- Open interest in Toncoin has increased significantly over the past few weeks.

- Declining network growth indicates less interest in new addresses.

Toncoin (TON) has been one of the few success stories in the market over the past few months, and TON has been particularly immune to market volatility and bearish sentiment. Therefore, it is worth looking into the factors that have facilitated such success and the scale of interest in Toncoin.

Explore TON’s interests

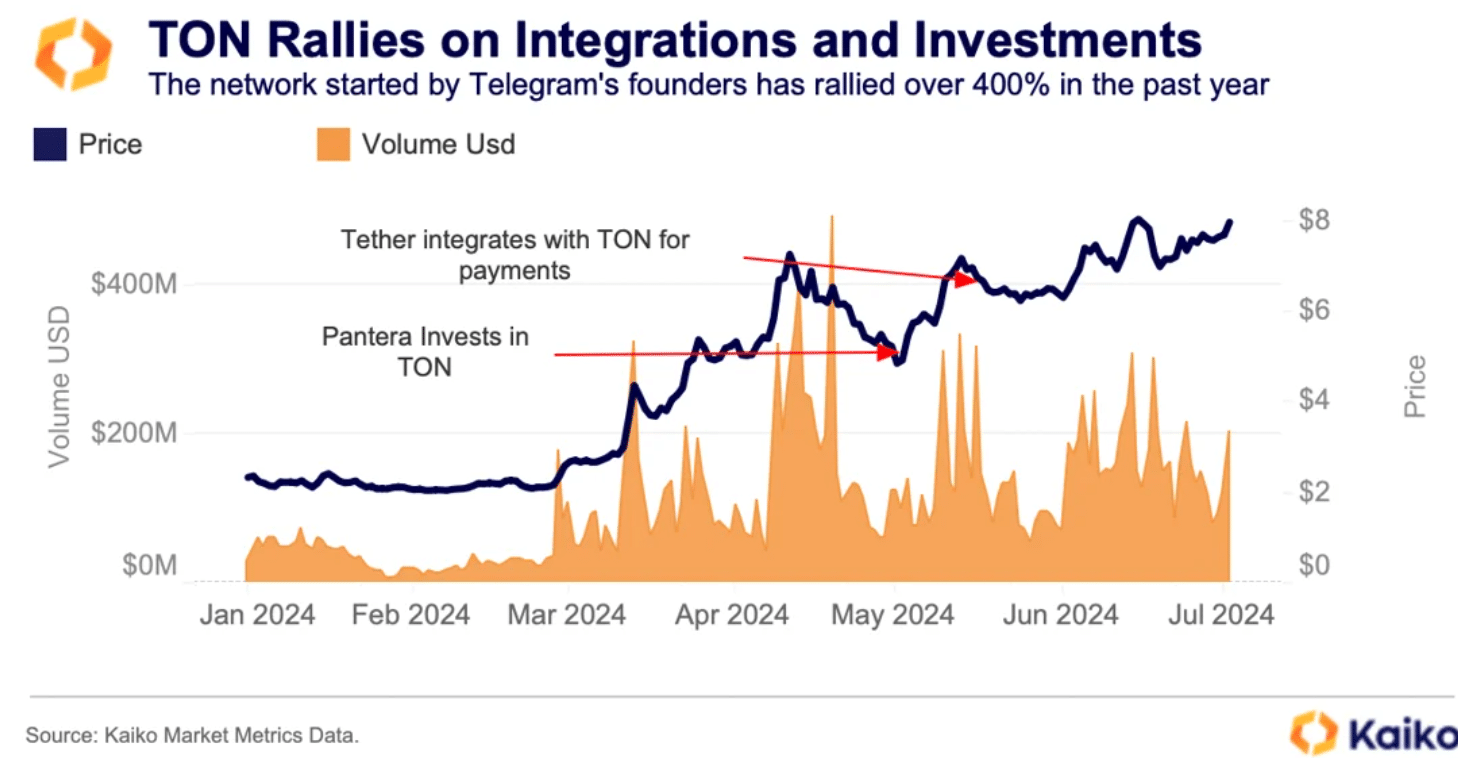

TON has seen notable growth in value recently, reaching a new all-time high of over $8.20 in mid-June, a milestone that most other altcoins have failed to achieve since the bull market of 2021. The increased interest in TON over the past year can be attributed to its close relationship with Telegram, a messaging app with a massive user base of over 1 billion.

Source: Kaiko

Trading activity for the token has also seen significant growth. Both dollar and asset volumes have increased significantly, indicating a significant increase in demand for TON beyond price-driven speculation. At the same time, TON liquidity has also expanded dramatically, with 1% market depth skyrocketing from $2.5 million in January to a whopping $8 million in July.

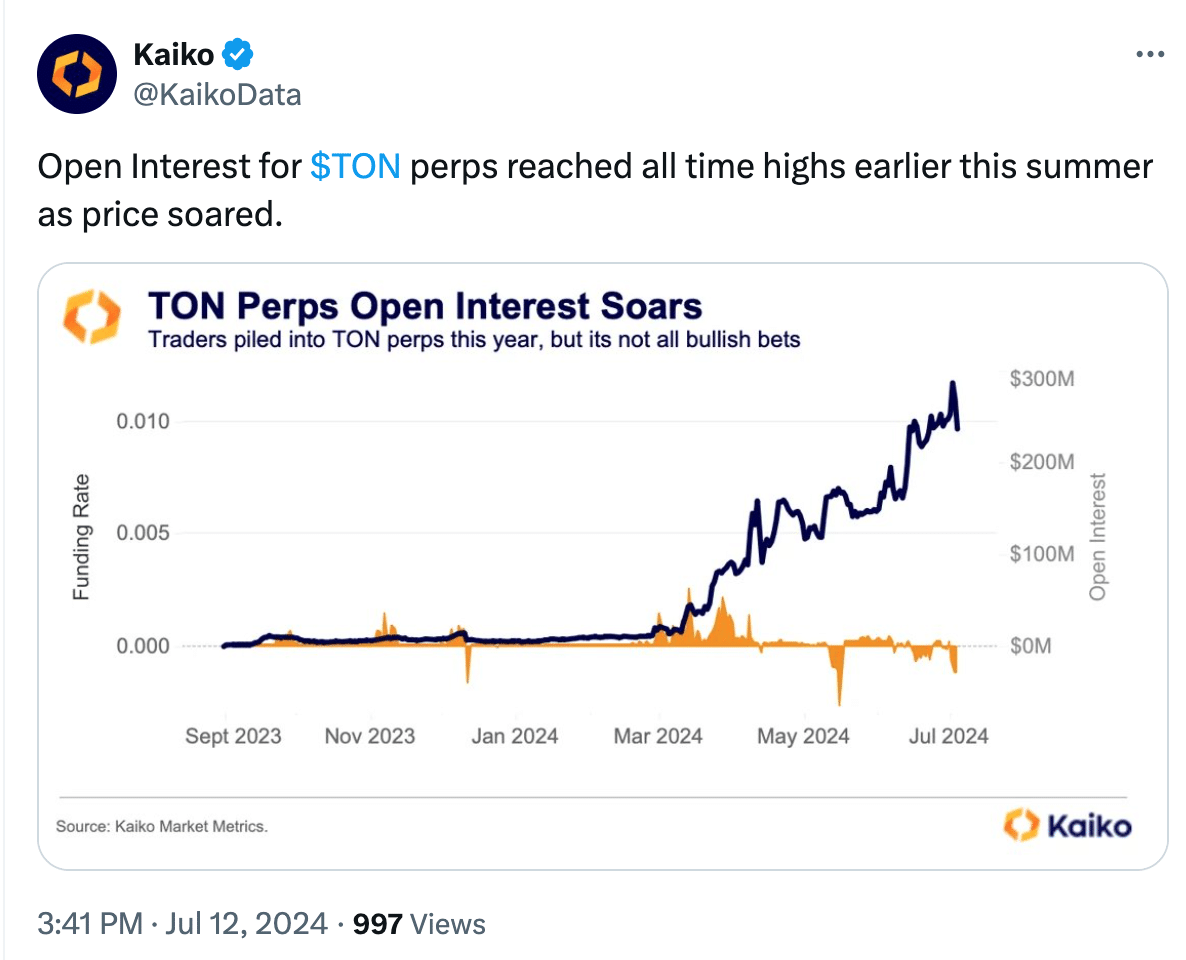

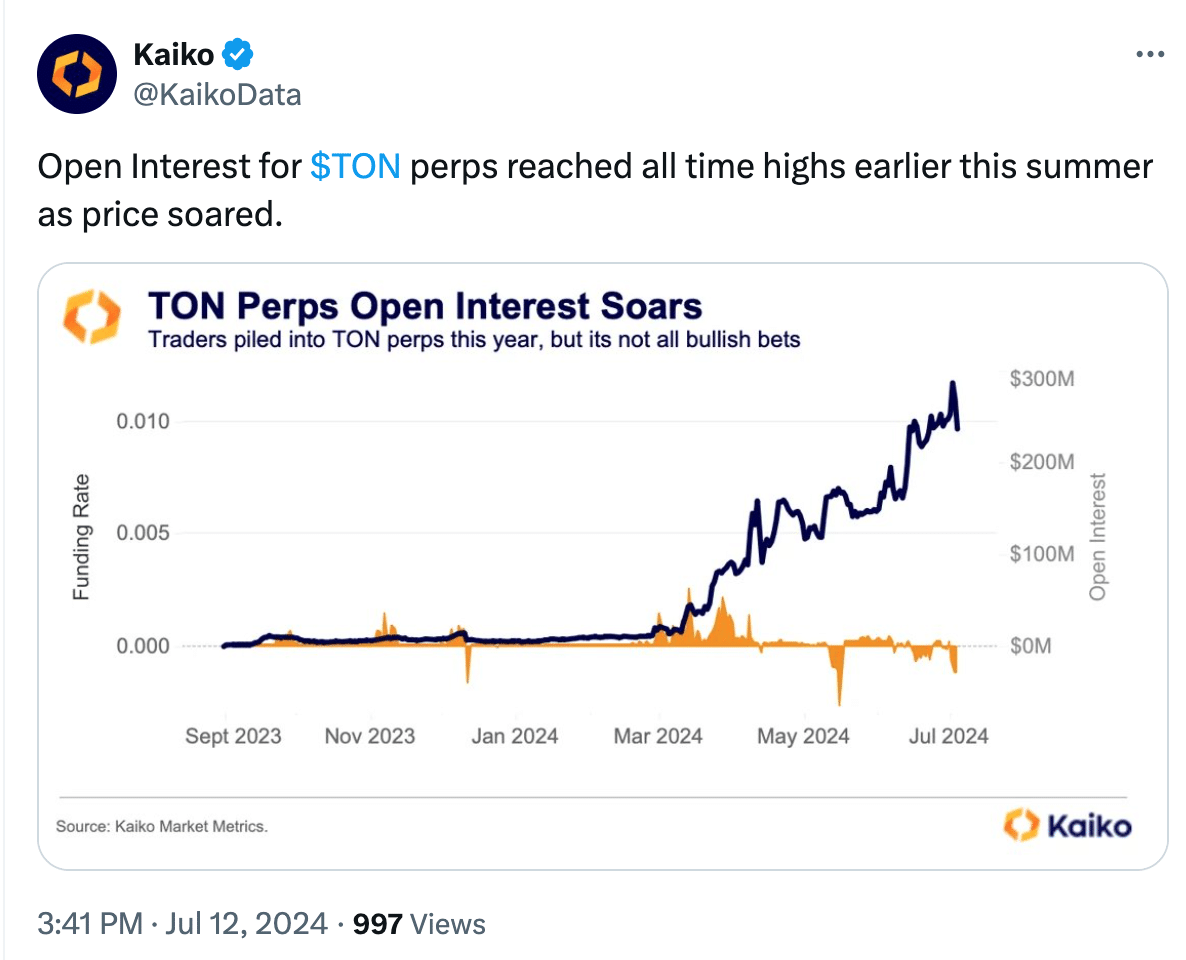

This market activity was further highlighted by the fact that TON’s open interest reached an all-time high of $287 million in early July, indicating a major inflow of capital into the token. The funding ratio was volatile, fluctuating between positive and negative territory throughout the year, which can be interpreted as indicating that traders have both bullish and bearish sentiment.

While there was a marked downtrend in May with funding rates falling sharply, recent months have been relatively balanced with both long and short positions being taken.

Source: X

The combination of high prices, increased trading volume, and increased liquidity could attract interest from both retail and institutional investors, which could in turn lead to a broader investor base and potentially higher demand for TON.

What does on-chain data tell us?

At the time of writing, TON was trading at $7.36, with the price up 0.12% over the last 24 hours.

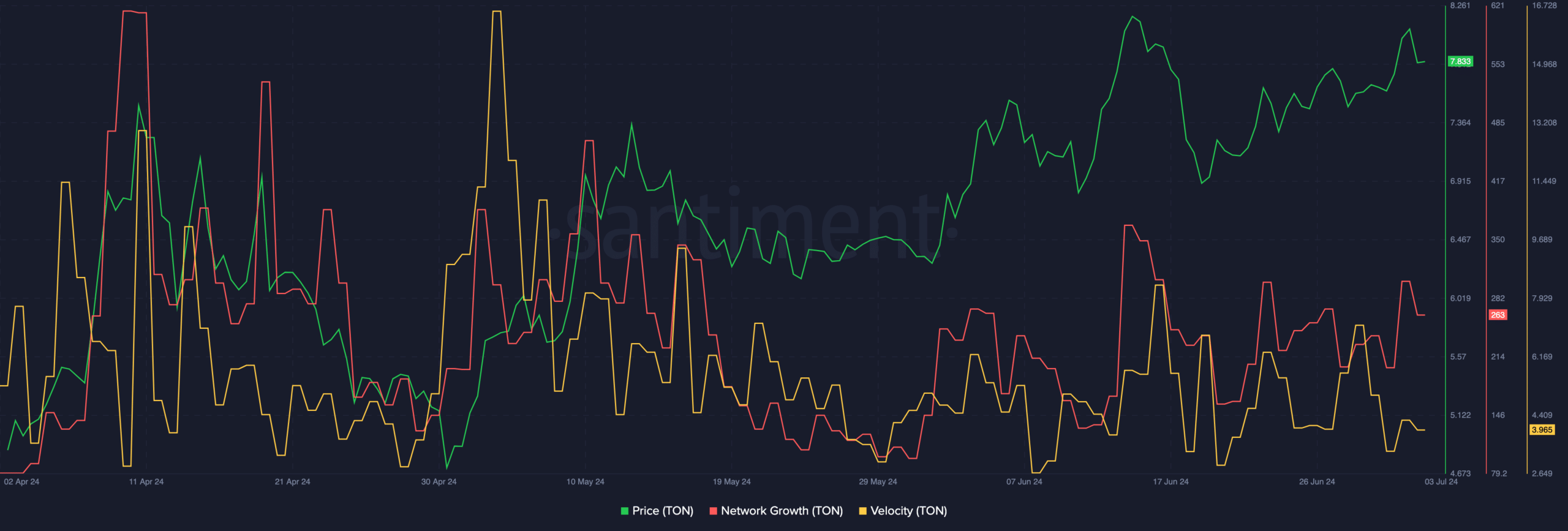

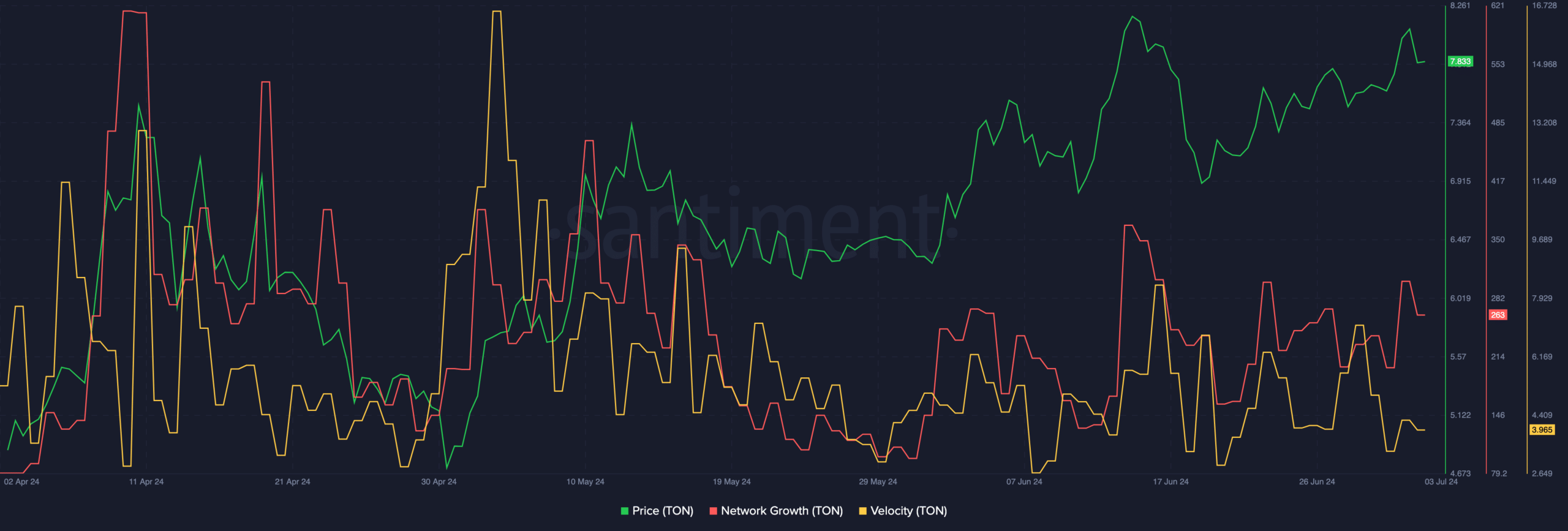

However, AMBCrypto’s analysis of Santiment’s data shows that TON’s network growth has slowed, meaning that interest from new addresses in TON has decreased significantly recently.

Read Toncoin (TON) Price Prediction 2024-25

TON’s transaction speed has also decreased, indicating that TON’s transaction frequency has dropped significantly.

Taking these factors into account, we can see that TON is likely to move sideways to some extent before experiencing any major price fluctuations in the short term.

Source: Santiment