Hello, my name is Adam from Platinum Crypto Academy. My journey in the cryptocurrency market has been a mix of challenges and triumphs shaped by understanding and applying on-chain metrics. These metrics are more than just data points. They are narratives of the blockchain world, each telling a unique story. Let’s take a look at how these indicators are incorporated into my trading strategy.

The power of on-chain indicators

When I first started trading, the cryptocurrency market felt like a maze. It was the on-chain indicators that gave me guidance. Extracted directly from blockchain data, these indicators provide insight into the state and direction of the market to accurately guide your trading decisions.

Daily Active Addresses – Network Pulse

One of the first metrics that caught my attention was daily active addresses. It’s very interesting to see how this simple metric can reveal so much about the popularity of a network. I remember when I noticed a surge in active addresses on a blockchain that was not on the radar of many traders. These early insights gave me a head start, and I saw firsthand how such surges often precede asset appreciation.

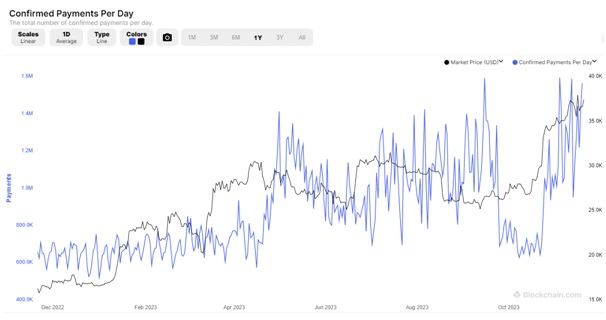

Daily Trading and Fees – Market Vitality

Beyond the number of active addresses, we started looking at daily transactions and fees. These numbers provide a vivid picture of blockchain activity. On days when a surge in trading hinted at an upcoming rally, I was able to adjust my portfolio in anticipation of market movements.

Exchange Supply Indicator – Selling Pressure Gauge

The Exchange Supply Indicator has been an important tool in my arsenal. It is like a barometer that measures the market atmosphere. High supply on an exchange often indicates bearish sentiment, while decreasing supply can indicate a bullish situation. This understanding helped me time my trades to take advantage of market changes.

MVRV Ratio – Rating Thermometer

Discovering the MVRV ratio was a turning point in my trading approach. This ratio has been a reliable indicator of whether an asset is overvalued or undervalued. It has helped me make more informed decisions, especially when considering long-term investments.

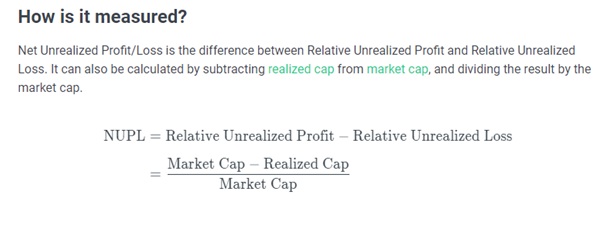

Identify market extremes

Timing is everything in the cryptocurrency market. Indicators like NUPL have been invaluable in identifying potential market highs and lows. These tools allow you to enter and exit trades at the optimal point to maximize your profits.

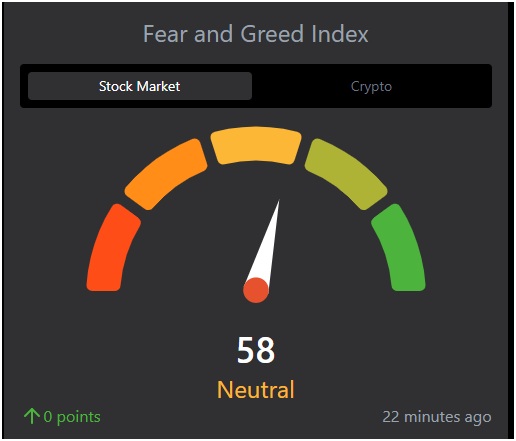

Investor Sentiment – Mood Meter

I quickly learned that market sentiment can be as volatile as the market itself. Sentiment analysis tools have been invaluable in understanding the collective mood of investors, allowing me to align my strategies with the emotional pulse of the market.

Miners’ profits and hashrate – the backbone of the network

The state of the blockchain is often reflected in miners’ revenue and hash rate. A particularly strong hash rate indicates a secure and active network. Monitoring these metrics gives me confidence in the networks I choose to invest in.

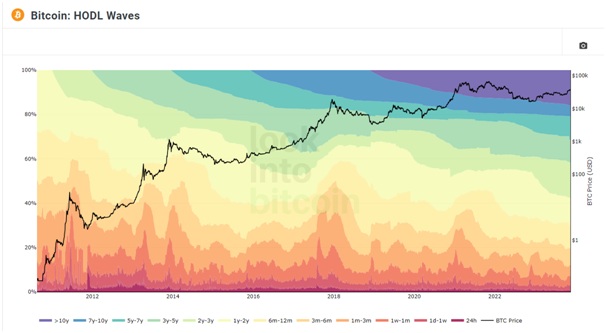

HODL Waves – Time-Tested Wisdom

The HODL wave provides a unique perspective on the era of coins in circulation. This historical perspective has been key to anticipating market changes, especially when long-term holders begin to move their assets. It’s like watching the ebb and flow of the market.

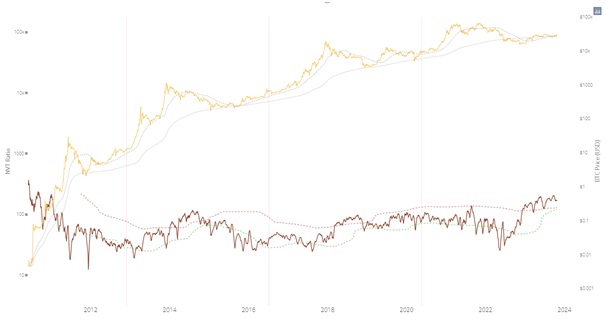

NVT Ratio – Check Your Financial Health

The NVT ratio is similar to a financial health check for a cryptocurrency. This has been instrumental in helping me identify the intrinsic value of assets and guiding me to invest based on solid fundamentals.

Smart Money Label – Follow the Leader

Lastly, tracking the investment patterns of the most informed players in the market has been enlightening. Smart money labels often reveal hidden trends and opportunities and guide you in making more profitable investment decisions.

My journey with on-chain metrics has been one of continuous learning and adaptation. These tools have not only improved my trading skills but also deepened my understanding of the complex dynamics of the cryptocurrency market. At Platinum Crypto Academy, we provide traders with this knowledge to ensure they are equipped to navigate the ever-evolving cryptocurrency trading landscape. Remember, in the cryptocurrency world, informed decisions are the key to success.

I hope you enjoyed today too article. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.