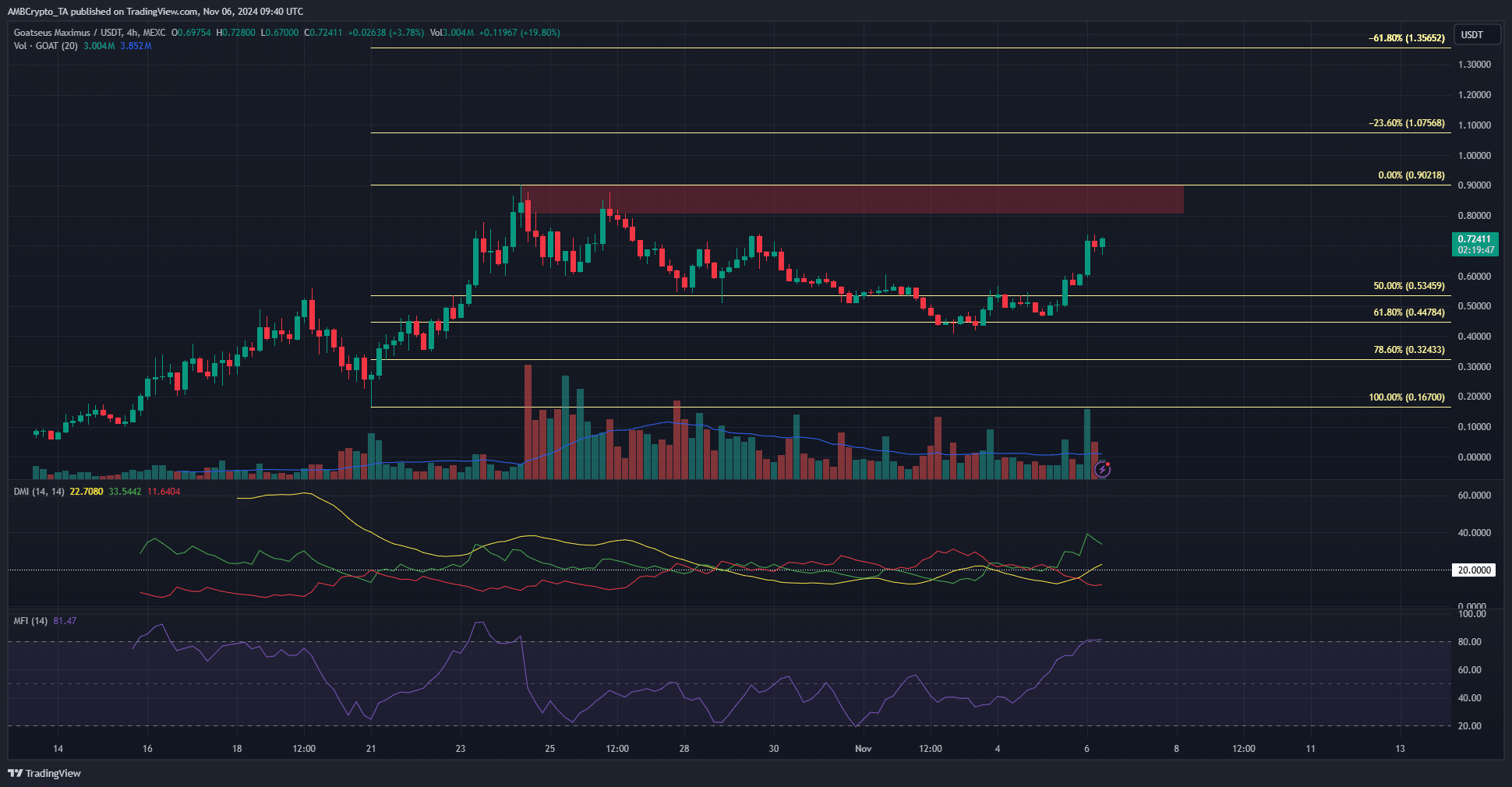

- GOAT has a bullish low term market structure.

- The DMI index showed a strong upward trend underway.

Goatceus Maximus (GOAT) is up 56% in 32 hours and is likely to rise further.

Mimcoin, which has a market capitalization of $722 million, has been in a retracement phase for the past 10 days, but has been on a rapid upward trend since November 4th.

Trading volumes have also been on the decline, but things are starting to change. On lower time frames, upward momentum strengthened and capital flows increased.

Goatseus Maximus begins an upward trend.

Source: GOAT/USDT on TradingView

The market structure on the 4-hour chart is bullish as GOAT is above the $0.566 level. Since November 4th there has been a series of higher highs and higher lows.

DMI agreed with the bullish structure and reflected a strong upward trend underway, with ADX (yellow) and +DI (green) above 20.

At the same time, MFI pushed north and was in overbought territory.

A bearish divergence in the coming days could lead to a correction near the $0.9 resistance zone. Movement into the area is expected in the coming days.

The breakout will depend on market sentiment and the trend of Bitcoin (BTC).

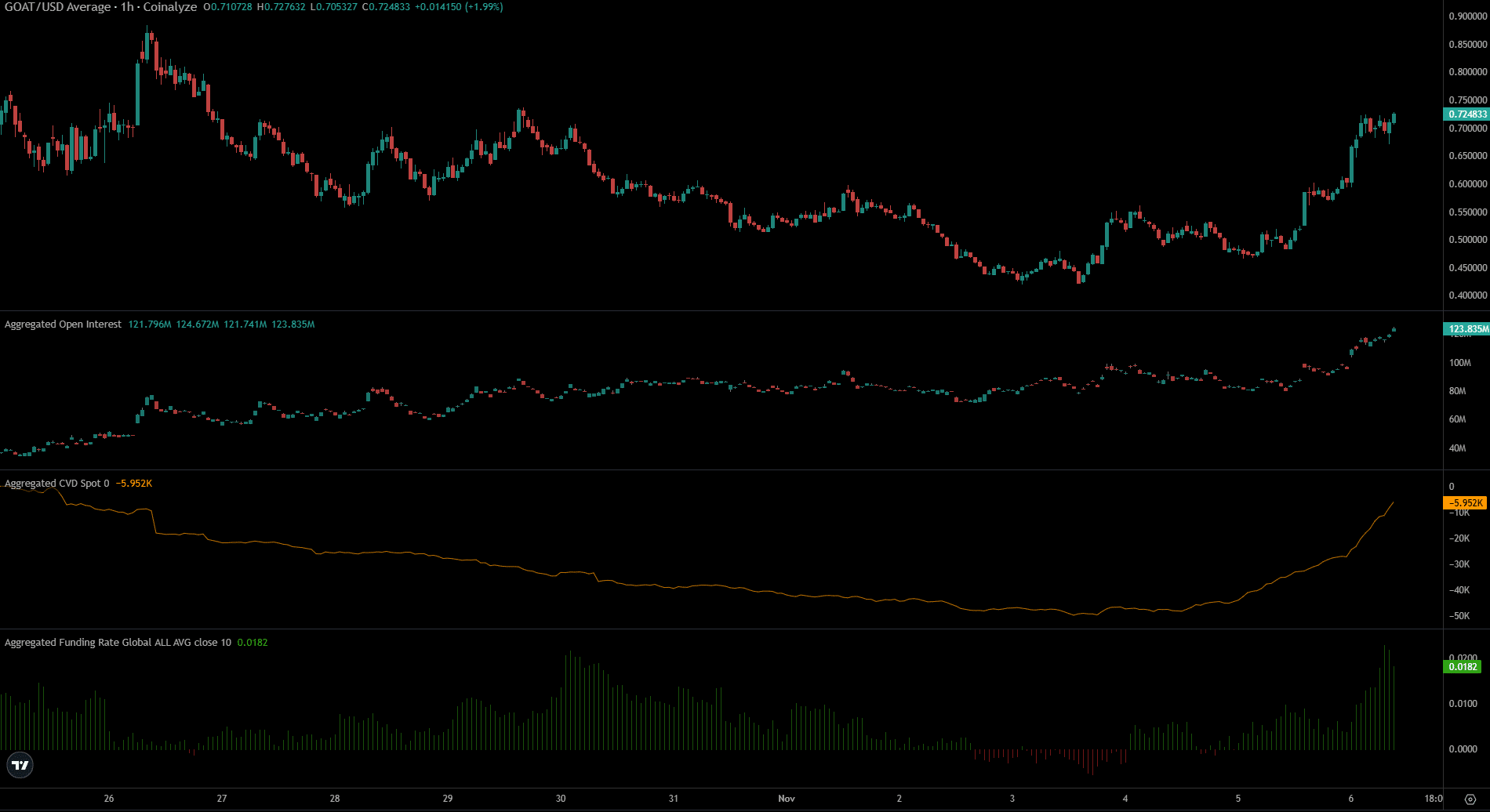

Short-term sentiment and demand favor the uptrend

Source: Coin Analysis

Spot CVD and Open Interest have risen rapidly over the past 24 hours. This was a signal that there was demand and speculative interest in the spot market.

Together they point to a sustainable northward run that could extend above $0.9.

Is your portfolio green? Check out our GOAT profit calculator

A high funding rate means that sentiment is very bullish, but it also means that spot prices and derivatives prices are different. Overall, local highs in the $0.9 region indicate a supply zone.

Traders and investors can wait for the $0.9 and psychological $1 levels to reverse into support levels before re-entering long positions.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.