Discerning the start of a real altcoin season is similar to predicting the next wave in a stormy sea. However, certain indicators suggest that the market is on the cusp of a significant shift away from Bitcoin’s dominance and into a broader altcoin season.

Renowned analysts such as Michaël van de Poppe and Josh Olszewicz provide insights into the mechanisms of this transition. They highlight the role of market cycles, technological upgrades, and economic events in fueling altcoin rallies.

When does altcoin season begin?

Bitcoin’s recent surge from $25,000 to $53,000 has caught the market’s attention, signaling a potential peak and subsequent shift to altcoins. Van de Poppe cited Ethereum’s strength as a harbinger of this change, highlighting the upcoming Dencun upgrade and the potential of spot exchange-traded funds (ETFs) to significantly lower transaction costs and increase the utility of Ethereum.

This technological leap could revitalize the Ethereum ecosystem and make it an attractive investment hub.

“If we are at the same level as the current Bitcoin price, Ethereum should be worth $3,800 to $4,200, so we need to catch up overall. Bitcoin will be consolidated and money will flow into Ethereum,” van de Poppe said.

The concept of altcoin season, or “altseason,” has evolved since its inception in 2017. This is no longer about a general market rally, but involves selective investments in promising ecosystems. Solana, Injective Protocol, and Render Protocol have been identified as frontrunners benefiting from the current market dynamics.

According to Van de Poppe, the post-Bitcoin halving altcoin season is likely to be favorable for this ecosystem, especially Ethereum, which has recently underperformed and is slated for future improvements in recent years.

“We are entering Ethereum alt season… In every cycle, Bitcoin’s dominance peaked before the halving. “With absolutely no events boosting confidence in Bitcoin, it is very understandable as investors are diverting profits from holding Bitcoin to other assets to generate higher ROI,” van de Poppe added.

Read more: 11 Best Altcoin Exchanges for Cryptocurrency Trading in February 2024

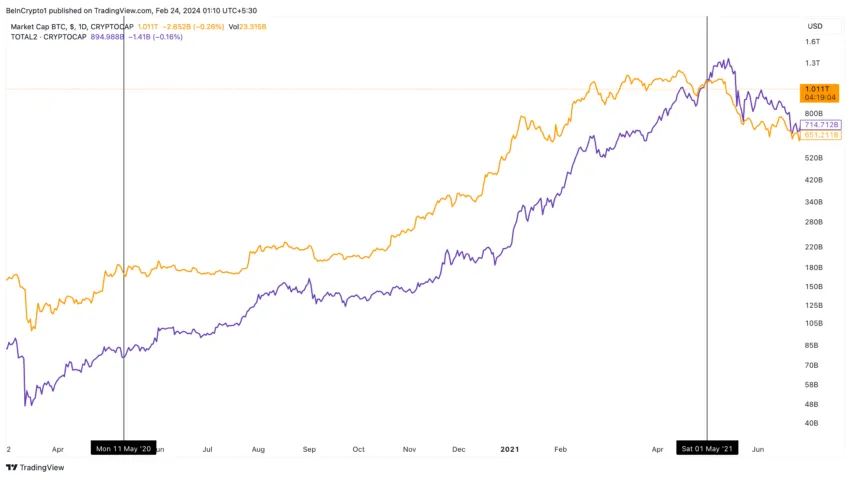

Likewise, Olszewicz pointed to patterns observed in past cycles. The overall market capitalization of altcoins, excluding Bitcoin, tends to catch up or surpass Bitcoin’s market capitalization after the halving. This phenomenon is important because it shows changes in investment sentiment and capital allocation within the cryptocurrency market.

Halving events, which halve the rewards for mining Bitcoin, have historically preceded performance improvements in altcoins. This is partly because Bitcoin rewards are shrinking, leading investors to seek higher returns in more volatile altcoins.

“Historically, you will see that the purple line or the altcoin line catches up after the Bitcoin halving. “Bitcoin is actually doing very well post-halving based on market capitalization, but this is a good sign to watch,” Olszewicz emphasized.

Olszewicz also emphasized the importance of the “crypto-asset effect.” He suggested that capital flowing into Bitcoin around the halving event would eventually flow into altcoins. This transition is fueled by Bitcoin’s increased liquidity and profitability, which will encourage investors to diversify once Bitcoin’s volatility begins to stabilize following the halving.

According to Olszewicz, expectations for an Ethereum ETF could further fuel this shift. Therefore, it switches ETF capital from Bitcoin to altcoins and amplifies the ‘crypto-asset effect’.

Read more: 13 Best Altcoins to Invest in February 2024

Despite the speculative nature of cryptocurrency investing, Van de Poppe and Olszewicz’s insights highlight a calculated approach to market exploration. The key to taking advantage of the impending altcoin season lies in recognizing signs of Bitcoin consolidation, the impact of Ethereum technological advancements, and the broader economic indicators that influence market cycles.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.