- BNB is starting to trade above long-term resistance levels.

- The coin price may recover to its all-time high in two years.

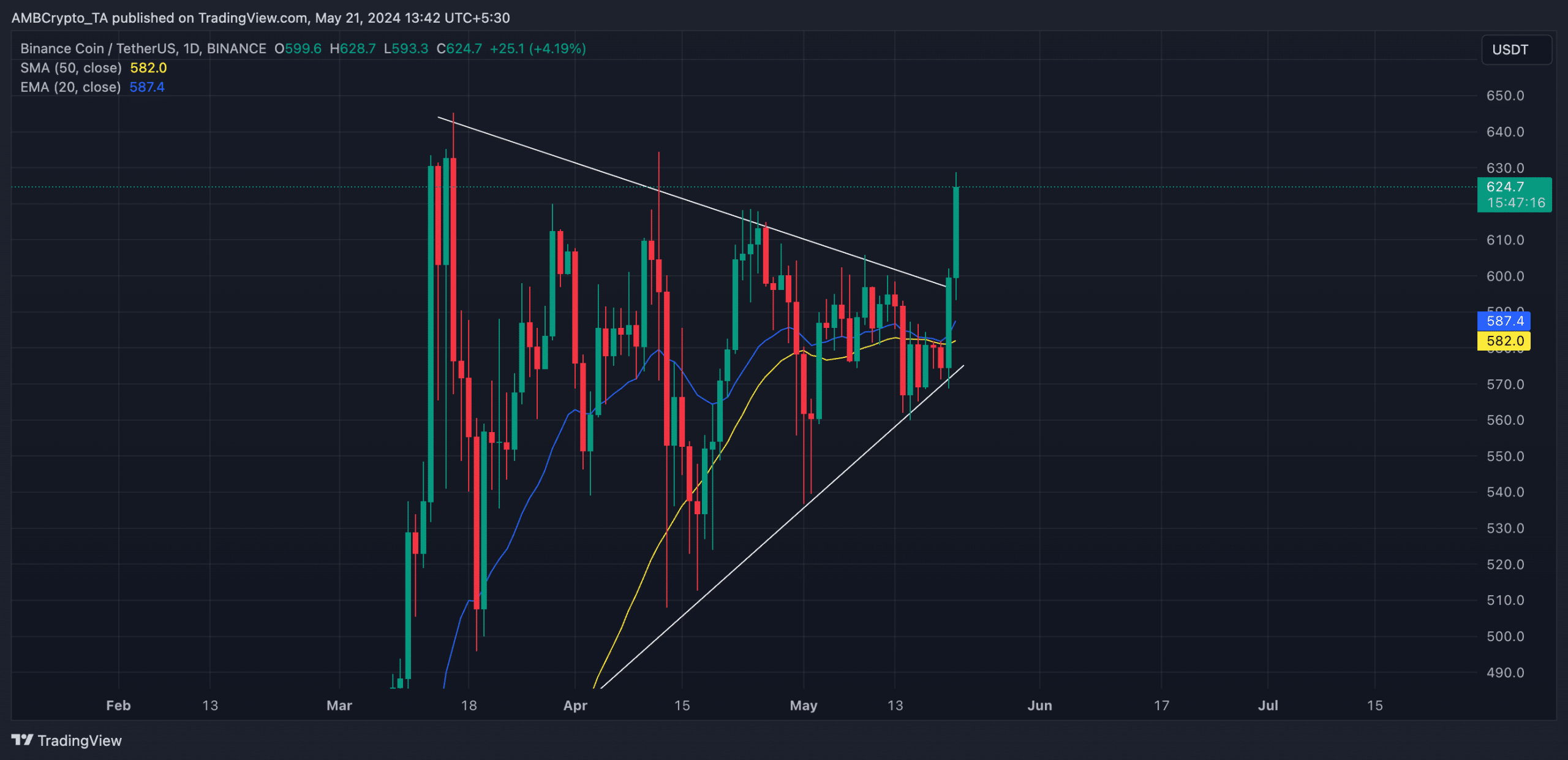

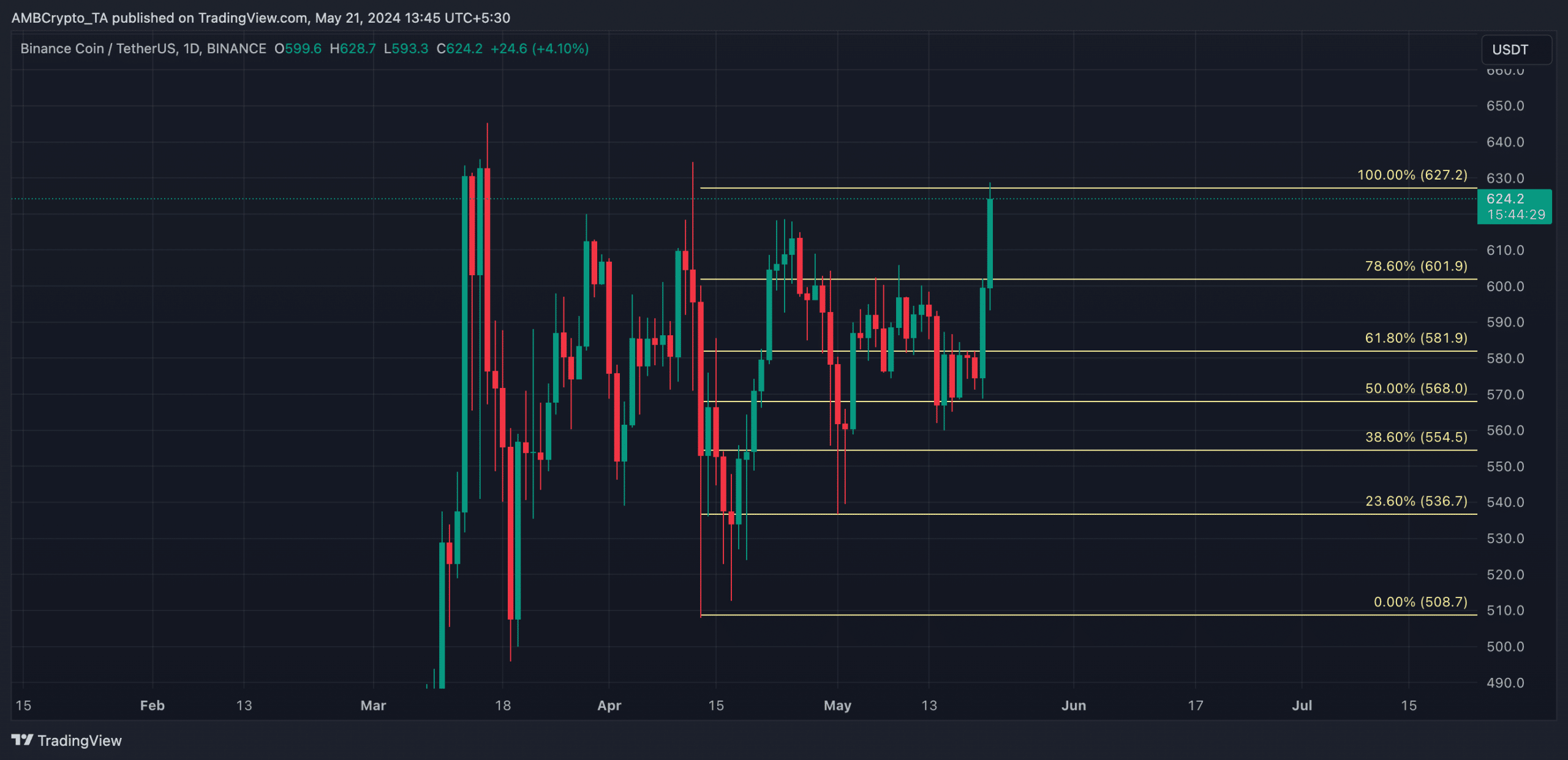

Binance Coin (BNB) has crossed the upper line of a long-term symmetrical triangle, indicating a surge in buying pressure.

At the time of writing, the altcoin is trading at $623, above the $595 price area where it has formed a significant resistance level since March.

Source: BNB/USDT, TradingView

When an asset is trading within a symmetrical triangle, its price continually reaches various lower highs and higher lows.

This suggests that asset prices are consolidating within a narrow range. Buyers are pushing prices higher to meet resistance and sellers are pushing prices lower to find support.

BNB is ready for further growth

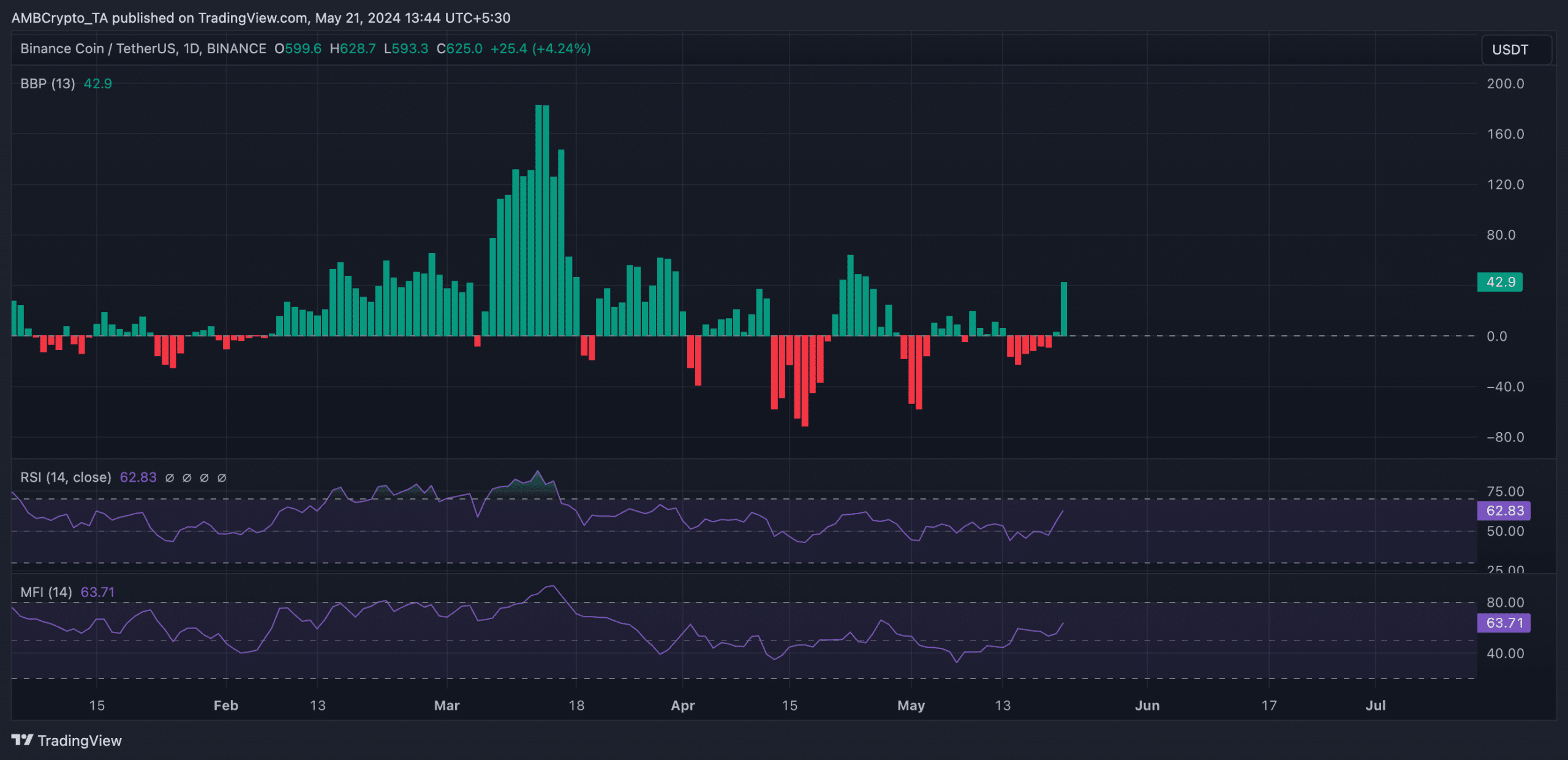

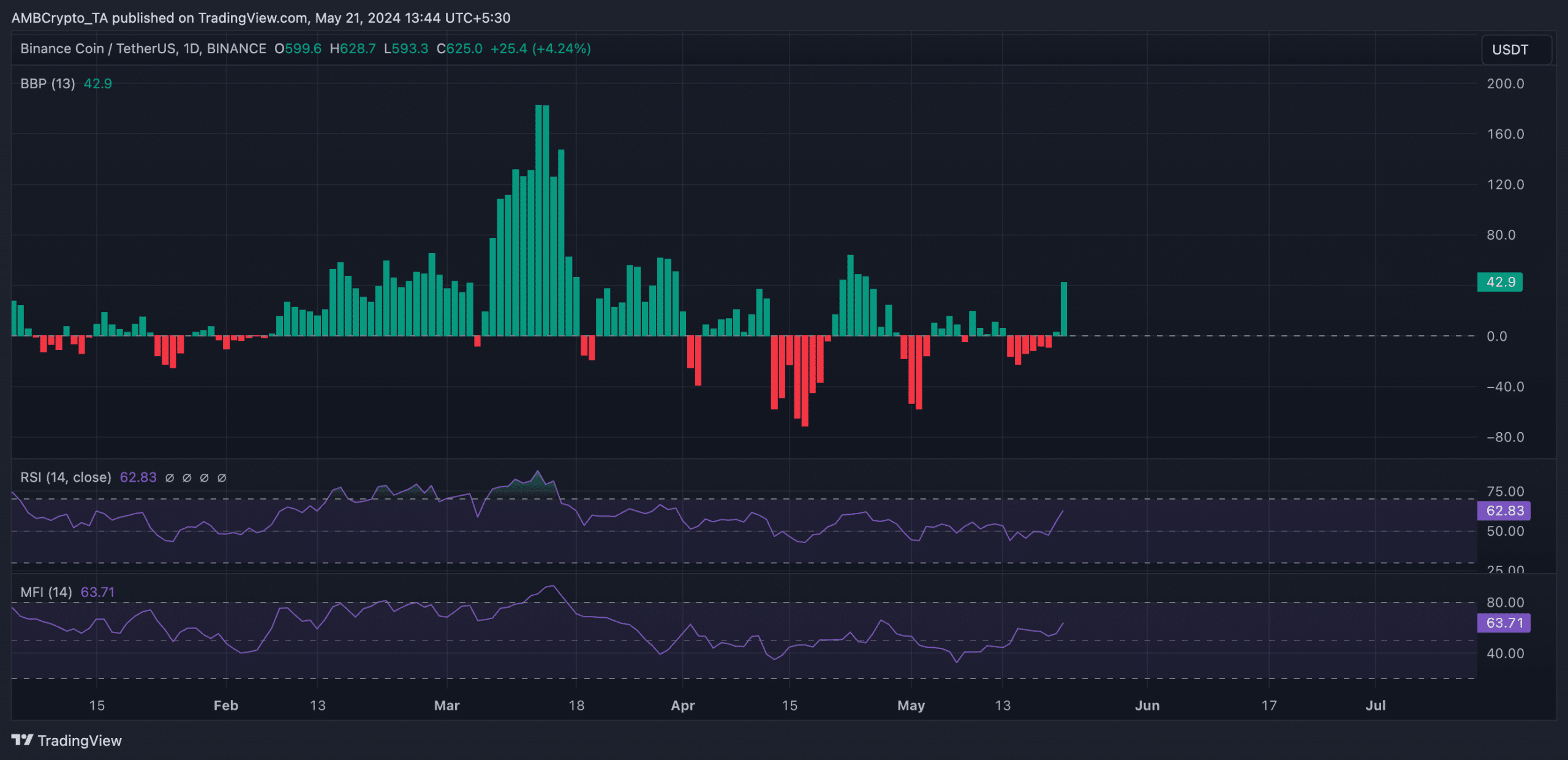

BNB’s price increase over the past 24 hours has led to its price rebounding above key moving averages.

At press time prices, the coin was trading above its 20-day exponential moving average (EMA) and 50-day small moving average (SMA) at the time of press.

This crossover is important because the price of BNB has been trading at this moving average for 5 days. This indicates indecision between bulls and bears ahead of the market rally on May 20th.

This crossover is causing the market to continue its upward trend. Traders interpret this as a change in momentum towards coin accumulation.

The coin’s Elder-Ray index returned positive values for the first time since May 14, confirming its upward trend. This indicator measures the relationship between the strength of BNB buyers and sellers in the market.

When the value is positive, bull power rules the market. At the time of writing, BNB’s Elder-Ray index was 41.44.

Additionally, the coin’s key momentum indicator is showing an upward trend, suggesting that the price increase over the past 24 hours has been supported by real demand for BNB.

The relative strength index (RSI) was 62.49 and the money flow index (MFI) was 63.37.

At these values, these indicators showed that market participants prefer to buy more BNB coins than sell their current holdings.

Source: BNB/USDT, TradingView

Is your portfolio green? Check out our BNB Profit Calculator

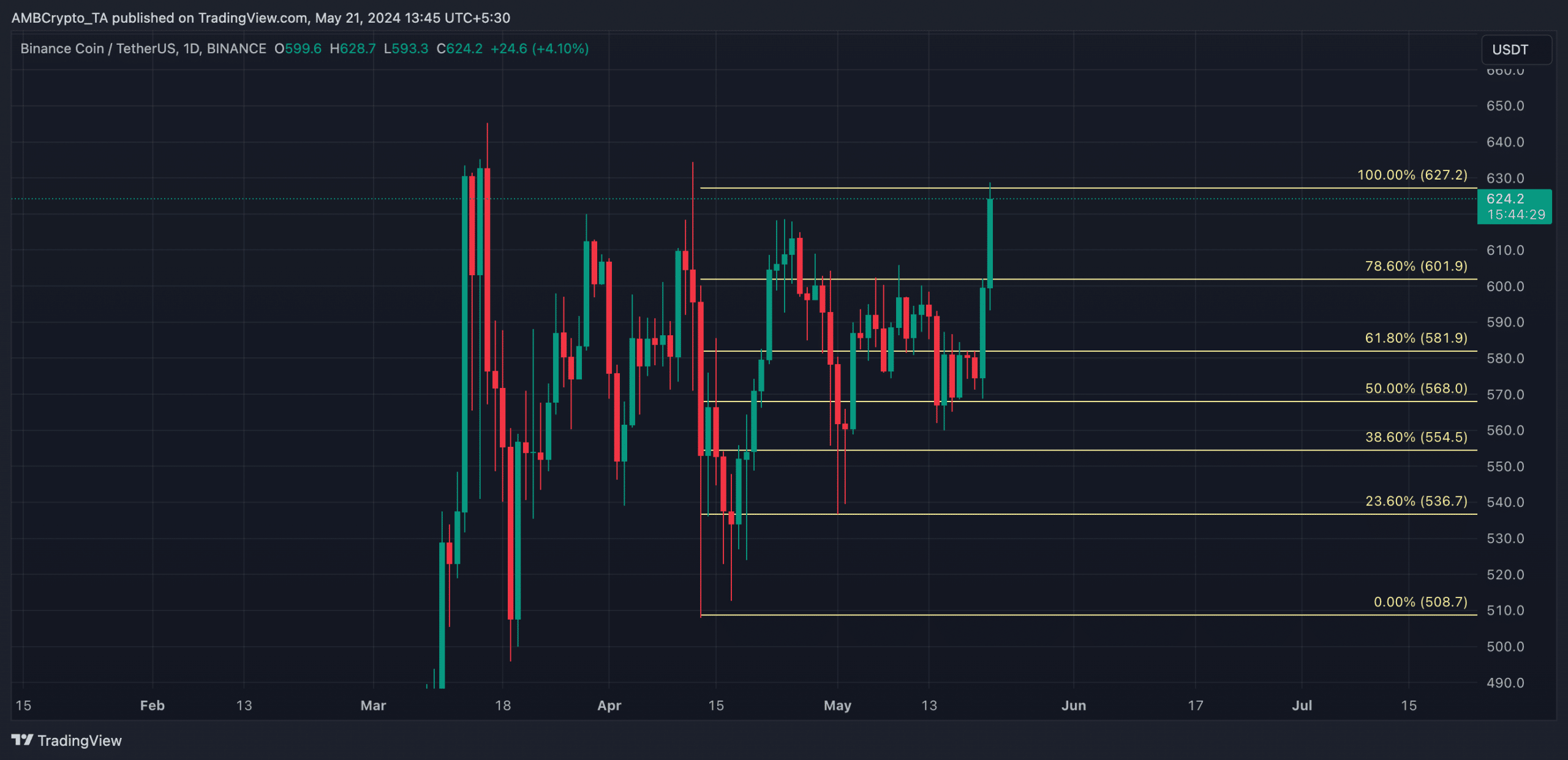

If buying momentum continues to grow relative to the coin’s next price point, BNB could rebound to regain its all-time high of $690, last reached three years ago.

Source: BNB/USDT, TradingView

However, if buyers get exhausted and bears regain control, BNB could return to resistance below $600.