HYPE price appears poised for strength in a descending wedge pattern as several catalysts, including the Robinhood listing, spark renewed investor interest in the token.

summation

- HYPE price is up 19% in the last 7 days.

- Robinhood listed HYPE and Hyperliquid Strategies Inc. announced plans to raise funds to accumulate the token.

- HYPE is almost breaking out of a descending wedge pattern on the 4-hour chart.

According to data from crypto.news, Hyperliquid (HYPE) was trading at $40 at last check on the morning of October 24, Asian time. It is up 8.1% in the last 24 hours and almost 19% above its low over the past seven days. However, zooming in on the chart, the token is still 33.6% below its yearly high.

A series of notable developments have recently helped reignite momentum for the token.

First, popular US-based trading platform Robinhood officially listed Hyperliquid yesterday, giving it access to a broader retail user base across the US.

Listing on Robinhood can significantly increase the visibility of your assets while laying the foundation for stable demand over the long term.

Second, on the same day that Robinhood listed HYPE, Hyperliquid Strategies Inc. filed an S-1 registration with the U.S. Securities and Exchange Commission to raise up to $1 billion through a stock offering. The company stated that a portion of the proceeds will be used to purchase and stake HYPE tokens, which sparked new community discussion in the Hyperliquid community.

HYPE’s gains were also supported by medical technology company ENDRA Life Sciences, which disclosed the purchase of $3 million worth of HYPE tokens as part of its new digital asset financing strategy.

According to the company, the HYPE token forms the cornerstone of a proactive financial management approach, signifying increased institutional confidence in the long-term utility and value proposition of the Hyperliquid ecosystem.

These events converge as HYPE approaches a technical inflection point, which could open the door to further upside in the future.

On the 4-hour chart, the HYPE price has been forming a downward wedge pattern since early September, with the highs gradually lowering and the lows converging into a narrowing range. A breakout from this type of pattern usually signals a bullish reversal.

At the time of writing, HYPE was trading near the upper limit of the descending wedge in the $41-$42 area.

A strong move above this range on the back of solid volume could give the bulls the momentum to push towards the $61.5 level, which is 54% above the current price level. This target is derived by measuring the height at the widest point of the wedge and projecting it upward from the breakout area.

Close analysis of technical indicators also adds weight to the bullish case. In particular, the Aroon Up indicator is 71.4% and the Aroon Down indicator is 14.29%, suggesting that buyers are currently leading. RSI has also rebounded from the neutral 50s and remains below the overbought zone. This indicates that there is still room to rise without an immediate correction signal occurring.

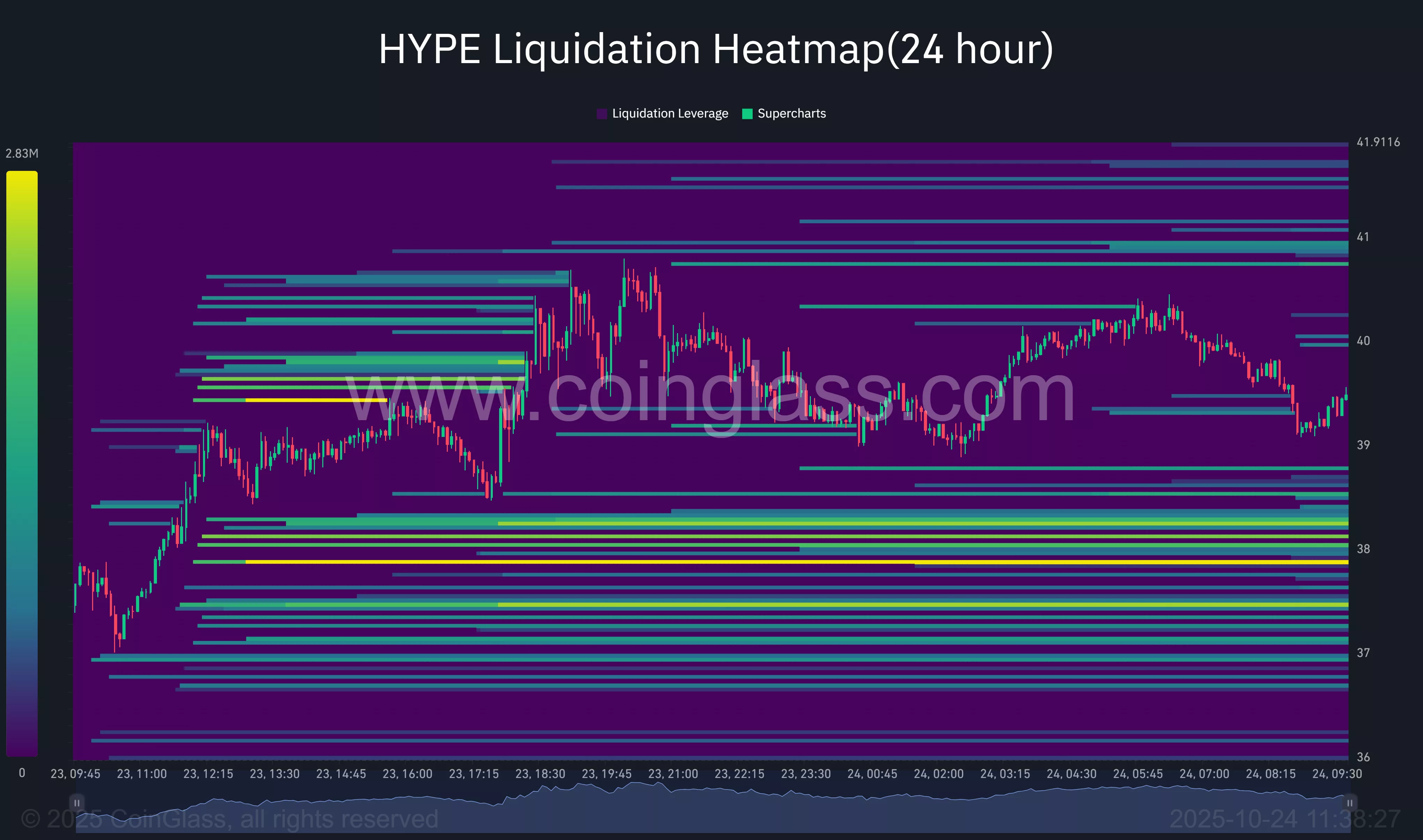

According to CoinGlass’ 24-hour liquidation heatmap, we see a noticeable cluster of sell liquidations between the $41 and $42 range, which coincides with the upper limit of the falling wedge pattern. A decisive break above this area could trigger a series of liquidations, reinforcing upward momentum as overleveraged short positions are wiped out.

The downside is that there is a lot of liquidation activity between $38 and $36, which could act as a short-term support zone. Buyers may try to defend this area to prevent prices from falling further. However, if HYPE falls below $36, trading activity and support below may decrease, leading to more price movement and a faster decline.