- 21Shares takes VanEck’s lead in pursuit of Spot Solana ETF.

- Once the application is completed, Solana inflow is expected to surge.

Solana (SOL)’s market performance over the past few years has recently caught the attention of many Wall Street institutions, so it’s no surprise that some of them are very excited about the idea of a physical Solana ETF.

21Stock Movement

Seeking to capitalize on the growing interest in SOL, Swiss asset management firm 21Shares has filed to list its Solana ETF in the U.S. The filing closely follows a similar filing by rival VanEck.

21Shares’ application depends on the legal classification of the altcoin. The filing assumes that Solana is not considered a security under U.S. law. This distinction is important because securities ETFs are subject to stricter regulation than standard ETFs.

If the SEC classifies it as a security, 21Shares could withdraw its application entirely. This potential withdrawal may result from the additional registration requirements that come with securities ETFs, which 21Shares may not want to meet.

How is SOL affected?

A potential Solana ETF is expected to boost the price of Solana (SOL). This is similar to Bitcoin’s surge following the approval of a spot ETF.

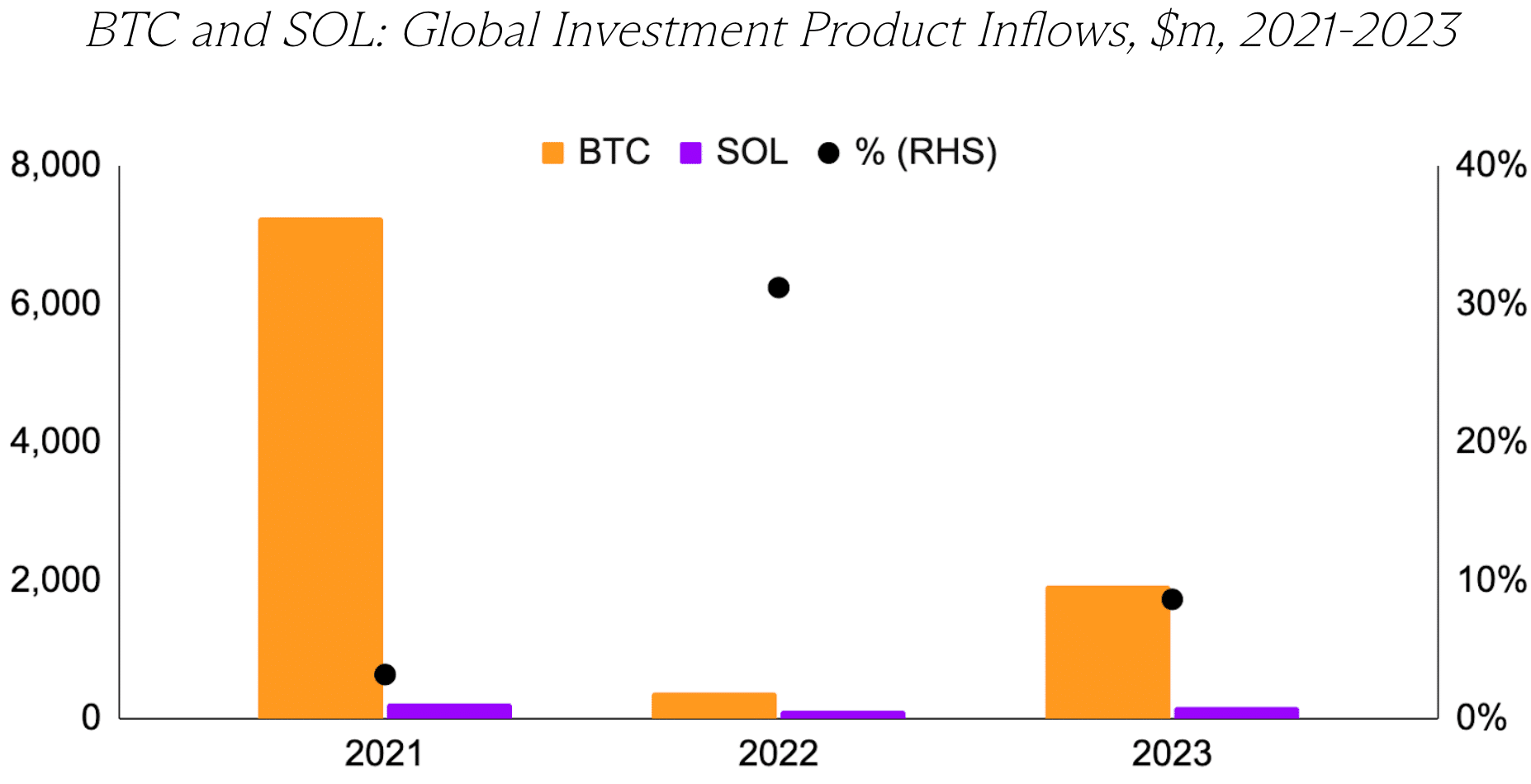

In fact, a recent analysis by GSR Markets actually used Bitcoin’s 2.3x price increase as a starting point. However, it’s worth pointing out that they acknowledged that the Solana ETF would likely not attract the same level of investment. To illustrate this, GSR explored three scenarios based on potential investment inflows involving Bitcoin ETFs.

In the Bear Case, they assumed a 2% increase in SOL inflows. This assumes a lower level of interest in the Solana ETF, which has inflows of only 2% compared to Bitcoin.

Below is the Base Case where the inflow is 5% compared to Bitcoin. This is a more moderate scenario based on actual investment activity in Solana products from 2021 to 2023, excluding 2024 to avoid the influence of Bitcoin ETFs.

In the most optimistic and optimistic scenario, GSR takes into account higher relative inflows of SOL in 2022 and 2023. We estimate that on average, altcoins could attract 14% of inflows compared to Bitcoin.

Source: GSR

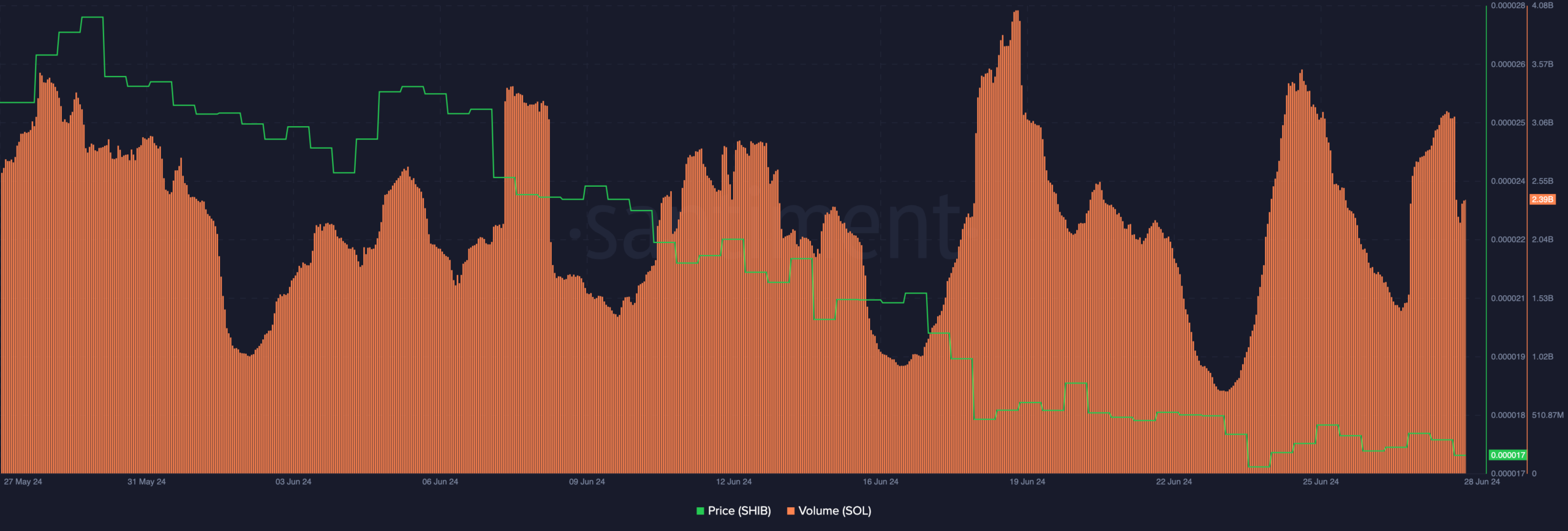

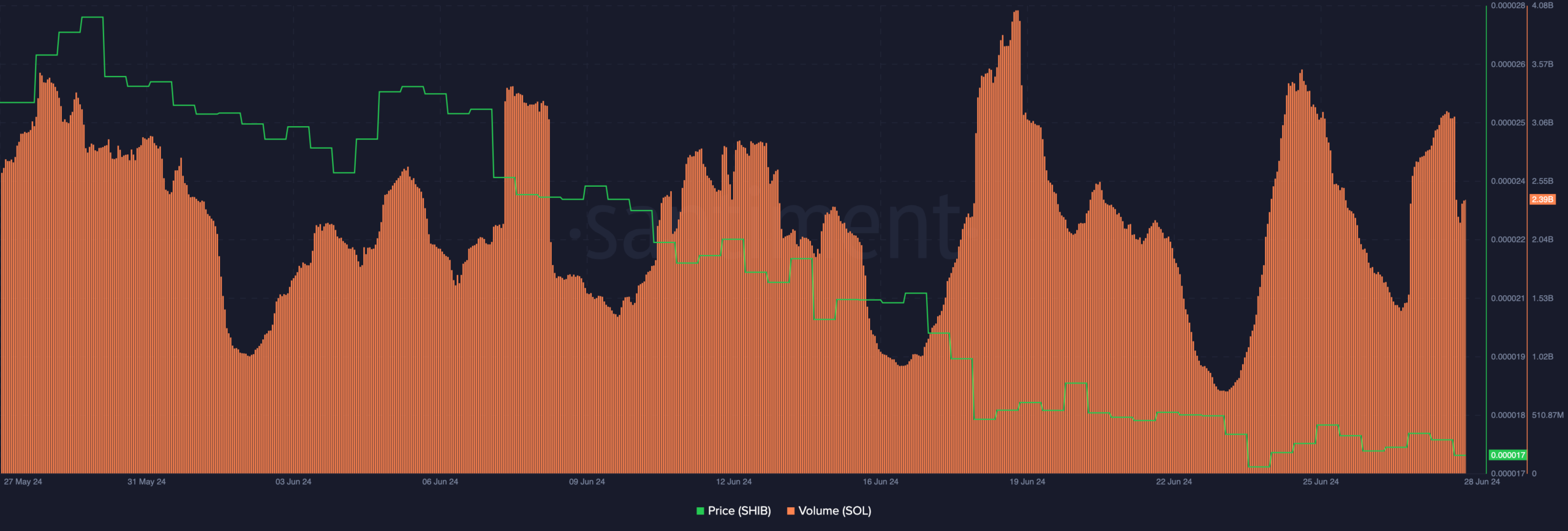

At the time of writing, SOL was trading at $141.80, with the price down 2.53% over the last 24 hours. In fact, the volume for the aforementioned period was also down 33.23% on the chart.

Is your portfolio green? Check out our SOL profit calculator

Source: Santiment