- ADA has been in a long-term downtrend, breaking below the 200-day EMA, but short-term volatility could provide opportunities for buyers.

- Altcoin funding rates show signs of easing selling pressure.

Overall sentiment towards Cardano (ADA) appears to have deteriorated over the past day, with the Crypto Fear and Greed Index entering ‘Extreme Fear’ territory.

After witnessing a series of red candles, we finally have a bullish reversal pattern on the daily chart. But will this be enough to change the bullish to bearish narrative?

At the time of writing, ADA was trading at $0.40, up about 2% over the past day.

Can Cardano Reverse Its Current Downtrend?

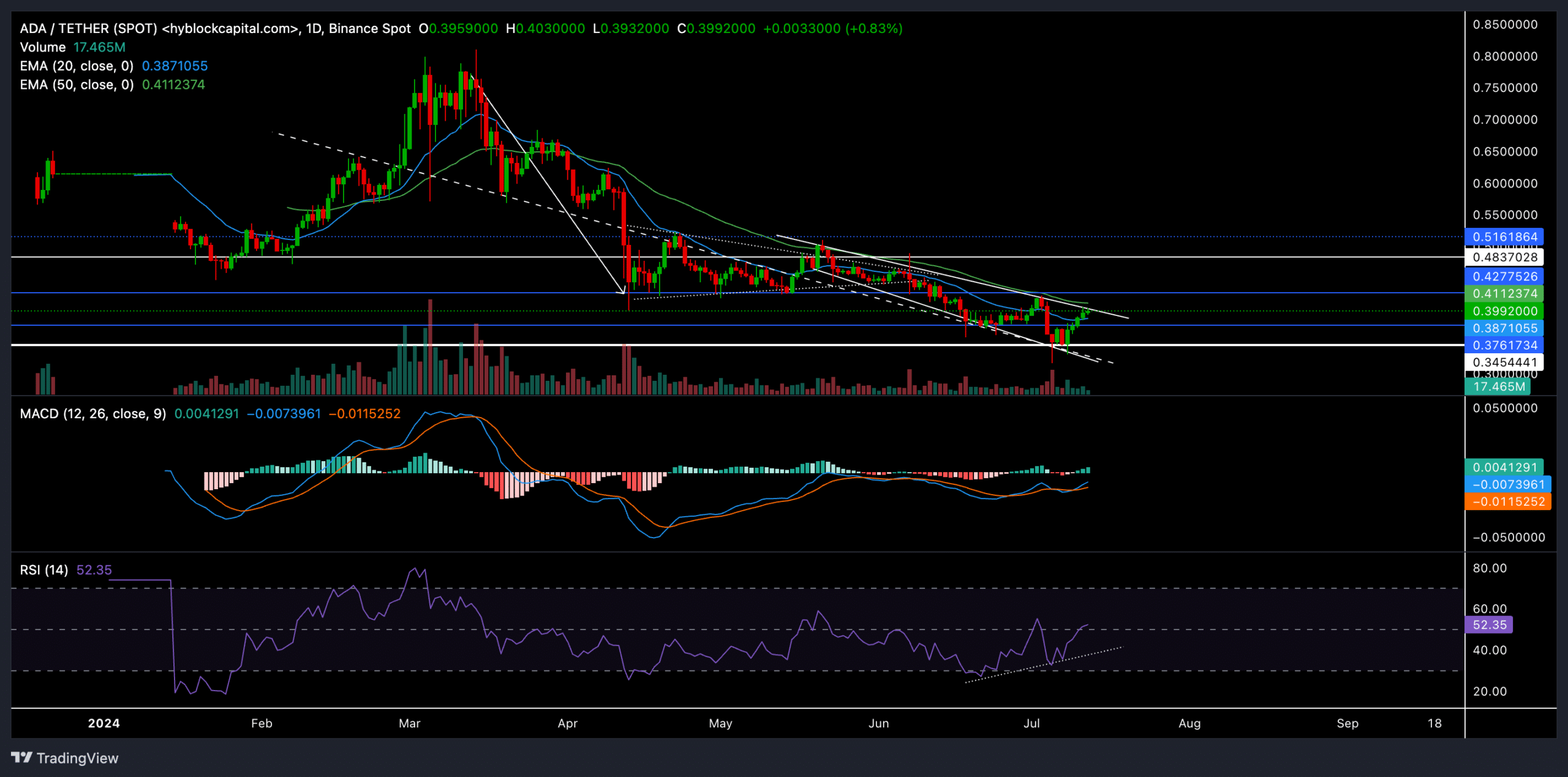

Source: TradingView, ADA/USDT

ADA has entered a relatively long-term downtrend, especially after breaking below the important 200-day EMA support level.

It is noteworthy that ADA’s 200 EMA has now become a major resistance level for the coin’s recovery.

For example, ADA recently showed a typical bearish pennant pattern after bouncing off this resistance level on the daily chart.

However, buyers can take advantage of the short-term volatility of the coin as it tries to break the chain of the 20-day and 50-day EMAs.

The $0.34 support level provided strong immediate support, and sellers tested it several times last week.

The recent bounce from this support has created a falling and widening wedge on the chart. As a result, the coin has surged more than 15% over the past four days and resisted the broader market uncertainty.

A close above the current pattern is likely to confirm a short-term bullish breakout. Buyers should wait for a close above the 20-day and 50-day EMAs to confirm this breakout.

In this case, ADA is likely to test the resistance level of $0.48 before making any concrete moves.

However, if the overall market sentiment continues to suffer, the coin may test the next major support level at $0.304.

The Relative Strength Index (RSI) finally closed above the 50 level mark, indicating that selling pressure has eased. This occurred after price action and bullish divergence were indicated.

The MACD line has shown a bullish crossover but has not yet crossed the equilibrium, which would set the stage for a strong bullish rebound.

Funding rates have shown an upward trend.

Source: Coinglass

According to Coinglass data, ADA’s funding rate across all exchanges has been on a steady upward trend throughout the past week, showing that its bullish momentum is growing steadily.

Read our Cardano (ADA) Price Prediction 2024-25

In fact, the open interest for ADA has also surged over the past day along with the daily price increase, suggesting that many traders are entering new positions.

ADA has shared an 84% correlation with Bitcoin over the past 60 days, so it is important to consider BTC sentiment before opening a new position.