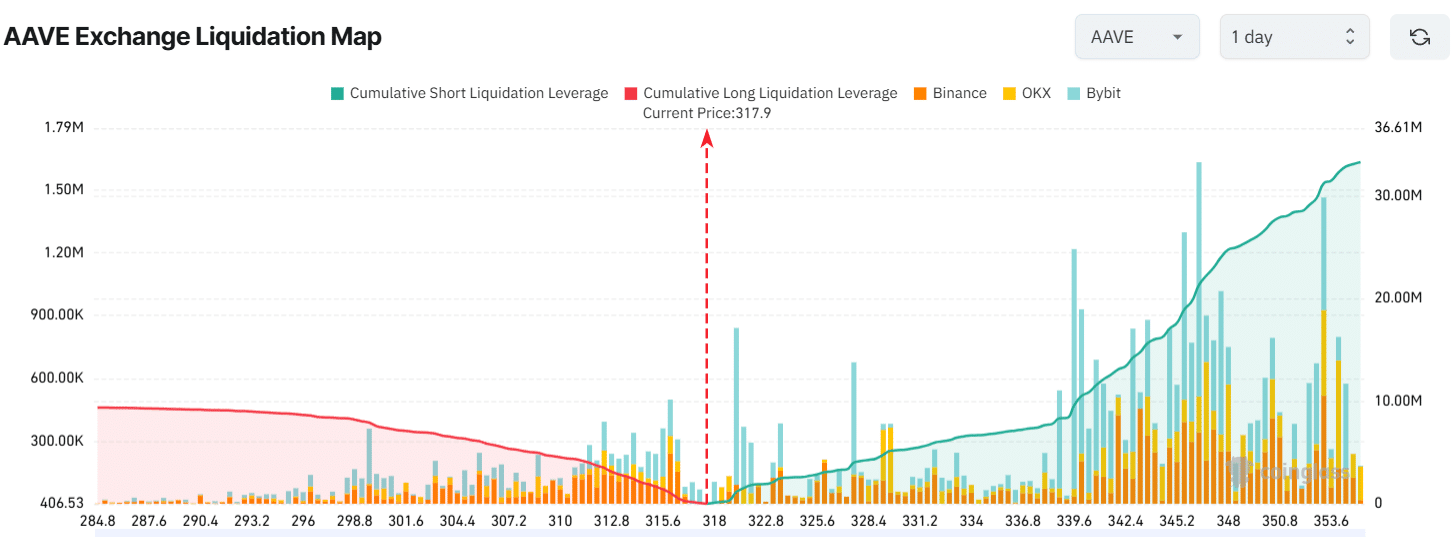

- The hot -term seller suggested that short -term sellers could cause sales pressure.

- The $ 343 and $ 365 levels represent pressure sales areas for AAVE prices.

Significant market volatility waves have seen many encryption assets moving largely in any direction. In this context, AAVE (AAVE) is receiving considerable attention from long -term holders, investors and whales. In particular, they seem to be accumulating tokens now.

One million dollars in AAVE’s accumulation

According to the latest post on the popular crypto expert ALI’s X (previous Twitter), Crypto Whales has purchased a $ 66 million AAVE token over the last three days. LOCLEONCHAIN, a blockchain -based transaction tracker, has been found to have accumulated 11,663 AAVEs in addition to this accumulation.

Looking at this number can be an ideal opportunity to buy AAVE tokens.

Merchant’s Bearrity Bet

In addition to the recent activities of whales, merchants in the vein appear to be using market sentiment.

In fact, according to CoingLass’s data, the bull has an excessive overdose of $ 316, $ 312 and $ 300, with a long position of more than $ 79 million. On the contrary, short sellers are excessively resolved at $ 320, $ 327, $ 340 and $ 345, with a short position worth $ 2,133 million.

Source: COINGLASS

These results suggest that short sellers strongly dominate their assets. Therefore, they may cause sales pressure and can fuel additional games of depreciation.

Despite the significant accumulation of whales and investors, the price of tokens is struggling to gain momentum due to the wider market feelings. This is because major cryptocurrencies, such as Bitcoin (BTC) and Etherrium (ETH), are moving sideways for a long time.

At the time of writing, AAVE was traded near $ 320 with a very low price increase of 0.45%over the last 24 hours. But during the same period, it attracted great attention to merchants and investors. This increased the volume of trading by 70%, especially compared to the previous day.

Technical analysis and major levels

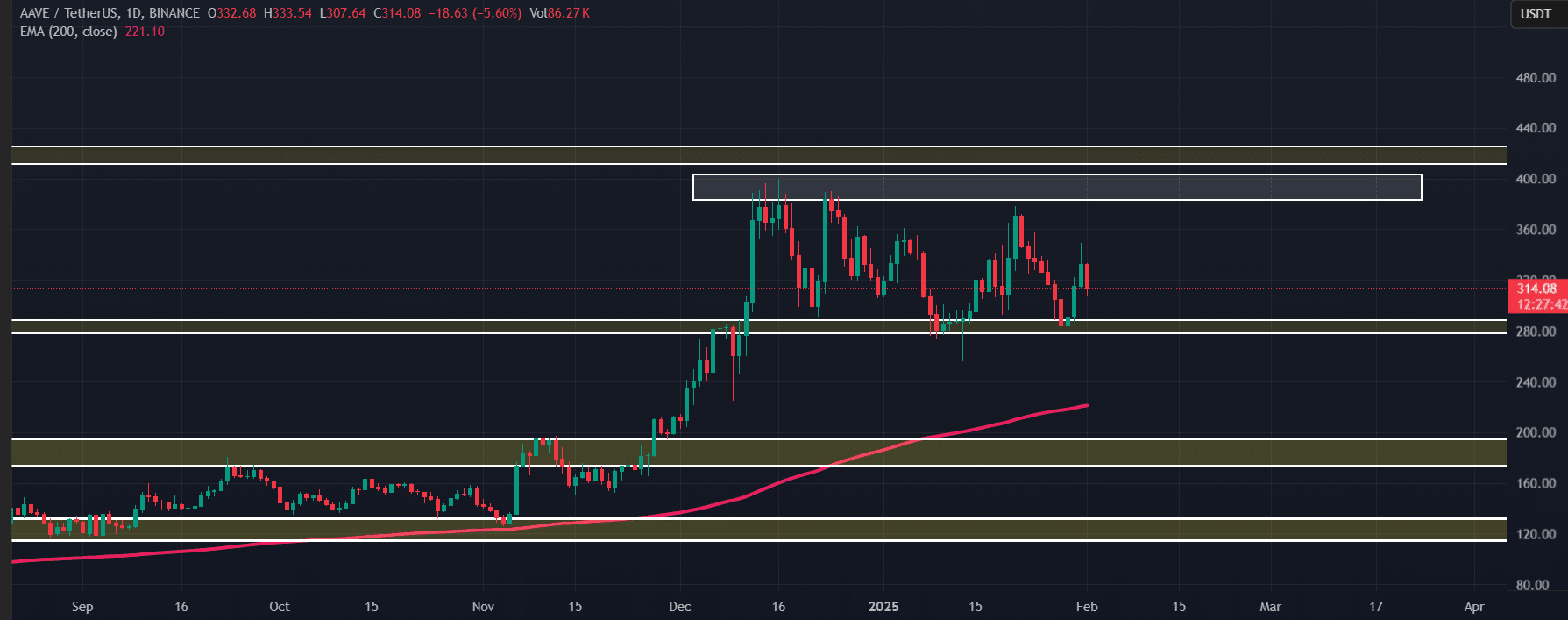

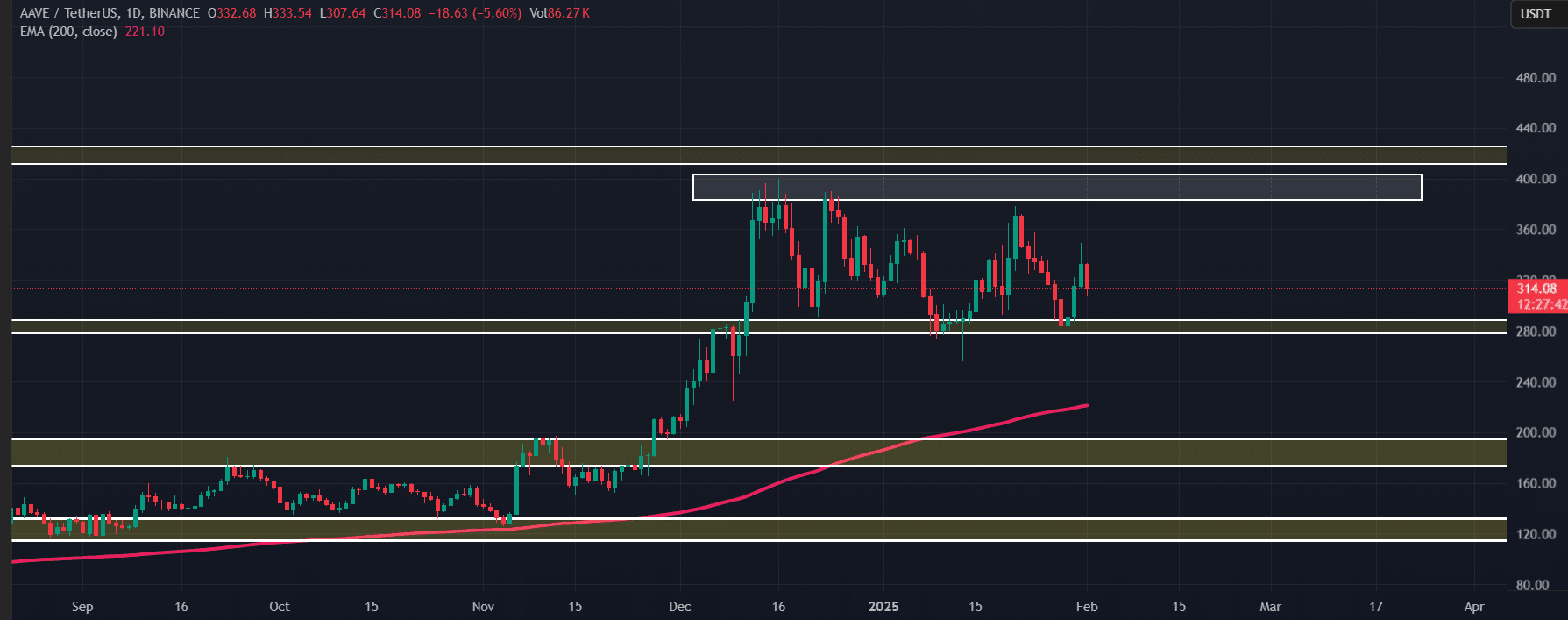

According to AMBCRYPTO’s analysis, AAVE has moved to parallel channel patterns between $ 384 to $ 285 over the last three months. AAVE can be moving to the level of $ 285 based on the latest price behavior and general market sentiment.

Source: TradingView

Despite the weak market outlook, at the time of writing, AAVE was still trading above the EMA (E) substrate average (EMA) for a daily period. This indicates that assets are still on the rise.

In addition, according to one encryption expert, according to chain data, the $ 343 and $ 365 levels indicate a supply zone that acts as a sales pressure area or a current barrier. Beyond these barriers, the brake out can be promoted in the chart.