In the first week of March, market volatility was quite high. Trump’s unexpected news, including plans to include Altcoin in US encryption reserves and new tax policies, influenced capital flow. As a result, liquids have soared to $ 1 billion.

The liquidation map of multiple altcoins indicates imbalance. This can inform the potential of the main liquidation.

According to XRP’s 7 -day liquidation hitmap, if the price drops below $ 2, the total long liquidation can exceed $ 225 million.

According to the chart data, the trader indicates that it is not short of XRP and is being tilted more in long positions. Currently, XRP has been trading at about $ 2.33 after decreasing 20% since March 3.

Whale Alert reported on March 3 that 500 million XRP was unlocked in Escrow. This happened shortly after President Trump announced that XRP would be part of the US encryption reserve army.

In addition, ZACHXBT, a whole chain investigator, said Ripple’s co -founder Chris Larsen still has 2.7 billion XRP ($ 71.8 billion). The address related to that was replaced with more than $ 190 million XRP in January 2025.

Such developments can raise concerns and potentially lead to liquidation events.

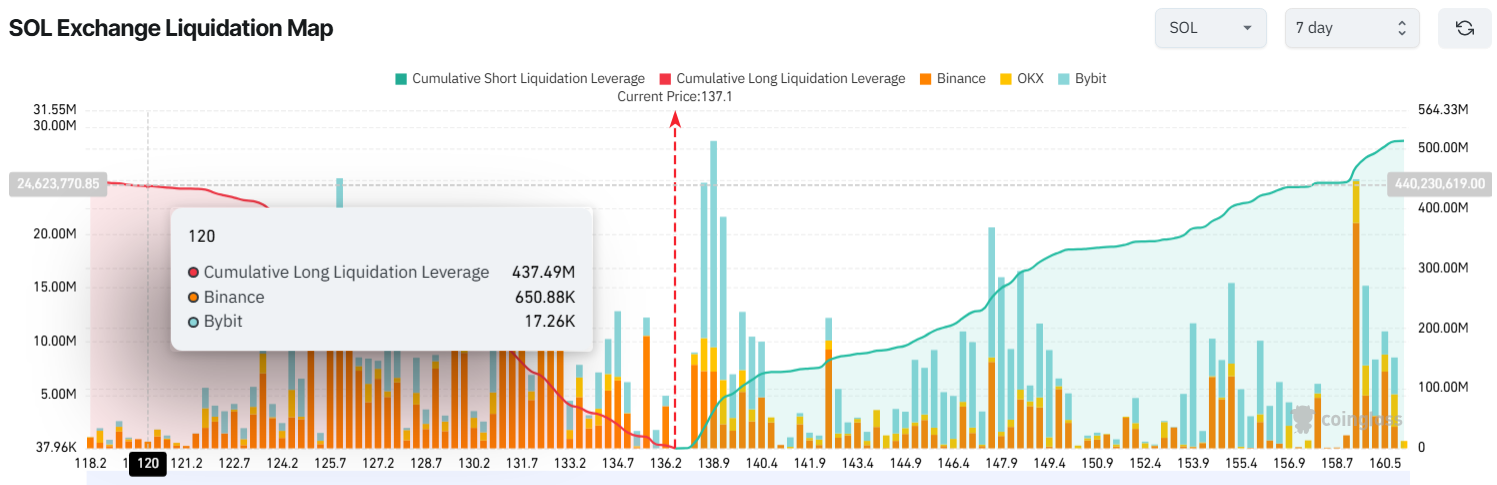

SOLANA (SOL) ‘s 7 -day liquidation heat map indicates that long liquids can exceed $ 437 million when the SOL falls to $ 120. This is the current price of $ 136.3 and an additional 11% decrease.

On-chain Tracking Account Alamonchain recently reported that wallets connected to FTX/Alameda have 33 million soles ($ 445 million) and have begun to move SOL to Binance.

Lookonchain said, “FTX/Alameda has 24,799 SOLs ($ 338 million) out of 33 million soles ($ 433 million).

The amount delivered to Binance is less than 0.1% of the total stake, but investors can guess more SOL will follow. This can lead to sales pressure and additional liquidation may occur.

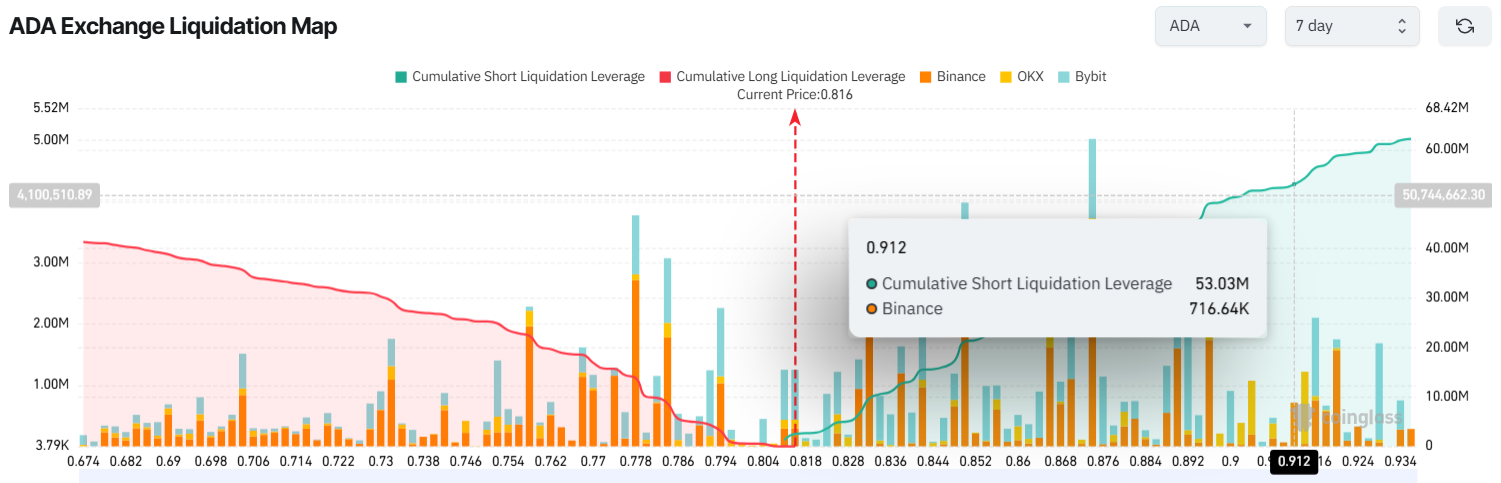

Cardano (ADA) ‘s 7 -day liquidation heat map suggests that short liquids can exceed $ 50 million in the ADA beyond $ 0.90. This indicates that the current price has increased by 10% from $ 0.81.

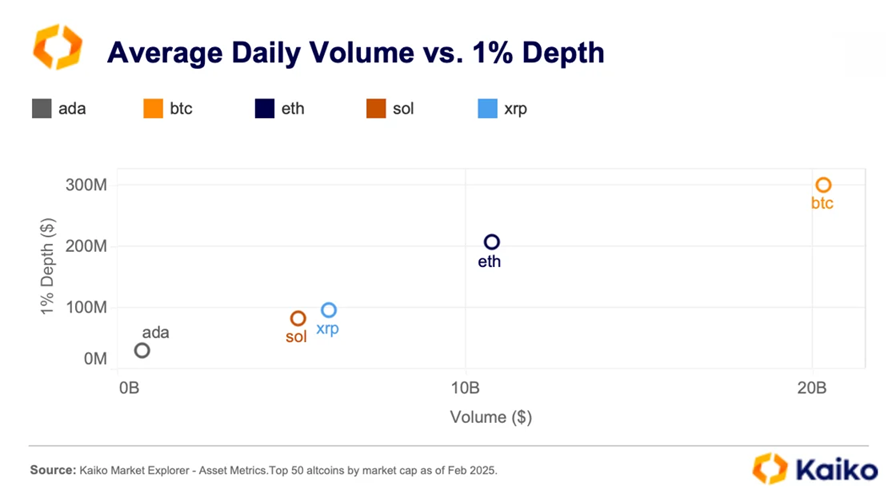

The liquidation volume of the ADA is lower than the XRP or SOL, but is the most volatile of the three. According to KAIKO’s latest report, ADA has the lowest market depth among the five Altcoins included in the US encryption reserve army.

The market depth shows the ability to measure liquidity and absorb mass purchase or sales orders without significant price changes.

KAIKO said, “In particular, the ADA delayed all other assets of strategic reserve troops and had the largest price impact.

Therefore, in the face of similar market shock, ADA is likely to increase the risk of liquidation by experiencing the highest volatility.

The liquidation is continuously adjusted to price fluctuations. However, the current data reflects very sensitive markets, and unpredictable news is increasing the risk of short -term traders, especially those who use high leverage.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.