- MATIC has been removed from Grayscale’s GSCPxE fund.

- The decision could be a result of a month-long downtrend in altcoins on the charts.

Grayscale Investments has announced adjustments to its fund composition after Q2 2024. Grayscale Investments is the world’s largest cryptocurrency asset manager and manages a variety of components, including GSCPxE, OTCOX: GDLC, and OTCQB: DEFG. After Q2 review, it has updated the fund composition weightings for all products. CSIMarket announced the development on the X official page, reporting:

“Grayscale Investments Rebalances Crypto Fund to Meet Investor Diversification Needs: $GBTC Grayscale Investments Announces Q2 2024 Crypto Fund Rebalancing.”

According to the aforementioned update, the GDLC token remained unchanged with assets such as BTC, ETH, SOL, XRP, and AVAX maintaining weights of 70.46%, 23.51%, 3.86%, 1.54%, and 0.63% respectively.

MATIC removed from Grayscale GSCPxE

However, various adjustments were made to GSCPxE based on the Coindesk Smart Contract Platform Select ex ETH Index. The adjustments included selling Polygon (MATIC) and using the proceeds to buy existing fund components according to their weighting.

Therefore, MATIC has been excluded from the GSCPxE fund. This adjustment was made to ensure flexibility in the weighting of each asset while still complying with the prevailing market trend.

Impact of MATIC price adjustment

At the time of writing, MATIC was trading at $0.4778 after rising 8.5% over the past 24 hours. At the same time, its market cap has also risen similarly, reaching $4 billion on the charts.

Conversely, trading volume has decreased by 39.74% over the last 24 hours, reaching $292 million. This is also due to the weekly price decline of altcoins.

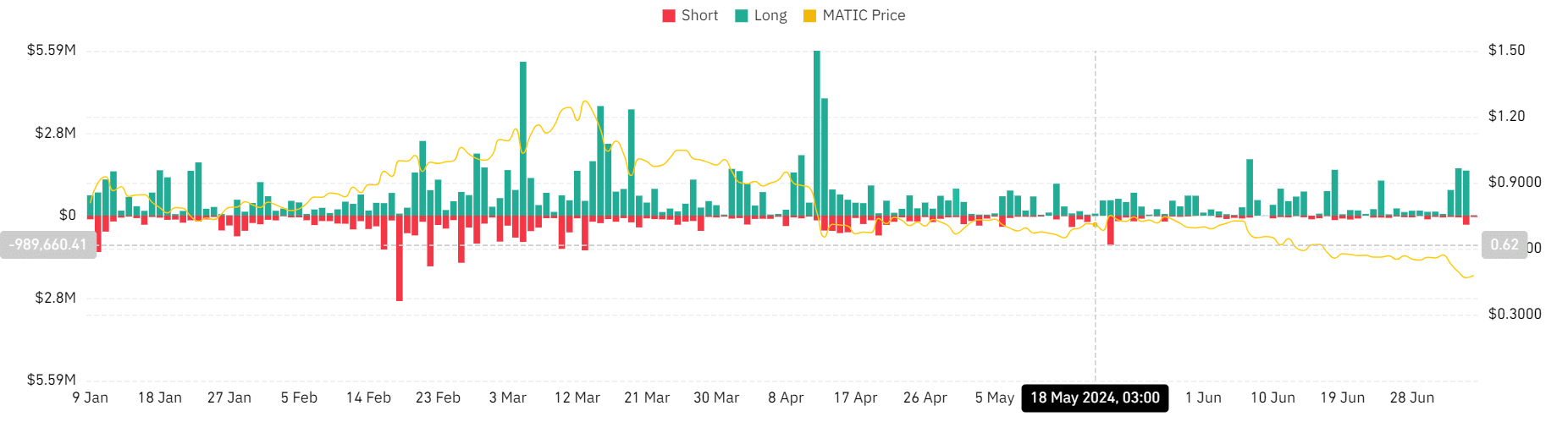

Source: Coinglass

Likewise, AMBCrypto’s analysis shows that MATIC is in a strong downtrend.

First of all, our analysis on Coinglass shows that MATIC has endured high liquidation levels. In particular, long position liquidations have been more frequent in the last 6 days, with $870K, $1.6M, and $1.5M in succession.

High liquidations on long positions indicate that the price decline did not meet investors’ expectations, which caused them to liquidate their positions.

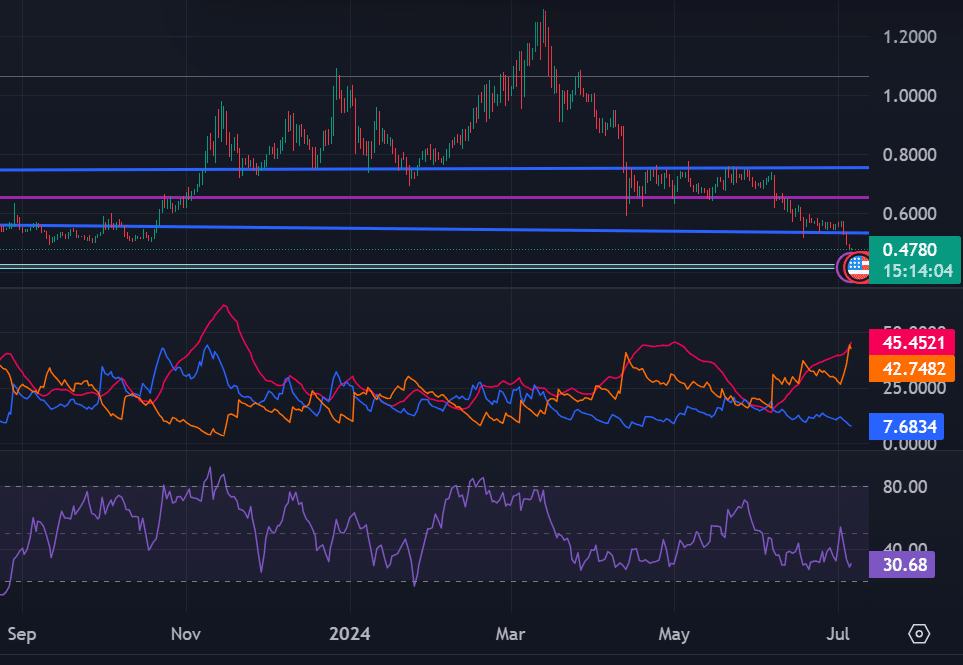

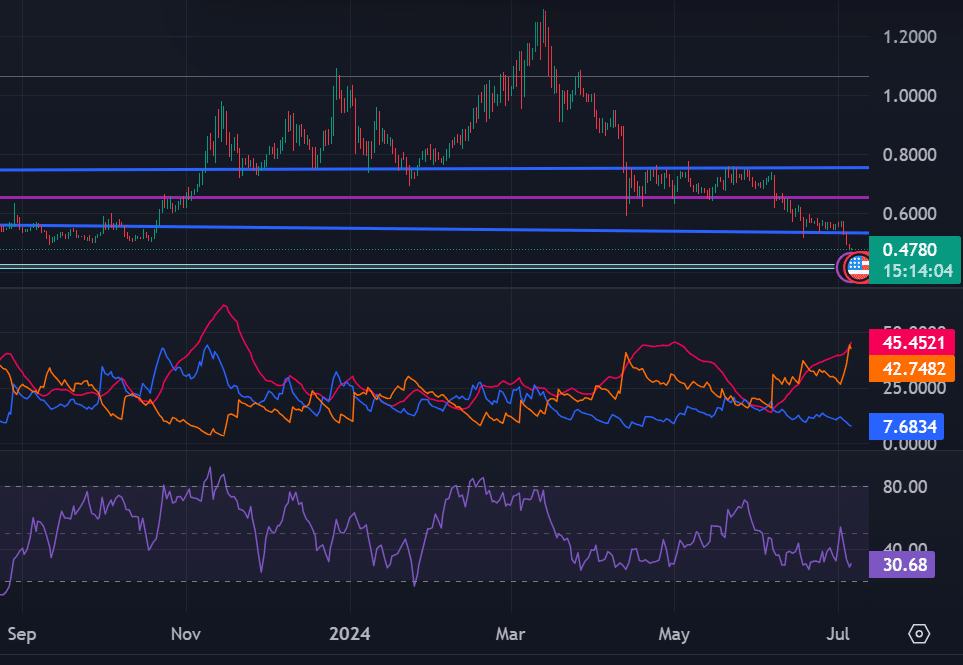

Source: Tradingview

Finally, as far as the Directional Movement Index is concerned, the negative index (42) was above the positive index at 7.6. When the DMI is set this way, it is a bearish signal. Simply put, it looked like selling pressure was outpacing demand on the chart.

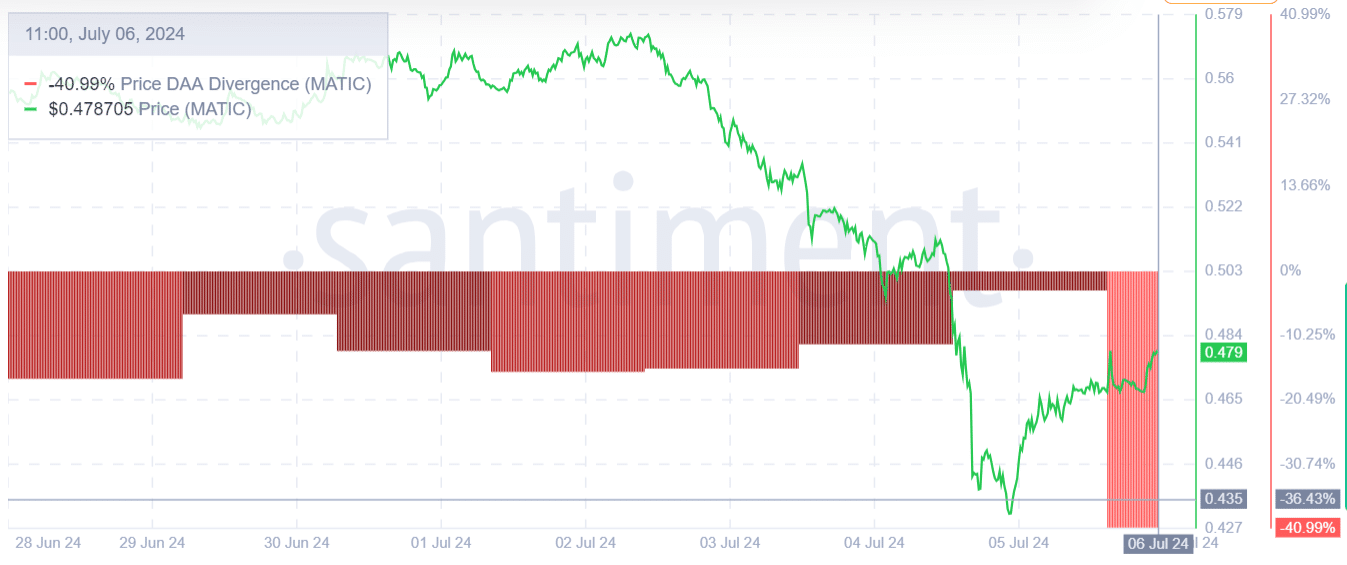

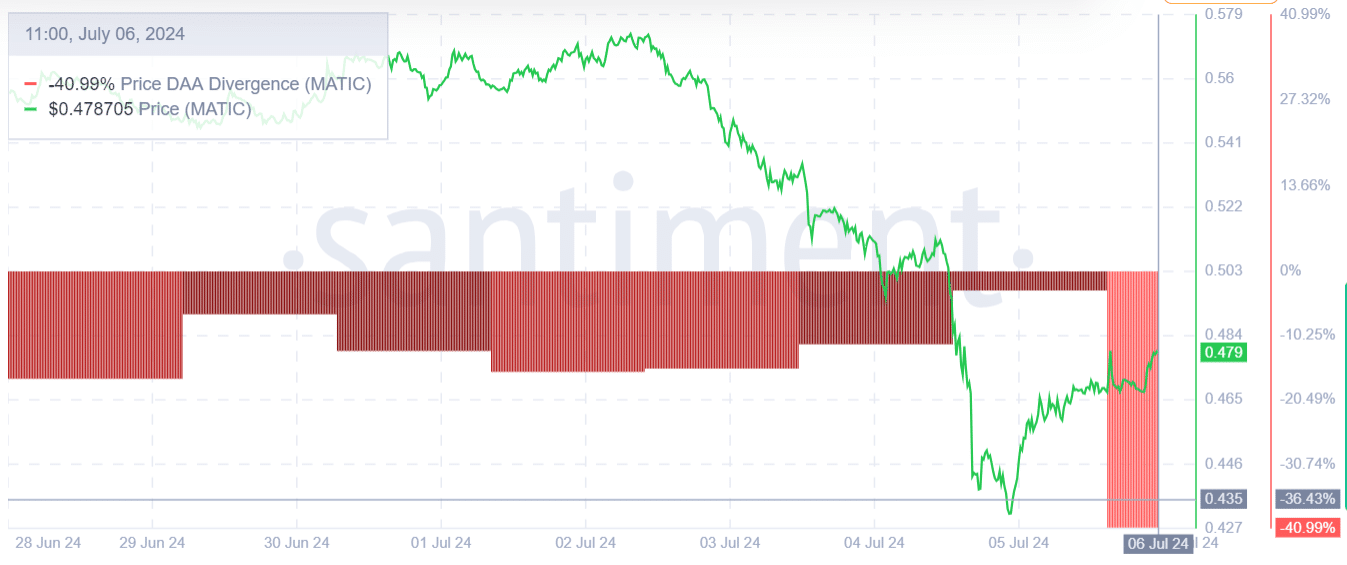

Source: Santiment

Also, the DAA Divergence of -40.99 indicates that the price may move against the level of activity. This may be a sign of weak market interest and that the price direction may be unsustainable unless user activity increases.

Can MATIC recover?

At the time of writing, MATIC is likely to remain in a bearish trend until it breaks the 200 MA. Therefore, if the trend continues, the price will fall to $0.42.

However, if the uptrend continues on the daily chart, the market will experience a trend reversal and move towards the next resistance level of $0.50.