- Buying pressure on ETH has remained high over the past few days.

- Technical indicators supported the possibility of a price increase.

As market conditions remain weak, Ethereum (ETH)Like most other cryptocurrencies, corrections have also been witnessed.

The recent decline has now become a test for the bulls as the king of altcoins failed to break the $3.9,000 resistance.

Ethereum Bulls Under Pressure

ETH has witnessed a price correction of more than 3% in the last 24 hours, taking the price below $3,000. At the time of this writing, the king of altcoins was trading at $3,760.02, giving it a market capitalization of over $452 billion.

While token prices were falling, the Ethereum Foundation took action. Spot On Chain recently posted: tweet It was revealed that the Ethereum Foundation just sold 100 ETH for 374,334 DAI.

This brings the total ETH sales in 2024 to 4,366 ETH, with an average price of $2,796, or $12.21 million.

To determine whether this sales trend is dominant in the market, AMBCrypto looked at other data sets.

Fortunately, not all investors sold their holdings. This could support the bulls to start a recovery and push ETH back above $3.9,000.

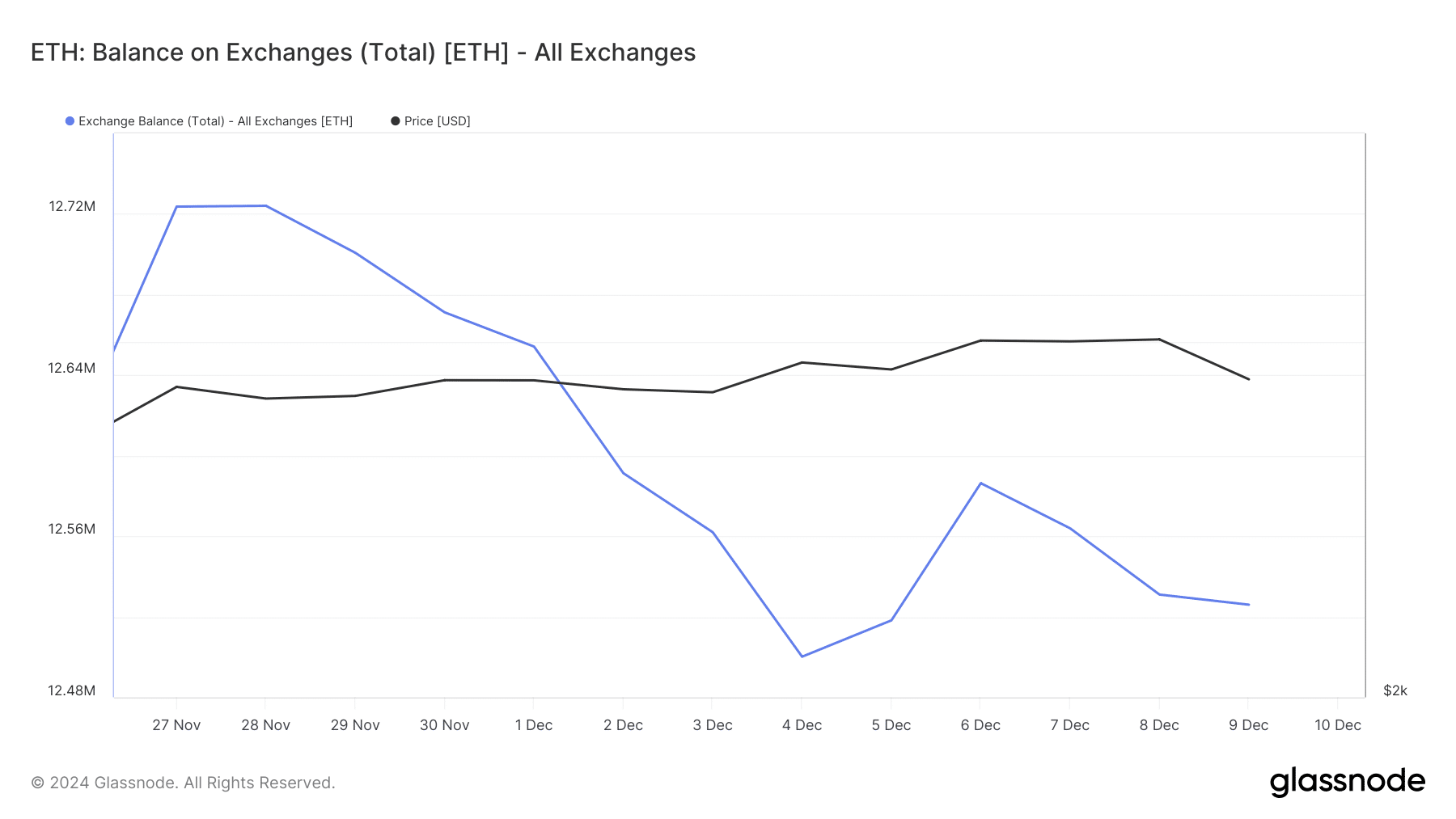

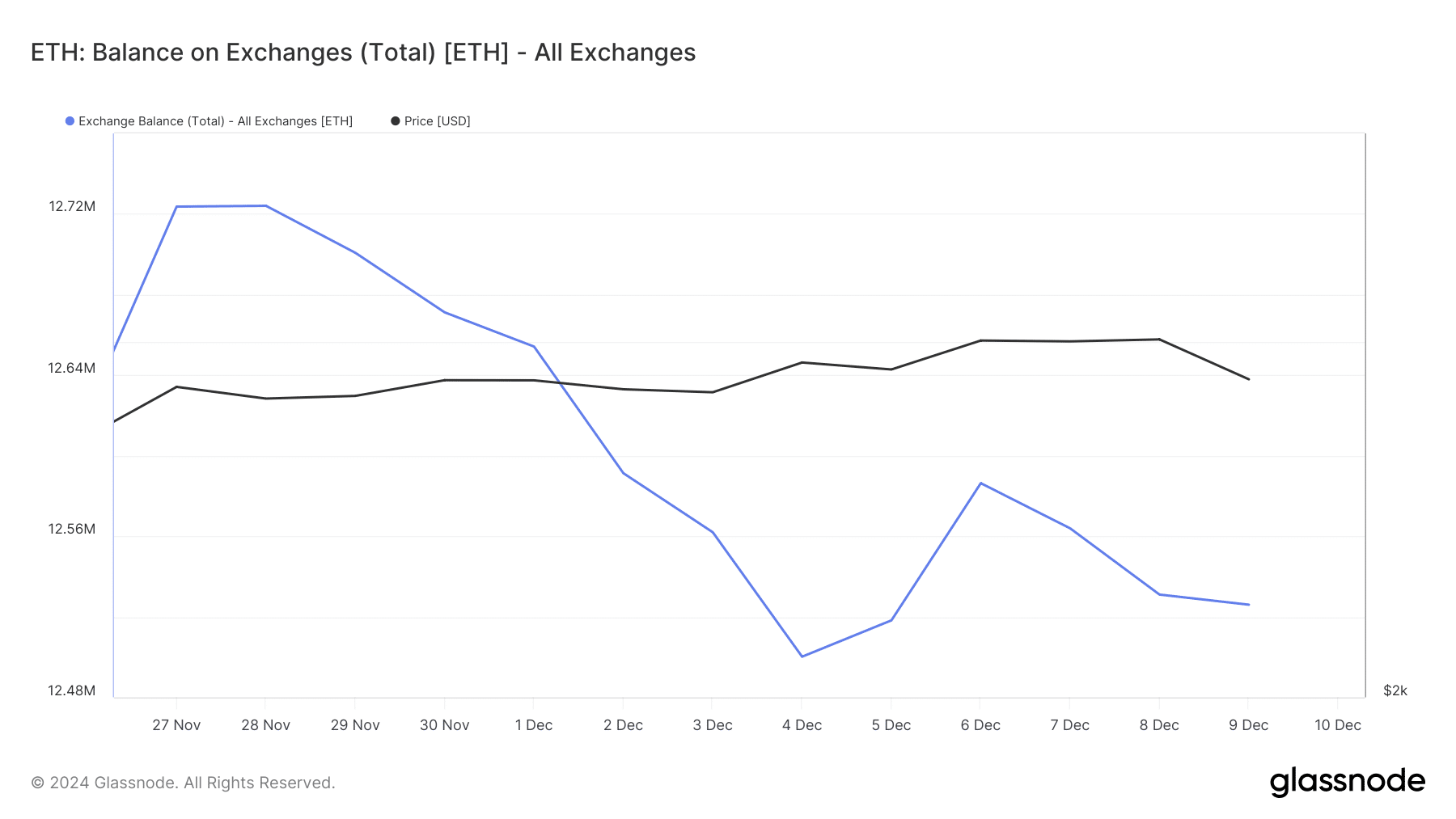

This trend is evident in the decline in ETH balances on exchanges over the past two weeks.

Source: Glassnode

Highblock Capital’s data After the surge, ETH’s selling volume was seen decreasing to 9.6. First of all, the closer the number is to 0, the lower the selling pressure, and the closer it is to 100, the higher the selling pressure.

But the whales decided to move in the opposite direction. According to CFGI.io dataWhale sentiment reached 61.5%, which is a sign that whale selling is active.

Can ETH bulls reverse the downtrend?

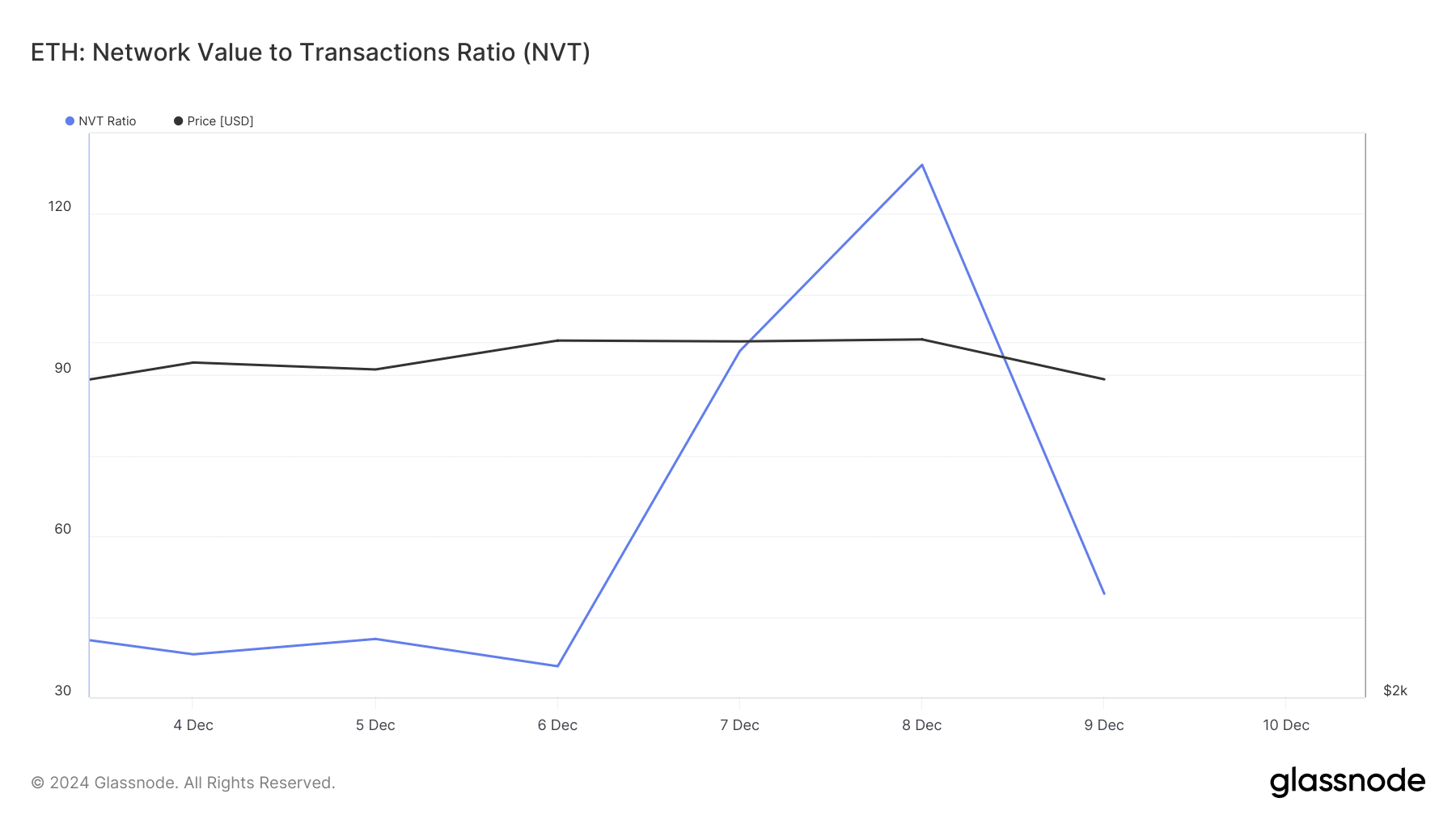

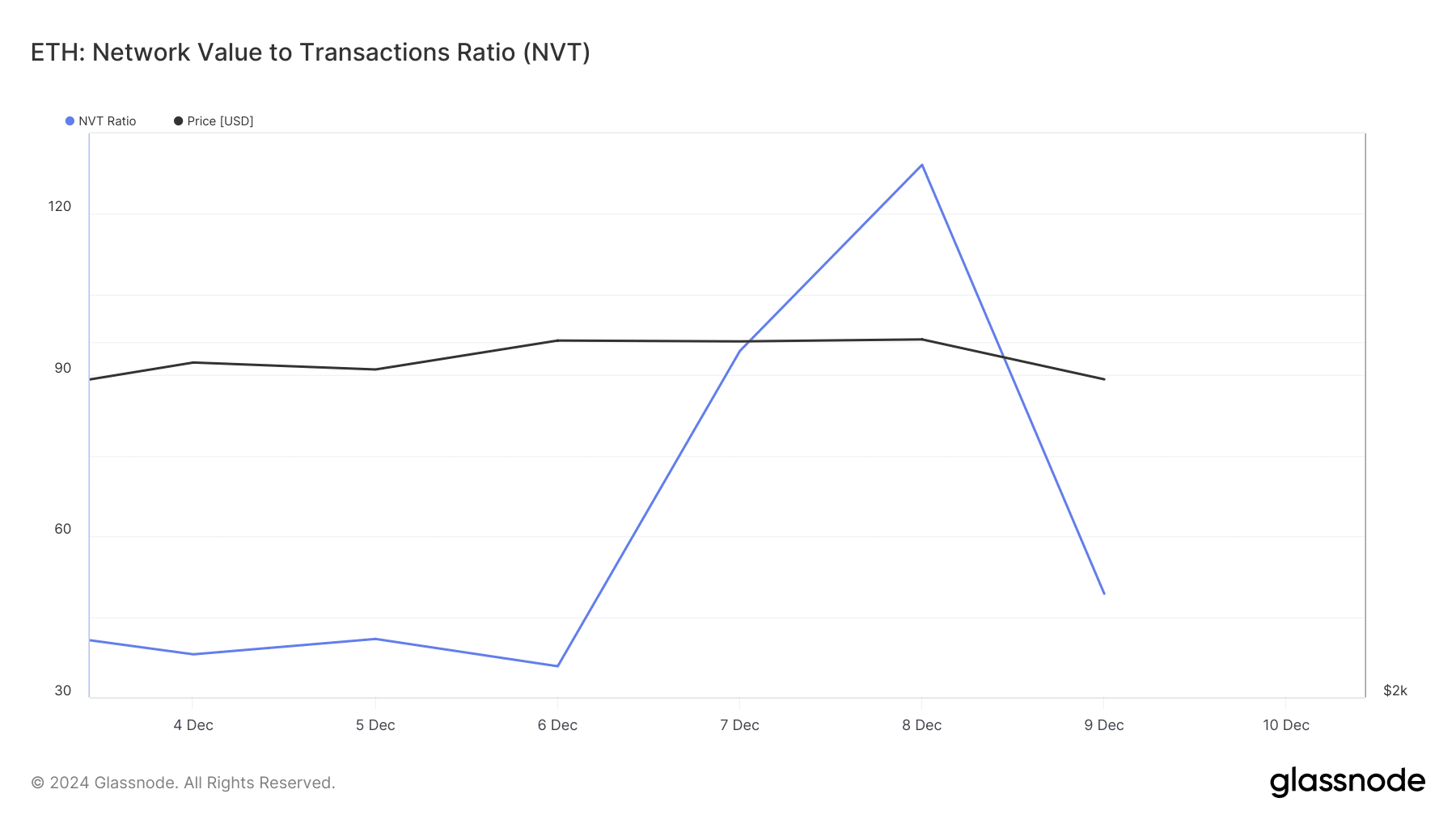

Even if the whales decide to sell, ETH bulls can still push the price of the token up. Ethereum’s NVT rate has been recording a decline over the past e days.

Whenever the indicator falls, it means that the asset is undervalued and its price will rise in the future.

Source: Glassnode

In addition to this, AMBCrypto supports ETH’s Long/Short Ratio Increased by 4 hours.

This means there are more long positions than short positions in the market, which generally suggests rising bullish sentiment towards the token.

Some technical indicators have suggested that the Ethereum bulls may be making a comeback. For example, the relative strength index (RSI), a technical indicator, showed a slight upward trend.

read Ethereum (ETH) price prediction 2024~2025

Chaikin Money Flow (CMF) also rose. A rise in CMF indicates that buying pressure is increasing and the market or asset is entering an upward trend.

Therefore, the Ethereum bulls could successfully pass the test and help the price of ETH rise again in the near term.

Source: TradingView