- The whales withdrew $3.05 million and $3.29 million PENGU from Binance and Bybit, respectively.

- If PENGU falls below $0.035, it could turn bearish.

The recent withdrawal of $3.05 million worth of Pudgy Penguins (PENGU) from Binance can be seen as a sign of significant accumulation by whales.

This activity, coupled with another large transfer on Bybit, indicates growing confidence among large holders. In fact, these movements often precede price spikes because whales can have a huge impact on market sentiment.

Source: SolScan

By consolidating large quantities of PENGU, these whales can potentially control supply dynamics, contributing to upward price pressure. As more whales participate, the perceived value and demand for PENGU may increase, creating an optimistic outlook for near-term market performance.

This strategic accumulation highlighted a pivotal moment that could improve Pudgy Penguins’ valuation in the market.

PENGU performance and predictions

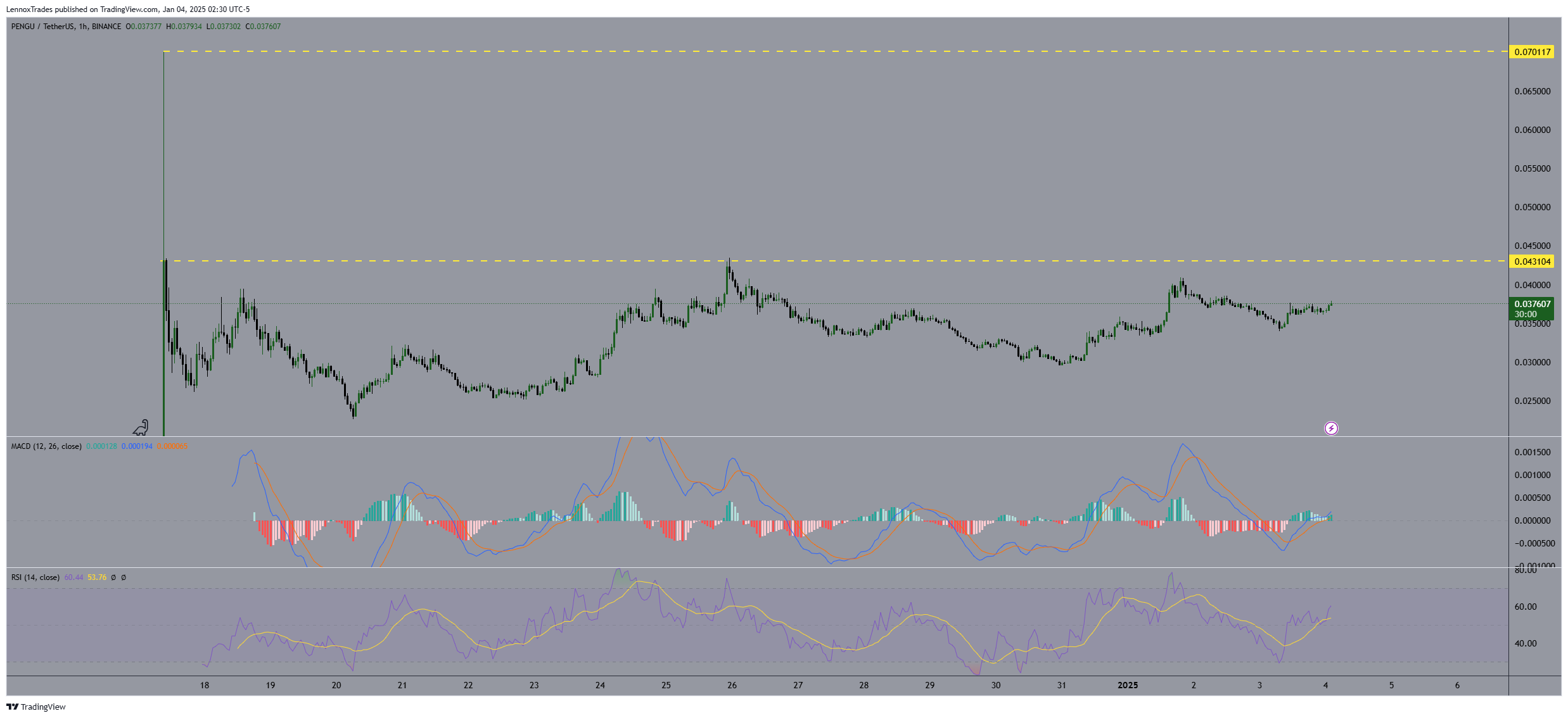

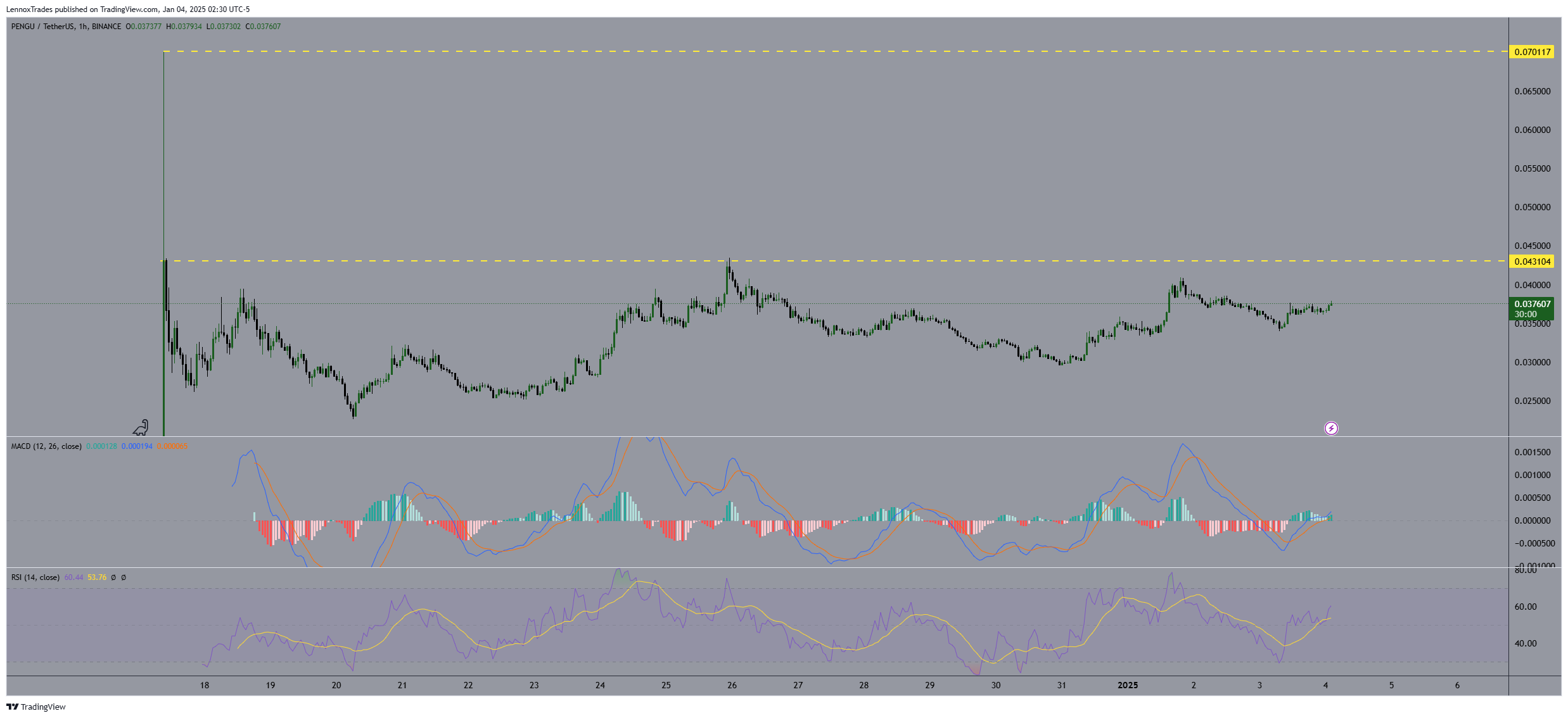

Looking at performance at press time, we see that PENGU is up over 3% in the last 24 hours, while daily trading volume is down over 5%. PENGU’s price chart also hinted at its resilience as the altcoin entered the market strongly, surging to $0.07017 before experiencing a significant decline.

It then established a solid base at $0.035, where it mostly fluctuated before starting a slow rise. This represents a consolidation phase that could set the stage for a future rally.

RSI has risen above the midpoint. This is a sign of growing buyer interest. The MACD supports this bullish outlook, marking a crossover that points to a potential upward trend.

Source: Trading View

At press time, PENGU was hovering near the critical support level at $0.035487. If this level fails, the price may fall towards the first target point of $0.043 and then to the second target point of $0.070. This suggests that PENGU has bounced back from its initial volatility. It may exceed the original market capitalization.

However, if support remains intact, a bounce above resistance $0.036921 is plausible for Pudgy Penguins. This could trigger a 98% rally above ATH.

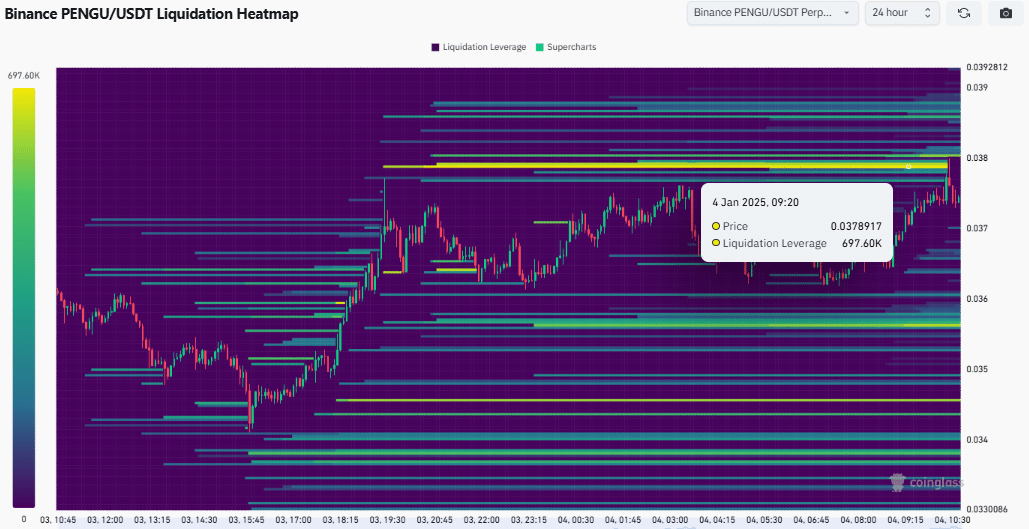

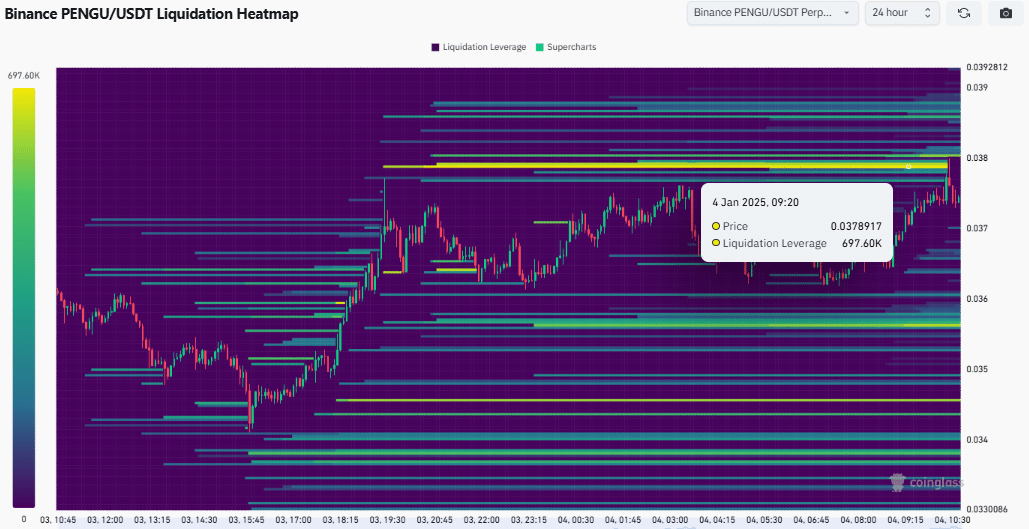

Liquidation Heat Map

Additionally, PENGU’s liquidation heatmap showed that leveraged positions vulnerable to liquidation were concentrated at $0.038. This position means that approximately 697.60K PENGU would be at risk if the price falls slightly below this level.

If PENGU violates this support, a sharp decline could trigger further selling in a cascading liquidation, adding downward pressure on the price.

Source: Coinglass

Conversely, if it remains above this level, the PENGU market will stabilize and could serve as a basis for a future rise, implying that a rebound is possible as buying support becomes stronger.

This delicate balance highlights the pivotal role of liquidation thresholds in influencing short-term price movements and market sentiment for leveraged assets.