In the days leading up to the Bitcoin halving, cryptocurrency markets experienced significant declines, raising concerns of a potential bear market.

While Bitcoin saw a notable price drop of 19%, altcoins saw much steeper declines, with some plummeting by as much as 70%. This trend has sparked debate among investors about the immediate future of cryptocurrencies as the halving approaches.

Bitcoin and altcoins plunge before halving

Historically, Bitcoin halvings (reduction in scheduled rewards for mining new blocks) have been a catalyst for optimistic market sentiment. This event effectively reduces the supply of new BTC, which theoretically should cause the price to rise if demand remains constant.

However, Garry Kabankin, market analyst at Santiment, told BeInCrypto that the market does not rely solely on fundamentals, especially during periods of significant events. Recent price corrections in Bitcoin and altcoins may reflect a natural market reaction to speculative expectations rather than a fundamental decline in value.

In fact, the current market scenario reflects a speculative trading environment leading up to the halving.

“The sharp decline in altcoins, much larger than Bitcoin, highlights the increase in volatility and speculative trading that can precede such an event. This is a reminder of the market’s sensitivity to changes in supply dynamics, which may lead to expectations of reduced supply pressure due to reduced block rewards after the halving,” Kabankin explained.

Kabankin explains that further insights can be gained by observing miner behavior, such as changes in miner balances and total supply. A decline in miners selling their holdings ahead of the halving could signal an optimistic outlook, with prices expected to be higher after the event.

Nonetheless, the true impact of the halving will only become clear in the next few weeks. As the market adapts to the new supply rate, we can understand how this will impact Bitcoin’s scarcity and value.

Read more: Bitcoin price prediction for 2024/2025/2030

The continued downward trend is somewhat typical of the cyclical nature observed around past halvings. In essence, predictions lead to speculative actions and revisions. However, Kabankin points out that a nuanced perspective is needed when considering current on-chain metrics and social sentiment.

“Historically, we have seen halving euphoria, often leading to a reassessment of positions following the event. “It is important to monitor social sentiment and whale behavior to get more immediate signals about market direction,” Kabankin added.

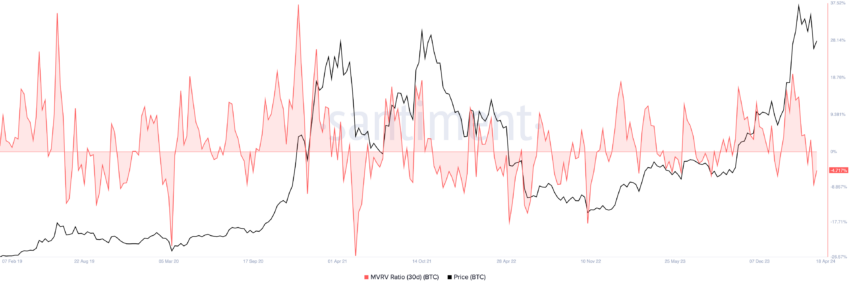

Additionally, the Market Value-Realized Value (MVRV) ratio provides a clear indication of market sentiment. This indicates whether an asset is overvalued or undervalued at a particular point in time. According to Kabankin, investors should also closely monitor average coin age. A significant decline could indicate increased movement and potential selling pressure, suggesting a broader market shift.

These indicators, combined with the traditional level of support from technical analysis, can guide investors through uncertain times.

Kabankin believes that investors should pay attention to the mix of social sentiment and on-chain indicators to identify a possible resumption of the uptrend. A decrease in fear, uncertainty, and doubt (FUD) and an increase in fear of missing out (FOMO) often precede a market rally.

Moreover, a significant increase in the supply of stablecoins moving to exchanges could signal a readiness for buying action, suggesting a bullish mood. Additionally, increasing volume can indicate growing support for a trend. That could suggest a healthier upside for the bull market.

“Looking at resistance barriers and on-chain signals is very important to spot potential reversals. One key indicator to keep an eye on is the average dollar investment age. “Particularly when the average investment age begins to decline, this may indicate that previously dormant tokens are on the move and may hint at a potential change in market sentiment,” Kabankin emphasized.

Cryptocurrency markets remain notoriously volatile, so these signs are invaluable in predicting the next move. Historical patterns following Bitcoin halvings often trigger altcoin seasons. This is a direct result of investors seeking higher returns beyond Bitcoin’s initial surge. Recent dynamics and on-chain activity suggest that another cycle may be on the horizon, suggesting an upward trend.

Read more: What happened at the last Bitcoin halving? Forecast for 2024

Interest in altcoins, as evidenced by social indicators and trading volumes, indicates that they are becoming increasingly popular among investors. However, rapid changes can occur in the cryptocurrency market, so it is important to monitor these trends closely.

disclaimer

In accordance with Trust Project guidelines, these feature articles present the opinions and perspectives of industry experts or individuals. While BeInCrypto is committed to transparent reporting, the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should independently verify the information and consult with professionals before making any decisions based on this content. Our Terms of Use, Privacy Policy and Disclaimer have been updated.