- The price of Ethereum has fallen more than 3% over the past seven days.

- Key indicators suggest ETH is undervalued, hinting at a recovery on the charts.

Ethereum (ETH) The price action on June 28 turned bullish, giving investors hope that they could recover from past losses. Unfortunately, this bullish trend did not last long, as the coin soon recorded a price correction. This caused both the weekly and daily charts to flash red.

Ethereum faces rejection

Following the aforementioned price increase, ETH’s downtrend has intensified once again, sending the altcoin price down by more than 3%. At the time of writing, the king of altcoins is trading at $3,391.51 with a market cap of over $407 billion.

The worst news is that Ethereum was recently rejected at the upper limit of a bullish wedge pattern. Twitter According to popular cryptocurrency analyst ZAYK Charts, the price of the token began consolidating within a pattern in late May. A successful breakout could have led to a 30% price increase, which would have pushed Ethereum past $4,000.

Interestingly, a similar pattern emerged in early March and again in May, which allowed the altcoin to hit $3.89,000 on the charts. However, since ETH was rejected this time, history may be unlikely to repeat itself.

Source: X

Is ETH not recovering?

AMBCrypto then took a closer look at the current state of Ethereum to determine whether it might fail to break out of its bullish pattern.

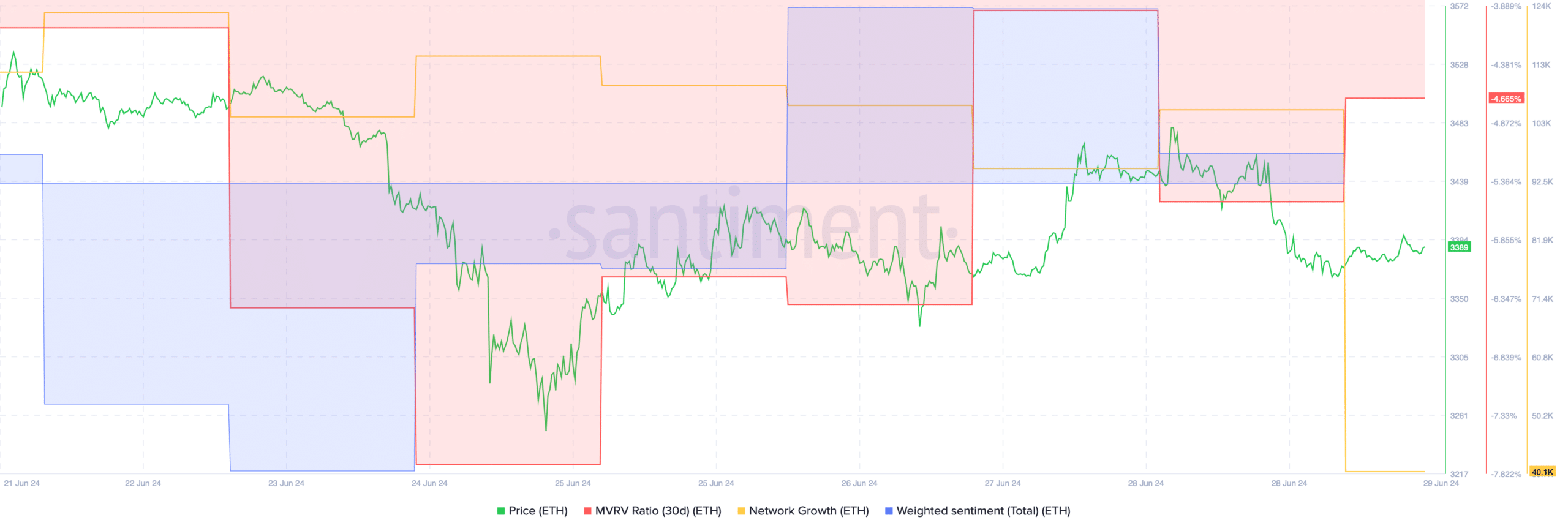

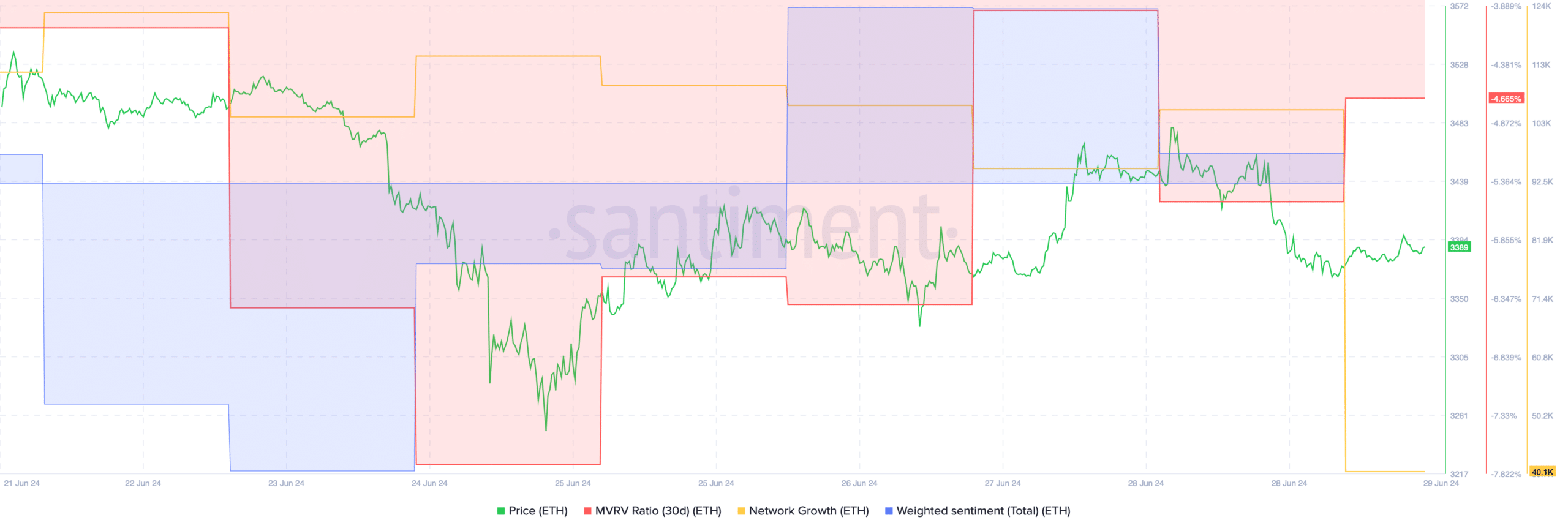

We find that market sentiment surrounding the king of altcoins remains bearish. This was evidenced by the decline in weighted sentiment after the spike on June 28th. Network growth also decreased slightly, resulting in fewer addresses being created to transfer tokens.

Source: Santiment

Nonetheless, several indicators favored a successful breakout.

For example, the MVRV ratio has been improving over the past few days, which could be interpreted as a bullish signal.

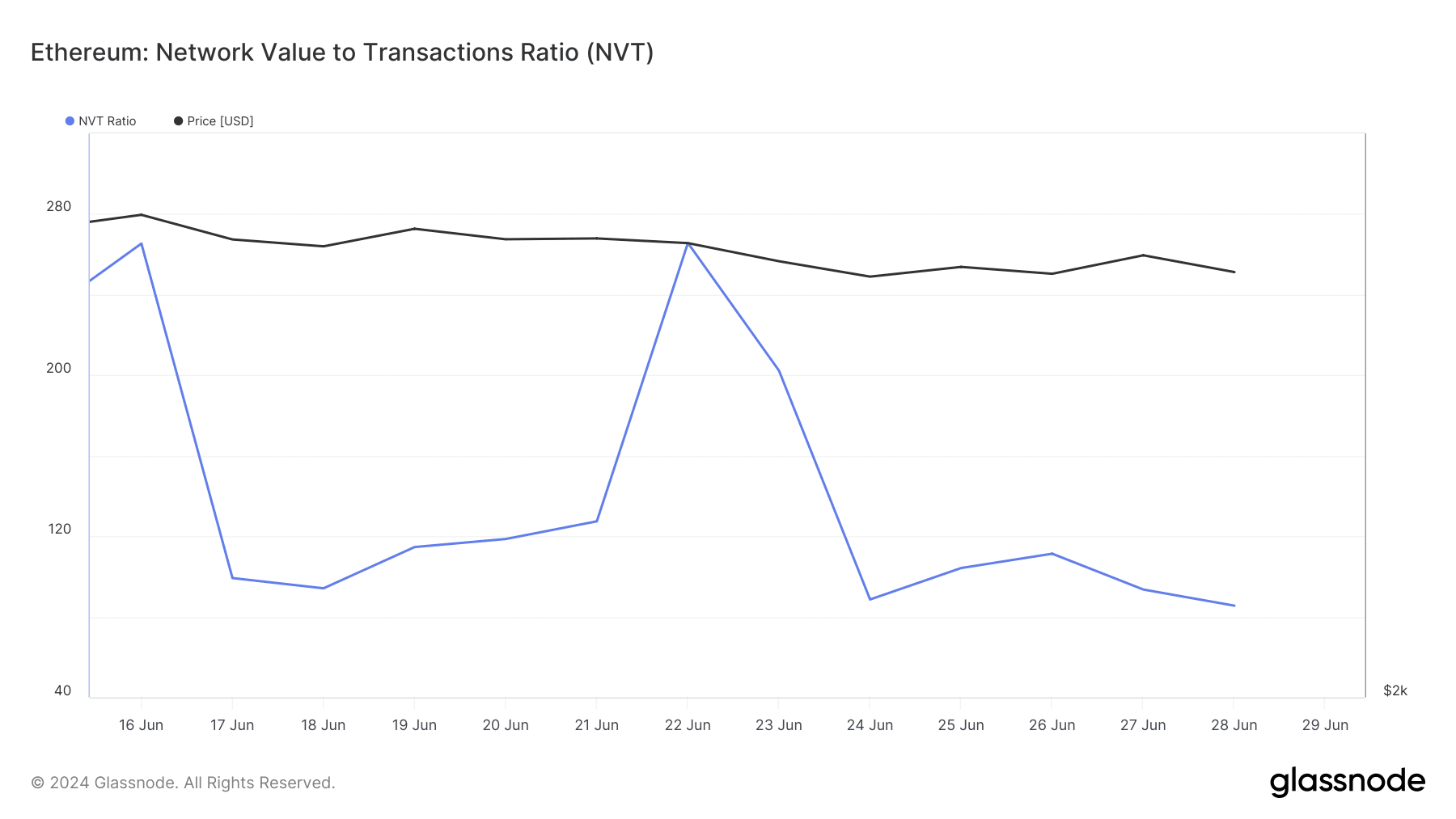

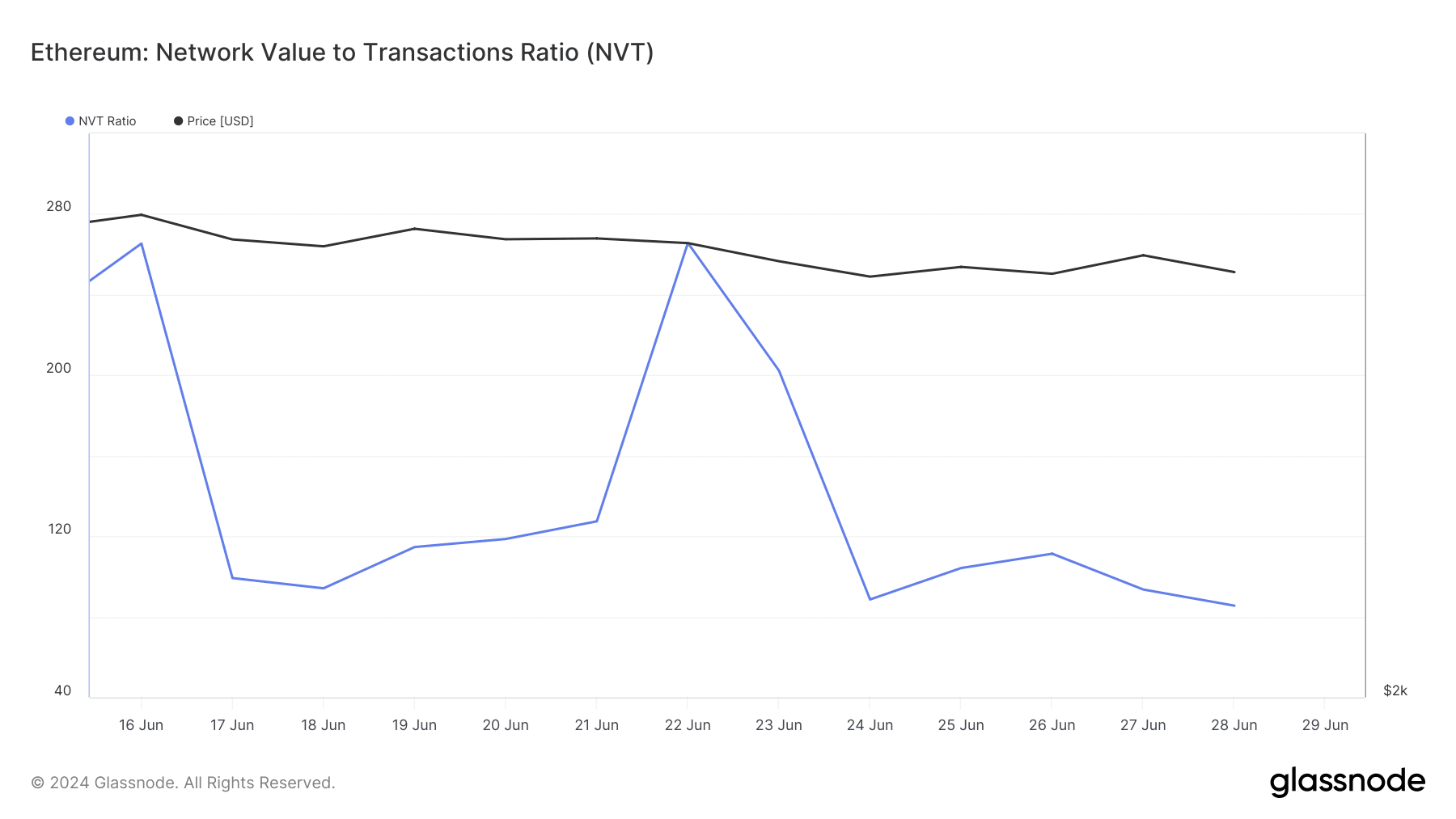

AMBCrypto evaluated data from Glassnode and found that Ethereum’s NVT rate has decreased dramatically. A decrease in this indicator usually means that the asset is undervalued. That means a price rise is imminent.

Source: Glassnode

AMBCrypto looked at data from Hyblock Capital and found immediate support and resistance levels.

According to our analysis, it will be important for ETH to touch and break the 3.5k mark to continue the bullish rally, as liquidations will increase rapidly. Typically, when liquidations increase, the price is corrected on the chart.

Is your portfolio green? Check it out ETH Profit Calculator

On the other hand, if the downtrend continues and ETH volatility moves south, a drop to $3,060 is possible.

Source: Hyblock Capital