- The failure of the H4 bullish order block promised a new low for the hypothetical price prediction.

- OBV made lower daily lows and CMF was trading lower.

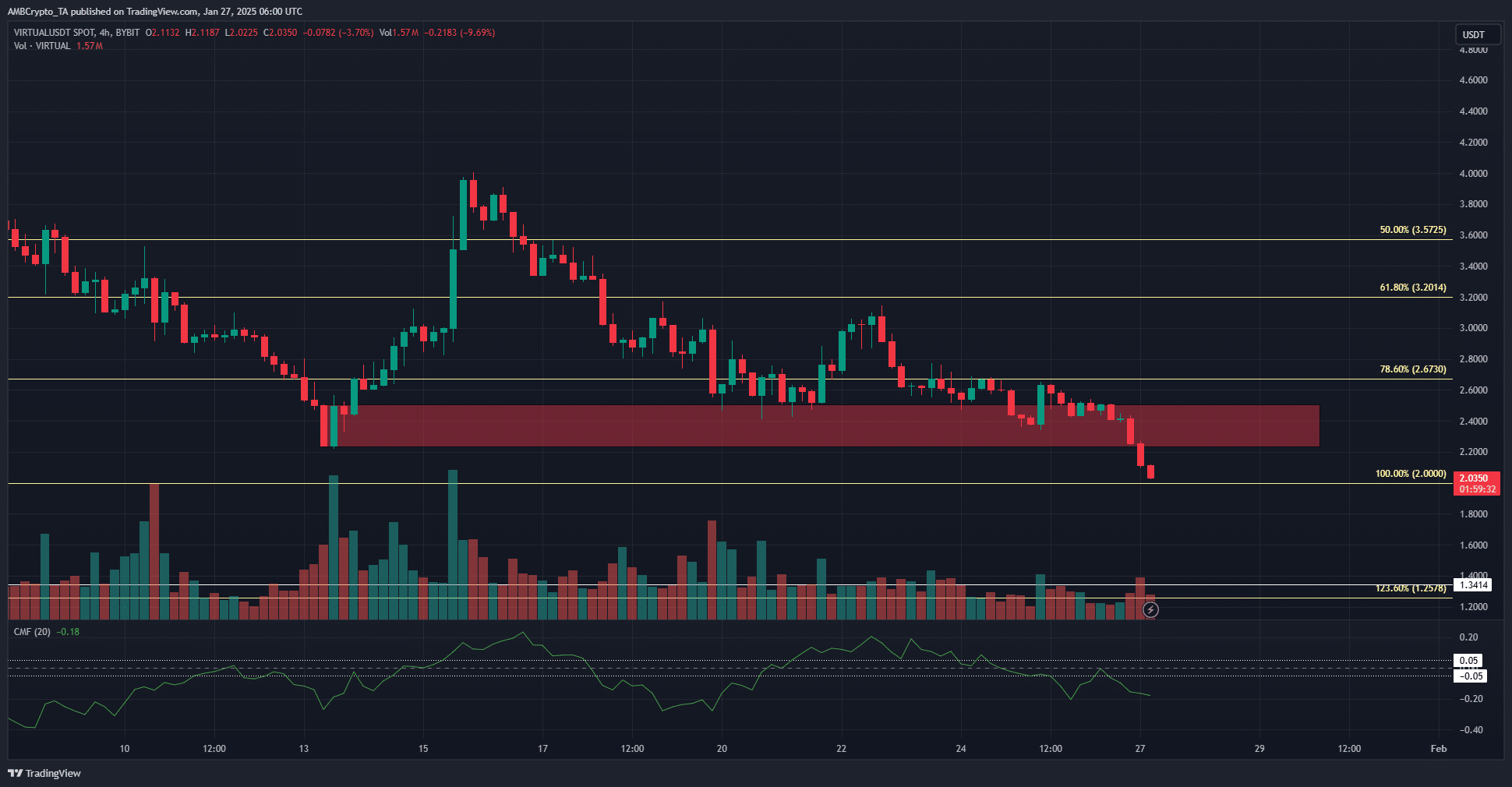

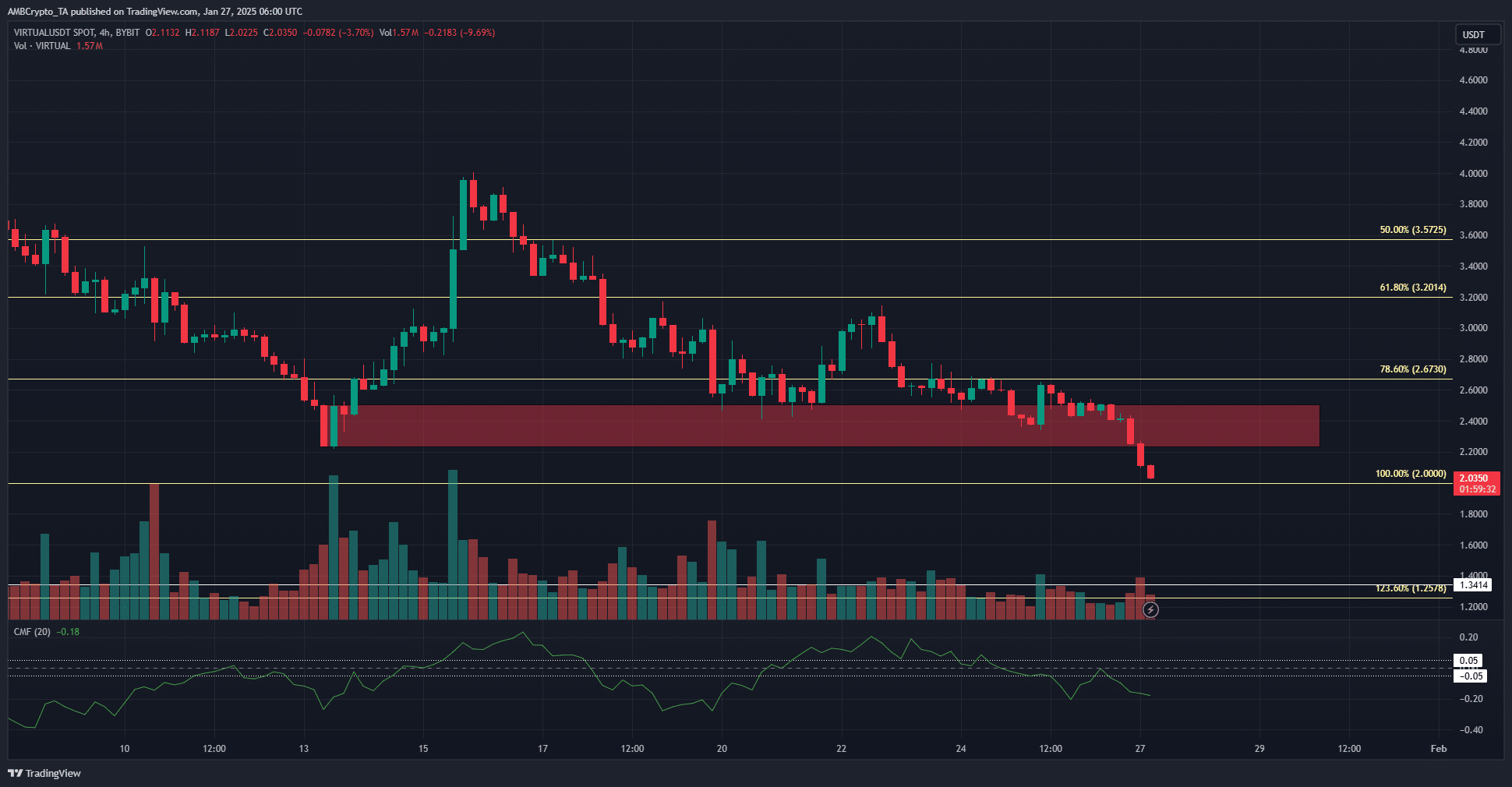

VIRTUAL has been trending downward over the past three weeks. A week ago, the downtrend was considered healthy, but the fall below the 78.6% Fibonacci retracement level of 2.67 on January 19th was the downside.

Since then, sellers have added to the bulls’ woes. Bitcoin (BTC) has become more volatile over the past three weeks.

The BTC pump didn’t push VIRTUAL significantly higher, but the former’s losses sent Virtuals Protocol and the rest of the altcoin market lower.

Hypothetical price prediction shows bearish turbulence ahead

Source: VIRTUAL/USDT on TradingView

Fibonacci retracement levels were constructed based on the upward trend of the token seen in December. At press time, VIRTUAL was just above the 100% retracement level.

As it failed to maintain the 78.6% level, the downward trend turned into a downward trend in the daily time frame.

The market structure has been bearish, with the daily RSI plummeting below the neutral 50 level earlier this month, showing that the bears are gaining the upper hand. This has not changed.

More worrying was the continued loss of OBV. We lowered the minimum throughout January to reflect steady sales.

Source: VIRTUAL/USDT on TradingView

The H4 chart reinforces the bearish outlook. The $2.4 bullish order block has been violated since mid-January. It is now expected to act as a resistance zone.

Virtuals price prediction shows a continued downtrend over the next few days.

CMF was below -0.05 and $2 would soon be challenged if the bullish order block was violated. If overcome, weakness would likely extend the price 23.6% south to $1.25.

This level coincided with the horizontal support level at $1.34.

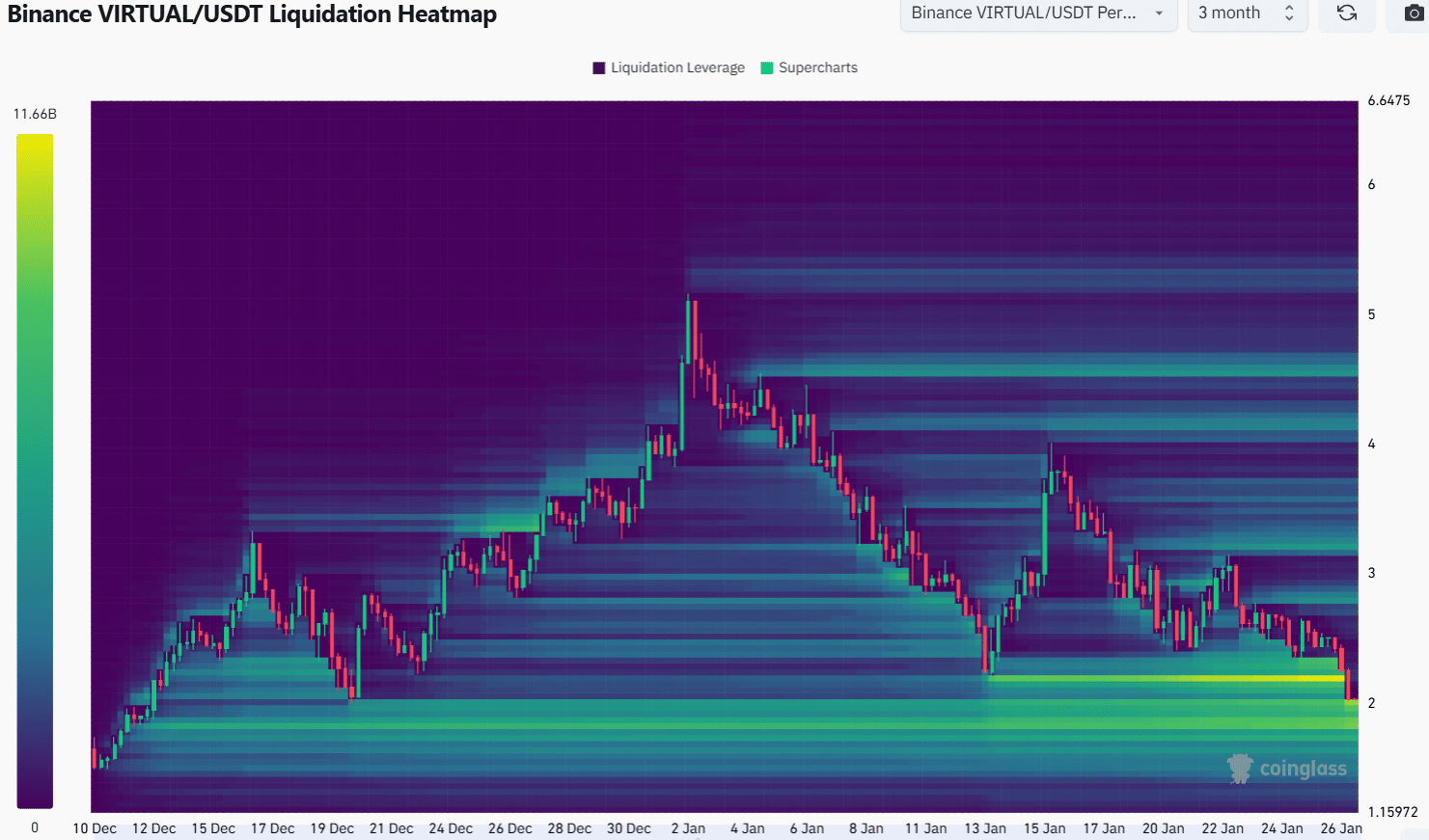

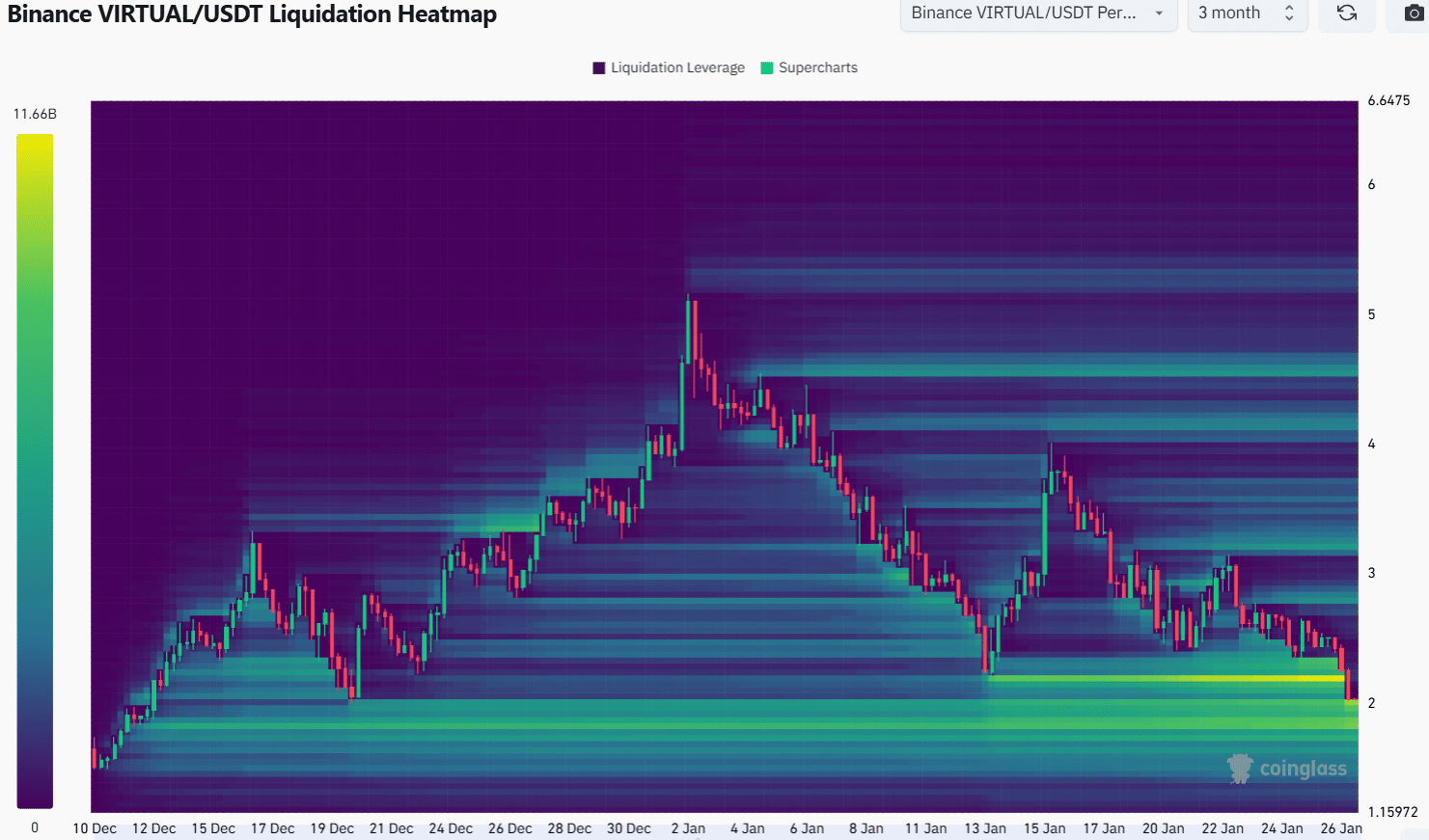

Source: Coinglass

The liquidation heatmap showed that the $2.2 and $1.95-$1.85 areas were candidates for a bullish reversal. The price movement over the last 24 hours shows a $2.2 crash and a liquidation cascade.

Read VIRTUAL Price Prediction for 2025-26

It seemed unlikely that the bearish pressure would ease over the next few days. A move to $1.85 could begin this week. Whether a bullish reversal can occur depends on capital inflows and BTC sentiment.

With BTC below $100,000, the Virtuals price prediction is very bearish in the short and medium term.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.