- Helium has surged about 10% over the past 24 years as trading volume has surged.

- The token’s increasing open interest and liquidation levels highlighted optimism but warned of potential volatility near key resistance levels.

Helium (HNT) captured the market’s attention with a 10% price surge in the last 24 hours. At the time of writing, bullish momentum has seen a 12% surge in trading volume, indicating heightened investor interest.

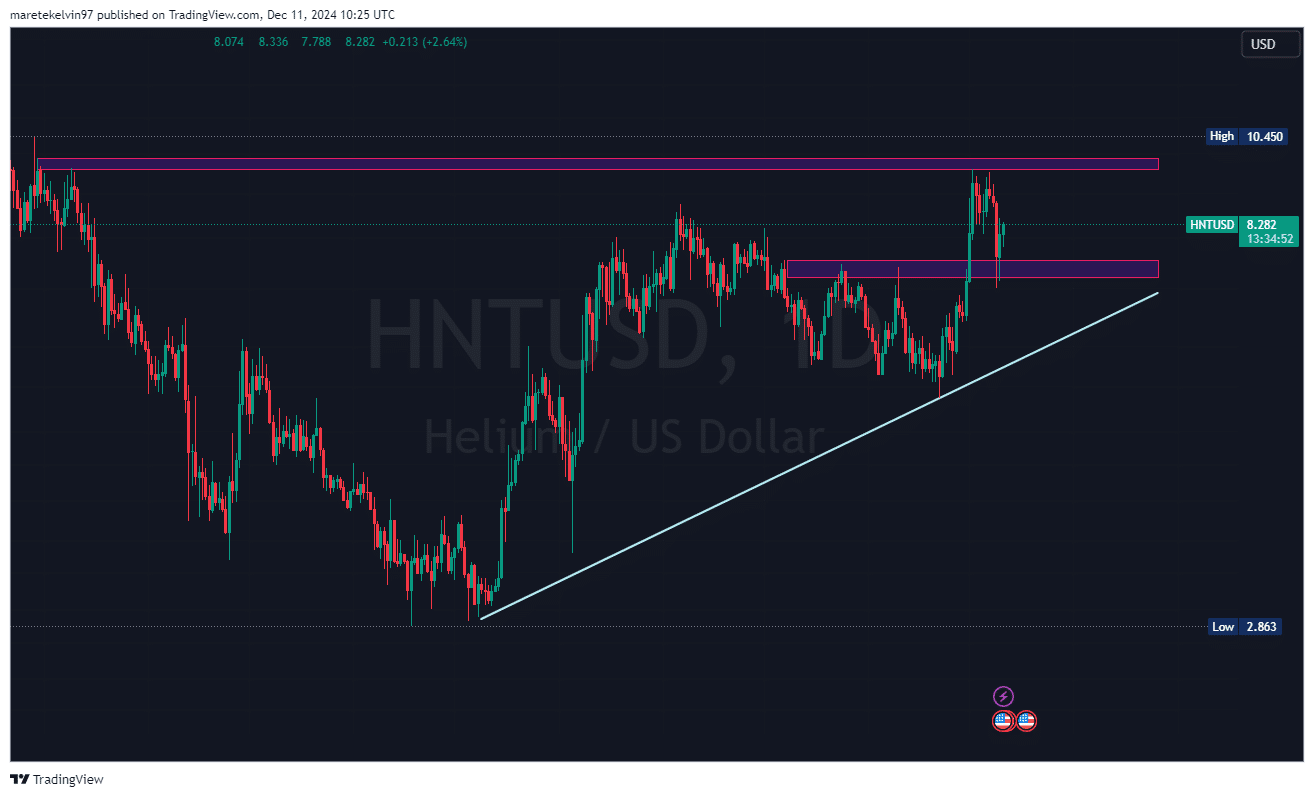

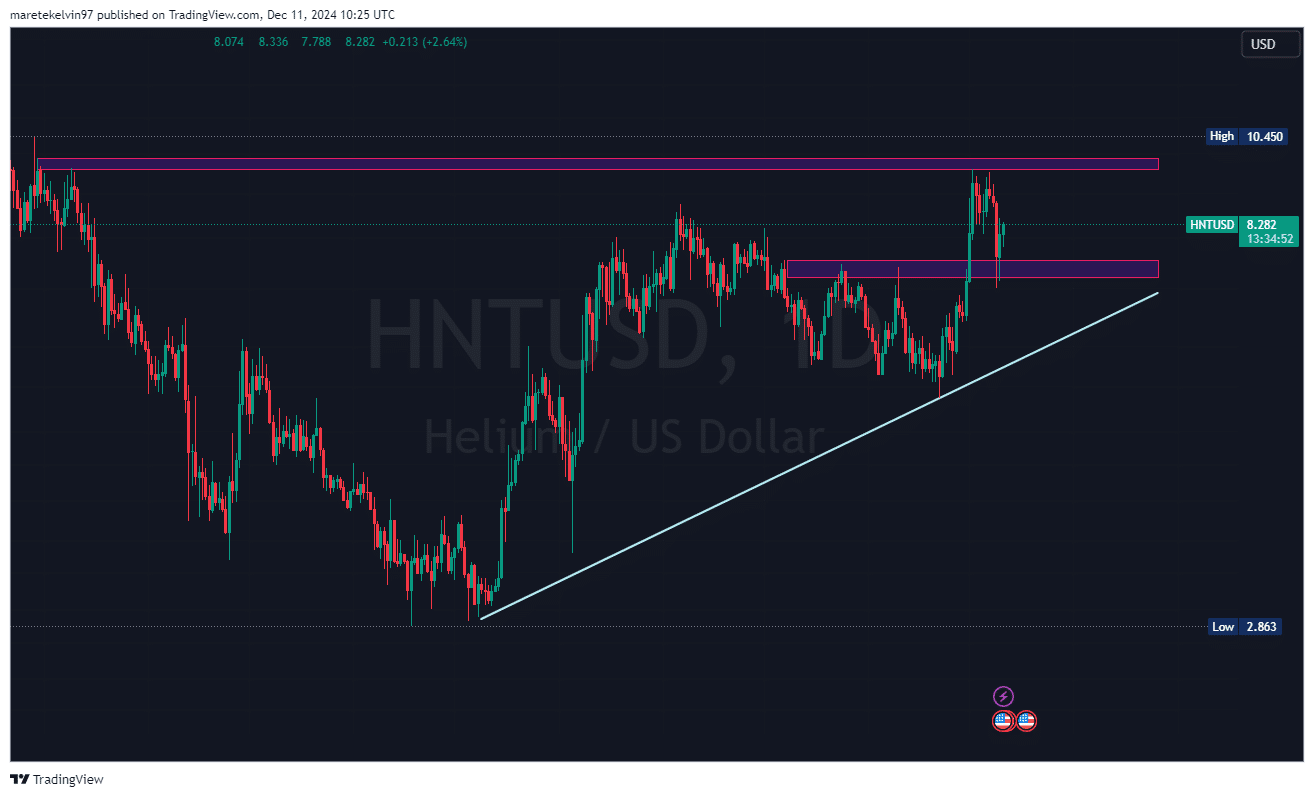

Source: TradingView

As helium prices approach the critical resistance of $9.5, market participants are wondering whether the rally will remain strong or weaken.

Helium’s powerful performance

Helium defied broader market movements and emerged as one of the top gainers over the past 24 hours. The daily chart shows an upward trend towards $9.5, a critical level that could determine the token’s next direction.

A break above this resistance could pave the way for a further bullish rally, potentially targeting the psychological level of $10.

However, non-compliance may result in revocation.

Market indicators point to a potential rally.

A clear upward trend is clearly visible on the daily chart. This upward trend is supported by an upward trend line originating from Helium’s recent low of $2.8.

The altcoin price is currently approaching the $8.2 support level, which initially acted as an ascending triangle pattern resistance level.

In a short period of time, the token is setting the stage for a potential upside, as seen by its recent 10% surge.

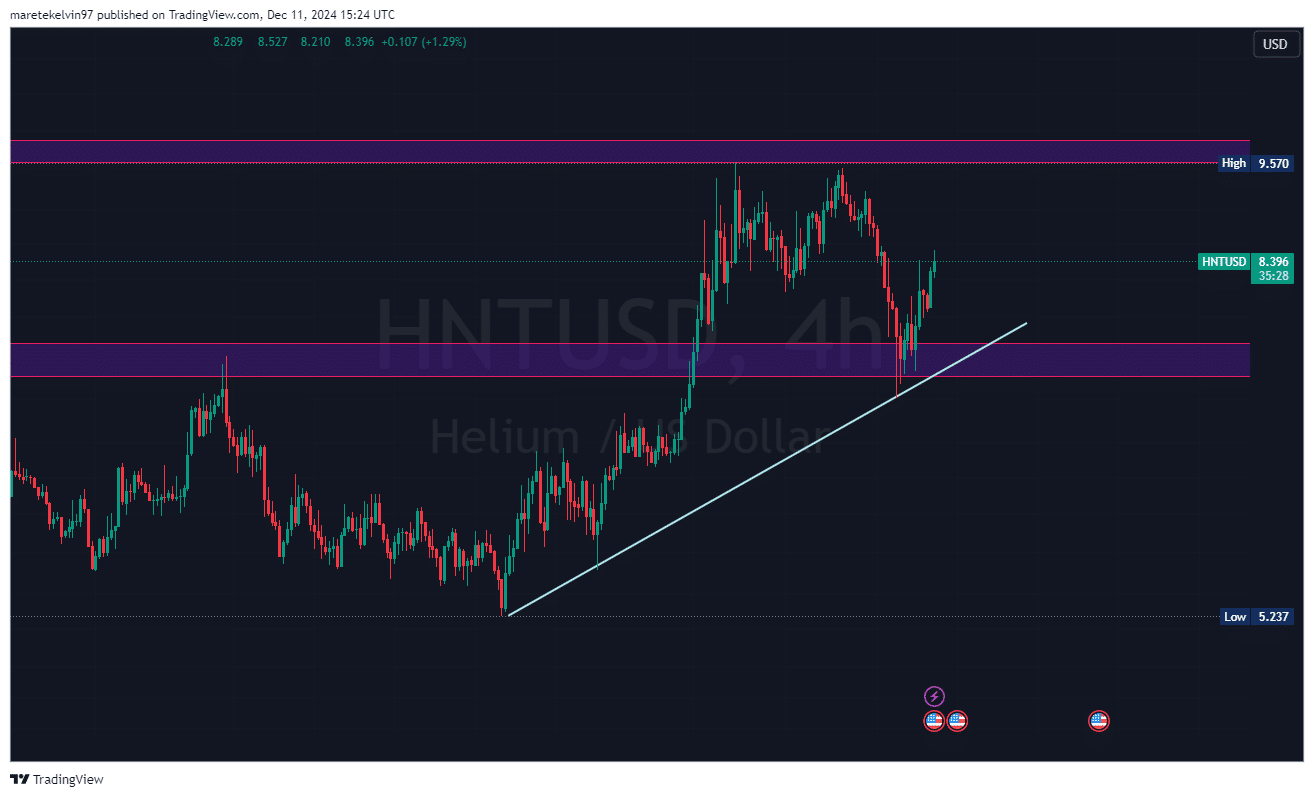

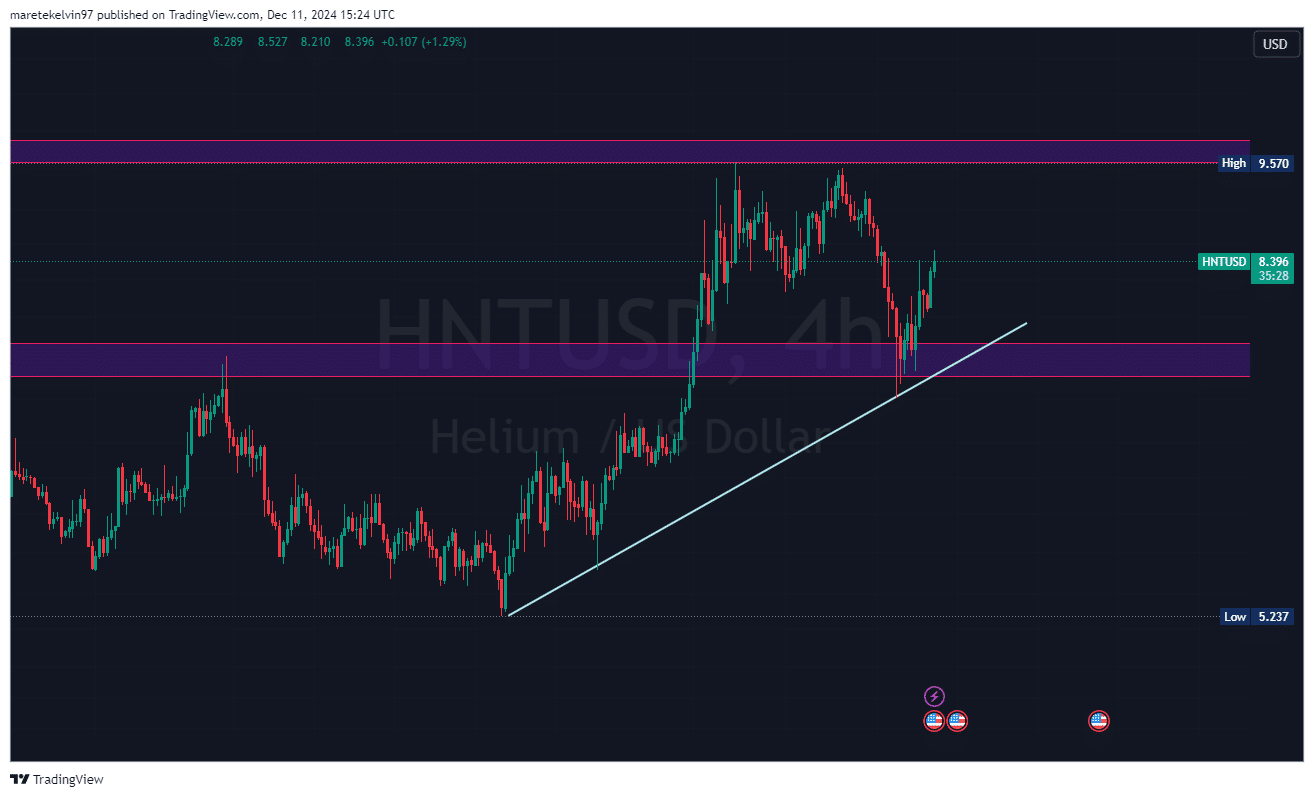

Source: TradingView

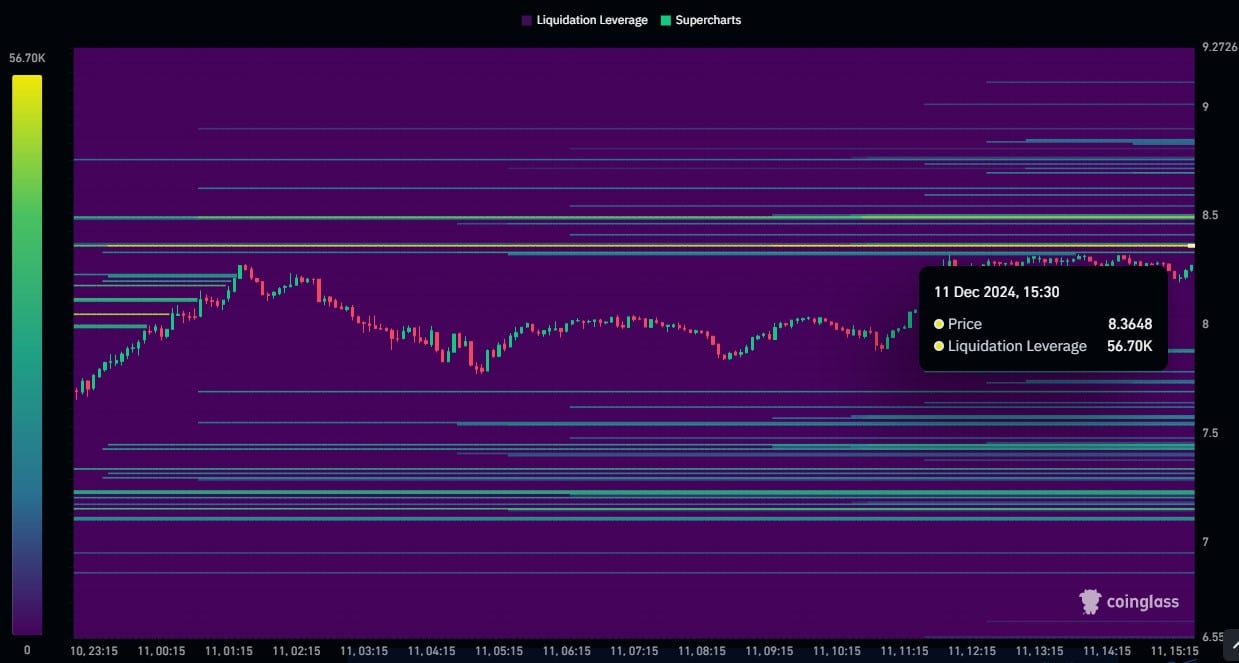

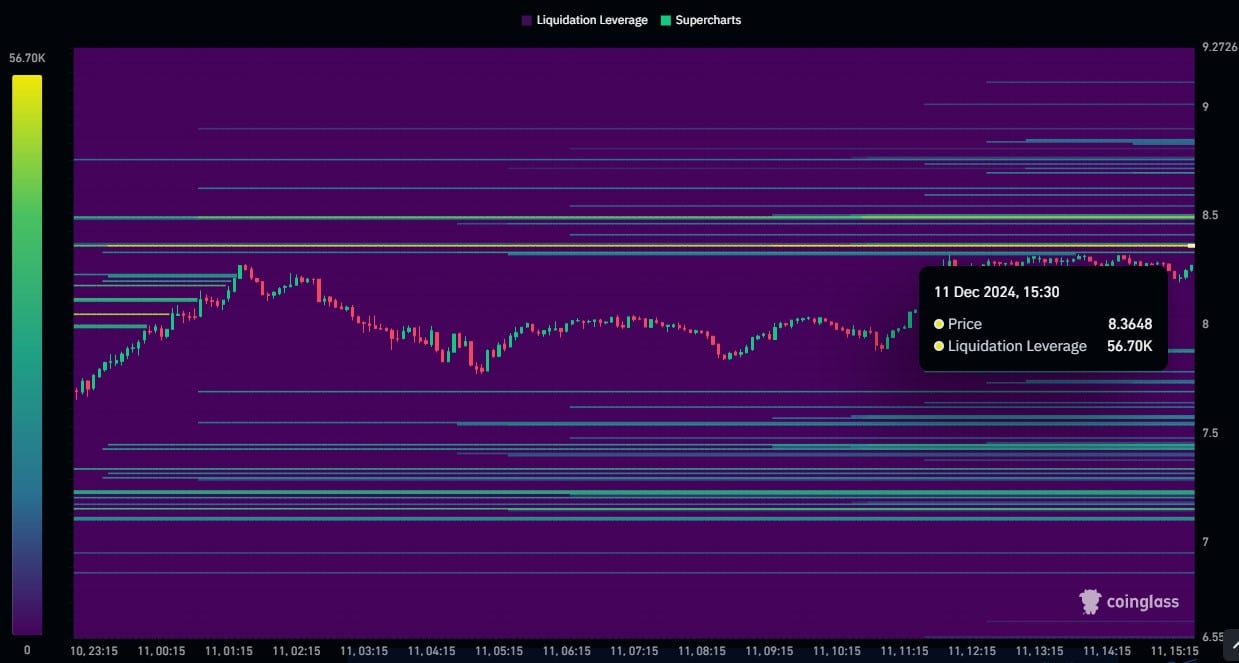

Coinglass liquidation data also shows an increase in leveraged positions. The data reports a 56.70K liquidation pool at the $8.3648 price level.

This implies increased risk among over-leveraged traders and a bullish bias that can drive prices to significant price levels.

Source: Coinglass

Similarly, Open Interest (OI) trends support this optimism with figures showing continued growth. This reflects growing confidence in Helium’s price action.

At the same time, the token’s trading volume coincides with these results and surges along with its price, a typical indicator of a healthy bullish trend.

Source: Coinglass

Broad market conditions were favorable, with Bitcoin’s steady price supporting the performance of altcoins, including HNT. But the big question is whether Helium will be able to break above the key resistance level of $9.5.

Is your portfolio green? Check out our Helium Profit Calculator

As Helium approaches the $9.5 resistance line, the bulls will need significant buying pressure to sustain the uptrend.

The market’s reaction at this level will be important. A breakout could lead to a quick rally towards $10, while a rejection could push the price back towards the $7.8-$8 support area.