- The token’s Fear and Greed Index sent a sell signal.

- A price correction could push HBAR money back up to $0.14.

Hedera (HBAR) It caught investors off guard with its best performance last week. However, these huge price increases often lead to corrections. Will HBAR meet a similar fate this time around?

Hedera’s rapid rise

HBAR investors should celebrate CoinMarketCap’s past week. data The token price surged 38% during the period.

The bullish trend continued in the last 24 hours as the token witnessed a further rise of nearly 24%. This brought the token’s price to $0.205 and its market capitalization to over $7.8 billion.

As Hedera’s value increased, so did its social metrics. This is a sign of the token’s growing popularity in the cryptocurrency space.

Meanwhile, famous cryptocurrency analyst Crypto Tony pointed out This price increase opens up a good entry point for investors. But is that really the case?

Why HBAR prices may fall

Although rapid price increases have been beneficial to investors, such events often lead to price corrections.

Once the hype subsides, the token may witness a slight decline, which would rather give the inventor a better opportunity to open new positions.

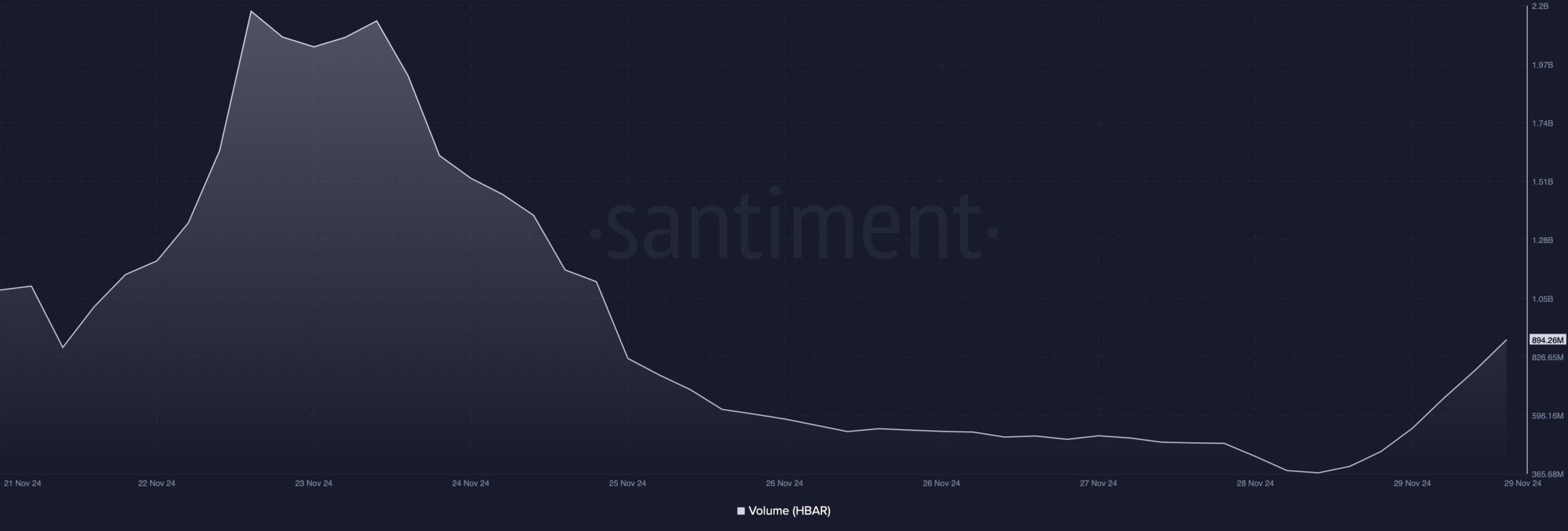

This possibility was supported by the token’s declining trading volume. According to data from Santiment, HBAR’s price has soared while its trading volume has fallen sharply. Whenever this happens, it suggests a bearish trend reversal.

Source: Santiment

In addition to that, the token Fear and Greed Index It also turned bearish. At the time of writing, the value of this indicator is 86%, which means that the market is in an “extreme greed” position.

Readings this high often signal a sell signal, which can have a negative impact on asset prices in the short term.

Additionally, Hedera’s long/short ratio has been ticking downward for 4 hours.

This clearly suggests that there are more selling positions than buying positions in the market, which is a sign of increasing bearish sentiment.

Source: Coinglass

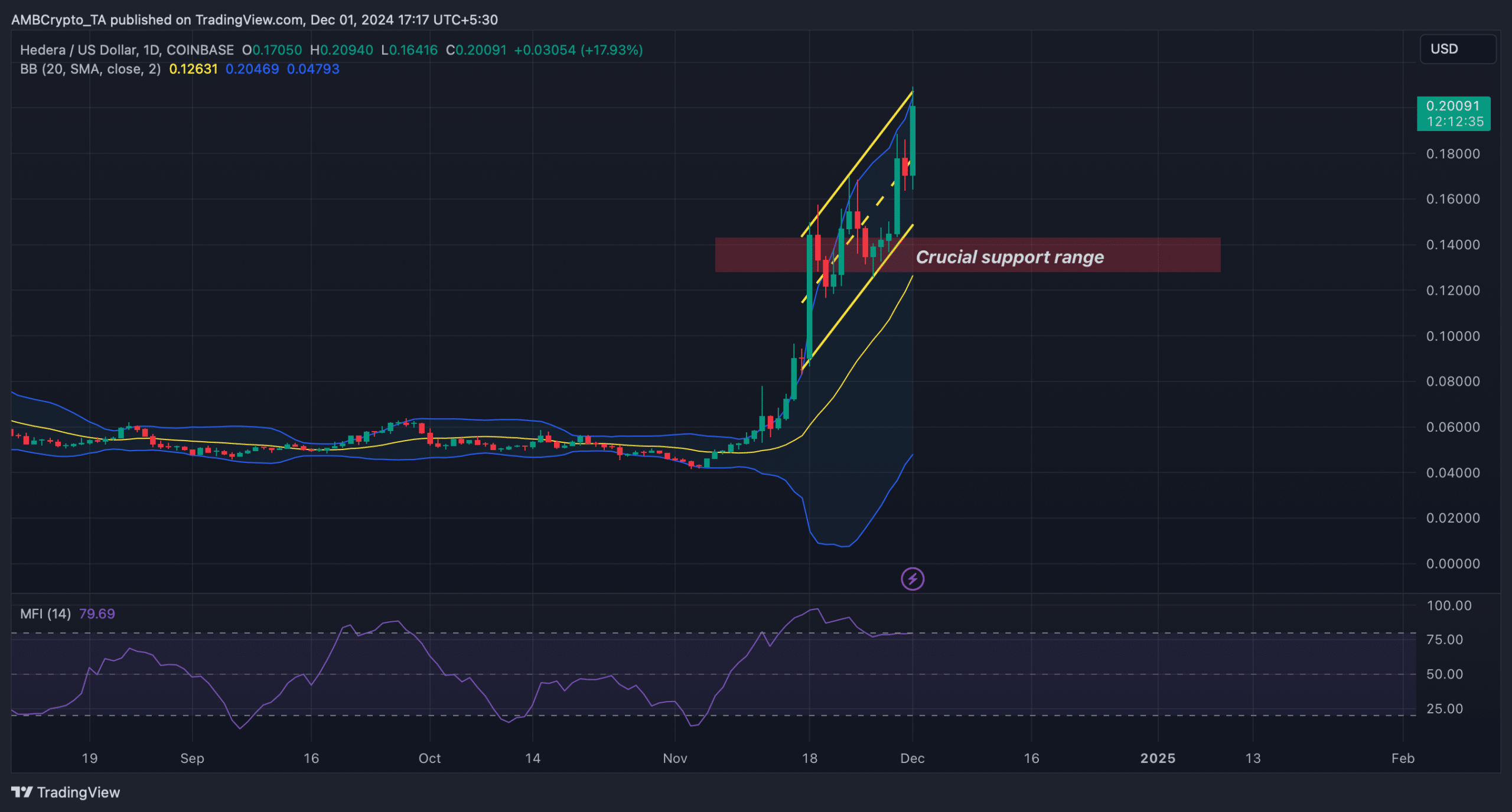

Hedera’s technical indicators also pointed to the possibility of a similar price correction. The price of HBAR moved within a sharp upward trend channel.

This caused the price to reach the upper Bollinger Band limit, resulting in a price correction.

Is your portfolio green? check it out HBAR Profit Calculator

The relative strength index (RSI), a technical indicator, remained near the overbought zone. Additional buying may increase selling pressure and eventually push the price down.

If that happens, investors could see HBAR fall into the critical support range of $0.142 and $0.128.

Source: TradingView