Recent updates on the Spot Ethereum ETF (Exchange Traded Fund) Nate GeraciAs the president of ETF Store, he has received a lot of attention from investors and institutions. According to his post on X, the U.S. Securities and Exchange Commission (SEC), which was expected to approve the launch of such a product by July 2, has postponed its decision to mid-July.

Following this update from Geraci, several Ethereum-based tokens have seen massive sell-offs.

Whales dump LDO, AAVE, UNI tokens at a loss

July 3, On-chain analytics company Look on Chain A single whale/institution has reportedly sold millions of dollars worth of Ethereum-based tokens, including Lido DAO (LDO), Aave (AAVE), UniSwap (UNI), and Frax Share (FXS). According to the data, they sold 3.13 million LDO worth $5.77 million, 49,771 AAVE worth $4.54 million, 269,177 UNI worth $2.41 million, and 250,969 FXS worth $708,000, all at a loss.

Following this market crash, token prices have plummeted significantly. For example, according to CoinMarketCap, LDO has recorded a 14% price drop, AAVE has dropped 9%, UNI has dropped 5%, and FXS has lost 12% of its value.

Here, it is worth pointing out that the whale initially spent over $73 million on Ethereum (ETH) and related tokens after the physical Ether ETF Form 19b-4 was approved in May 2024. In addition to this massive dump, the whale still holds 3.33 million LDO worth $5.83 million and 31,191 AAVE worth $2.8 million.

Ethereum (ETH) Price Following ETF Update

This massive dump is a sign that the US SEC may be delaying or delaying the process. Spot Ether ETF Once again, we could see another massive selloff in ETH and related tokens in the coming days. In fact, following the ETF update, Steve Kurz, head of asset management giant Galaxy Digital, told Bloomberg that the U.S. SEC is likely to approve a spot Ether ETF in the coming weeks.

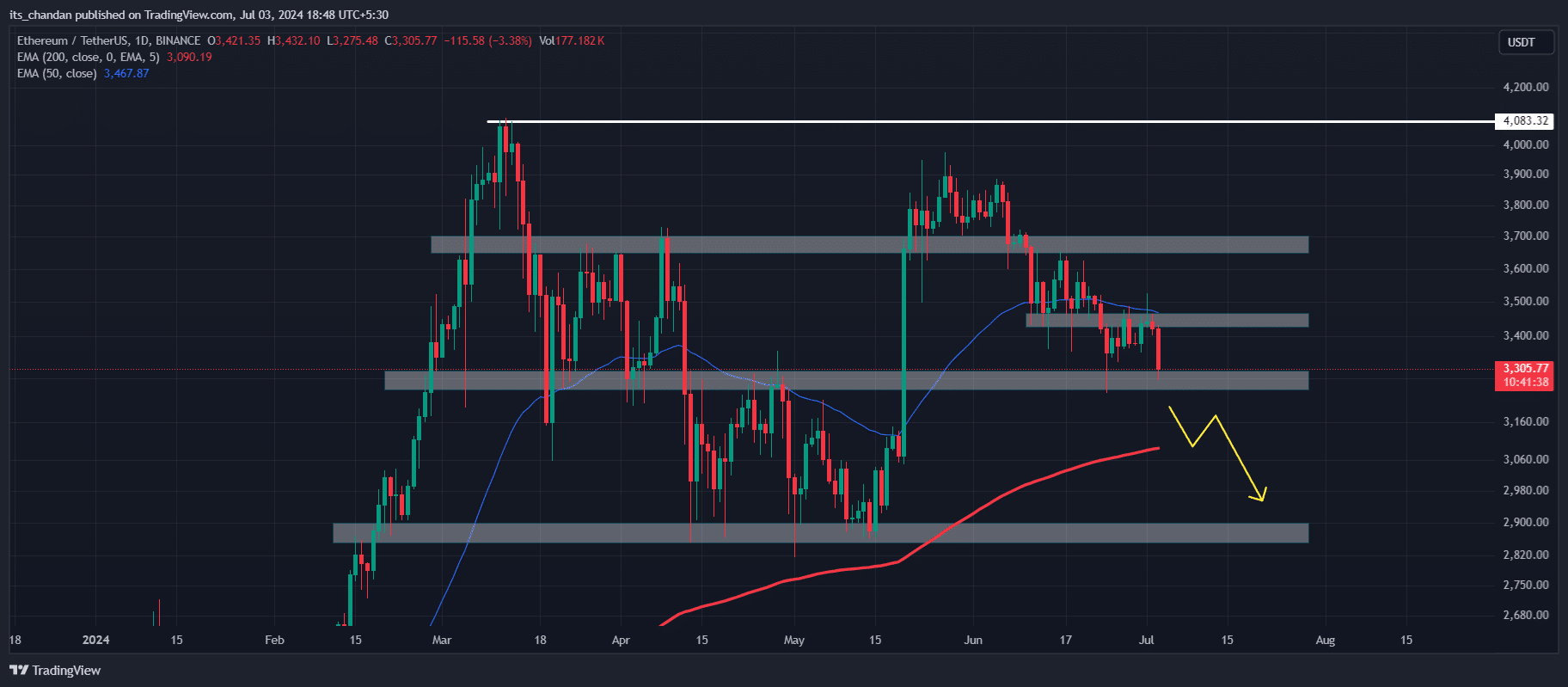

On the price chart, ETH appears to be nearing the important support level of $3,250 and below the 50 EMA (Exponential Moving Average). If ETH fails to hold this level, a significant decline towards $2,870 levels is possible in the coming days.

Source: ETH/USDT, TradingView

Despite the bullish outlook for the Spot Ether ETF and other Ether-based tokens, ETH also recorded a 5% price drop over the past 24 hours.