- TRON fee revenues will reach an all-time high in 2024, signaling increased adoption.

- Market fundamentals point to a potential trend reversal for TRX

Since hitting its recent high of $4.5 three weeks ago, Tron (TRX) has been putting strong downward pressure on the charts. In fact, the altcoin has not fully recovered since hitting a low of $0.22. At the time of writing, the cryptocurrency appears to be trading within a consolidated range between $0.22 and $0.26.

Despite TRX failing to maintain an upward trend on the price chart, network adoption and usage surged throughout the year.

TRON achieved its highest ever fee revenue.

According to CryptoQuant, TRON has reached an all-time high in terms of fee revenue. In October 2024, the TRON blockchain recorded its highest ever fee revenue, exceeding $200 million.

These increases continued in November, with total fee revenue figures exceeding $180 million.

Source: CryptoQuant

In comparison, the TRON blockchain recorded figures of $32.6 million in November 2022 and $102.3 million in November 2023.

This is a seven-fold increase from 2022 and almost a two-fold increase from 2023. Therefore, the currently observed fee surge is a clear sign that TRON’s activity is increasing and the ecosystem continues to expand significantly. This growth in the ecosystem and network usage is well-positioned to benefit the native token TRX.

Will this affect TRX?

While TRON has seen a significant increase in network usage, TRX has also faced significant challenges. This made it impossible to keep up with the pace.

However, it is worth noting that the altcoin’s recent price action and on-chain indicators point to a potential trend reversal and subsequent price recovery.

Source: TradingView

First of all, TRX’s Relative Strength Index (RSI) has shown a bullish crossover over the past 24 hours. This crossover suggests that a buyer has entered the market and is now in control. As more buyers enter the market, buying pressure increases and prices rise.

This could be further strengthened by the Relative Vitality Index (RVGI), which showed a strong crossover on the day. This means that the cryptocurrency’s upward momentum is strengthening and downward trend pressure is also decreasing.

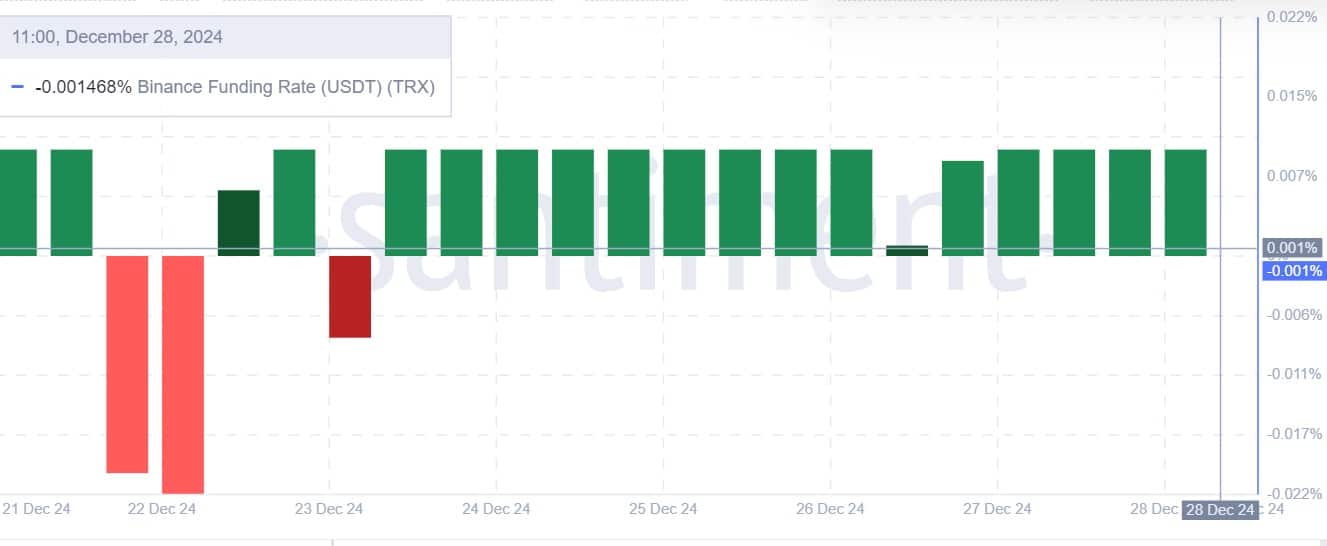

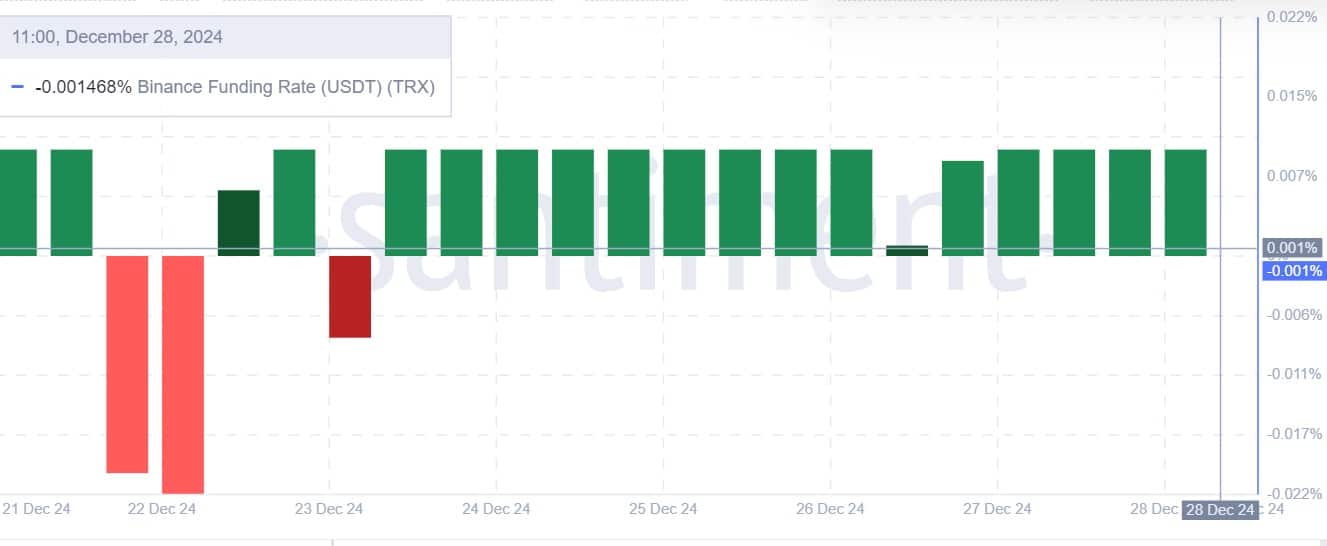

Source: Santiment

Additionally, TRX’s Binance funding ratio has remained positive over the past five days. This highlighted the high demand for long positions.

Therefore, investors were willing to pay premium fees to hold the trade, expecting to gain more profits from the TRX price chart.

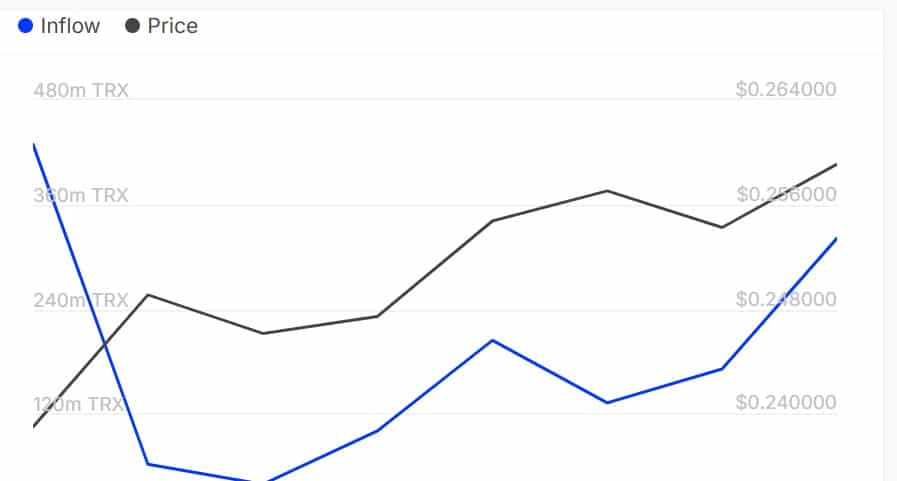

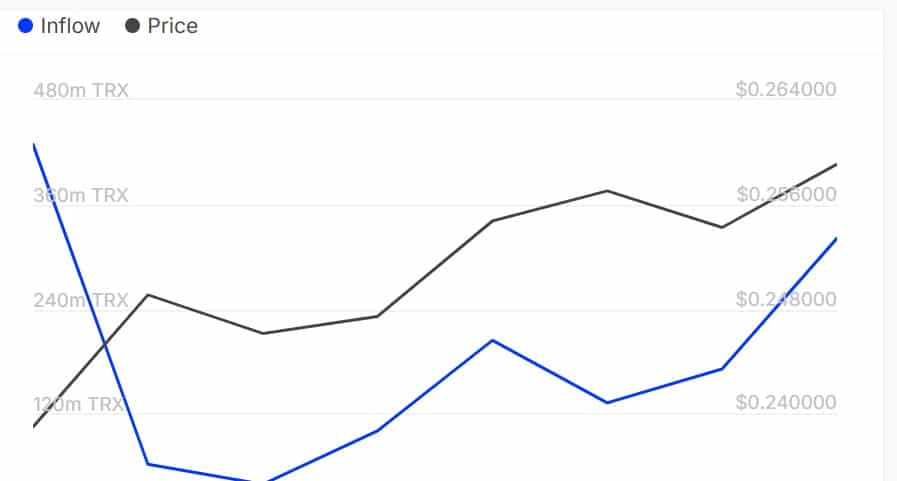

Source: IntoTheBlock

Finally, optimism has become widespread among whales as well. Last week, large holder inflows surged to 321.45 million, according to IntoTheBlock. Increasing capital inflows from large holders are an indication of their confidence, and the market is likely also expecting more profits.

TRON fee revenues may be skyrocketing, but TRX has not been able to keep pace with this growth in the past. However, increased network usage could provide a positive outlook for TRX.

If the observed strength holds, TRX will break out of the $0.26 resistance and regain $0.30. However, if this fails to hold, TRX will fall below the consolidation range and fall to $0.20.