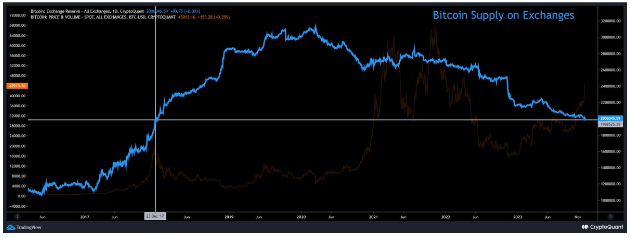

On-chain data showed growing sentiment among investors to hold Bitcoin. Bitcoin has been on the rise since the beginning of this month, breaking a new yearly high. At the same time, CryptoQuant’s exchange data allows cryptocurrencies to Preparing for a continued upward trend. According to an on-chain analytics platform, Bitcoin’s exchange supply, or the amount of money that can be purchased on exchanges, has fallen to its lowest level since 2017.

Exchange supply falls to lowest level in 6 years

The Bitcoin market is flashing bullish signals that are correlated with expectations for spot Bitcoin ETF applications. CryptoQuant’s chart of exchange holdings shows that Bitcoin supply has been steadily declining on centralized exchanges since 2020, when it peaked at over 3.2 million BTC. The outflows worsened in the fourth quarter of 2022, when the collapse of cryptocurrency exchange FTX caused panic and investors began opting for self-storage in cold wallets. During this period, exchange holdings decreased from 2.512 million BTC to 21.58 million BTC in one month.

https://x.com/cryptoQuant_com/status/1733005131216744749?s=20

lowest supply #Bitcoin within 6 years

“We are entering our 45th month of declining supply. For the first time, supplies have returned to 2017 levels. ”

by @1Mr. PappyLink 👇https://t.co/dY6QyFNit4

— CryptoQuant.com (@cryptoQuant_com) December 8, 2023

Exchange deposits began to slowly increase in early 2023, rising again to 2.24 million in May. But things started to change in June. Submission by BlackRock and other investment companies Spot Bitcoin ETF Trading in the US has started a period of bullish sentiment.

Bitcoin slightly below the $44K level today. Chart: TradingView.com

Since then, reserves on centralized exchanges have been steadily declining. As of this writing, exchange reserves have now fallen below 2 million BTC, a level they have not yet reached since December 2017. The six-year low for this indicator is especially interesting considering that the total circulating supply of Bitcoin has increased since 2017. The current supply is 19,564,812 BTC, a 16% increase from the December 2017 supply of 16.78 million BTC.

Bitcoin Price Outlook: Bullish Signal?

Although technically there are more Bitcoins available now, Increased adoption is making it It is becoming increasingly difficult for merchants. To secure assets. Declining exchange supply is a bullish signal for a cryptocurrency asset, and periods of low exchange supply have historically been associated with the beginning of Bitcoin bull runs. The last time Bitcoin’s exchange reserves declined sharply was in 2020, and the cryptocurrency subsequently hit an all-time high the following year.

Bitcoin is It is currently leading the way in new inflows. Coinmarketcap’s Fear and Greed Index is now making inroads into the cryptocurrency industry. 82’s extreme greed. The best asset in the industry It broke above $44,000. It’s the second time this week it’s risen 14% in seven days. Bitcoin is expected to achieve a massive rise in 2024, many analysts predict Target price expected to be over $100,000.

(The content of this site should not be construed as investment advice. Investing involves risk. When you invest, your capital is at risk.)

Featured image from Freepik