The fear and greed indices in the cryptocurrency market have reached their highest levels since the end of 2021, indicating greed.

According to the latest data from the Alternative.me platform, the fear and greed indices in the cryptocurrency market have reached their highest levels since November 2021. At that time, the price of Bitcoin hit $69,000. Currently, this number stands at 76 points, indicating a bullish greed sentiment not seen since.

This index provides a numerical representation of the emotions and feelings of cryptocurrency market participants. The needle is now in the ‘extreme greed’ area. Throughout the past month, the indicator has fluctuated from 71 to 74. It wasn’t until December 5th, when the price of Bitcoin (BTC) surged to $44,000, that the needle briefly moved to the 75-point mark.

Previously, the cryptocurrency market moved into “extreme greed” territory on November 11, 2021. Afterwards, the indicator was 77 and the cost of the first cryptocurrency reached a historical maximum.

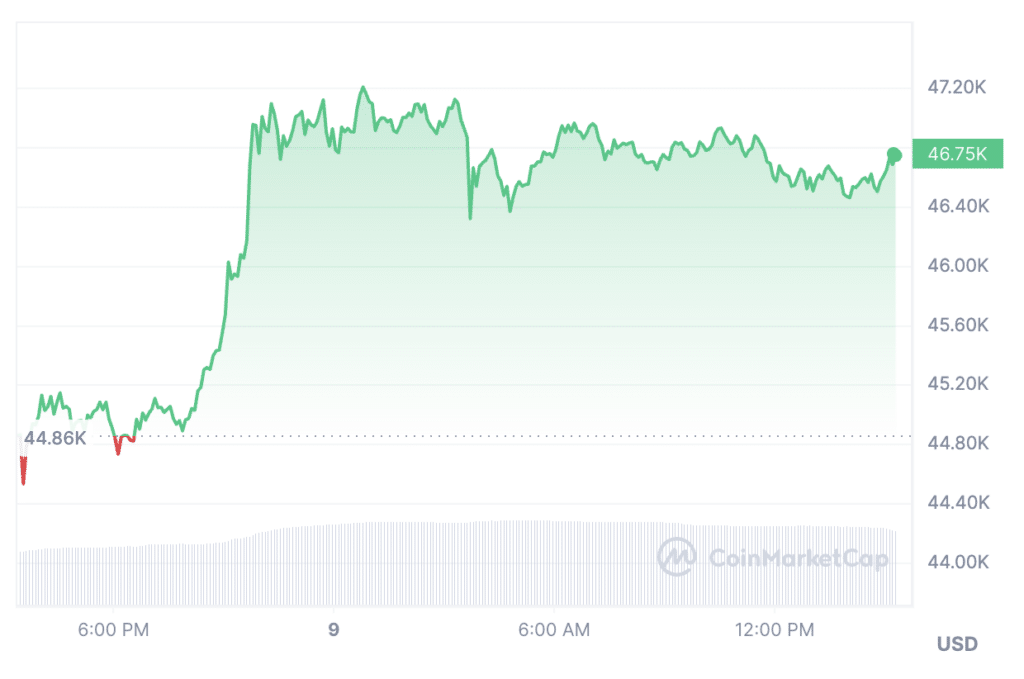

On January 8, the price of Bitcoin hit another yearly high of $47,000. The original cryptocurrency is now trading at $46,707. Over the past 24 hours, asset costs have increased by 4% overall.

This greedy sentiment comes amid news that the issuers of the BTC spot ETF have submitted their final applications to the U.S. Securities and Exchange Commission (SEC). Analysts expect regulators to make a decision by January 10.