- Helium’s daily chart is free of any major hurdles, which could help the asset rise smoothly.

- HNT’s open interest has increased by 7% in the last 24 hours, suggesting growing demand and interest from investors.

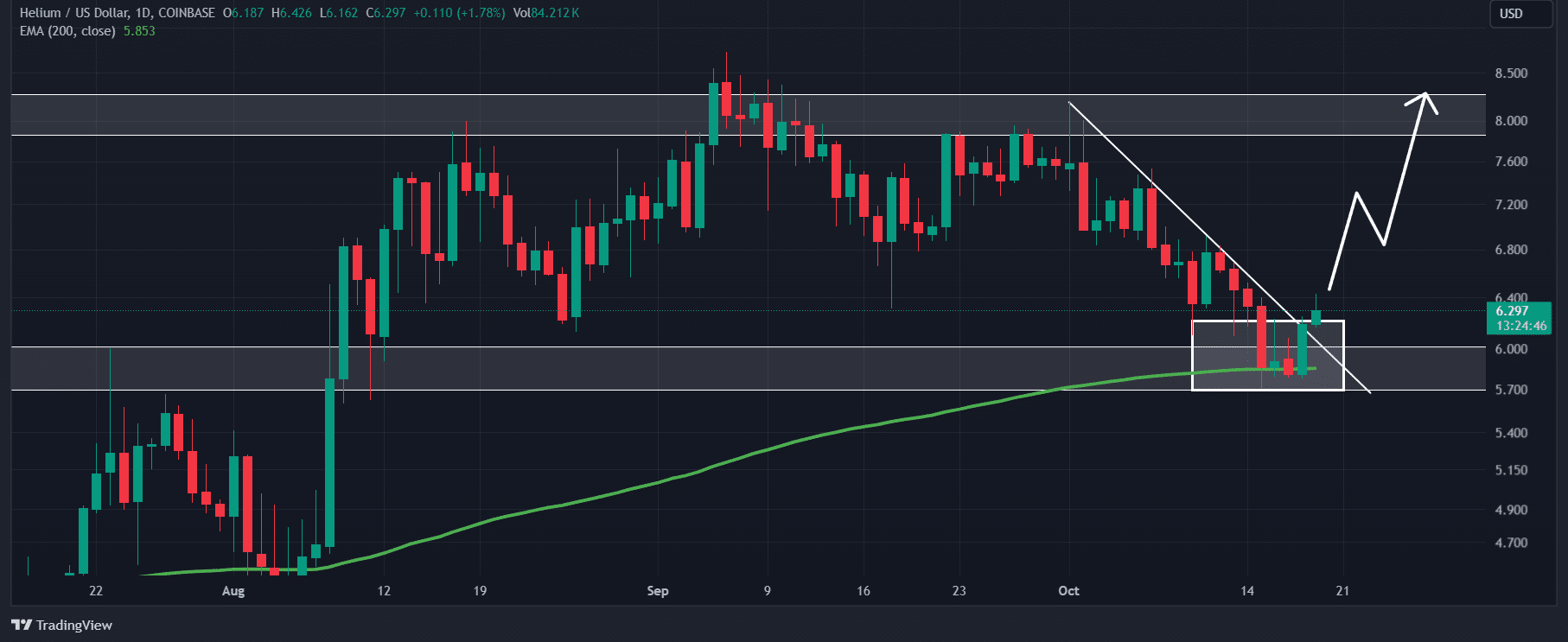

Helium (HNT)Appeared at the time of reporting After retesting important support and breaking away from the downtrend line, we are all set for a massive rally. t as expectedHis move seems to have completely shifted sentiment from a downturn to an uptick.

Technical Analysis of Helium

According to AMBCrypto’s assessment, HNT strengthened after breaking out of the descending trend line that has been acting as resistance since October 1, 2024.

In fact, altcoins also went bankrupt. Consolidated area of $5.8 support.

Source: TradingView

Considering this positive outlook and recent price movements, it is likely that HNT will surge 30% in the coming days and reach the $8.40 level.

At the time of writing, Helium’s daily chart shows no significant obstacles. This could help the asset bounce back smoothly in the future.

Additionally, HNT’s relative strength index (RSI) and 200-day exponential moving average (EMA) suggest a bullish outlook, while also suggesting significant upside.

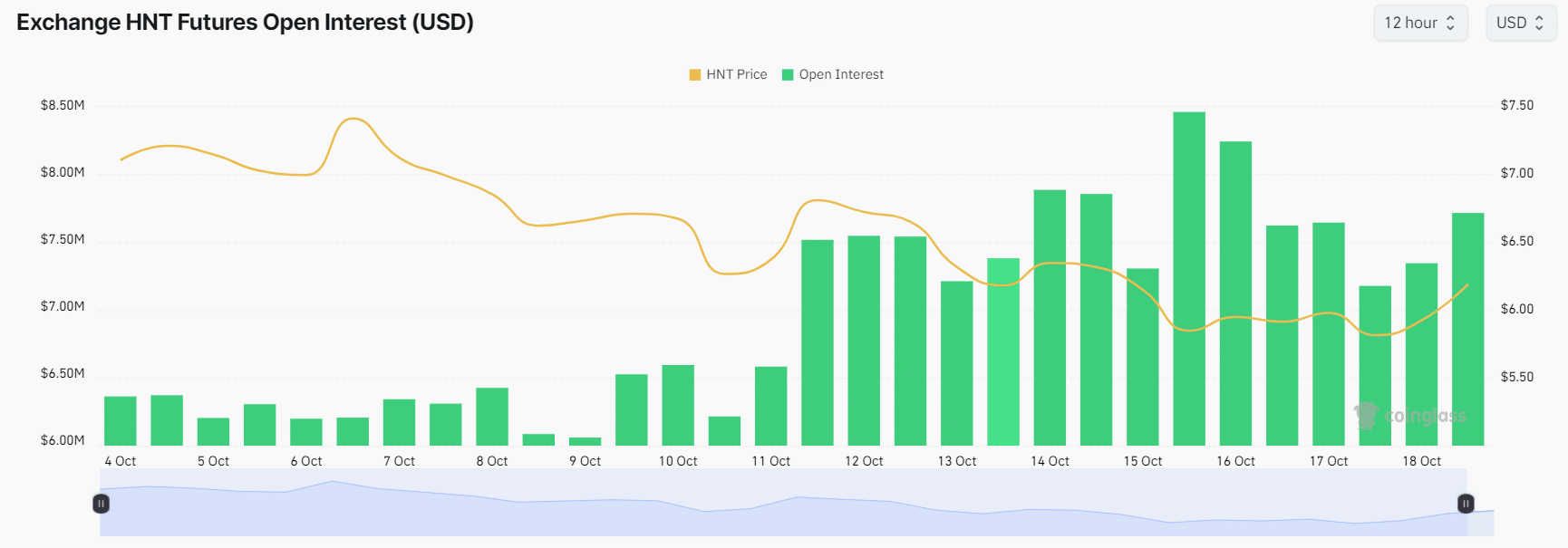

Bullish on-chain indicators

HNT’s positive outlook can be further supported by on-chain indicators. According to Coinglass, HNT’s Long/Short Ratio stood at 1.008 at the time of press. This hinted at a strong sense of optimism among altcoin traders.

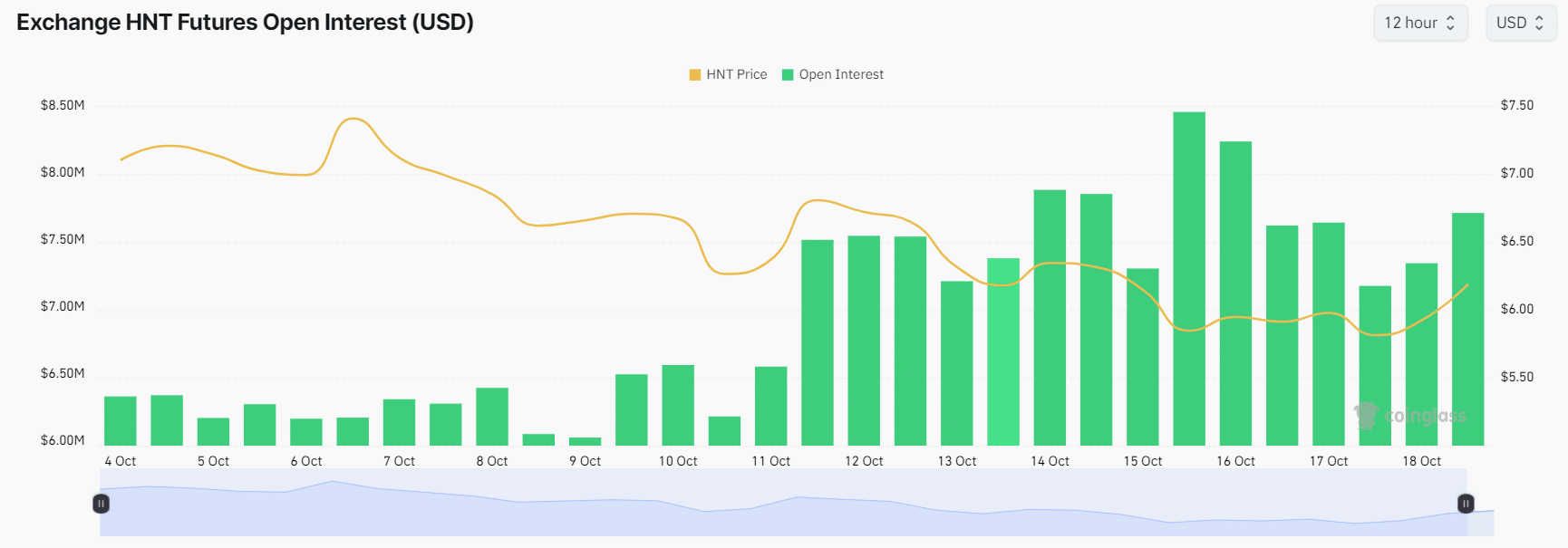

The coin’s Open Interest (OI) is up 7% in the last 24 hours and has been steadily rising on the charts for the week before.

This rise in OI can be interpreted as a sign of increasing demand and interest from investors. This is likely due to the cryptocurrency’s recent breakthrough and optimistic market sentiment.

Source: Coinglass

Traders and investors often use a rising OI and a bid/sell ratio greater than 1 when establishing long positions.

According to Coinglass, the key liquidation levels were $6.06 at the bottom and $6.5 at the top, with traders using excessive leverage at these levels.

Combining these on-chain indicators with technical analysis, we can infer that bulls are currently dominating the asset. They could support HNT and help it reach the $8.40 level in the coming days.

Read Helium (HNT) Price Forecast for 2024-25

At press time, HNT was trading near $6.37 after recording a price surge of more than 8.2% in the past 24 hours.

During the same period, trading volume surged by 20%, showing increased participation from traders and investors compared to the past few days.