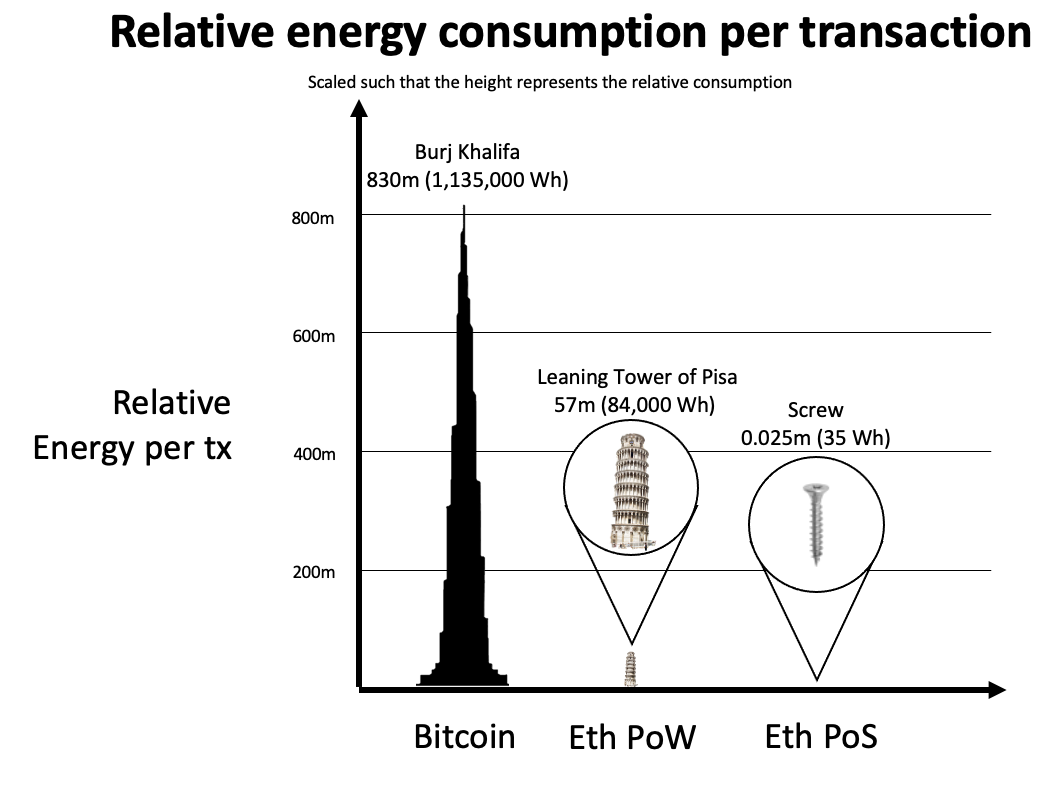

Digiconomist estimates Ethereum miners currently consume 44.49 TWh per year, which amounts to 5.13 gigawatts on a consistent basis. This means that PoS is up to 2000 times more energy efficient, based on the conservative estimates above, which reflects at least a 99.95% reduction in total energy usage.

If your energy consumption per transaction is faster than your speed, that’s ~35Wh/tx (~60K gas/tx on average), or about 20 minutes of TV watching time. In contrast, Ethereum PoW uses energy equivalent to 2.8 days of housing per transaction, while Bitcoin consumes 38 days worth of housing.

from now on

Ethereum currently continues to use PoW, but this will no longer be the case. Over the past few weeks, we saw The emergence of the first testnet absorption, the name given to the moment Ethereum switches from PoW to PoS. Several teams of engineers are working overtime. absorption Arrive as quickly as possible without risking your safety.

Scaling solutions (such as rollups and sharding) help leverage economies of scale to further reduce the energy consumed per transaction.

I can’t count the days when Ethereum is power hungry, and I hope it’s the same for the rest of the industry.

Thanks to Joseph Schweitzer, Danny Ryan, Sacha Yves Saint-Leger, Dankrad Feist and @phil_eth for their comments.