The recent price surge of GRASS, up 187.99% over the past 7 days, appears to have been fueled by the success of the airdrop and BTC’s new all-time high. These factors, along with the listing of GRASS on Binance Futures with up to 75x leverage, have created a wave of bullish momentum.

However, the current RSI shows that GRASS is still in overbought territory, suggesting caution may be needed as buying pressure may weaken.

GRASS RSI is above overbought level.

GRASS’s RSI has surged significantly since the recent price increase, rising to 71.8 from 55 just two days ago. This sharp rise signals strong buying pressure, which has pushed the indicator into overbought territory.

This swift move highlights that GRASS is receiving increasing attention from investors. It is important to remember that GRASS RSI reached approximately 85 just a few days after the airdrop.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change in price movements. An RSI value above 70 generally indicates that the asset is overbought, while an RSI value below 30 indicates oversold conditions. With an RSI currently at 71.8, GRASS is in overbought territory, which suggests that the recent mania may have pushed the price too far, too fast.

However, since RSI has declined significantly since yesterday, this could indicate a potential cooling off period with buying momentum waning and a price correction imminent.

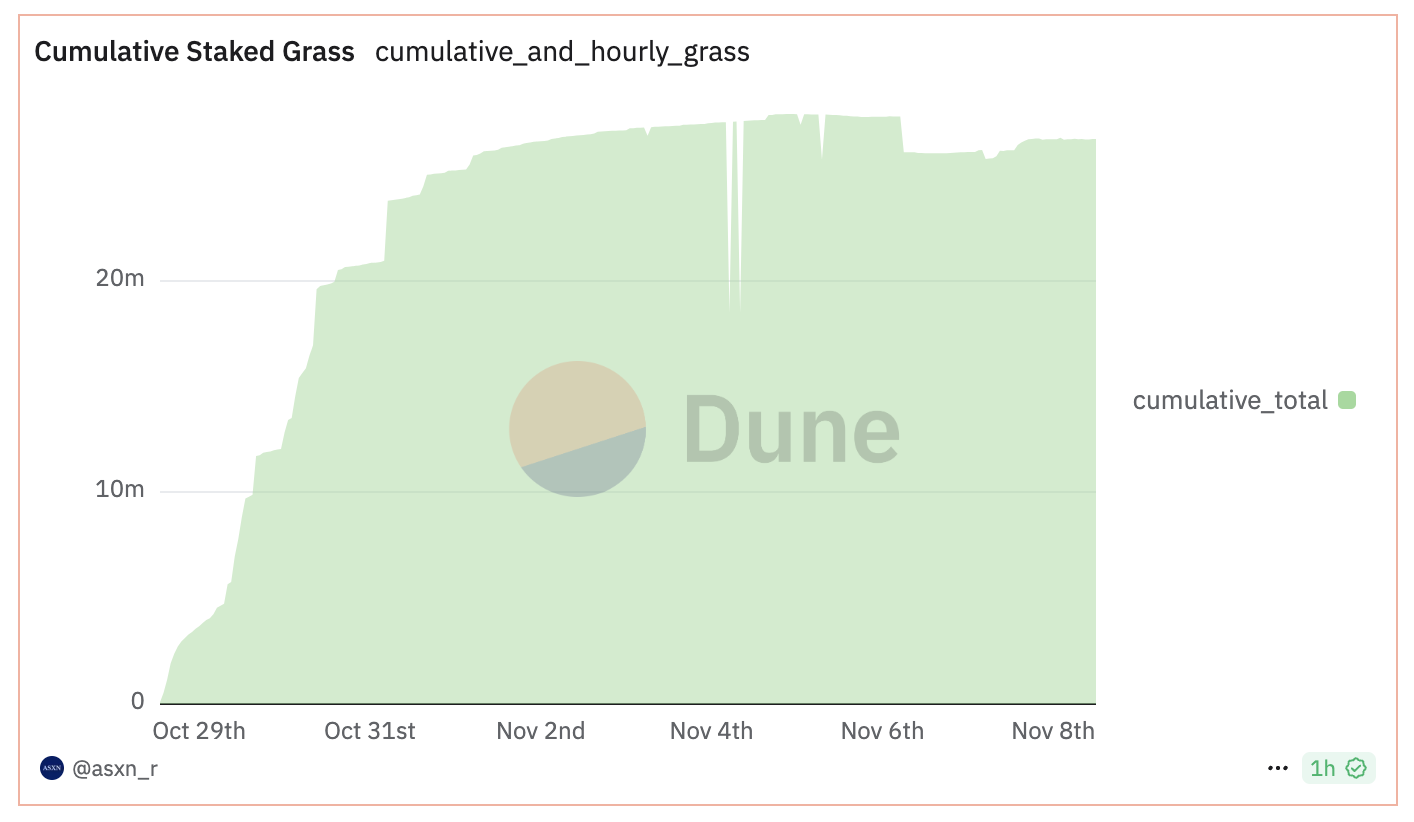

Staked GRASS is now stable

Cumulative staked GRASS has remained stable at 26,600,000 since November 6th. This stability indicates that staking activity has settled into a consistent pattern after a slight decline compared to highs earlier this month.

Recent trends indicate that most people who were actively staking are now locked into their positions.

Tracking staked coin metrics is important because it provides insight into investor confidence and willingness to hold their assets for the long term. The higher the amount of GRASS staked, the less likely it is for investors to sell, meaning less available supply and potentially more price stability. On November 4th and 5th, the staked amount reached 28 million, but then decreased and stabilized at a slightly lower level.

This move means that while enthusiasm for staking was initially strong, some participants took profits or exited, leaving the base of long-term stakers more stable. This current stability may reflect a period of consolidation with committed investors entrenched.

GRASS Price Prediction: Potential 28.5% Correction?

If we analyze the GRASS Ichimoku Cloud chart, we can see that the price is much higher than the cloud, which suggests strong bullish momentum as the entire Solana ecosystem appears to be very active.

The first major area of support is around the upper edge of the cloud, roughly around the $2.9 level, and coincides with the point where the cloud begins to thicken.

If the price falls further, the lower edge of the cloud near the $2.5 level will act as the next important support level. This means that a potential 28.5% price correction is possible as GRASS becomes one of the more interesting coins among the newly launched Solana coins.

If BTC maintains strong momentum and the Binance listing puts strong buying pressure, GRASS could continue its upward trend and possibly break the $4 threshold soon.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.