- The XRP has a strong potential to destroy $ 2.50, which is supported by flexible price measures and support levels.

- Strong feelings grew up on the back of 72.28% long position ratio and strong derivatives.

XRP Recently, due to volatility, it has been well recovered from the price chart after a single match and is interested in Altcoin Sparking Traders. In the press time, XRP has been traded at $ 2.45 with an increase of 2.14%over the last 24 hours.

So the question -Can XRP break the level of $ 2.50 and trigger the assembly? In particular, considering the formation of optimistic patterns, the main level is no longer expected to rise.

Can XRP continue to rise?

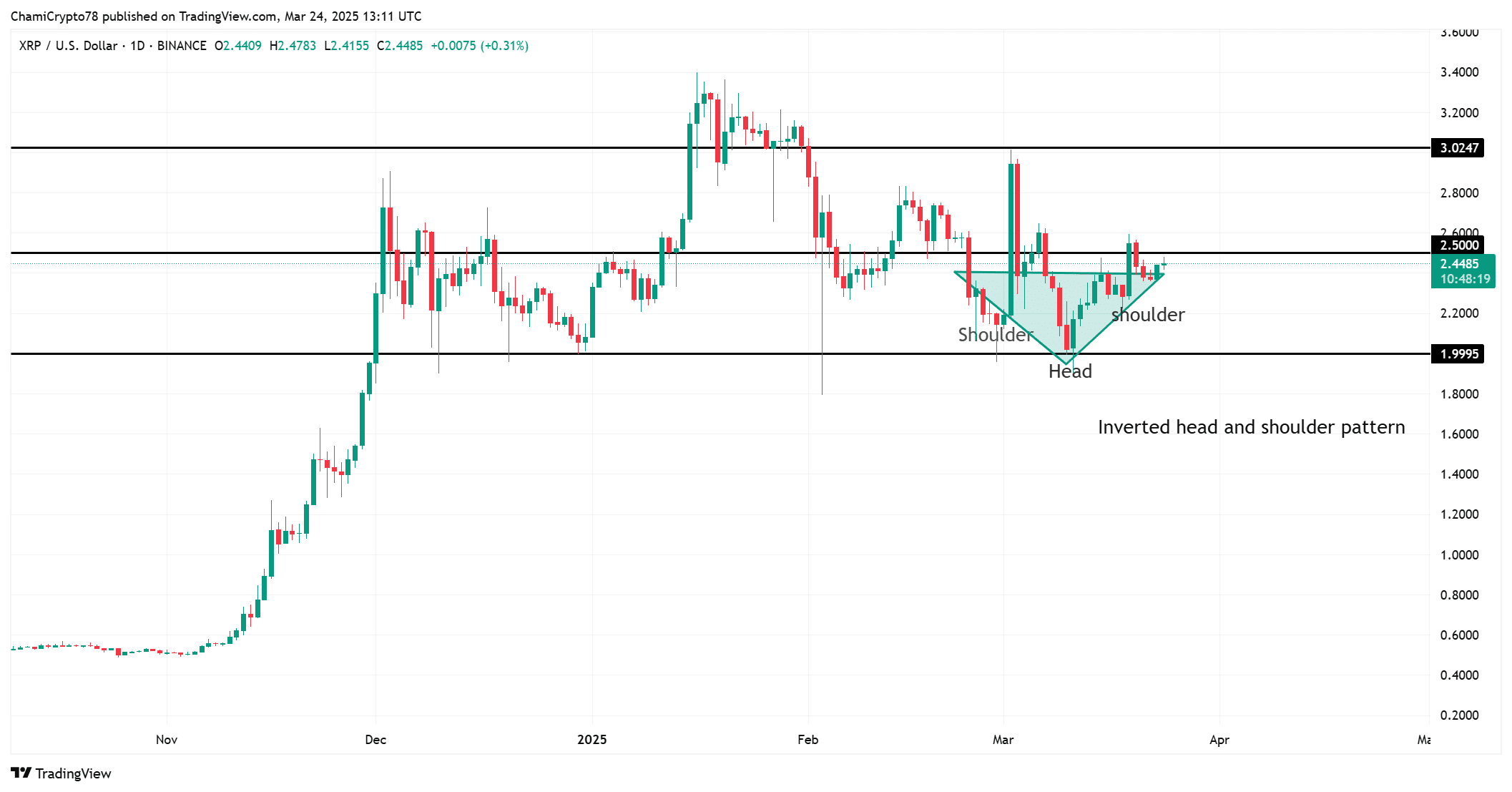

At the time of writing, XRP formed a backward head and a shoulder pattern. The pattern consists of three important points: left shoulder, head and right shoulder. The head was formed at levels of $ 1.99 and the right shoulder occurred near $ 2.20.

The neckline, which plays an important role in checking this pattern, is at $ 2.45. Rest on this neckline can be opened to move to $ 2.60 or more. If the price goes through $ 2.50, the rally can be extended and potential resistance can be close to $ 3.00.

Source: TradingView

What is the long and short ratio of XRP’s future?

The long/short ratio of Binance FutureS lent another major insight into market sentiment. In the press time, 72.28%of the merchants maintain a long position, indicating a strong strong feeling. This means that most traders believe that the price of XRP will continue to rise.

In fact, only 27.72%of the traders bet on the short -term reduction.

This ratio is a signal that increases the confidence in the potential of XRP that can penetrate the resistance level. Therefore, the strong feelings can continue to fuel the positive outlook for the price.

Derivatives data analysis -What are you telling us in the market?

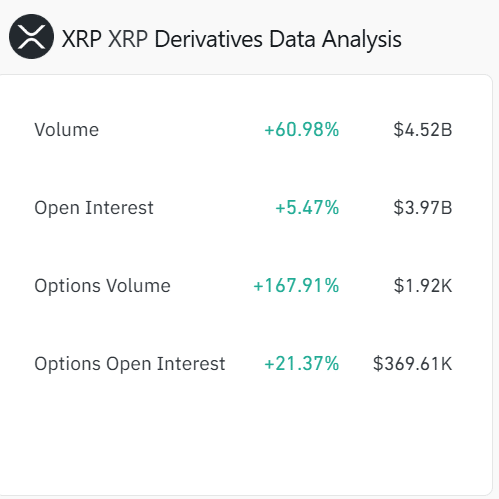

The derivatives market provided another clue about the growth potential of assets. The amount of Altcoin increased 60.98%, and the same climber surged to $ 4.55 billion.

The surge in trading activities suggests interest in XRP.

In addition, the optional volume also rises by the amazing 167.91%, which supports the idea that market participants are guessing the price hike. This metrics showed that the derivatives market actively supports the strong outlook for XRP.

Source: COINGLASS

Based on technical analysis, long -term/short ratio and derivatives data, XRP is expected to penetrate $ 2.50 resistance. The general market situation, including an increase in interest and positive feelings, suggested that meetings can be imminent in the short term.