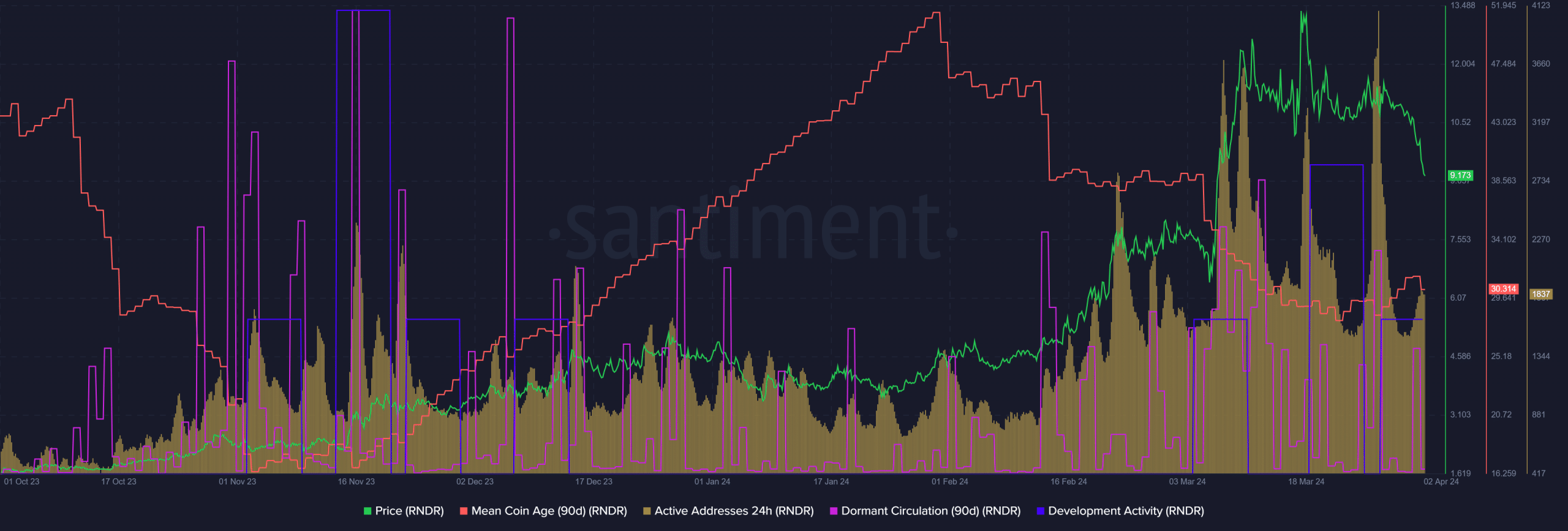

- Fetch.ai and Rendr showed a high volume of active addresses.

- Following the recent downtrend, RNDR has accumulated.

Santiment’s recent post on AI and trading strategies were also major topics of discussion.

Fetch.ai (FET) and Rendr (RNDR) were among the largest tokens in the AI sector by market capitalization. Given the hype around AI despite the market downturn, AMBCrypto decided to take a look at what investors should prepare for in the coming weeks.

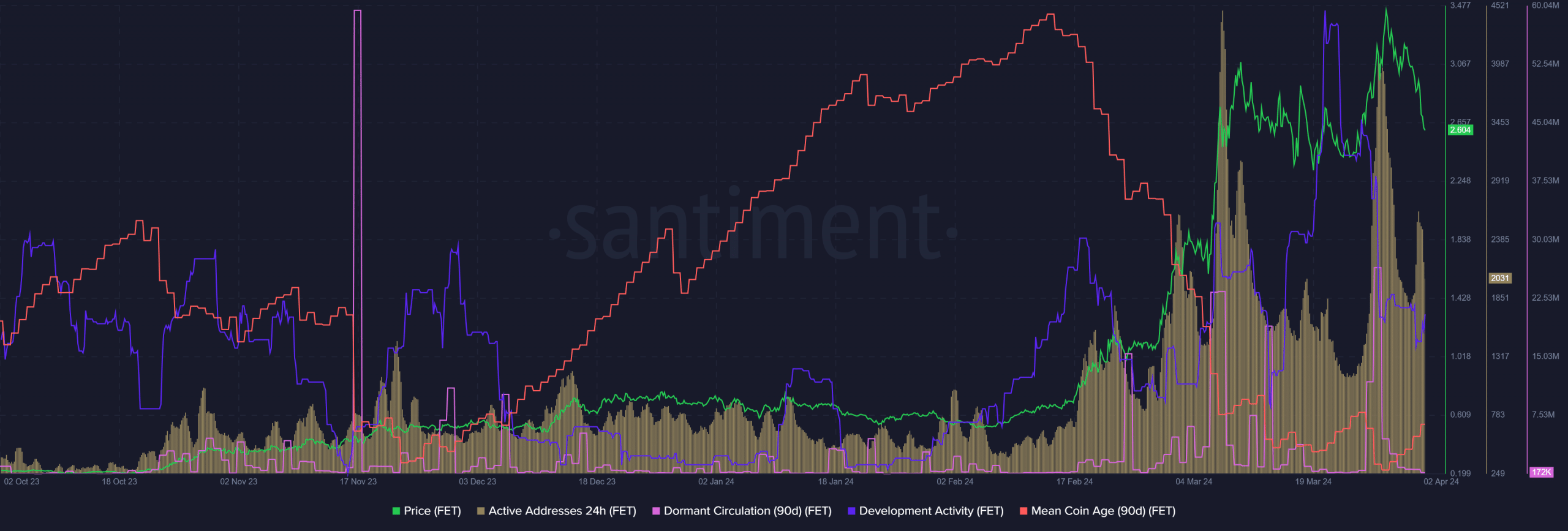

Fetch.ai demonstrated strong on-chain activity.

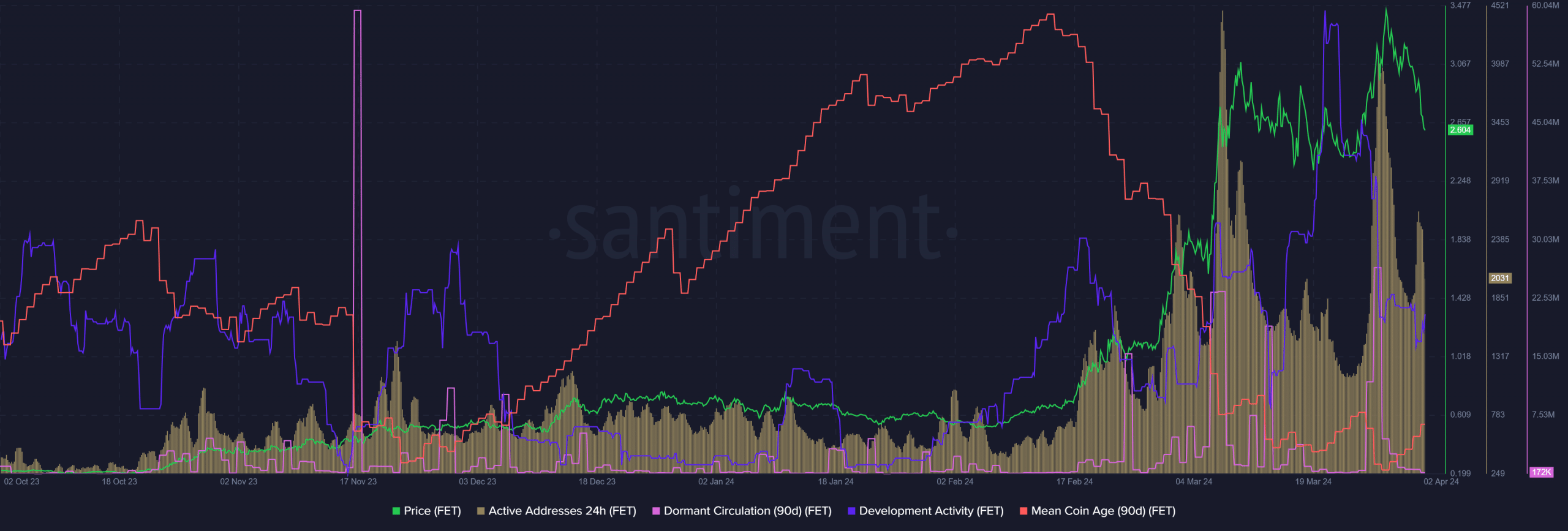

Source: Santiment

The number of active addresses is growing significantly. This was a positive sign and showed increased engagement and demand for the token. The average age of money is decreasing.

This meant that holders were moving their tokens around, possibly for sale purposes. This also indicates that older coins are coming back into circulation. Several large spikes were also seen in the dormant circulation.

This spike was similar in size to the late December spike. This indicator is another indicator that typically highlights a sharp increase in sales activity. The RNDR price held steady above $10.5 for most of March. Selling pressure over the past two days has finally made buyers cave.

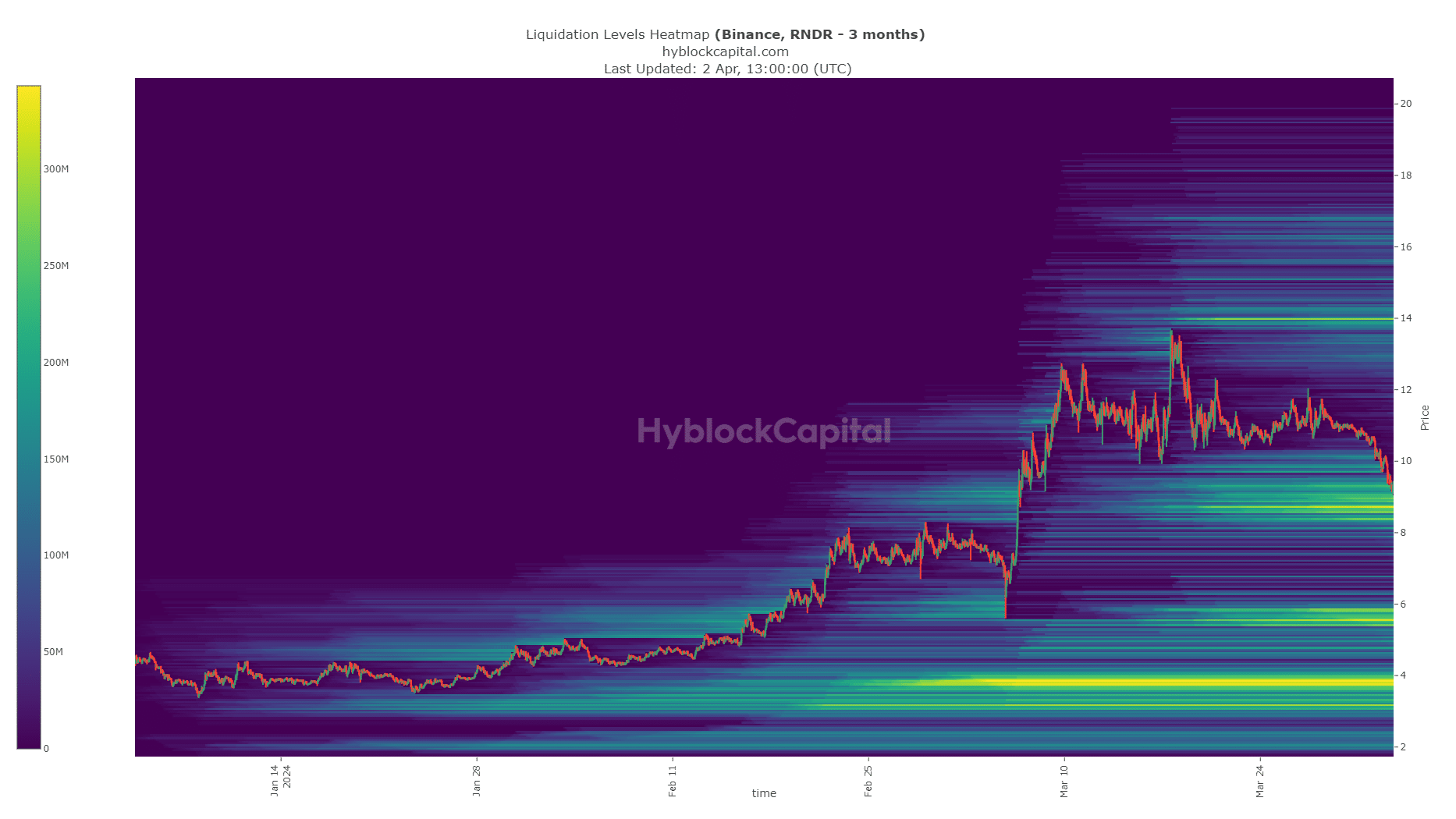

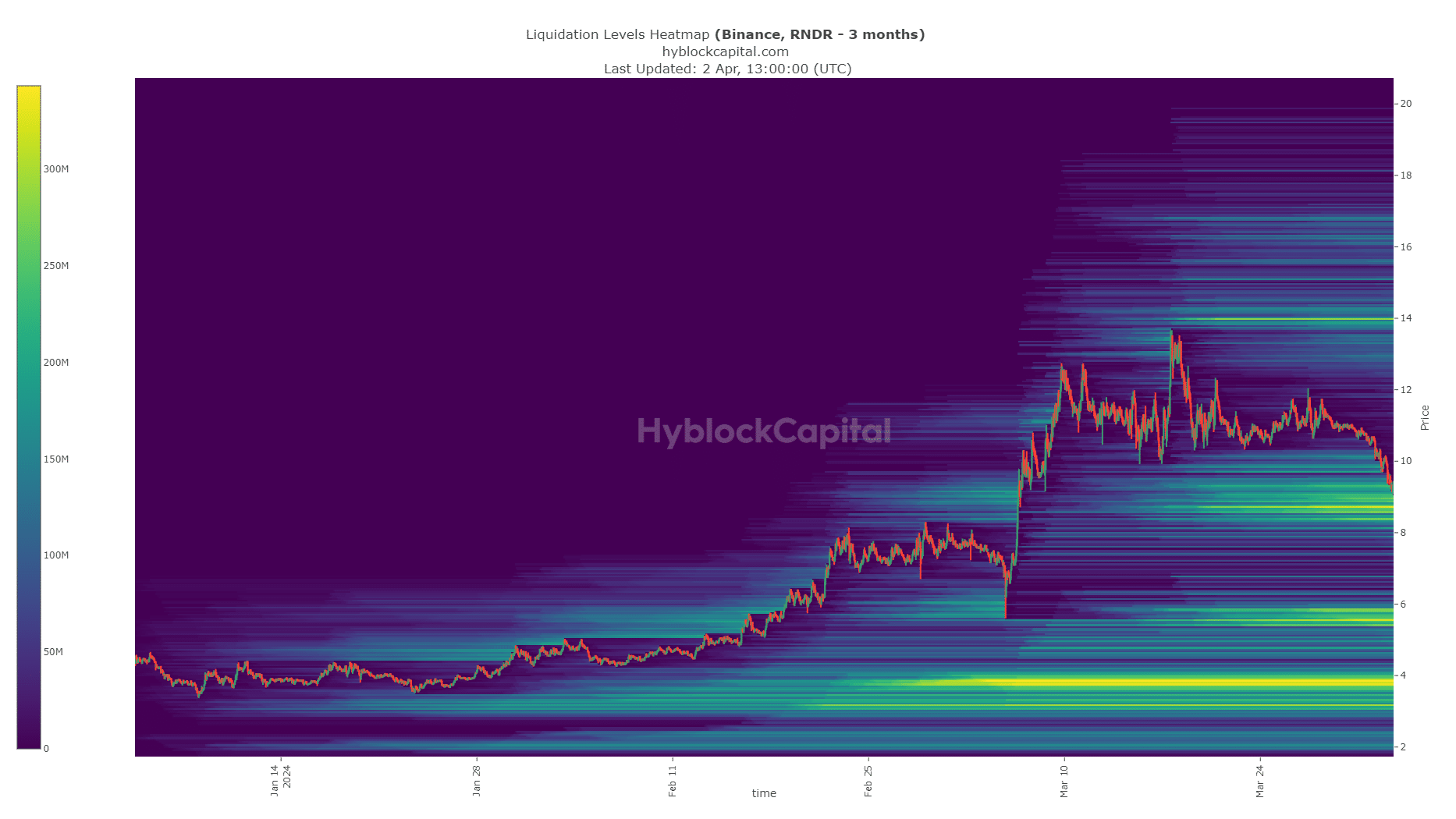

Source: Hiblock

The liquidation heatmap shows the RNDR price falling into a high area with concentrated liquidation levels. The $8.4-$8.7 area was estimated to have much higher liquidation levels.

Another selling pressure is likely to send the price plummeting below $8 before we see a positive response. For long-term investors, the $8.4 and $5.7-$5.9 areas offered good buying opportunities.

Analysis of Bitcoin’s price movements and careful risk management will help investors avoid panic in a scenario where the April downturn is prolonged.

Fetch.ai has seen strong development activity.

Source: Santiment

FET’s strong performance on the charts was just one of the factors keeping investors confident. The Alliance for Decentralized Artificial Intelligence was another event whose story could continue throughout this run.

Development activity for FET has been picking up since February, showing that there is significant work going on behind the scenes. Active addresses saw a significant spike in March.

Dormant distribution volume also showed an increase. It was a sign that holders who had realized profits from the recent rally were actively selling. However, this selling was not enough to break FET’s bear market structure on the higher period chart.

Average coin age has clearly trended downward since February as prices have rebounded. Over the past five days, the indicator has started moving higher and building an upward trend. Traders and investors can keep an eye on movements over the next few days for clues as to whether an accumulation phase is about to begin.

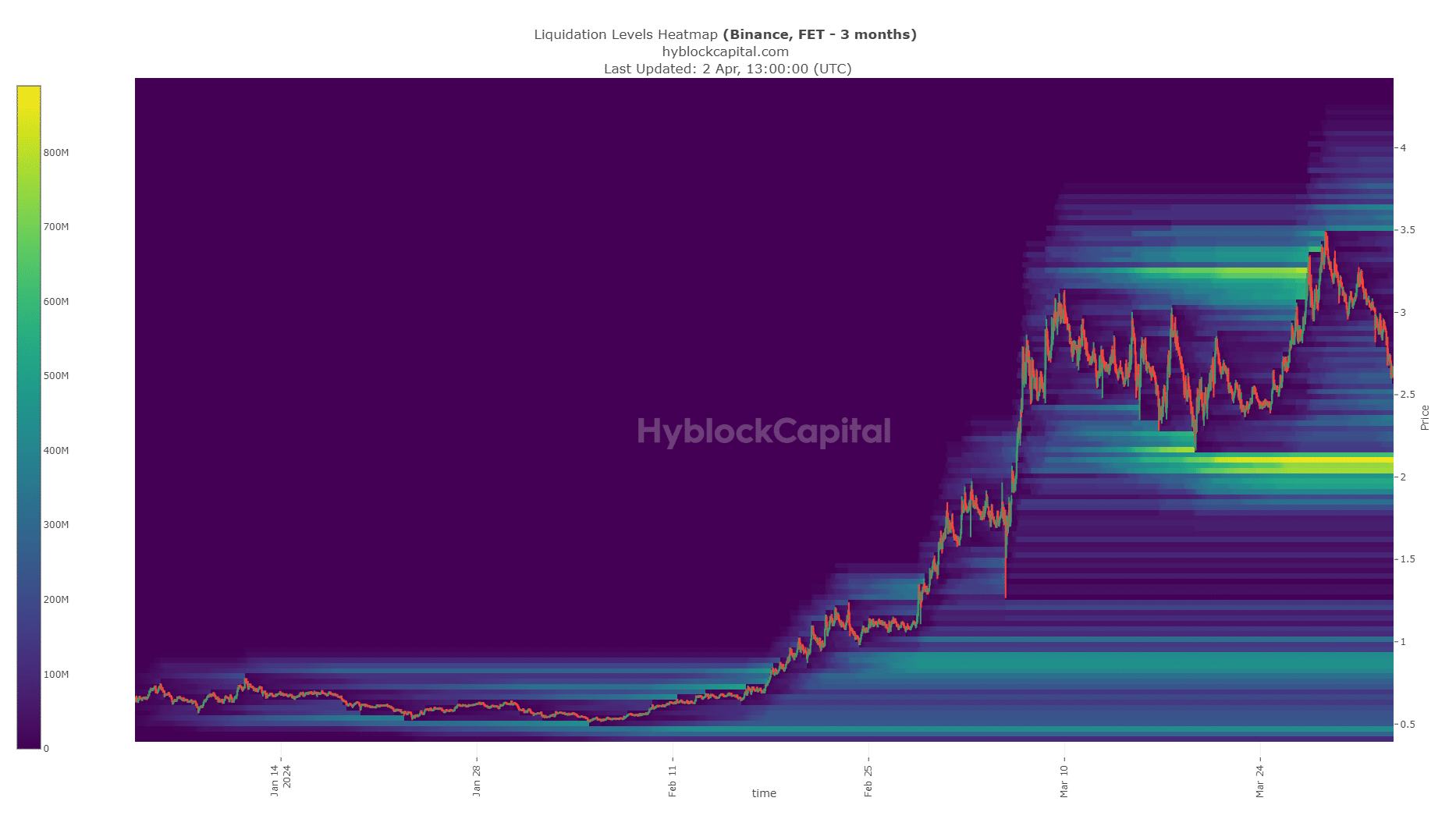

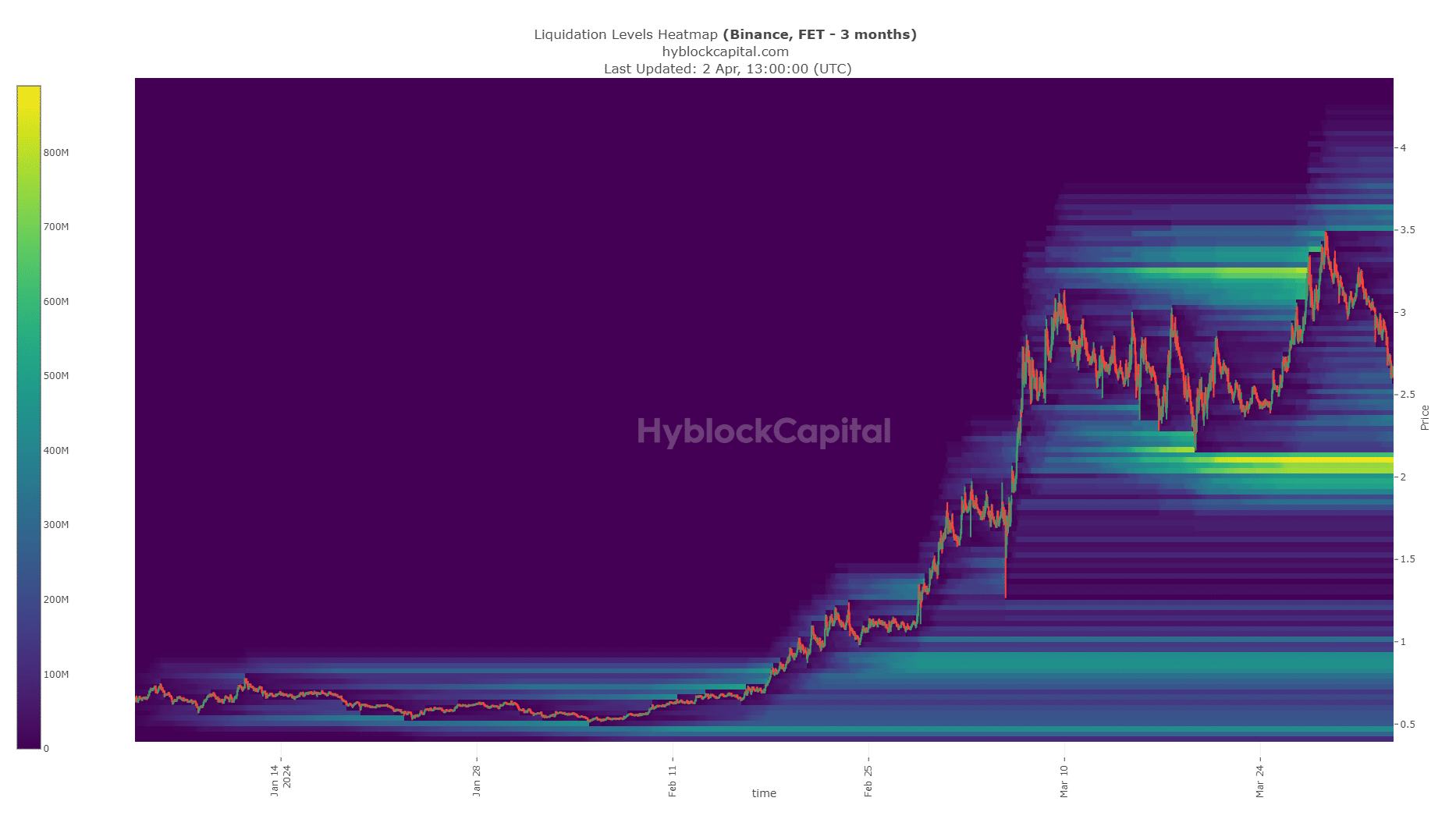

Source: Hiblock

The recent rally to $3.5 eliminated the liquidation level centered around $3.25. After sweeping the liquidity pool, the price started to reverse the trend. FET began retracement even before Bitcoin’s recent decline.

Read Fetch.ai (FET) price prediction for 2023-24

Liquidation levels were concentrated in the $2-$2.15 region.

There is a possibility that the Fetch.ai price could fall into this area, especially if Bitcoin continues to record losses. Hitting this pocket of liquidity can cause the trend to reverse.