- 52.67% of top traders hold sell positions, while 47.33% have buy positions.

- Some whales have also been found to be accumulating ETH.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, appears to be showing signs of a potential price decline after forming a bearish pattern on the charts as of press time.

Weak outlook for Ethereum (ETH)

However, some of his bearish trends are evident not only in ETH, but also in major cryptocurrencies such as Bitcoin (BTC), XRP, and Solana (SOL).

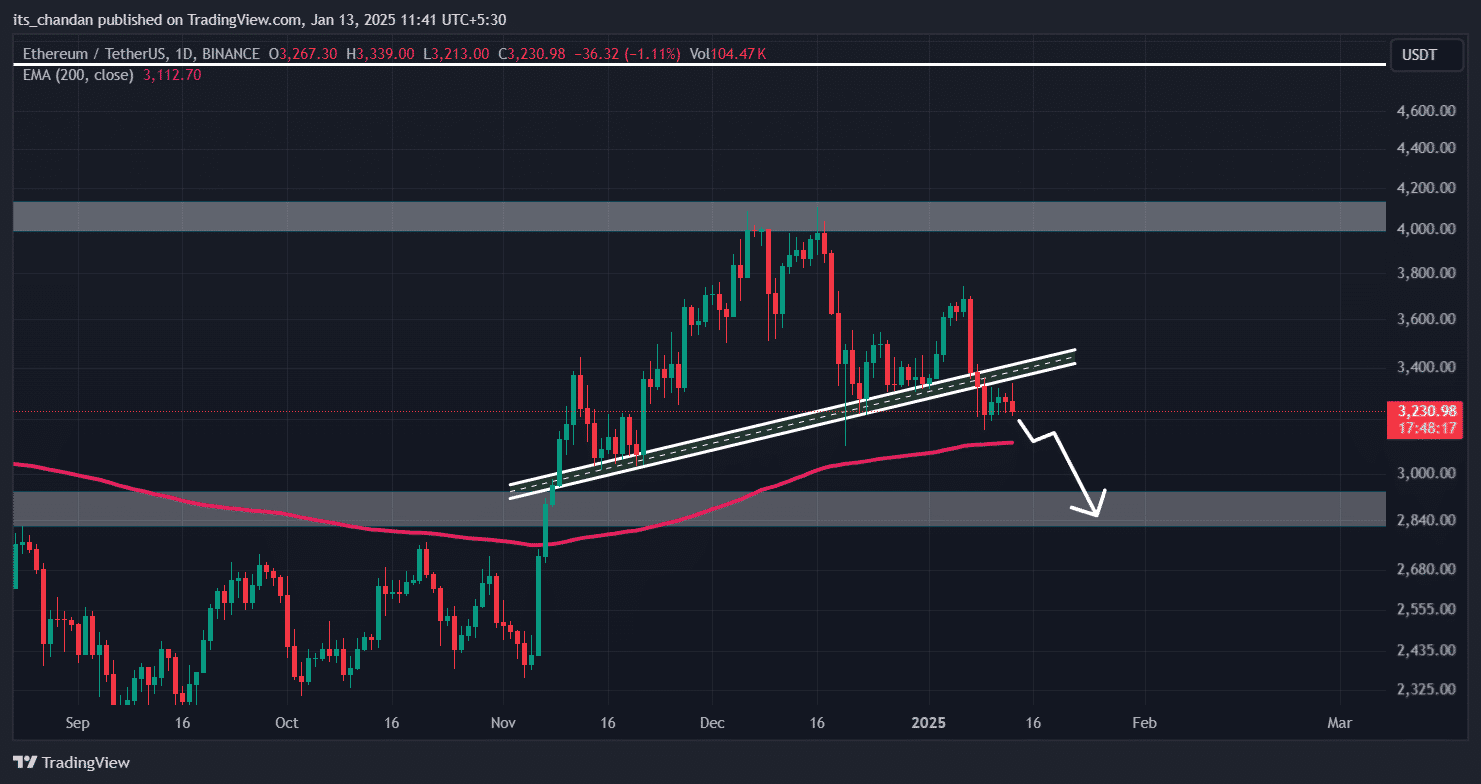

Since December 2024, ETH has been in a downward trend and has collapsed, successfully retesting the collapse level to support the downtrend.

Source: ETH/USDT, TradingView

ETH price prediction

Based on recent price action and historical momentum, if this sentiment does not change, it is likely that ETH will decline by 10% in the coming days and reach the $2,850 level. However, technical indicators still suggest a possible price rebound.

For example, on the daily time frame, ETH’s Relative Strength Index (RSI) was near oversold territory, suggesting a potential recovery. This means that the 200 exponential moving average (EMA) indicates that the asset is in an upward trend.

Traders maintain a bearish bias.

However, despite the optimistic outlook of these indicators, traders are still hesitant to take long positions, according to a report by on-chain analytics firm CoinGlass. At press time, the long/short ratio for ETH was 0.94, indicating strong bearish sentiment among traders.

As a result of the evaluation, 52.67% of the top traders held short positions, and 47.33% held long positions.

However, during this bearish period, traders’ positions rose significantly. Notably, ETH’s open interest increased by 4.5% in the last 24 hours. These indicators indicate that intraday traders are showing signs of weakness, which could lead to lower prices in the future.

Recent activity of whales

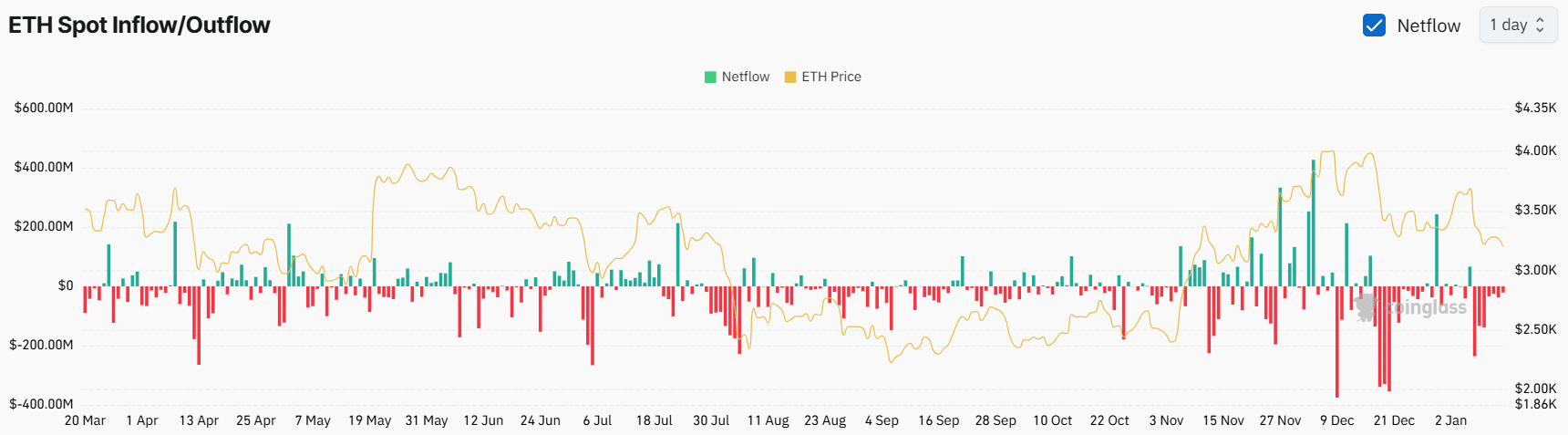

In addition to traders, long-term holders and whales also appear to be accumulating ETH, as CoinGlass’ spot inflow/outflow indicator shows.

Source: Coinglass

In fact, data shows that $21 million worth of ETH was leaked from exchanges in the last 24 hours. This indicates potential accumulation that could create buying pressure and buying opportunities.