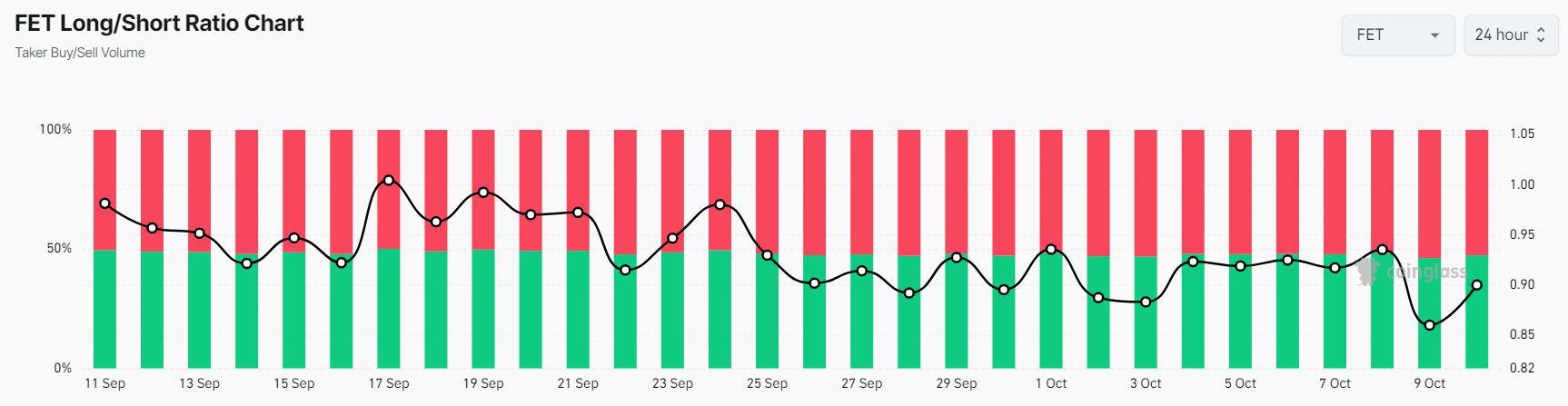

- FET’s long/short ratio was 0.90, indicating strong bearish market sentiment among traders.

- Among the top traders, 53.2% have short positions and 46.8% have long positions.

Amid persistent bearish market sentiment, the Artificial Intelligence Federated Price Forecast (FET) is unable to maintain critical support levels, leading to massive price declines.

Likewise, major cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), have been struggling, experiencing notable price declines over the past 24 hours.

Current price momentum

At press time, FET was trading near $1.35 after falling more than 4.7% in price over the past 24 hours. During the same period, trading volume decreased by 4.9%, reducing the participation of traders and investors.

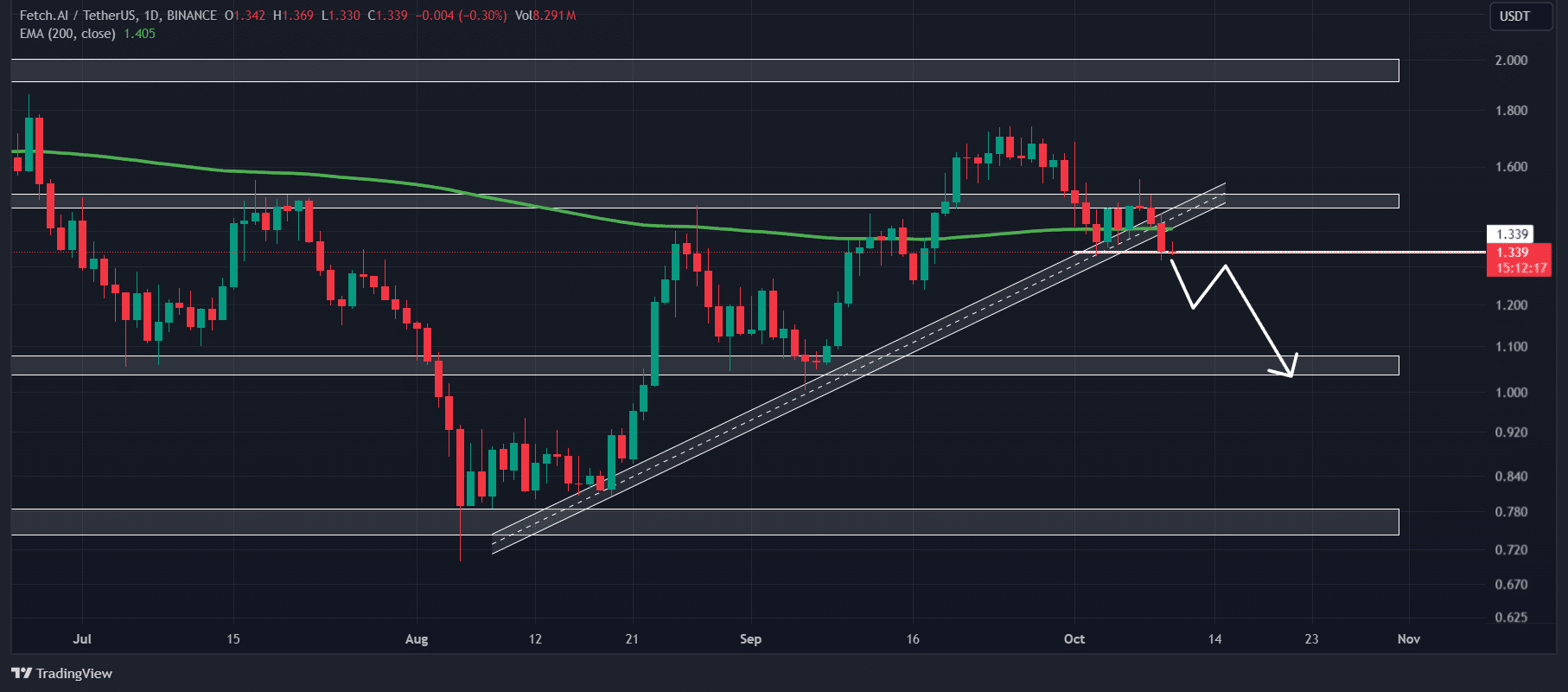

FET recently violated important trendline support, a strong consolidation area, and the 200 exponential moving average (EMA) on the daily time frame.

A successful collapse was confirmed by closing the daily candle below the sideways range.

Source: TradingView

Based on historical price momentum, it is likely that FET price will decline 20% in the next few days and reach the $1.03 level.

Despite this bearish outlook, the Relative Strength Index (RSI) is in oversold territory, suggesting a potential price recovery.

However, that seems unlikely at the moment due to the bearish sentiment in the market.

Bearish On-Chain Indicators

The negative outlook for altcoins is further supported by on-chain indicators.

At press time, FET’s long/short ratio was 0.90, indicating strong bearish market sentiment among traders, according to on-chain analytics firm Coinglass.

Source: Coinglass

Additionally, Futures Open Interest (FUS) is down 6.7% over the past 24 hours and is continuing to decline, indicating continued bearish market sentiment.

At press time, 53.2% of top traders hold short positions and 46.8% hold long positions.

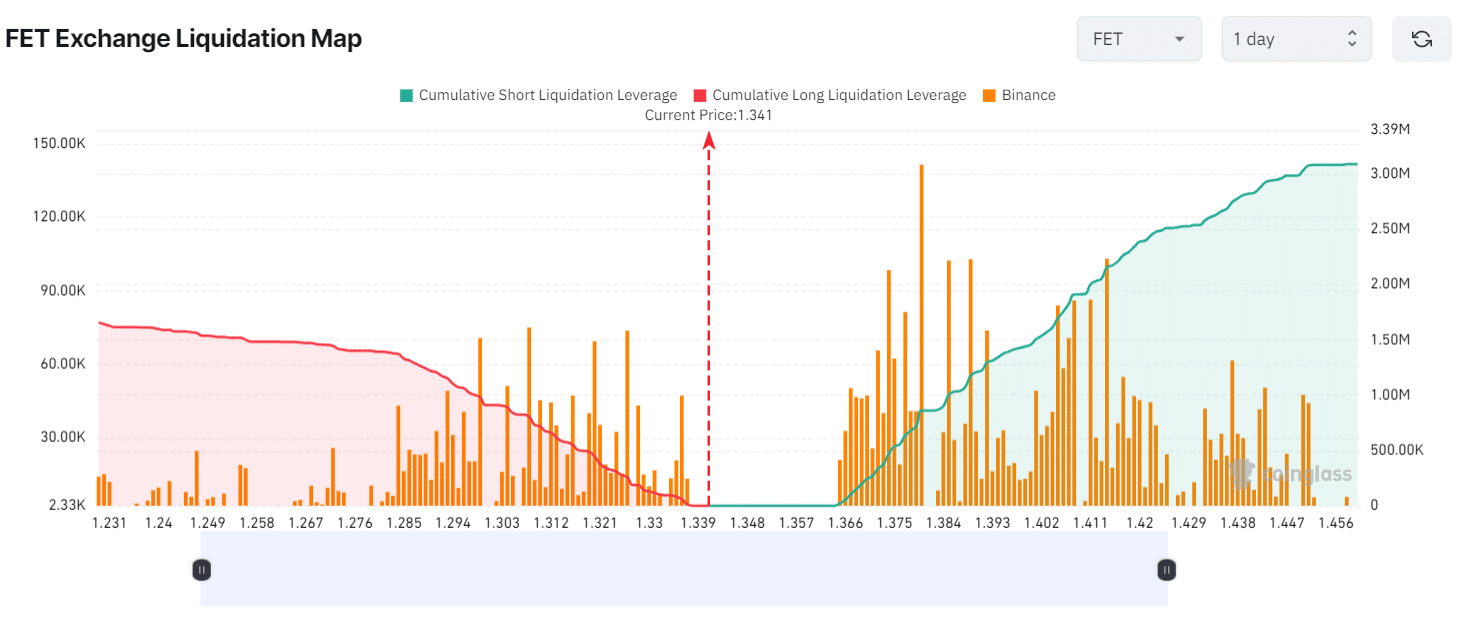

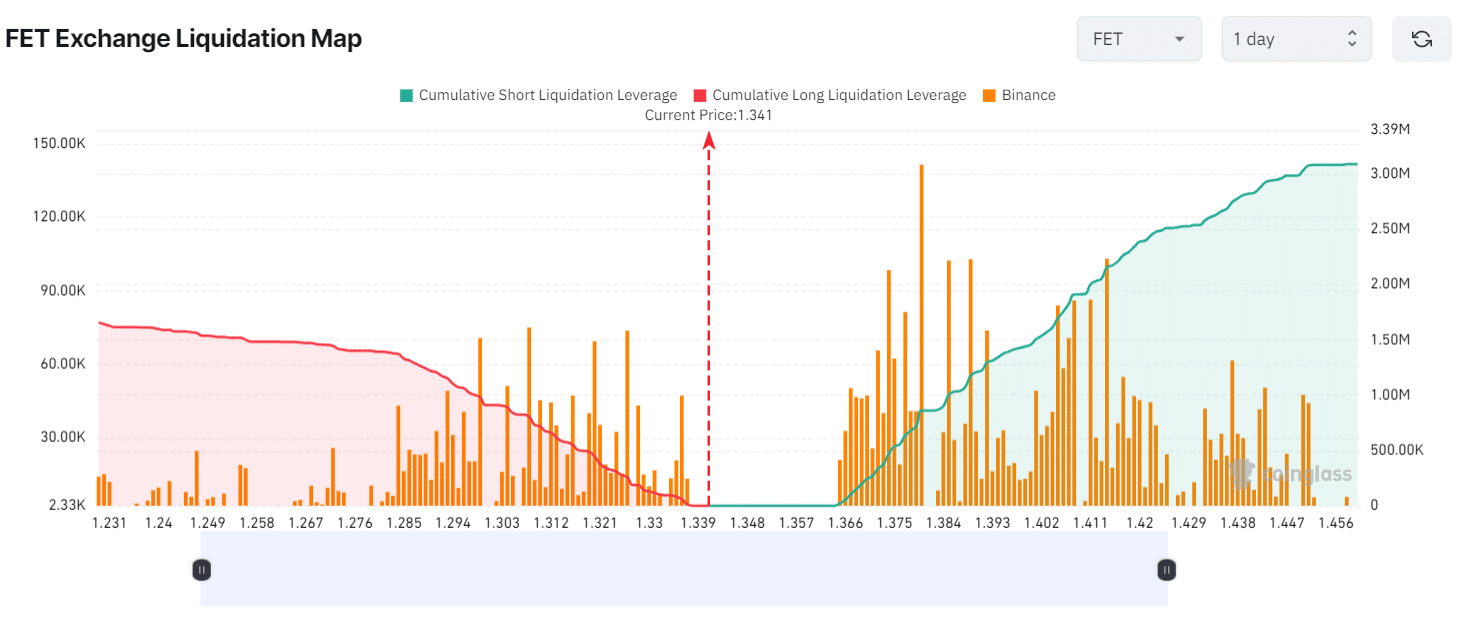

According to Coinglass data, key liquidation levels were $1.30 at the bottom and $1.38 at the top, with traders using excessive leverage at these levels.

Source: Coinglass

If the market remains unchanged and the price of FET falls to $1.30, approximately $807,000 worth of long positions will be liquidated.

Conversely, if sentiment changes and the price rises to $1.38, approximately $2.17 million worth of short positions will be liquidated.

Read Artificial Superintelligence Alliance (FET) price forecast for 2024-2025

This data shows that short sellers have been betting heavily on short positions over the past 24 hours.

By combining technical analysis with on-chain indicators such as open interest and long/short ratios, it appears that bears are currently dominating the asset and are likely to drive massive price declines.