April will be a monumental month in the cryptocurrency industry, with pivotal news that could impact the market.

From significant block reward halvings to high-stakes legal developments and landmark project launches, here’s what to watch for.

Block Reward Halving: BCH and BTC

April marks the expected halving of block rewards for two major cryptocurrencies, Bitcoin (BTC) and Bitcoin Cash (BCH).

Market participants expect BCH to be halved around April 3, reducing mining rewards from 6.25 BCH to 3.125 BCH. This event, which is important in controlling the inflation and supply dynamics of a coin, often triggers speculative interest by reducing the rate at which new coins enter circulation.

Soon after, on April 25th, Bitcoin will undergo its own halving. The reward for mining a block will be reduced from 6.25 BTC to 3.125 BTC. Historically, these events have fueled bullish market trends, fueling speculation and interest in Bitcoin.

These halvings highlight the deflationary nature of these digital assets, potentially increasing their value over time.

Regulatory Spotlight: SEC vs. Coinbase

The cryptocurrency regulatory environment is also heating up. An important development to note is the April 19th deadline for the SEC and Coinbase to agree to mediate the case.

This follows the ruling on Coinbase’s motion to dismiss the SEC lawsuit, highlighting ongoing tensions between cryptocurrency companies and regulators. These discussions could impact the entire industry by establishing a precedent for cryptocurrency regulation in the United States.

CZ’s Sentence and Market Impact

Another important case is the sentencing of Binance founder Changpeng Zhao, known as “CZ.” The sentencing, originally scheduled for March 30, was postponed to April 30.

Zhao’s case, which involved allegations of failing to maintain an effective anti-money laundering program, sent ripples through the cryptocurrency market and highlighted the legal challenges facing industry leaders.

EigenLayer mainnet launch

As we end this month celebrating innovation, the cryptocurrency market is eagerly anticipating the mainnet launch of EigenLayer.

With a significant $100 million investment from Andreessen Horowitz and an innovative protocol that allows users to re-stake Ether, EigenLayer is set to introduce a new paradigm in the security and performance of Ethereum. The project’s move to mainnet aims to improve Ethereum’s scalability and functionality after a successful testing phase.

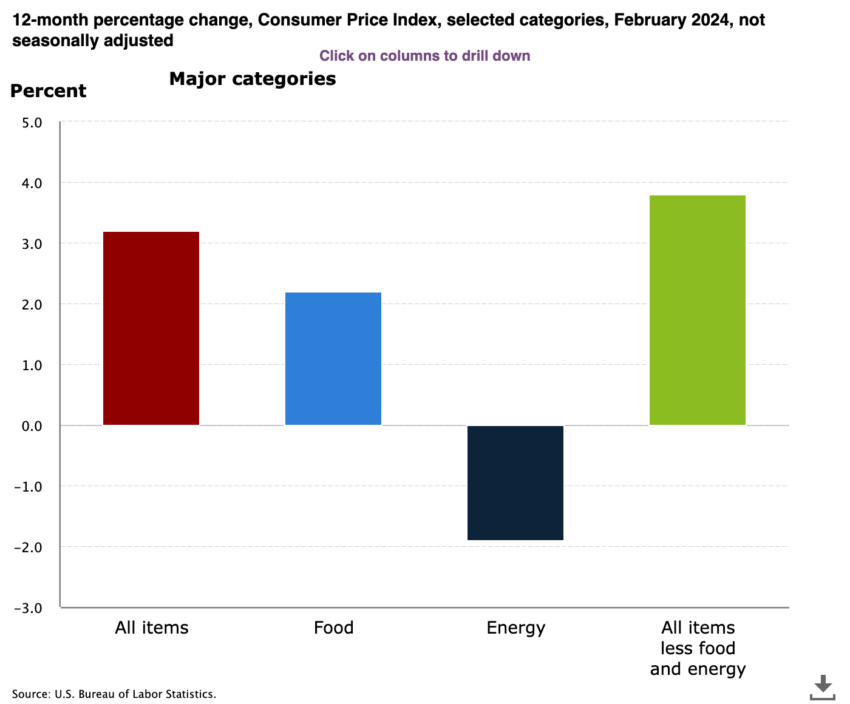

Economic Indicators: March CPI

Moreover, the US March Consumer Price Index (CPI), scheduled to be released on April 10, is still an important economic indicator that can influence market sentiment. February’s CPI increase has left investors on edge as it reflects broader economic trends that indirectly impact the cryptocurrency market.

In summary, April was filled with news that summarized the multifaceted nature of the cryptocurrency market, from regulatory issues and economic indicators to technological developments and market dynamics. These developments highlight the complexity of the sector and its increasing integration with broader financial and regulatory frameworks.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.