- A bullish breakout for Fantom targets $1.40, following a textbook cup and handle pattern.

- On-chain indicators and increased open interest highlighted strong market confidence in the upward trend of FTM.

Phantom (FTM) is trading at $1.28 at press time, up 5.01% over the last 24 hours as optimism about recent price action grows.

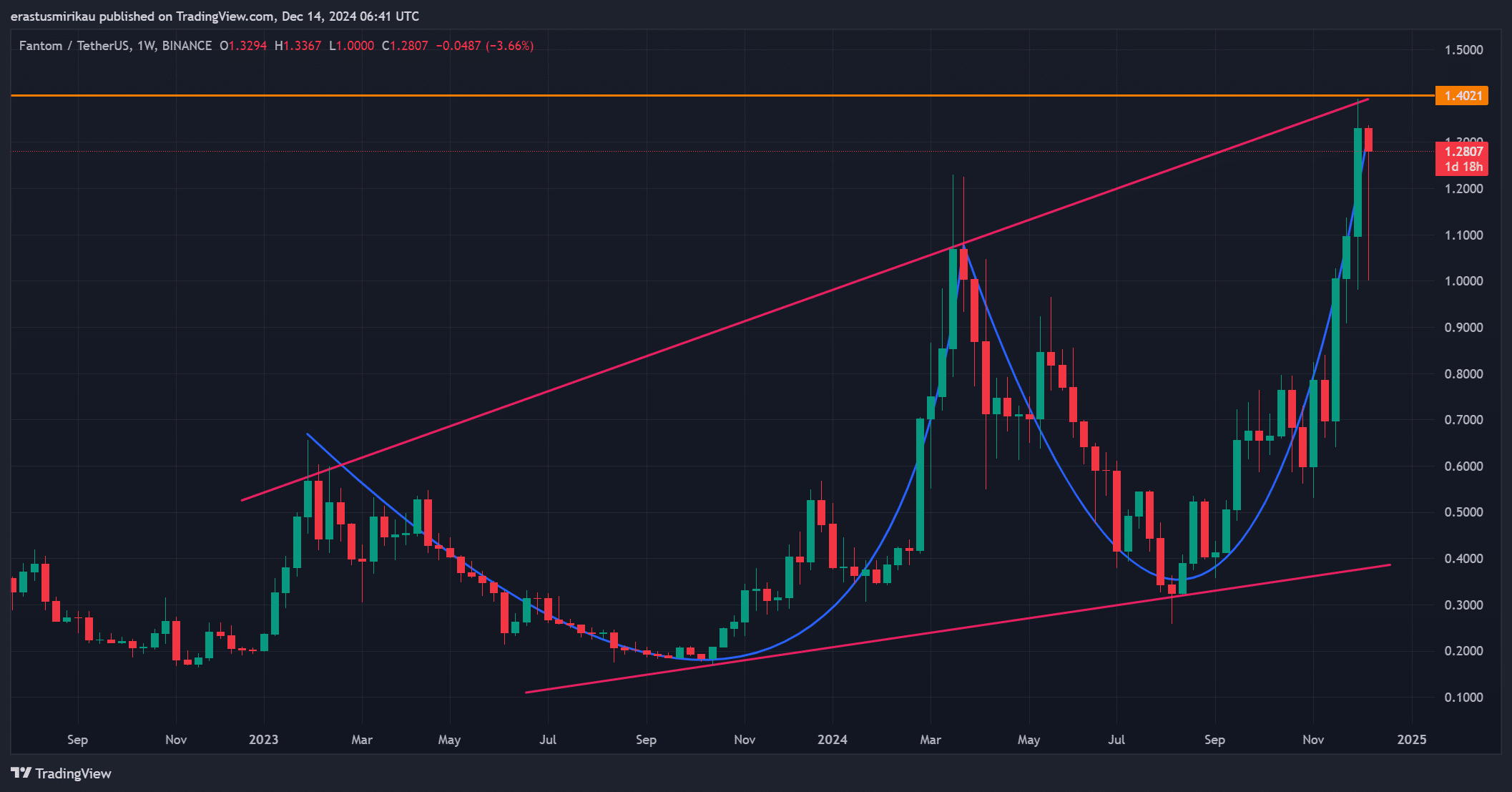

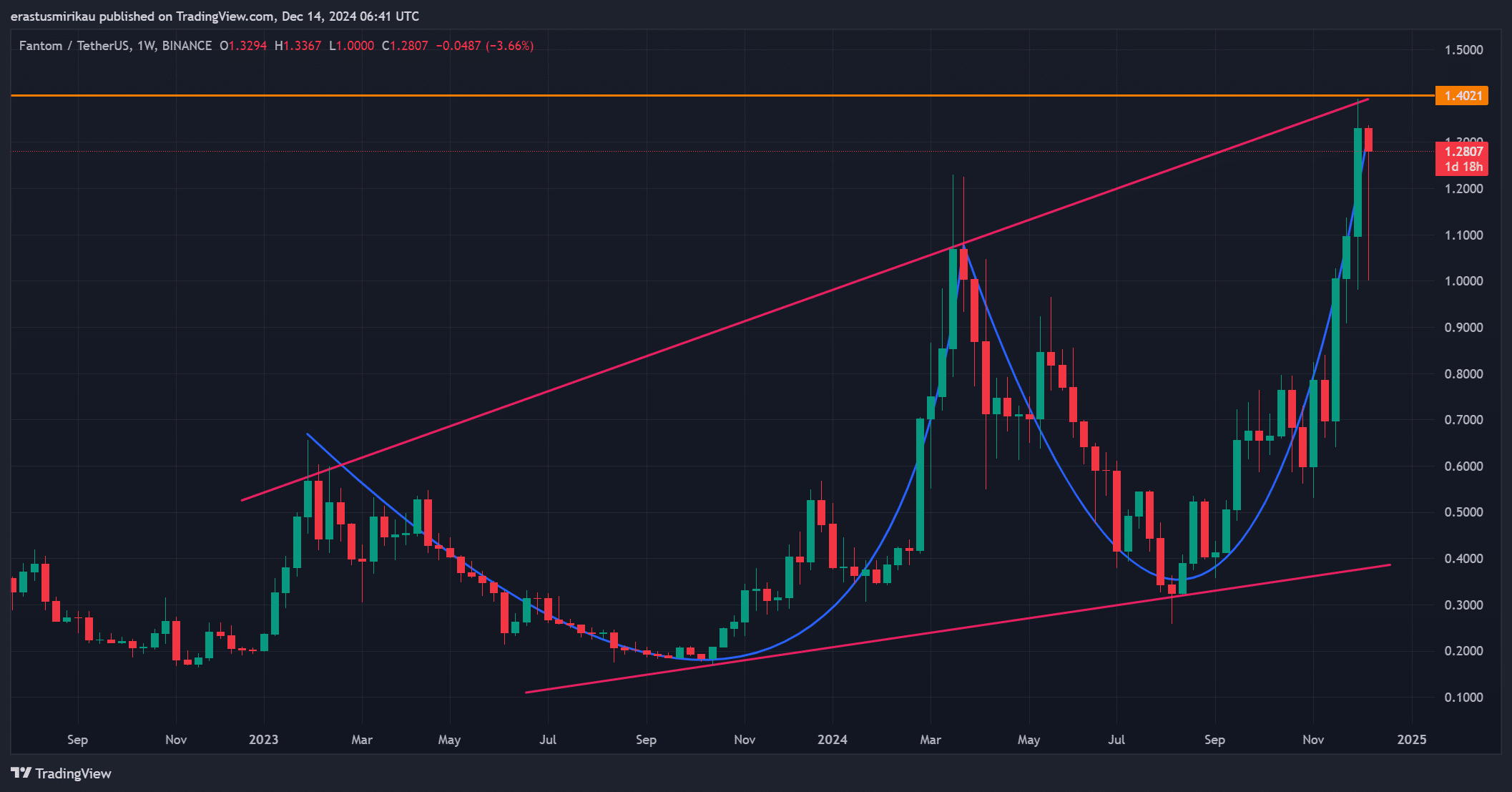

This rise coincides with the textbook cup-handle shape on a weekly chart and usually indicates an upward trend.

FTM’s current price action puts it in a strong position to challenge the important $1.40 resistance level. However, sustained buying pressure and favorable market conditions are needed to break this barrier. Traders are closely watching the altcoin’s next move.

Technical Analysis: FTM targets $1.40 resistance.

FTM’s weekly chart highlights the importance of cup and handle breakouts. This pattern often marks the beginning of a bullish trend, and the price of FTM is no exception.

Currently, $1.40 resistance is a major hurdle, acting as both a psychological barrier and an important technical level.

Additionally, continued formation of higher lows and increased buying volume strengthens the bullish case for FTM. If this momentum continues, a break above $1.40 could open a new phase of aggressive upside for the token.

Source: TradingView

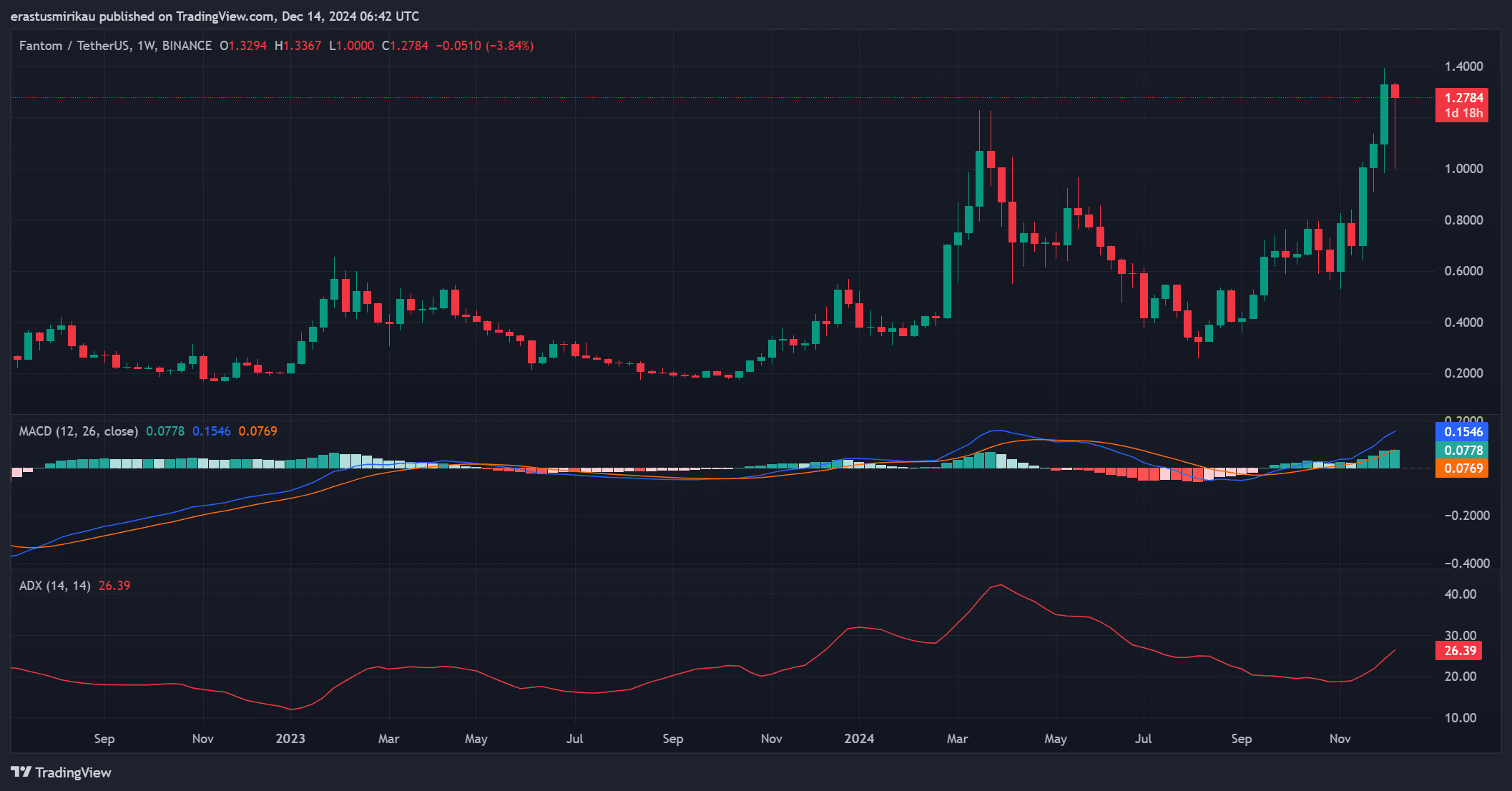

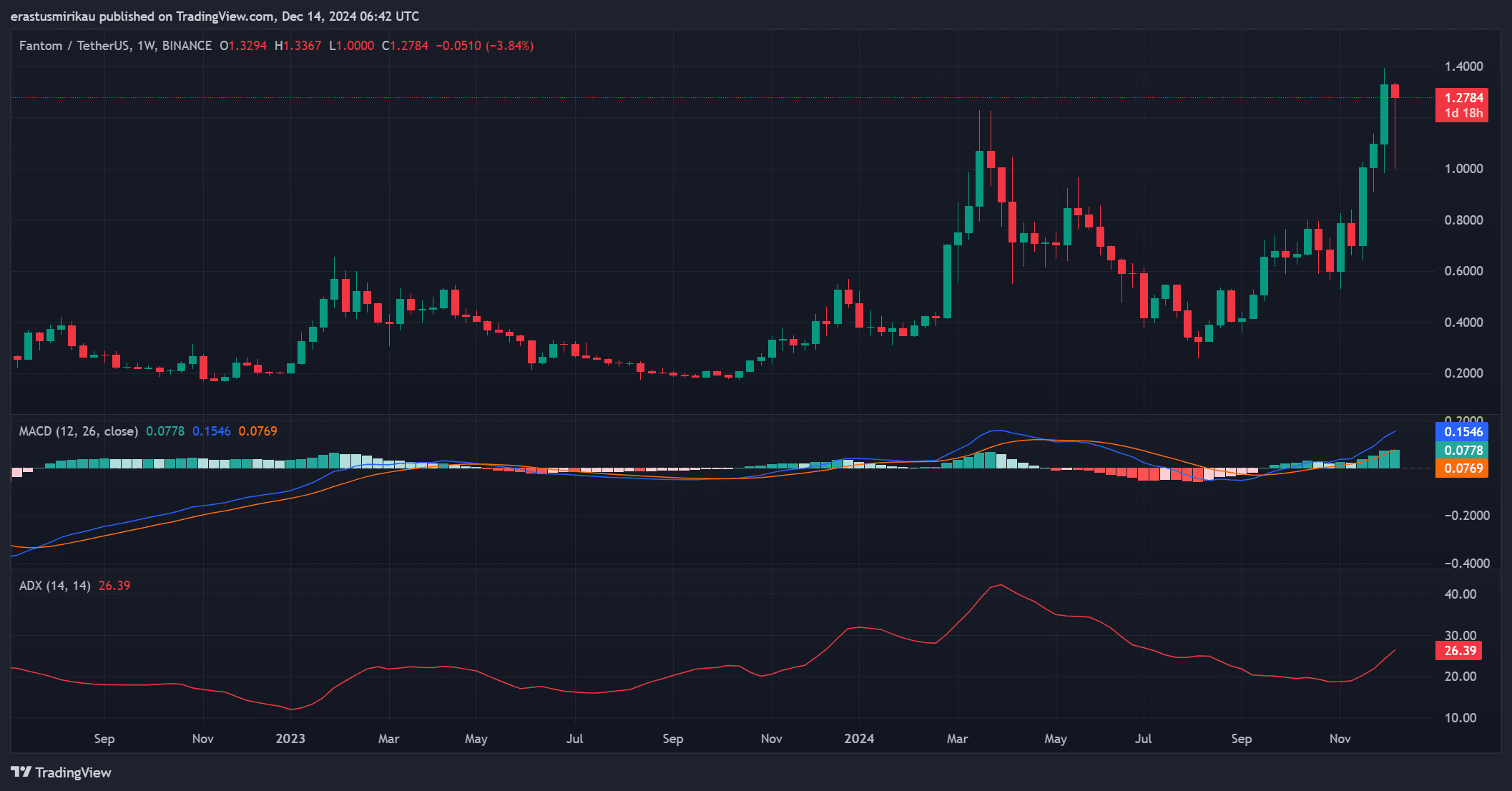

Technical indicators suggest continued strength.

Technical indicators validate FTM’s optimistic outlook. For example, MACD had a strong bullish crossover with the MACD line at 0.1546 well above the signal line at 0.0769. This signals continued upward momentum.

Additionally, the average directional index (ADX) was 26.39, confirming the bullish trend and reinforcing the market’s optimistic mood. Therefore, these indicators suggest that FTM has the momentum to test and potentially surpass the immediate resistance level.

Source: TradingView

FTM on-chain signal highlights market confidence

On-chain indicators support the rally in FTM. Net network growth increased by 0.45%, reflecting increased user engagement. In addition, large-scale transactions increased by 0.62%, highlighting the interest of institutional investors.

The “In the Money” indicator shows a minor bearish signal at -0.37%, while the concentrated indicator at -0.10% indicates that large holders are holding steady, further supporting the ongoing uptrend. Together, these indicators highlight strong market confidence.

Open interest reinforces bullish sentiment.

FTM’s open interest (OI) surged 4.75% and now totals $377.65 million. The increase highlights growing confidence among traders and signals heightened speculative interest in FTM’s ability to overcome immediate resistance.

Therefore, the rise in OI further strengthens the case for FTM’s optimistic outlook in the near term.

Source: Coinglass

Read Fantom (FTM) Price Prediction for 2024-25

Fantom’s strong technical structure, strong on-chain metrics, and increasing OI strongly suggest that it will break the $1.40 resistance. If the current momentum continues, Phantom could not only surpass this level, but also set the stage for a continued rally in the altcoin market.