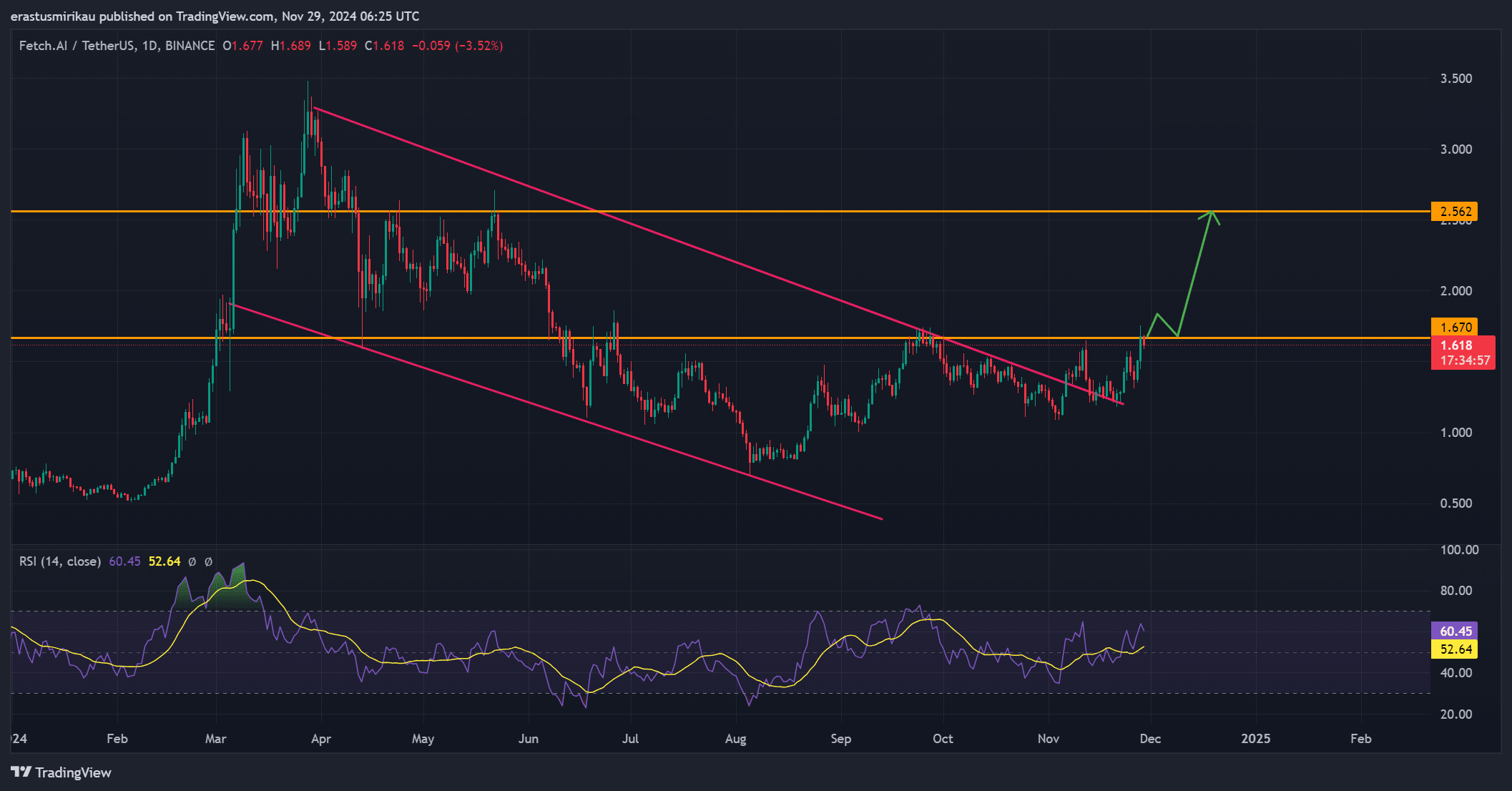

- If FET breaks out of the descending channel and is likely to break above $1.67, the price could rise to $2.56.

- On-chain signals and increased open interest point to a continued bullish outlook and support further price rises.

Federation of Artificial Superintelligence (FET) It recently announced plans to launch an earn-and-burn mechanism in December to burn up to 100 million tokens to reduce supply and potentially drive up the price.

Following this news, FET is up 9.19% and is trading at $1.62 at press time. The question on everyone’s mind is whether this rally can continue and what the technical outlook suggests for the future of FETs.

Is FET breaking out of its downtrend?

FET recently broke out of its bearish channel. This is a movement that usually indicates a change in market momentum. This breakout is promising and suggests that the token could enter a more bullish phase.

FET is currently testing key resistance at $1.67. If the token can break this level, heading toward $2.56 becomes a realistic target. With an RSI of 60.45, FET is not yet in overbought territory, leaving room for further price movement.

Source: TradingView

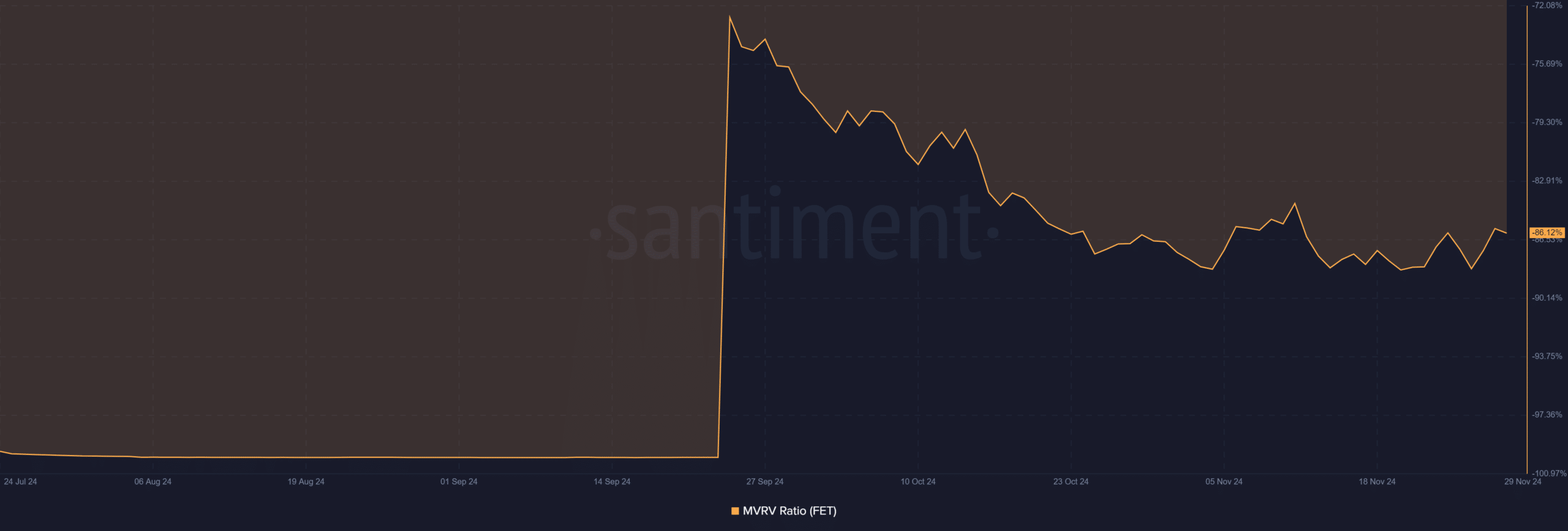

What does the MVRV ratio indicate about investor behavior?

FET’s MVRV ratio is -86.12%, indicating that many holders are losing money. While this may seem worrisome, it points to undervalued assets and could potentially set the stage for a price rebound.

Therefore, the current negative MVRV ratio may represent an opportunity for long-term investors looking for price recovery.

Source: Santiment

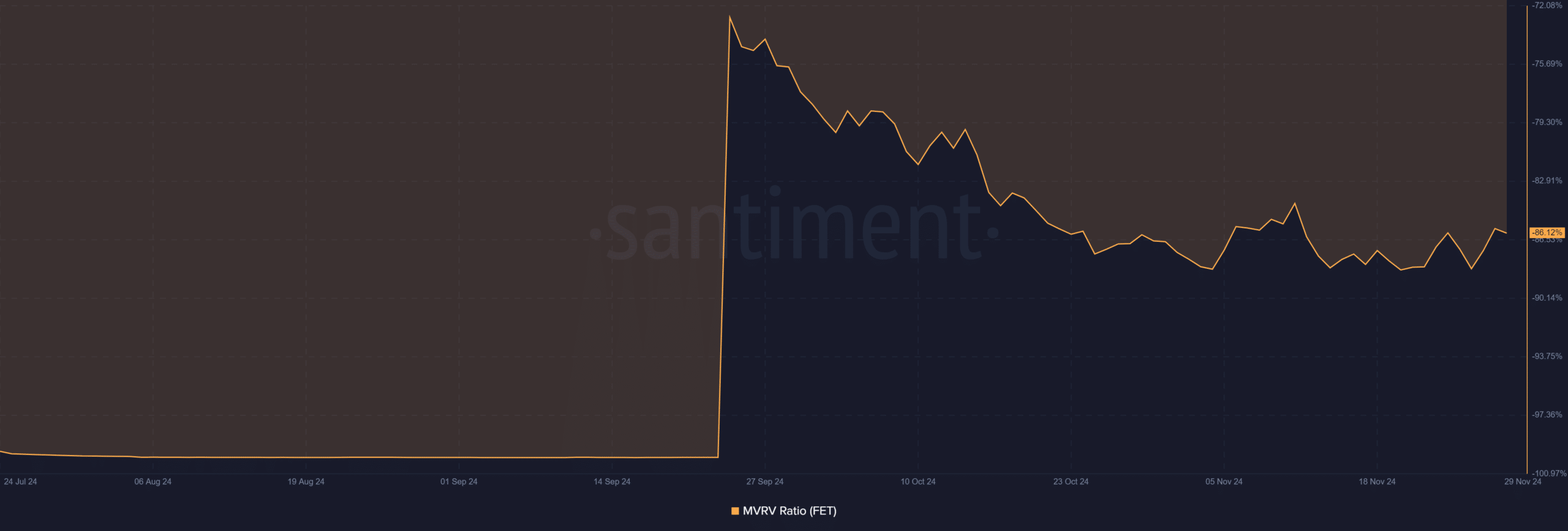

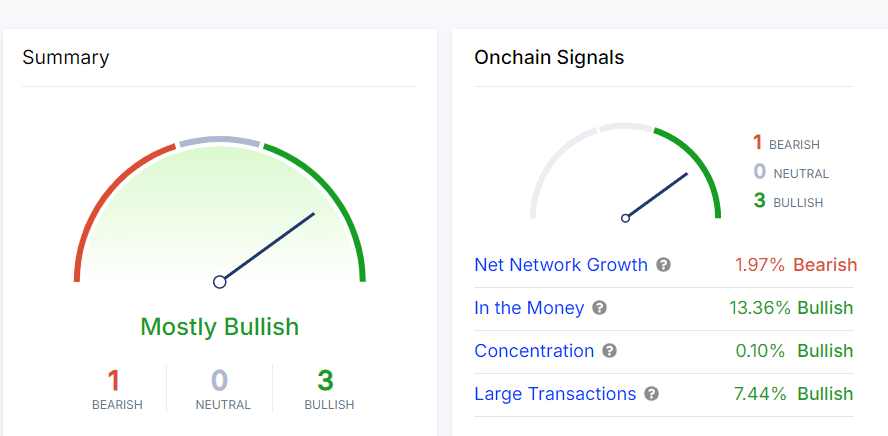

How do on-chain signals support the optimistic outlook?

On-chain indicators generally provide an optimistic picture. Net network growth decreased slightly to 1.97%, but this is not a major issue considering overall market sentiment.

More importantly, other key signals are very bullish. Into the Money is at 13.36%, meaning a significant portion of FET holders are profiting.

Additionally, large transactions increased by 7.44%, indicating increasing institutional interest. Additionally, the concentration is 0.10%, indicating that investors are accumulating tokens. Collectively, these factors suggest strong support for FET’s price momentum.

Source: IntoTheBlock

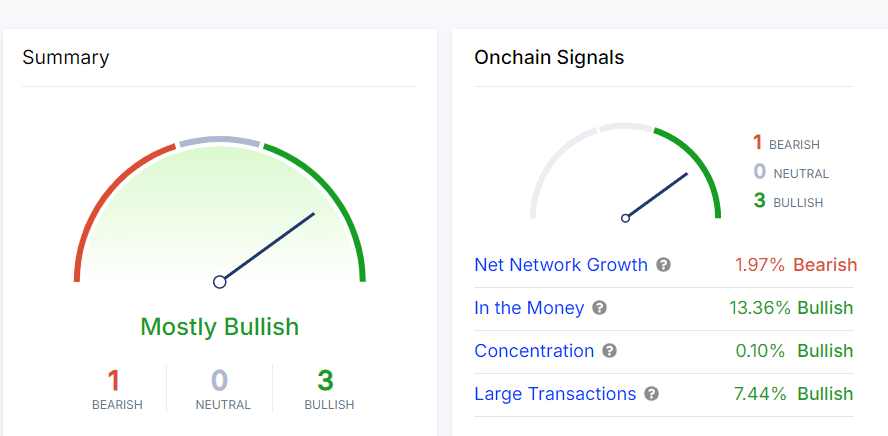

Is market sentiment changing in favor of FETs?

Market sentiment is increasingly optimistic. Open interest increased 10.38% to $156.26 million. This is a clear indicator that traders expect further price rises. This increase in open interest suggests that the market is expecting more upside for FET, especially with the upcoming token burn.

Source: Coinglass

Read Artificial Superintelligence Alliance (FET) price forecast for 2024-2025

Given the strong technical breakthrough, positive market sentiment, and bullish on-chain signals, FET is well-positioned for continued price appreciation.

The recent surge in open interest reflects rising investor confidence, and if FET can break the $1.67 resistance, a move towards $2.56 is very likely. Therefore, the uptrend is likely to continue, but we need to keep an eye on key resistance levels to confirm this.