The Bitcoin price appears to be on the verge of breaking its current all-time high (ATH) level. Cryptocurrencies have received a strong boost from the launch of spot Bitcoin exchange-traded funds (ETFs), which have officially registered institutions in the nascent sector.

At the time of this writing, Bitcoin (BTC) is trading at around $62,900 over the past 24 hours, with a gain of 3%. Last week, the cryptocurrency registered a significant gain of 22%. It was one of the three biggest gainers in the top 10 by market capitalization, surpassing Solana (25%) and Dogecoin (57%) during the same period.

Bitcoin-Based Derivatives Hint at Additional Profits

Data from derivatives platform Deribit shows a surge in long positions by options operators. Since early February, these traders have been accumulating significant call (buy) contracts with strike prices exceeding $65,000.

Initially, the increase in bullish positions was seen as part of a Bitcoin “halving” strategy, as the report indicates. However, BTC ETF flows appear to be a key component of the rally.

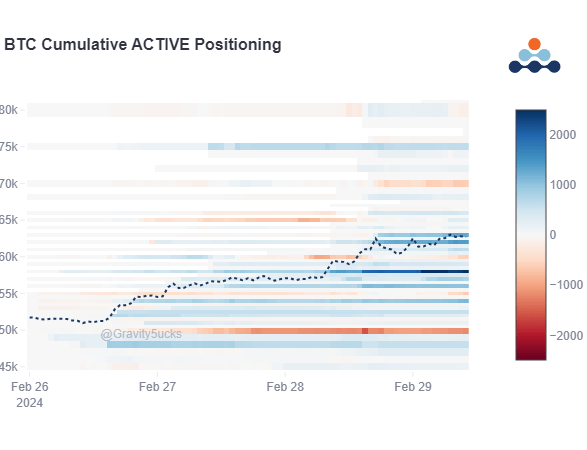

As the cryptocurrency entered the $60,000 zone, several operators rushed to accumulate currency contracts, which led to the Fear Of Missing Out (FOMO) rally to current levels. The chart below shows that FOMO buying began when BTC broke the $57,000 level.

A surge in trading activity during yesterday’s session led to a significant increase in implied volatility (IV). Excessively leveraged positions further fueled the indicator, Deribit said:

The surge from 62,000 to 64,000 was very quick and due to high leverage across the entire system, when the sale hit the market it cascaded, with BTC falling to 59,000 in 15 minutes and some Alts (also heavily leveraged) immediately falling 50% on some exchanges. I did. BTC bounced, jumping to 61.5k.

There is little change in the market structure of the derivatives sector as high IVs continue to cause rapid market movements. That said, Deribit still has a number of bullish positions for the coming months, suggesting bullish confidence from these players.

BTC price over a short period of time

Despite the bull market, Bitcoin prices may fall as euphoria takes over the markets. Trading volume has surged, according to economist Alex Krüeger. This appears across the derivatives sector. Forming a ‘local top’.

Analysts believe retail has returned to the market due to FOMO, which often signals short-term difficulties for long-term traders. Krüger, through his Official

The analyst said:

ATH is a few inches away. That’s the price discovery area. So things tend to get even crazier. This is not the place to open a new long position. It’s too easy to quickly flush nowhere. Ideally, we would see a breakout after the funding breaks and the price consolidates below the ATH.

Cover image by Dall-E, chart by Tradingview

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.