- ADA rose 8.13% in 24 hours, possibly influenced by the Bitcoin rally.

- Altcoins have faced issues with declining speed and user numbers.

In the last 24 hours, Cardano (ADA) has experienced a notable surge, rising 8.13%. This surge may seem related to the recent Bitcoin rally, but a deeper analysis over the past few weeks paints a more nuanced picture.

Looking at the price

Since January 22nd, the price of ADA has shown a significant upward trend, recording a significant growth of 40%.

The performance showed a consistent trend of higher highs and higher lows, suggesting potential sustainability.

If ADA successfully retests the 0.641 resistance, the surge is likely to expand further.

ADA’s Relative Strength Index (RSI) reached 63.18 at press time, indicating increasing strength. This may suggest positive sentiment among traders and investors.

However, Chaikin Money Flow (CMF) has decreased from 0.34 to 0.17 at the time of writing, suggesting a potential shift in fund flows and liquidity and raising concerns about the sustainability of ADA’s current trend.

At press time, ADA was trading at $0.6217, with volume up 93.48%.

Source: Trading View

However, some factors may hinder the potential growth of ADA.

Some challenges ahead

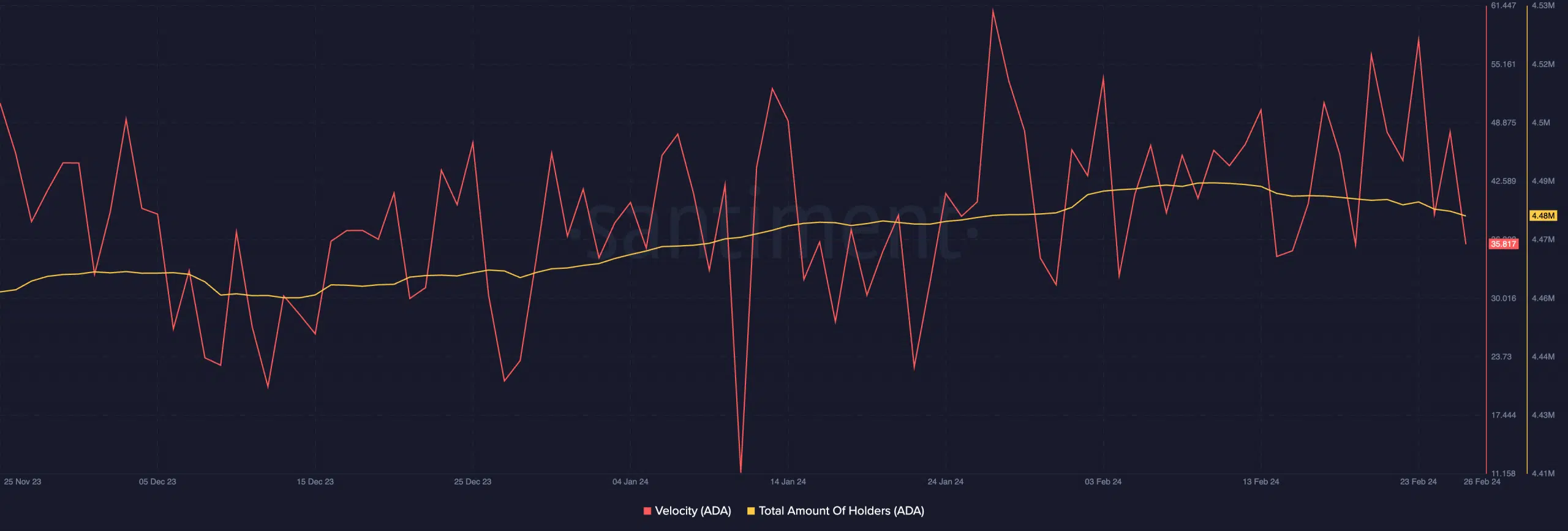

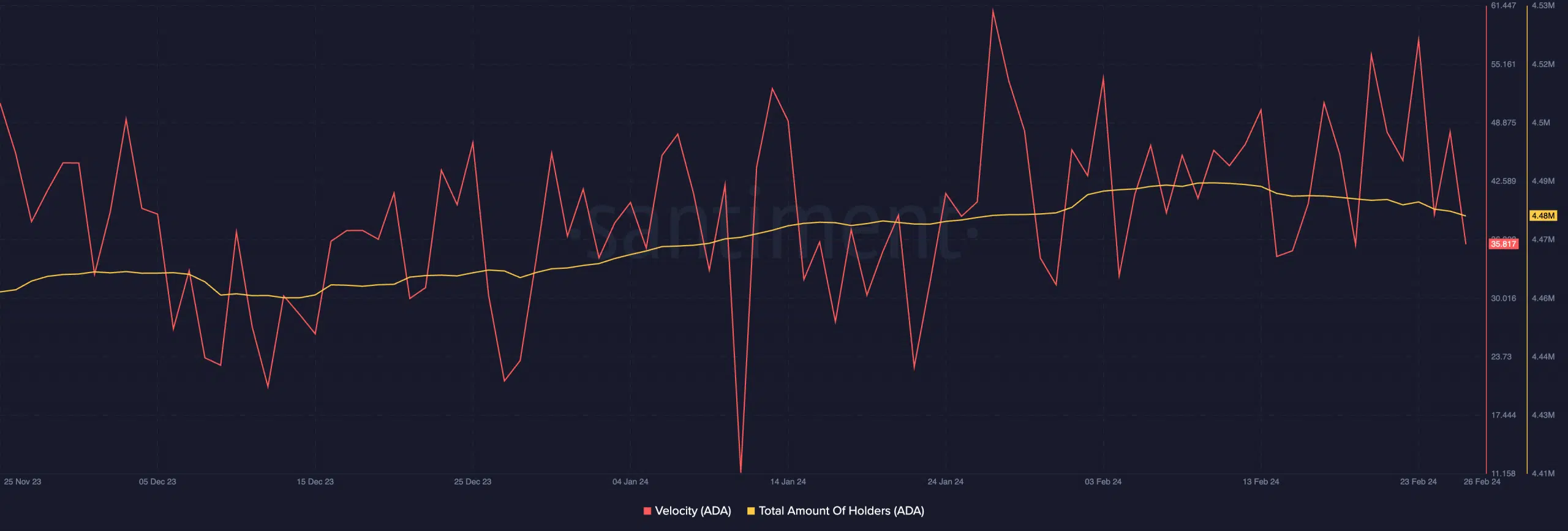

The velocity of ADA, which measures the frequency of transactions, is trending downward, indicating a decrease in activity.

Low velocity could be a sign of reduced interest or participation and could potentially negatively impact ADA’s near-term price dynamics.

Additionally, the total number of holders accumulating ADA has decreased slightly. Although it is not a drastic decline, a decrease in holder accumulation may affect ADA’s resilience to market fluctuations.

Source: Santiment

AMBCrypto’s investigation into Cardano’s network activity provided a variety of signals. Although the number of daily users on the network has declined, overall transactions have soared.

How much is 1,10,100 ADA worth today?

This dichotomy suggests that the user base is still actively participating in the network, even though it has shrunk. Cardano’s Total Value Locked (TVL) also saw an upward trend.

However, despite this growth, trading volume on Cardano’s decentralized exchange (DEX) has declined, which could signal a change in trading preferences or market dynamics.

Source: Artemis