Key Points

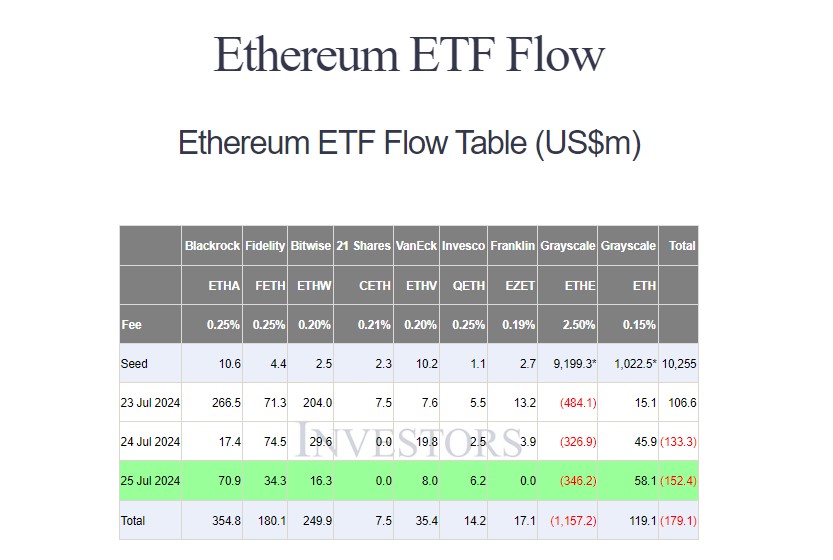

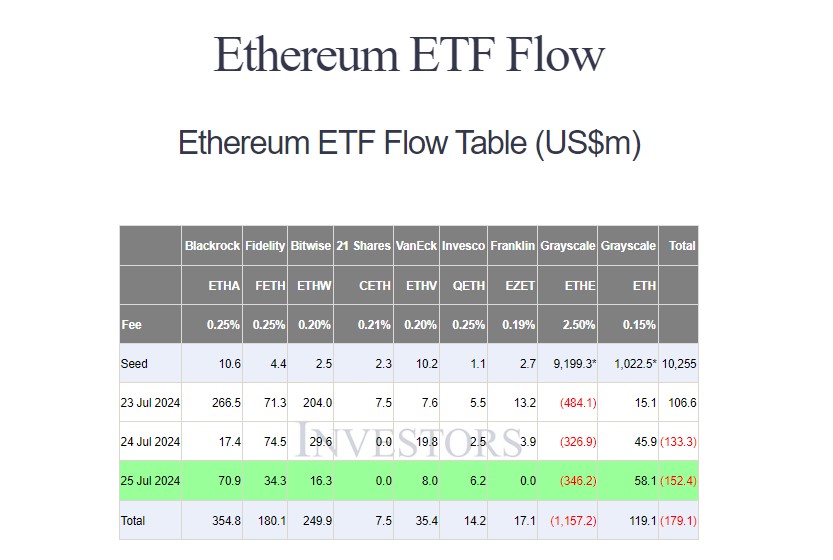

- Grayscale’s Ethereum ETF saw net outflows of $346 million on its third day of trading.

- BlackRock’s iShares Ethereum Trust led the way with $71 million in inflows.

Share this article

![]()

Grayscale’s Ethereum ETF (ETHE) closed Thursday with net outflows of about $346 million, widening losses to $1.1 billion in the three trading days since the switch, according to data from Farside Investors. In three trading days, ETHE’s assets under management have plummeted from $9 billion to $7.4 billion, the largest drop since the launch of a U.S. spot Ethereum ETF.

Meanwhile, BlackRock’s iShares Ethereum Trust (ETHA) led inflows on Thursday, taking in about $71 million. Grayscale’s Ethereum Mini Trust (ETH), a spinoff of Grayscale’s Ethereum Trust, followed with more than $58 million in net inflows.

Other funds also reported inflows, including Fidelity’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH). The remaining ETFs saw no inflows.

Despite inflows into eight Ethereum ETFs, net outflows across all nine funds on Wednesday were $152 million, the largest since trading began on July 23. The outflows were largely driven by Grayscale’s ETHE.

ETHE’s 2.5% fee makes it a fairly expensive option for investors. People who want to be exposed Ethereum. Investors It’s for sale ETHE stocks and transition to new companies with lower fees.

This isn’t entirely unexpected given the experience of Grayscale’s Bitcoin ETF (GBTC), which has seen outflows of over $5 billion since its first month of trading. Data from Bloomberg.

But this time, Grayscale’s Ethereum Mini Trust could help put an end to that. that much Deja vu. ETH’s 0.15% fee makes it one of the lowest-cost spot Ethereum funds in the US market, and the fund has seen steady inflows since it converted to an ETF.

Share this article

![]()

![]()