OKX’s Web3 Department developed a permanent trading platform distributed in 2023 in 2023, aiming to compete with prominent platforms such as Kori and Aster. However, according to the OKX founder and CEO Star XU, the company cited regulatory problems as a major obstacle, and failed to openly launch the platform.

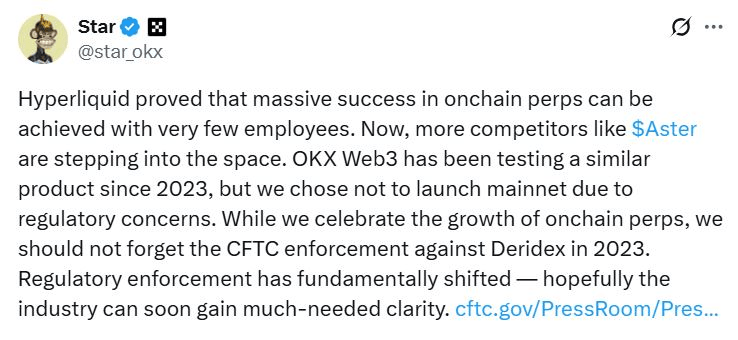

In X’s recent post, the XU emphasized the rapid success of Hyper Clicade, a decentralized exchange exchange that achieved a notable milestone in the thermal permanent space despite the Lean team. He pointed out: “Hyper Ricquid has been a huge success in Onchain Perps, proving that there are very few employees. Now more competitors like Aster are entering the space.” He added: “OKX Web3 has been testing similar products since 2023, but I decided not to start mainnet due to regulatory problems.”

Distributed permanent exchange gains exercise amount

The Hyper Clicade, which was released in 2024, became one of the main platforms of Defi’s Perpetual Arena and recorded a new peak with about $ 31.9 billion in July.

At the same time, he made his debut in July as ASTER Chain, and ASTER, supported by YZI Labs, an entity connected to Binance CEO Changpeng Zhao, had a big impact. According to DEFILLAMA’s data, ASTER has been a major competitor in the encryption derivatives environment, with a transaction volume of more than $ 22 billion over the last 30 days.

Regulatory obstacles delay a wider layout.

The XU did not specify how much the development of his platform was, but pointed out the September 2023 enforcement measures of the Commodity Future Trading Commission (CFTC) against Deridex. CFTC accused Deridex that it raised regulatory rims by providing digital asset derivatives, especially permanent swaps.

Other protocols, such as OPYN and ZeroEx, have also been found to emphasize the changing regulatory environment by providing leverage and margin retail product transactions for digital assets.

The XU emphasized: “We must not forget the CFTC execution of Deridex in 2023 while we are celebrating the growth of onchain perps.

US regulatory environment change

Following the election of the encryption -friendly administration, the US regulatory policy was notable. Recently, CFTC has appointed a new member to Global Markets Advisory Committe, including Crypto’s many industry leaders.

The July report on the White House’s Crypto policy was recommended for co -supervision between Securities and Exchange Commission (SEC) and CFTC, and the latter was responsible for SPOT Crypto Markets. This signals the potential path for clear regulations on the rapid growth cryptocurrency industry.