- ETH found important support at key levels.

- More ETH addresses appear due to network growth.

Ethereum (ETH) price enjoys strong support between $3,700 and $3,810, with 3 million addresses accumulating 4.6 million ETH. This important accumulation area reflects growing investor confidence and provides a cushion against potential bearish pressure.

The bullish case for Ethereum continues to strengthen with strong supply-demand dynamics and key Fibonacci levels pointing to $5,000 as a plausible target.

Support levels and accumulation zones

Analyzing Ethereum’s price trajectory reveals a strong demand area between $3,700 and $3,810. According to data from IntoTheBlock, around 3 million addresses have accumulated 4.6 million ETH at this price range.

Analysis shows that this level appears to be an important area of support, providing a buffer against potential bearish pressure. Here, strong accumulation reflects investor confidence and hints at the potential for continued bullish momentum.

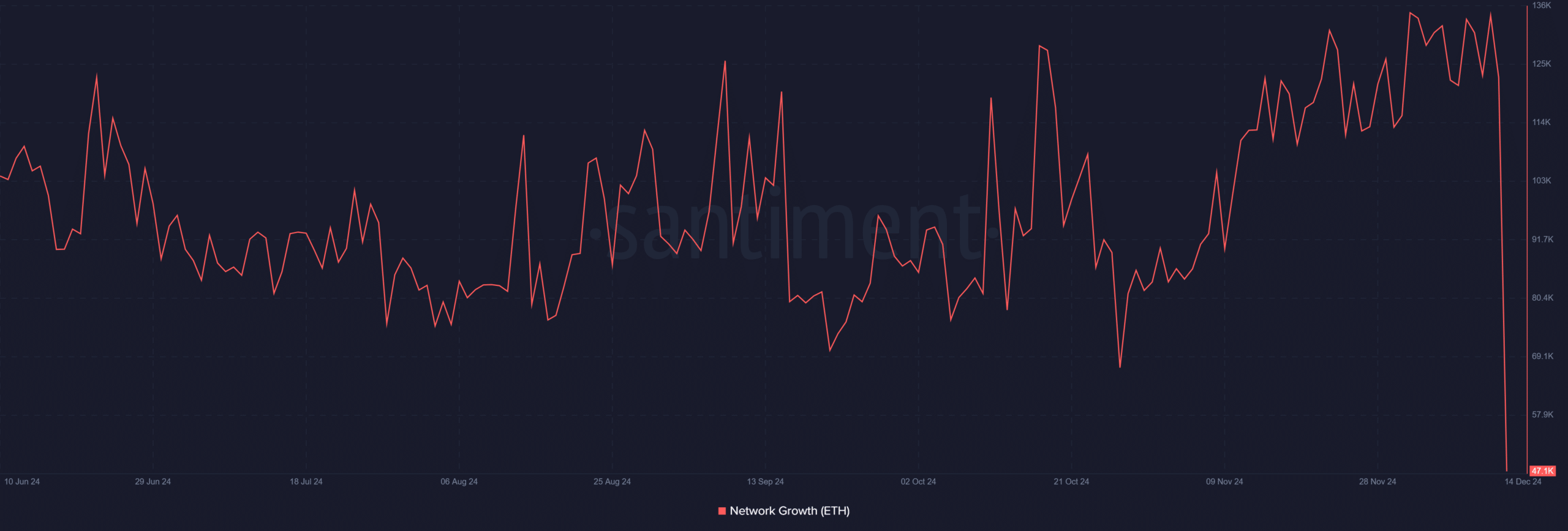

Ethereum network growth hits new highs.

According to Santiment’s analysis of Ethereum network growth, there has been a significant increase. The analysis showed that an average of 130,200 new wallets were created per day in December.

This marks a new high in eight months and signals renewed interest in ETH, attracting interest from both retail and institutional participants.

Source: Santiment

Moreover, this increase in wallet creation suggests that Ethereum’s network activity is expanding, which reinforces the idea of a growing user base and increased trading activity.

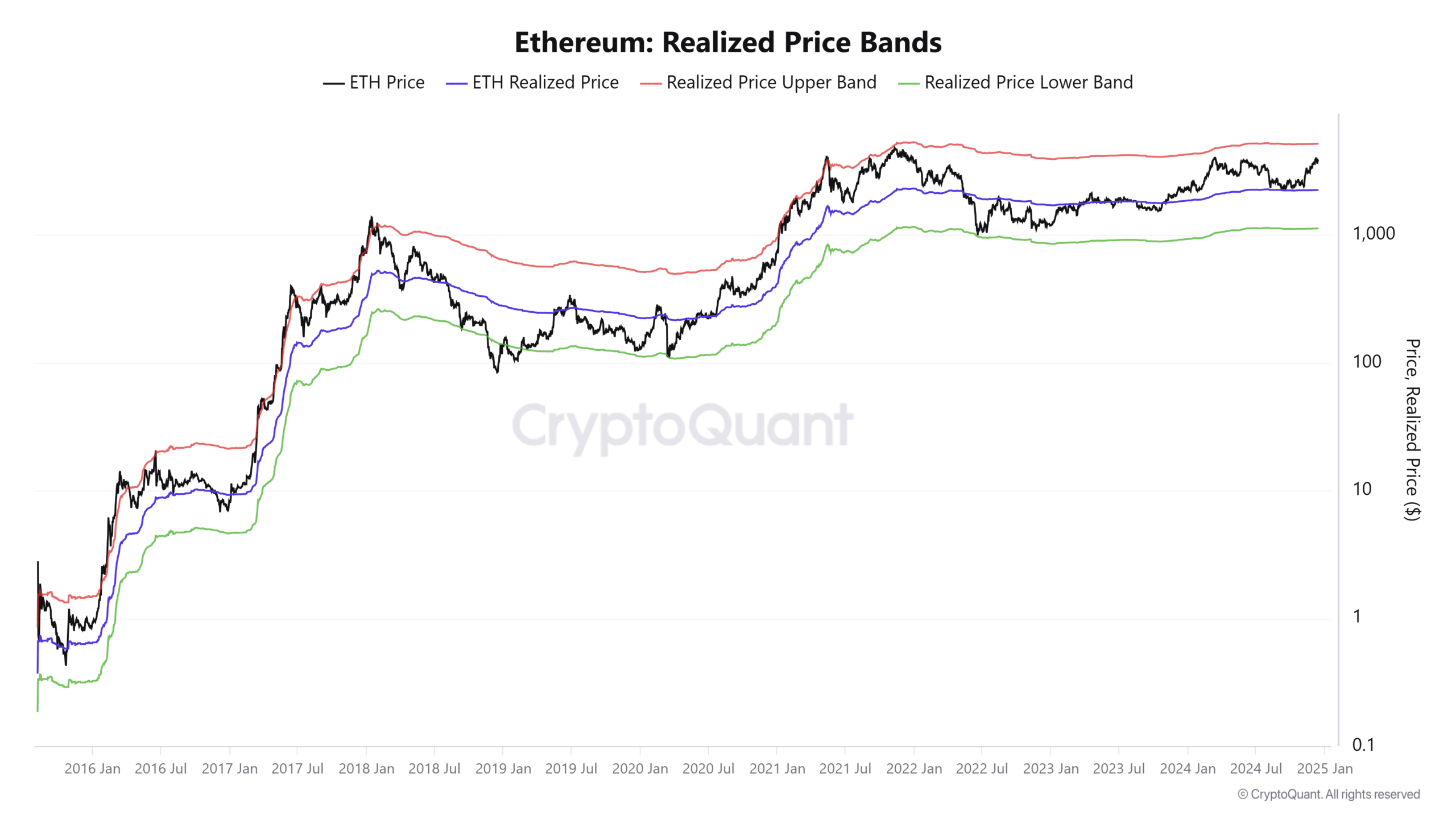

The upper realized price band indicates bullish potential.

The currently realized price ceiling is $5,200, which is consistent with Ethereum’s 2021 bullish peak. This level is a psychological barrier and potential price target in the ongoing bullish cycle.

Source: CryptoQuant

Additionally, Ethereum’s realized price of $2,300 reflects the average acquisition cost across the network, highlighting the profitability of current holders.

With spot prices hovering around $3,900, the gap between the realized price and the upper band highlights room for further upside.

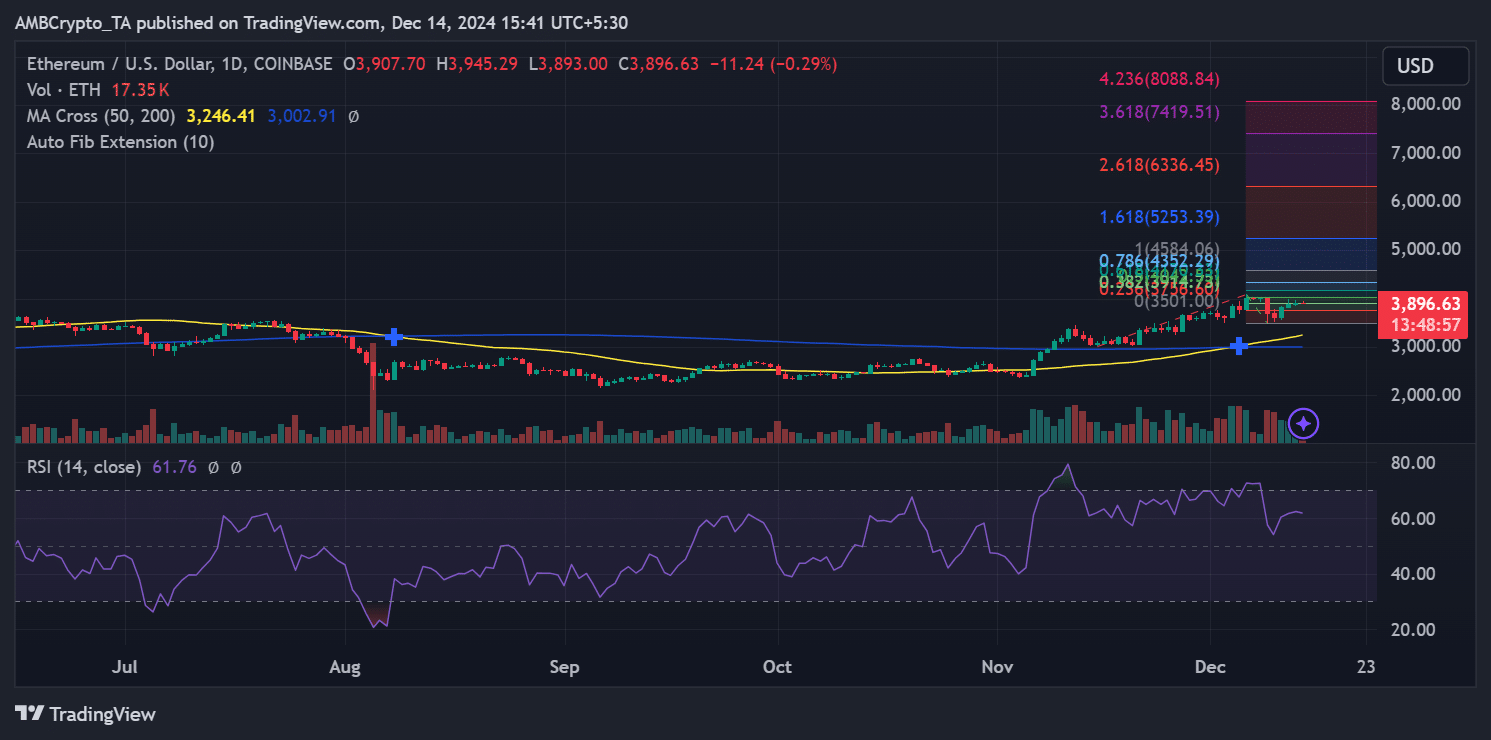

Ethereum Fibonacci extension level signal…

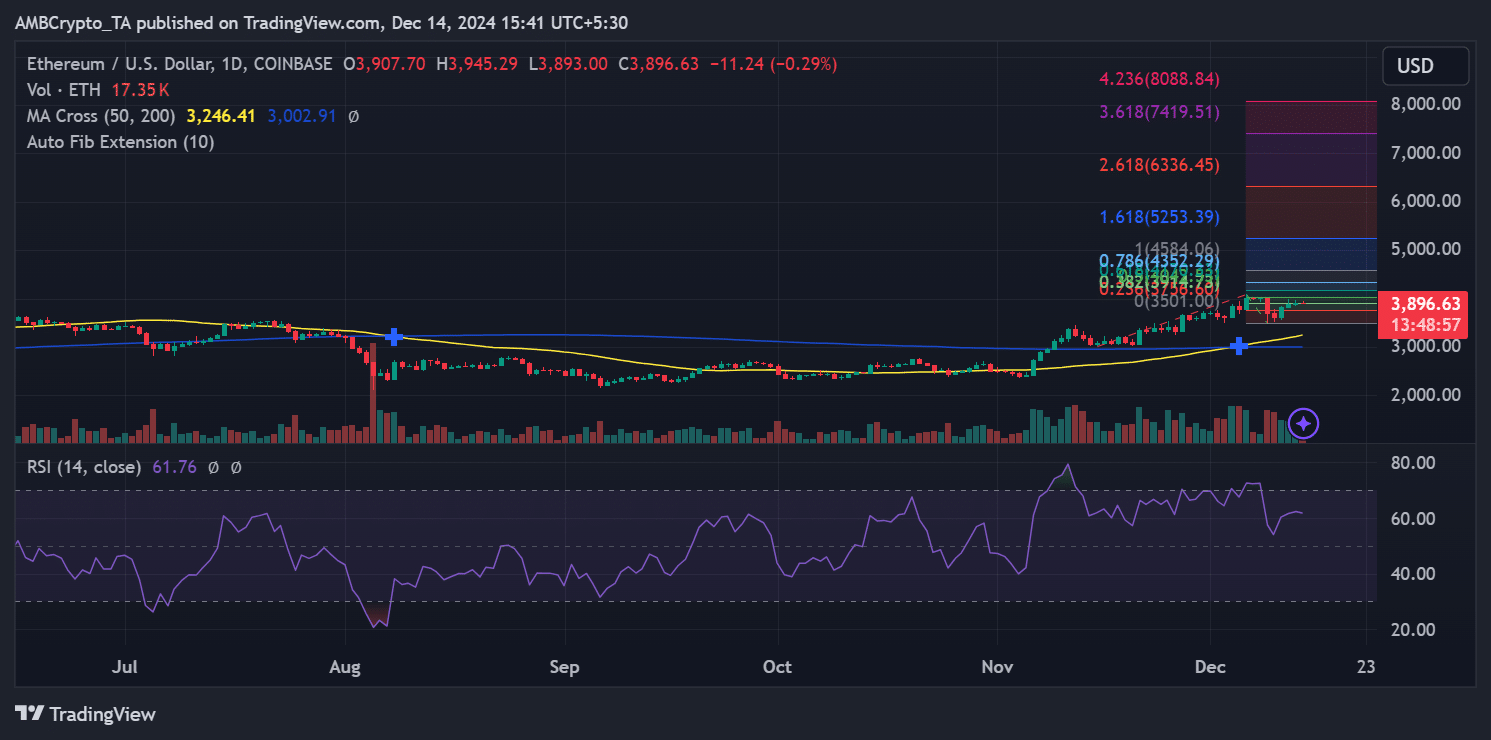

At press time, Ethereum was trading at $3,896. Key skill levels provide insight into potential advancement paths. Analysis using the Fibonacci extension tool highlights critical resistance and target levels.

Ethereum was approaching the 1.618 Fibonacci extension level at $5,253, which is almost in line with the realized price upper limit of $5,200.

A break above this level would signal strong bullish momentum and potentially set the stage for a rally towards an extension of 2.618, above $6,336.

Source: TradingView

Ethereum’s intermediate resistance lies at $4,278, a significant hurdle identified by the 0.786 Fibonacci retracement level.

Overcoming this level could pave the way for further upward momentum, taking ETH closer to the psychological $5,000 point. On the downside, immediate support is near $3,700, which coincides with the important accumulation zone.

Supply dynamics and implications for $5,000

Favorable supply-demand dynamics are driving Ethereum’s price action. The concentration of holdings in the $3,700-$3,810 range and the rapid expansion of active addresses demonstrate continued interest from long-term investors and new entrants.

If Ethereum maintains its current trajectory and breaks through key resistance levels, the $5,000 mark could become a reality sooner than expected.

Read Ethereum (ETH) Price Prediction for 2024-25

Ethereum’s journey towards $5,000 is supported by strong accumulation areas, record network growth, and key Fibonacci extension levels that are consistent with historical price indicators.

These converging factors highlight the well-supported bullish case for ETH likely to surpass $5,000 as demand and technical momentum strengthen.