HBAR price rose 15% on February 6, reaching a 20-day high of $0.78. It comes just hours after the Hedera team finalized a $250 million contract with the Saudi Arabian Ministry of Investment.

Hedera recently initiated positive pricing action through a five-year partnership agreement with the Saudi Arabian government. However, particularly important market indicators suggest that derivatives traders may be able to hinder HBAR price gains.

Hedera prices surged 15% as investors reacted to the Saudi partnership.

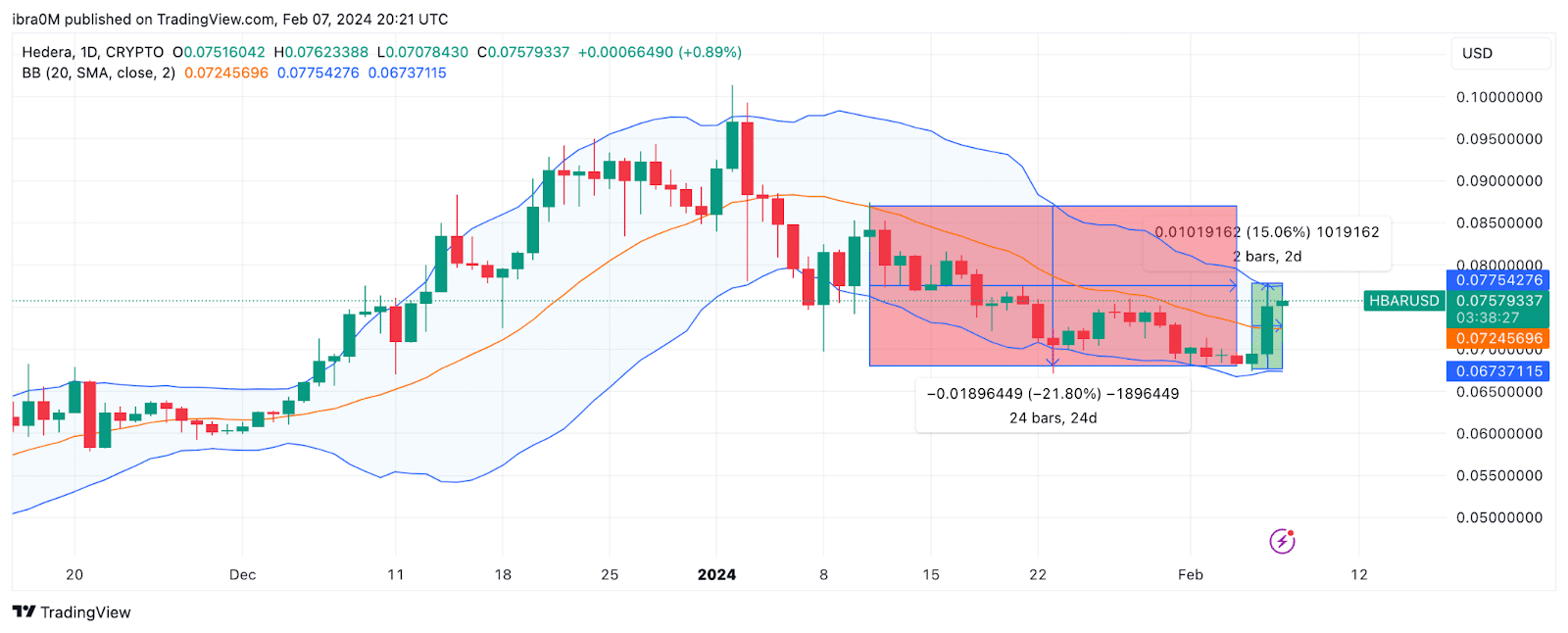

HBAR price has been declining since the cryptocurrency market correction that heralded the approval of the Bitcoin ETF in mid-January.

The Hedera blockchain native coin fell 22% from January 11 to February 5, but momentum turned bullish following the announcement of a partnership between Hedera and the Saudi Arabian government on February 6.

Details of the partnership were outlined by the newly launched DeepTech Venture Studio in Riyadh, which plans to invest in enabling companies to create cutting-edge technological solutions.

In a dramatic turn of events, the price of HBAR rose 15% from $0.69 to $0.77 within 24 hours of the announcement, as depicted in the chart above.

Speculative traders placing large bets on retracements

The rare rally took Hedera to a 20-day high after lagging for three straight weeks. However, important market indicators show that speculative traders may hinder the recovery phase.

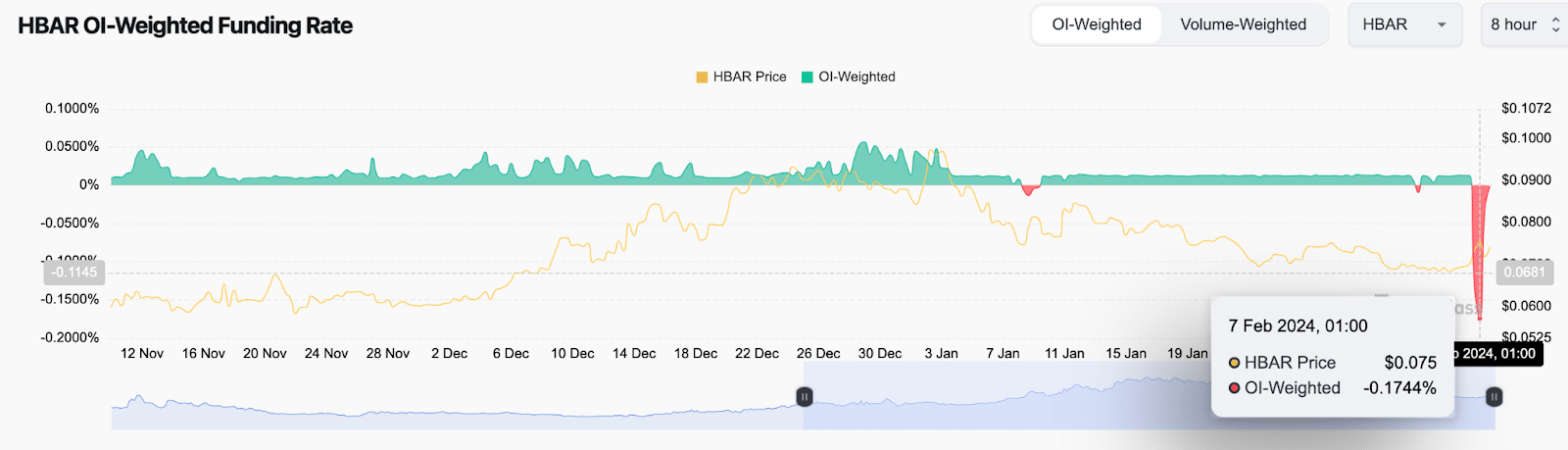

Coinglass’ Funding Rate indicator tracks real-time changes in the fees paid by long and short traders in derivatives markets to maintain contract positions.

The HBAR funding rate recorded a notable decline in the negative zone due to strong market activity in the spot market. If you look closely at the chart below, you will see that on February 7th the funding rate fell to a 90-day low of -0.02%.

When funding rates fall sharply into the negative during a rally, most speculative short-term traders pay record fees to hold futures positions to profit when prices fall.

Essentially, the negative trend in HBAR funding rates means that the prevailing sentiment in the derivatives market is skeptical about the sustainability of the price rise. If bulls fail to counter these positions and build stronger upward momentum, the HBAR spot price could soon be at risk of experiencing a sharp decline.

HBAR Price Prediction: Bears Could Target $0.65.

Inferring from the market data trends analyzed above, the positive impact of the $250 million Saudi Arabian partnership on Hedera’s price may be short-lived.

And after trading as low as $0.67 on February 5 before the recent rally, bears could look for a bolder downside below $0.65 on their next attempt.

However, the Bollinger Bands technical indicator shows that bulls could build strong support around $0.67. However, if that support level does not remain stable, there is a possibility of a downward reversal to $0.60.

On the positive side, if the bulls can build on the momentum from the Saudi partnership, they could lead to a $0.80 retest, invalidating these negative Hedera price predictions.

However, a selling wall of $0.78 is looming, as shown at the top of the Bollinger Band on the chart, which could derail the rally.