- The decrease in dex trading volume has signed a decrease in activity, but the unique address of potential regeneration has increased.

- The hotint indicators such as the MVRV ratio and SOP suggested that Etherrium could be undervalued.

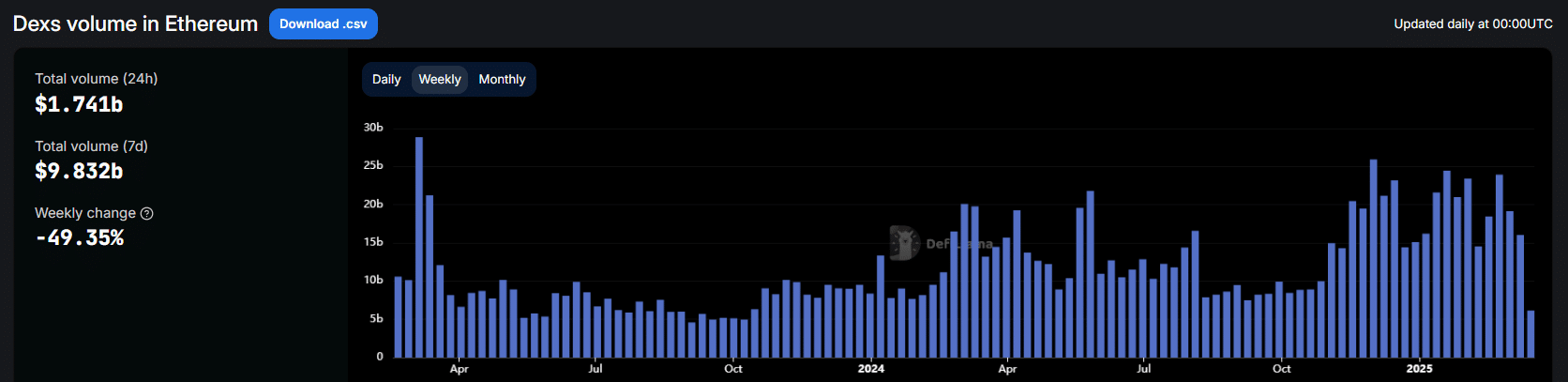

Ether Leeum Dex volume is reduced by 50% a week

Ether Leeum’s (ETH) DEX market has seen a sharp recession these days, and daytime trading volume has been almost 50%.

Over the past month, ALINE has decreased steeply by decreasing from $ 86.2 billion in January to $ 14.55 billion in February. Basically, the activity decreased 83%.

Source: Defillama

The decline in transaction interests is a sign of weakening of participation, and it naturally raises concerns about Ether Lee’s wide market participation.

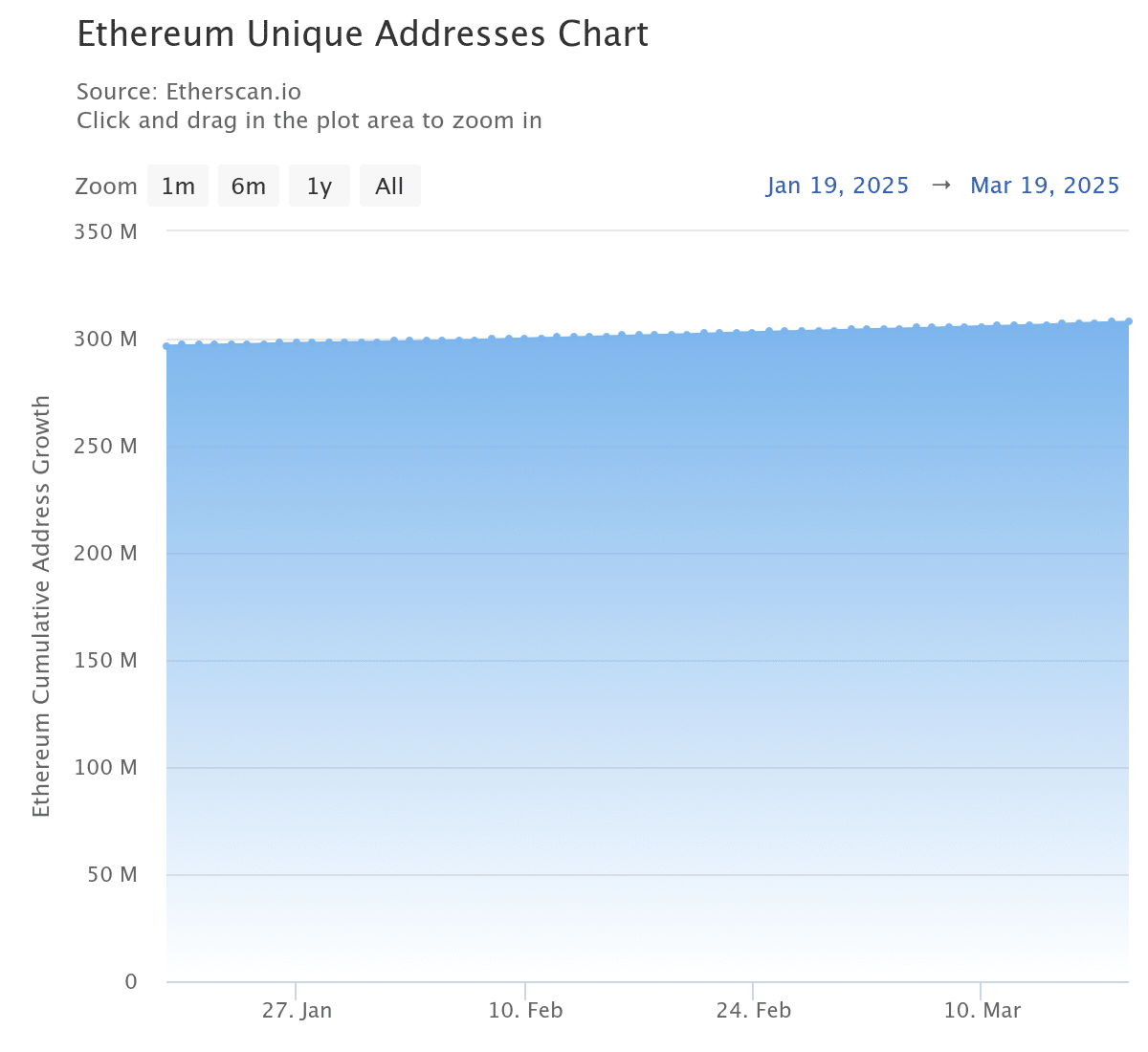

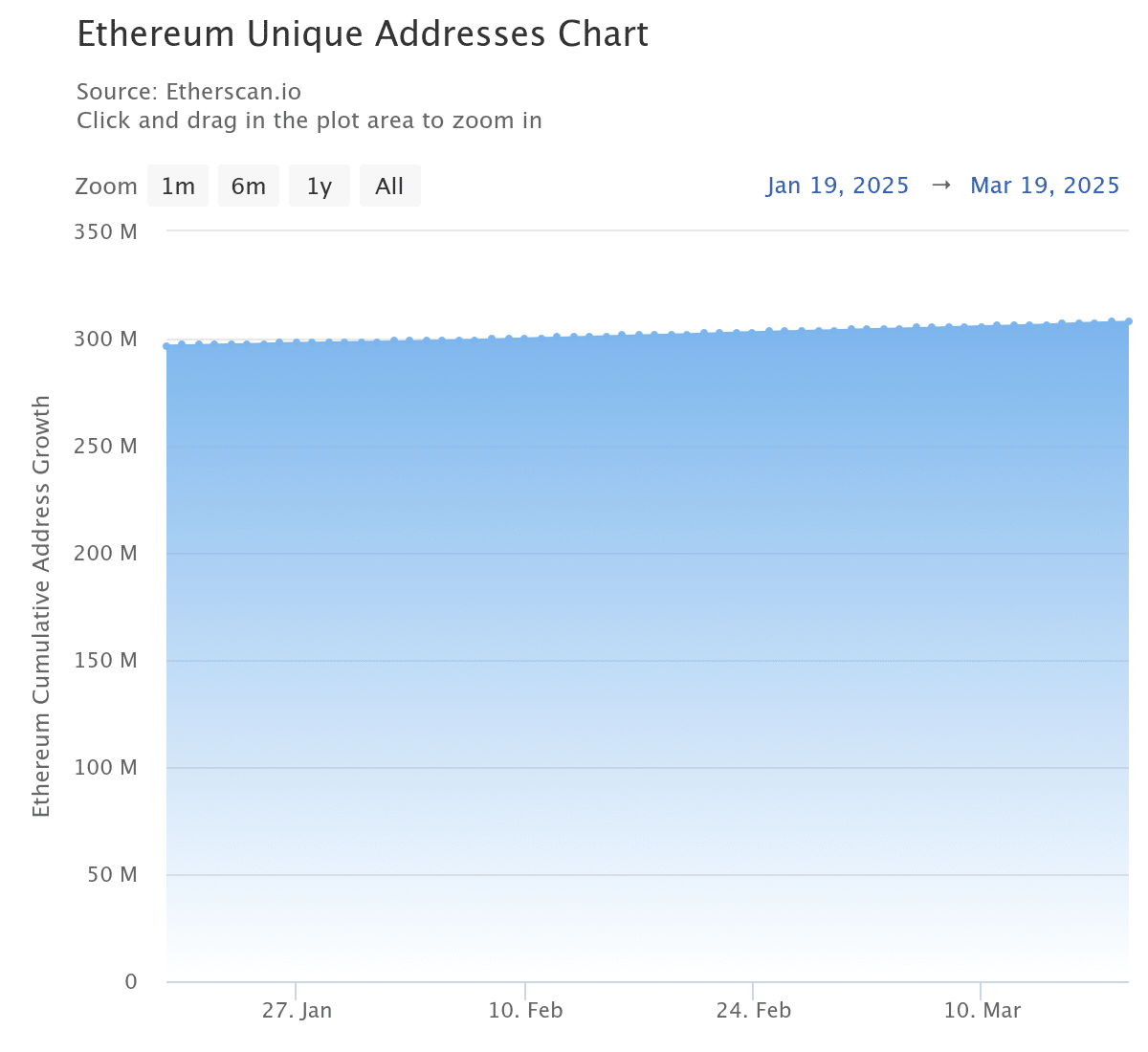

However, despite this decline, Ether Lee’s unique address has steadily increased, increasing 11.93% from January to March.

Source: Etherscan

This trend suggests that existing participants may be reducing their activities while new users continue to enter the network. The contrast between the decrease in trading volume and the rise in the inherent address indicates that the user may be moving to drowsiness or staying rather than an active deal.

To better understand this, you need to check the data more.

The deck has a small hand-the hot chain data signals the cooling market.

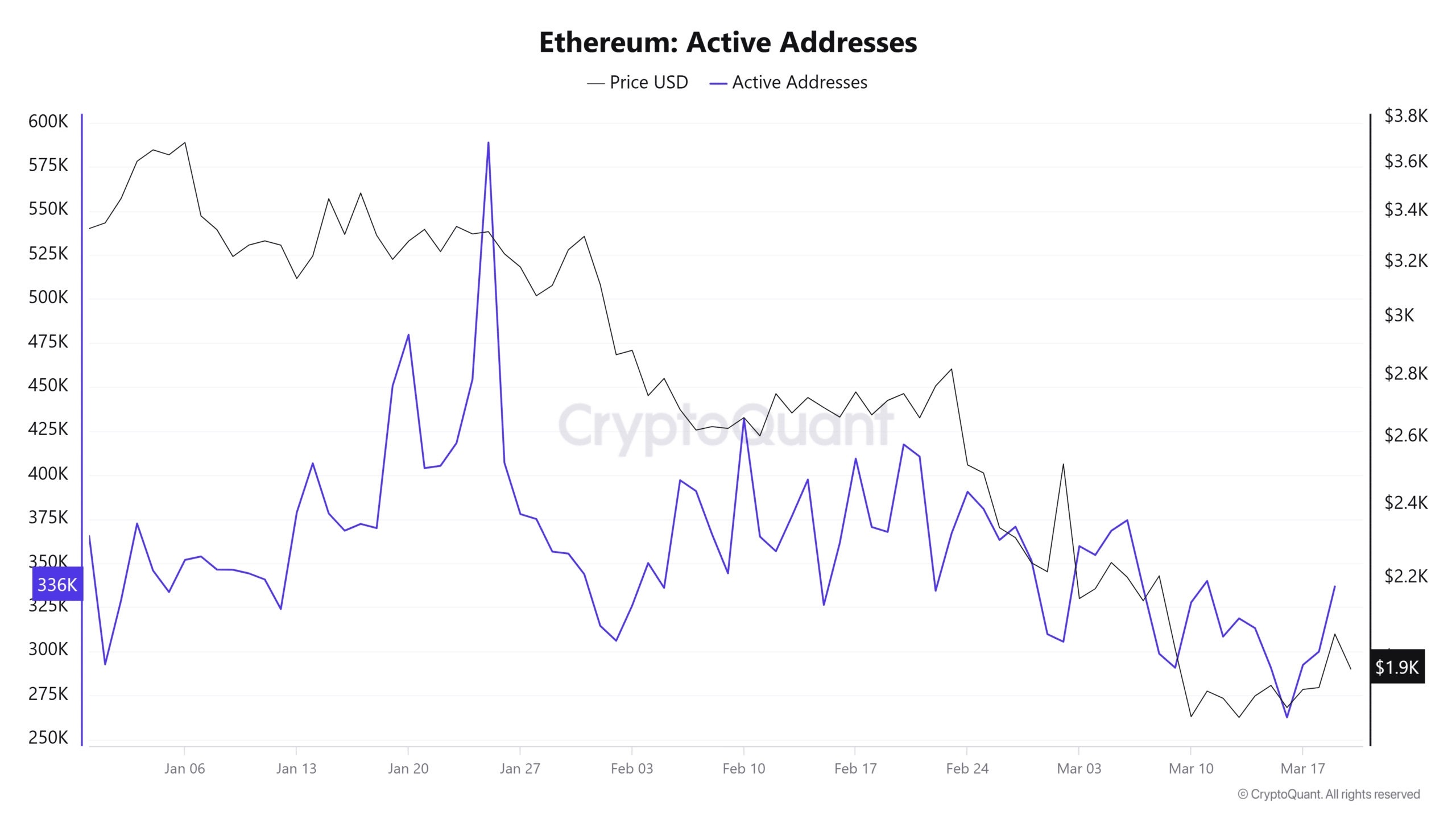

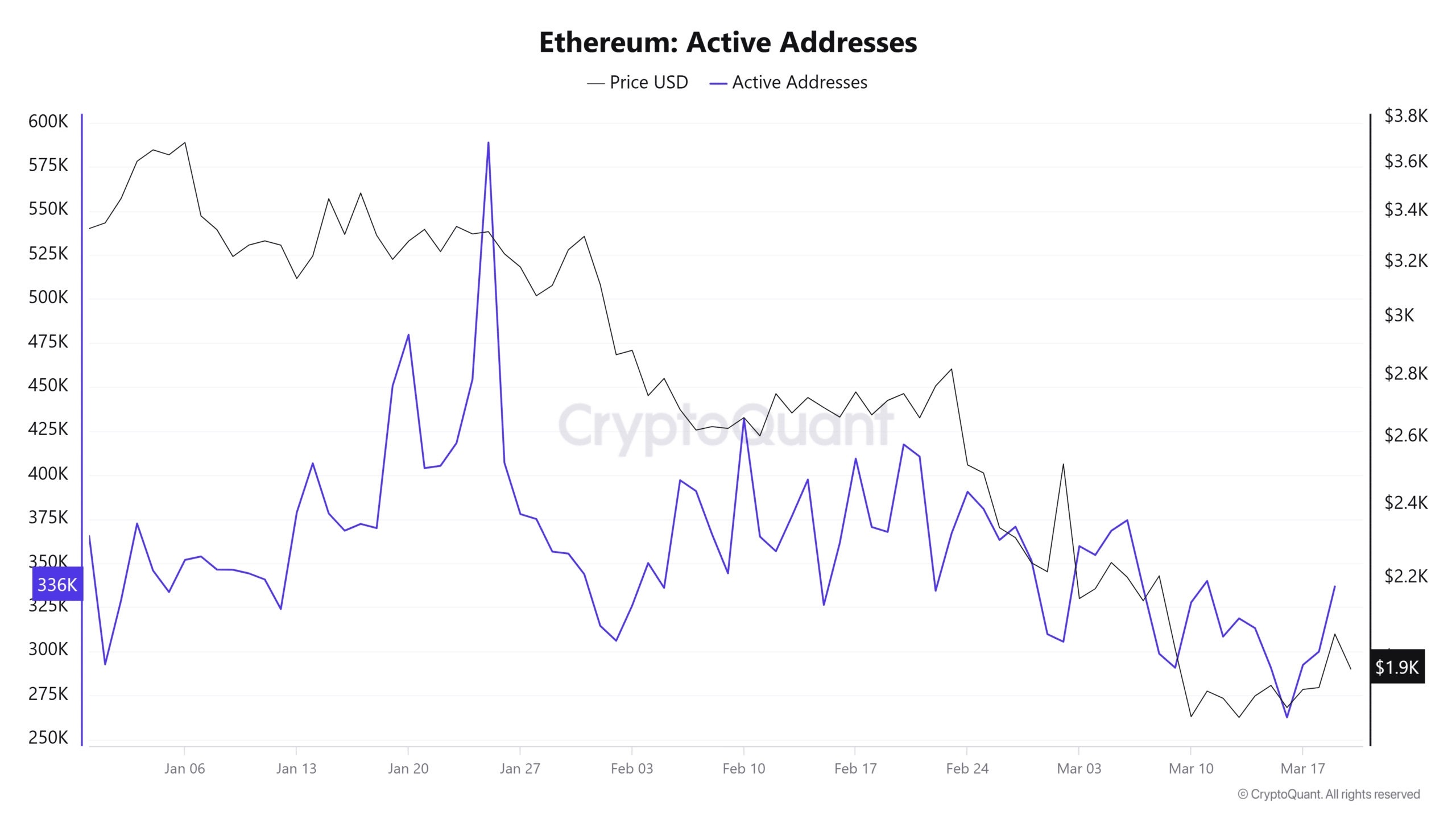

Ether Lee’s network activity fell by 55.4% from 588,782 on January 25 to 262,466 from March 16.

Source: cryptoquant

The price decreased by 43.7% from $ 3,353 to $ 1,887, reflecting this fall.

Historically, low address activities are interpreted as weak demand, raising concerns about Ether Lee’s continuous decline.

MVRV has an alarm -Ethereum is undervalued?

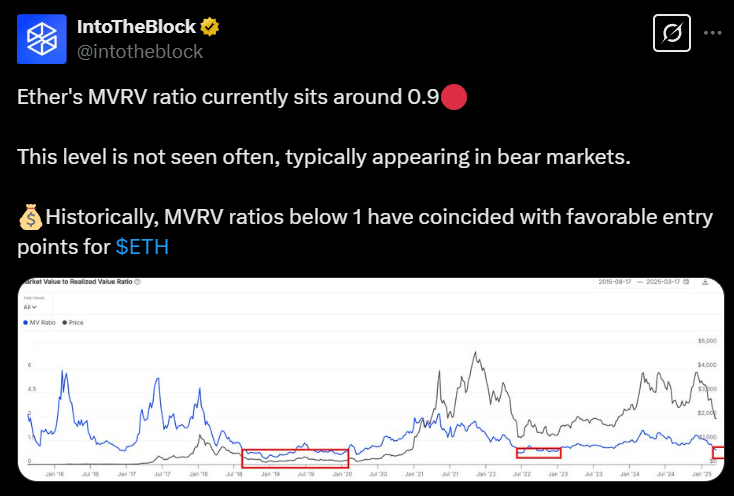

While the network activity is decreasing, Ether Lee’s realization value (MVRV) ratio has dropped to 0.9 on the chart.

Source: INTOTHEBLOCK ‘sx

The ratio of less than 1.0 has historically announced that Ether Lee is evaluated. This level of transfer was consistent with the bottom of the bear market. What does this mean?

Ether Lee’s MVRV ratio decreased by 30% from 1.32 in February, reflecting market corrections in the past in 2018, 2020 and 2022.

Surrender or hidden accumulation play?

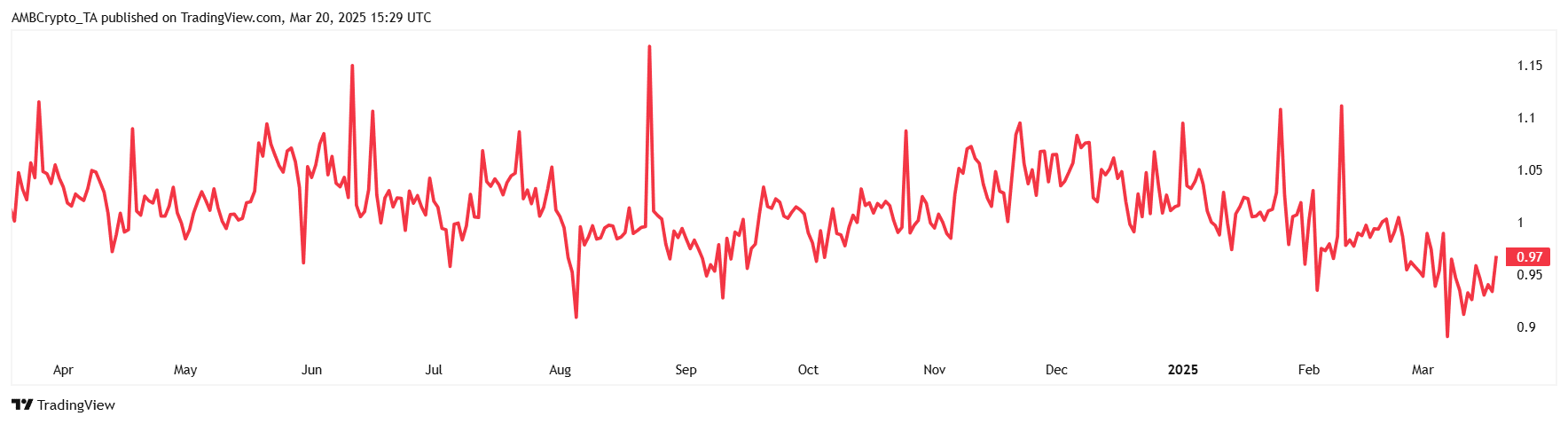

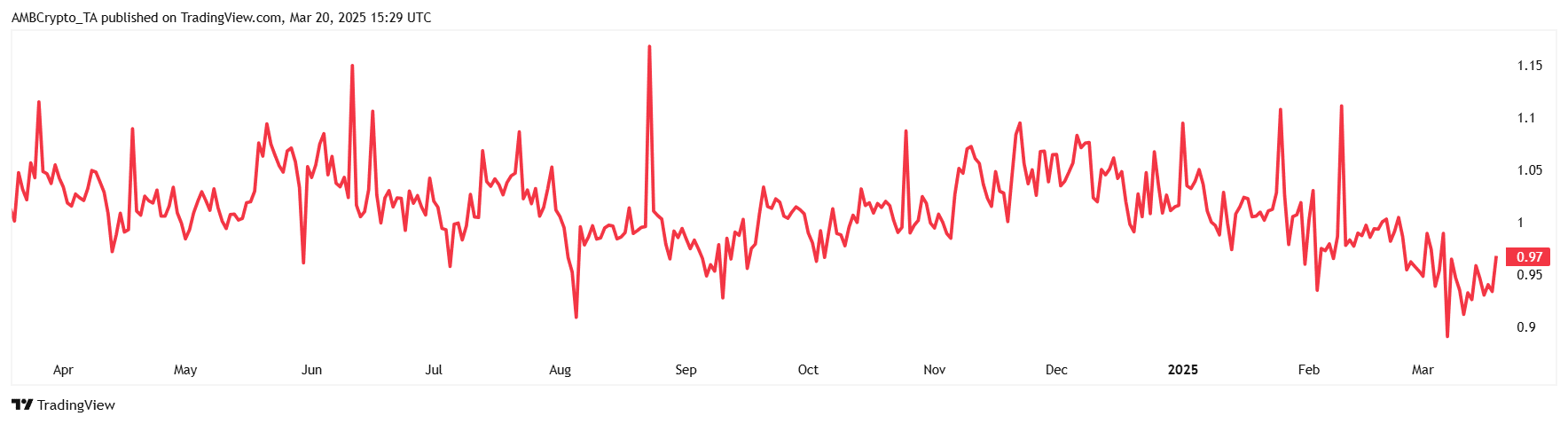

Another major metrics, the SPEENT OUTPUT Profit Ratio (SOP), added additional insights to investor behavior.

Source: TradingView

At the time of writing, SOPR sat at 0.97 and signaled that most ETH transactions were lost. If the SOP drops to less than 1.0, the sales pressure is often displayed as the floor of the local market.

The decrease in the two indicators is a sign that Ether Lee is near the bottom of the region. Historically, it is a stage of accumulation before recovery.

Intersection

Ether Leeum’s market conditions show two possible results.

Trading volume and decline in network activities can weaken demand and lower prices. However, if the MVRV and SOP are historically low (to be viewed before major rebounds), it can be an accumulation stage.

Whether or not the market is seeing additional loss depends on how investors react to the data.