- INJ has recorded a double-digit rise since listing on Upbit.

- Will the update help break INJ’s downward trend?

October 17th, Injection (INJ) It surged 16% right after Upbit, Korea’s largest cryptocurrency exchange. presentation It will be listed on the platform. The token surged from $20 to $23 in part due to a 112% increase in daily trading volume.

Source: CoinMarketCap

Although the pumps may have subsided a bit at press time, the listing of Upbit is very significant considering the impact it has had on Cat World (MEW).

For perspective, MEW was launched in March and has been listed on several exchanges, including Bybit and OKX. However, Upbit’s listing last September sparked a craze for cat-themed meme coins.

The reason for the explosive pump is that the exchange is Korea’s largest cryptocurrency trading platform. So the question arises, will INJ follow MEW’s steps?

Will the upward trend continue?

It remains to be seen whether INJ’s upward trend will continue even after listing. However, the price movements following the update were triggered by speculators in the futures market rather than the spot market.

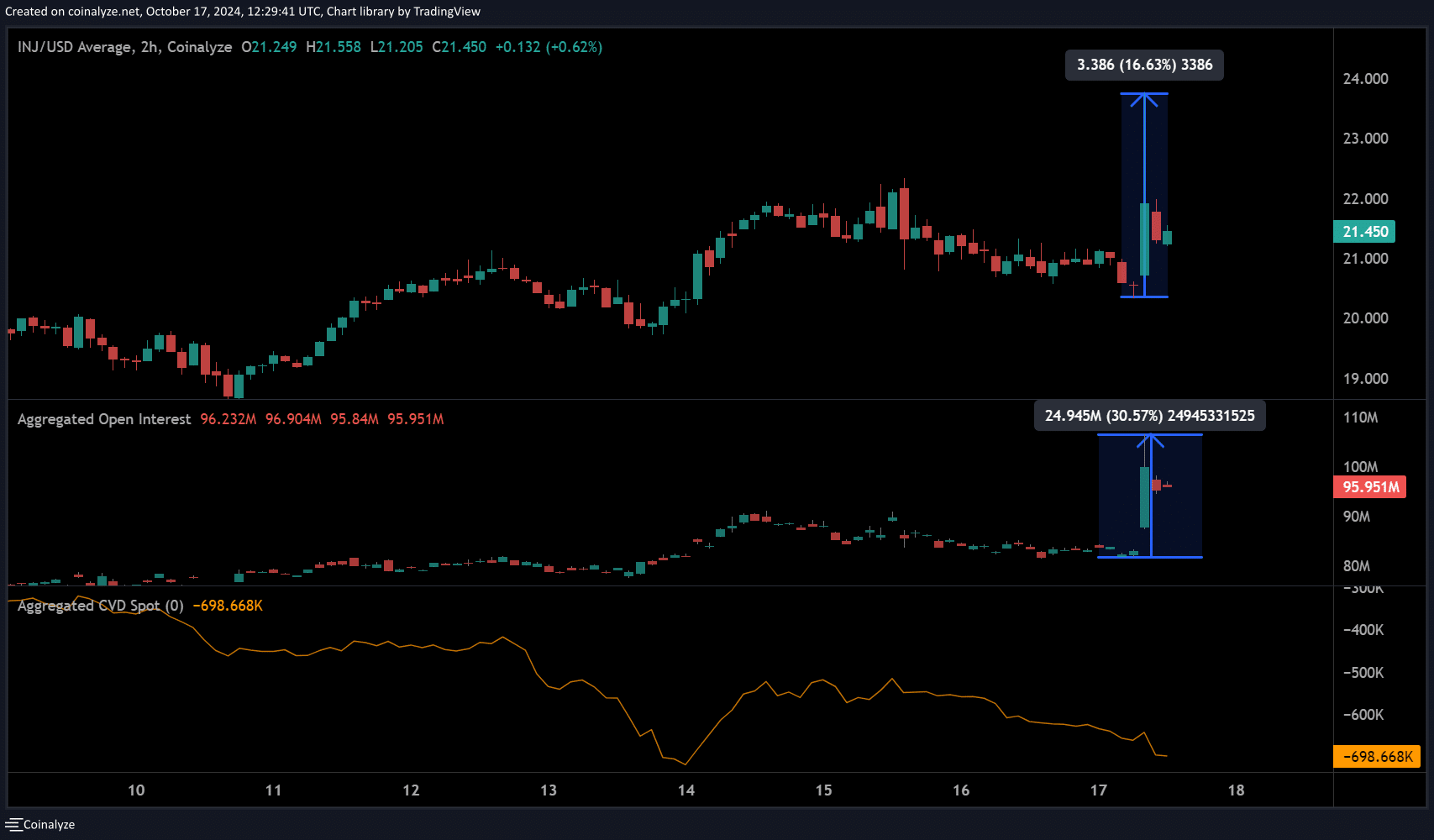

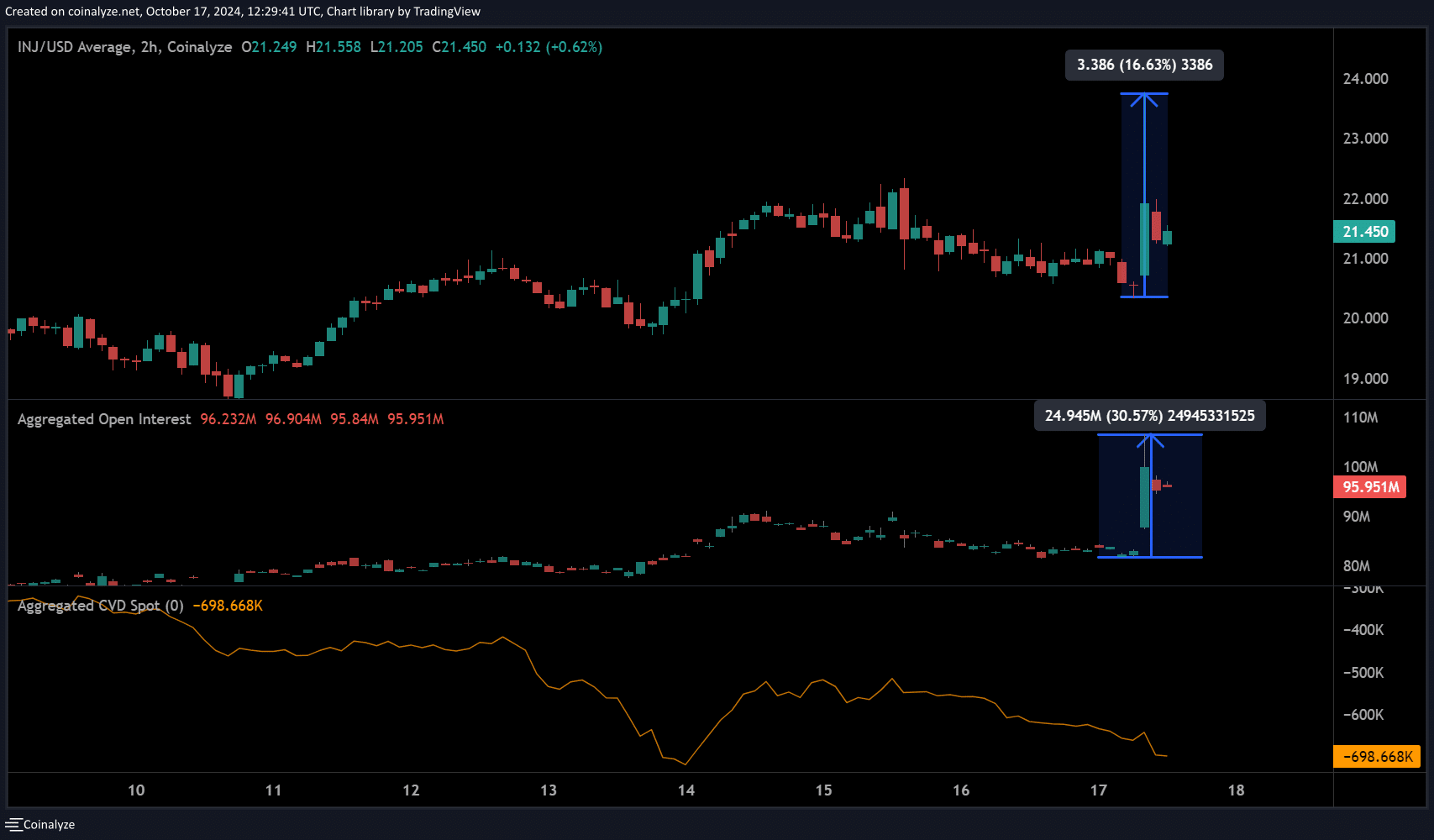

The rally added more than 15 million INJ open interests to the Binance exchange, according to Coinalyze data.

This means that leveraged traders have driven the explosive rally as spot demand has slowed, as evidenced by low spot CVD (cumulative volume delta).

For context, CVD measures buying and selling volume across exchanges, and a downward trend indicates that selling volume (sellers) is dominant.

Source: Coin Analysis

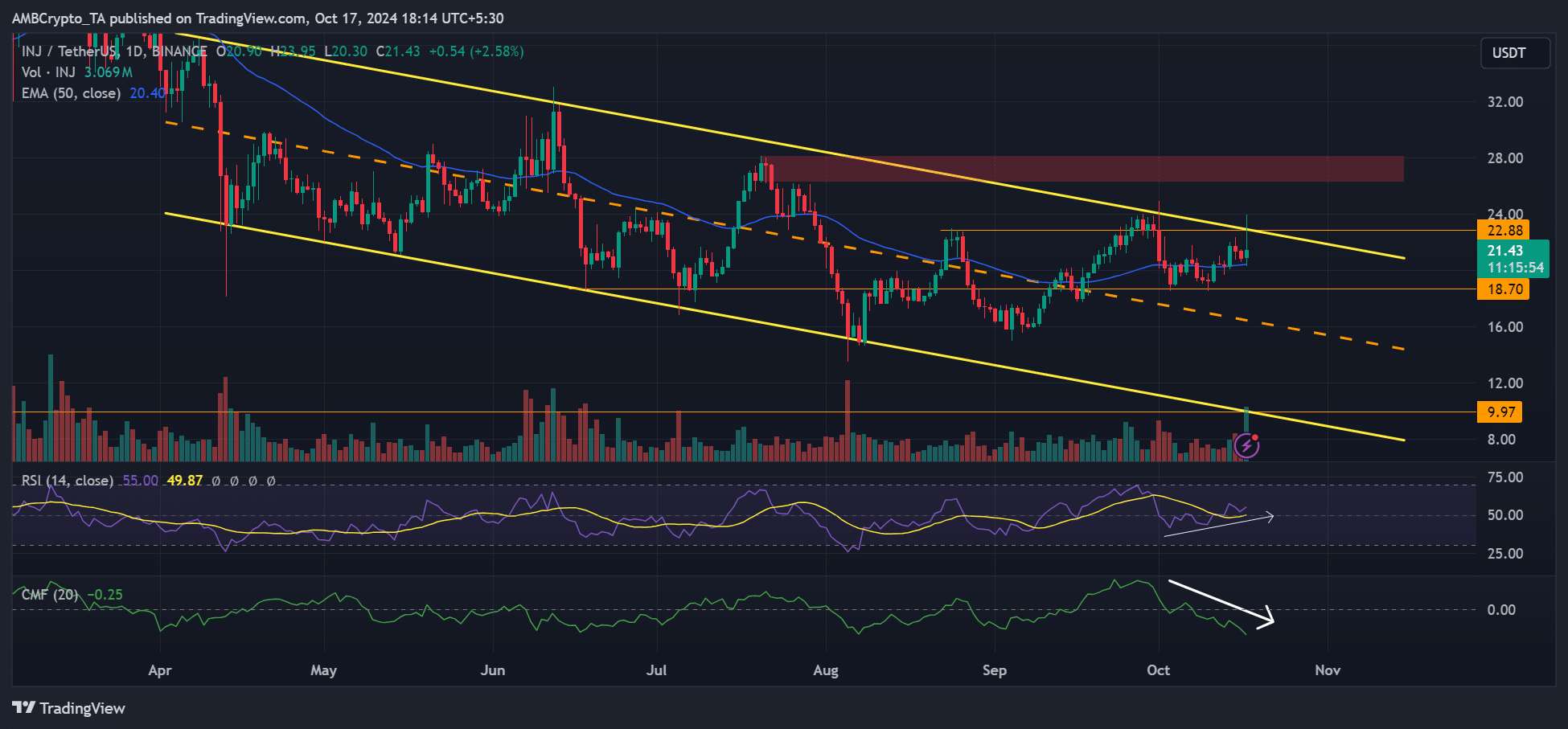

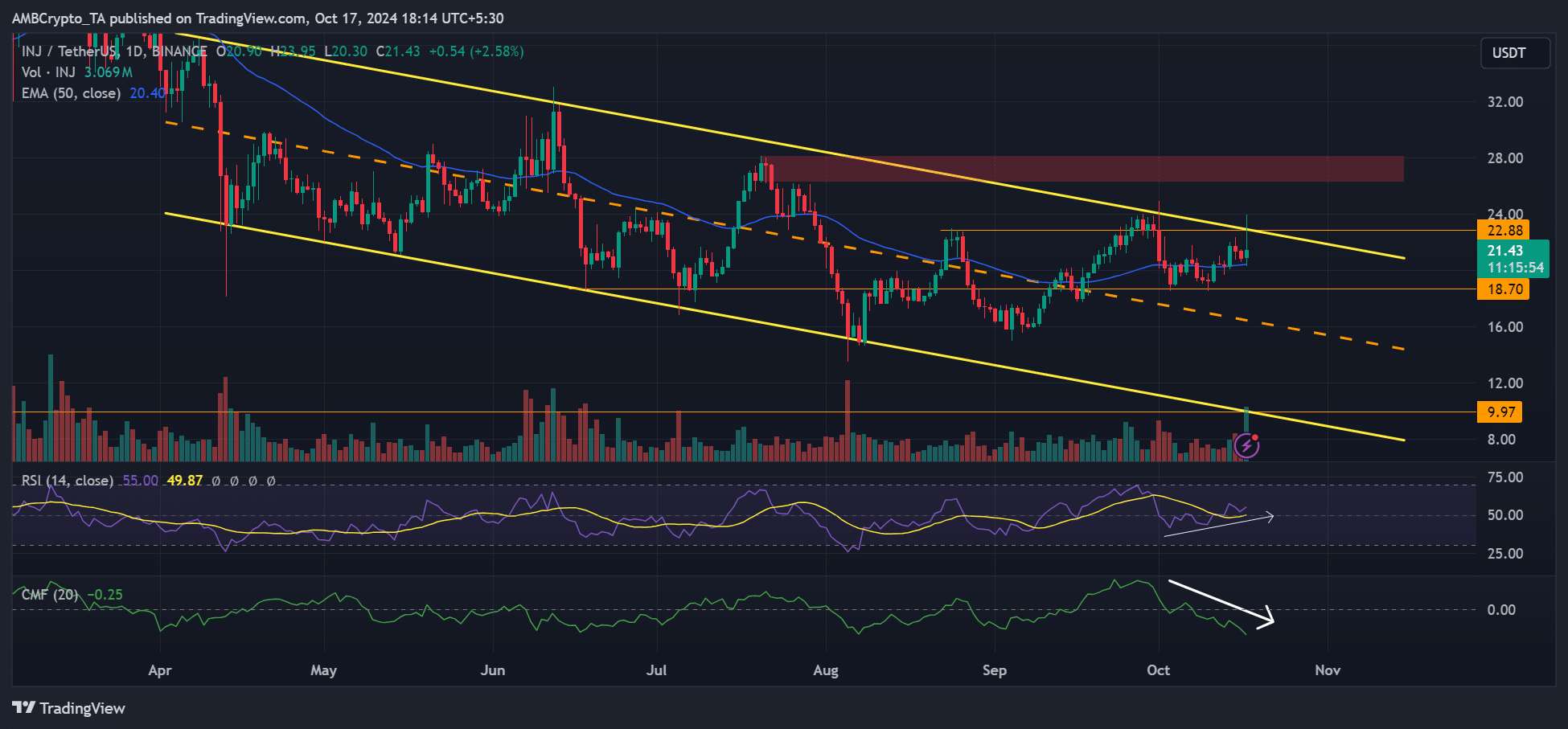

On the higher timeframe charts, Thursday’s pump strengthened INJ’s bullish market structure. This is especially true in October with higher lows and higher highs.

The rally hit the high point of the descending channel (yellow). However, it failed to definitively break down the downward trend structure.

Source: INJ/USDT, TradingView

INJ is on the verge of a breakout, but has been facing massive outflows from the market since late September. This is indicated by the southbound Chaikin Money Flow (CMF). Low capital inflows may delay the prospect of a breakout.

However, at the time of going to press, INJ had defended the 50-day EMA as support and could attempt another rise from the level. If so, $24 or $28 could be the next target, especially if the bullish momentum continues over the next few days.

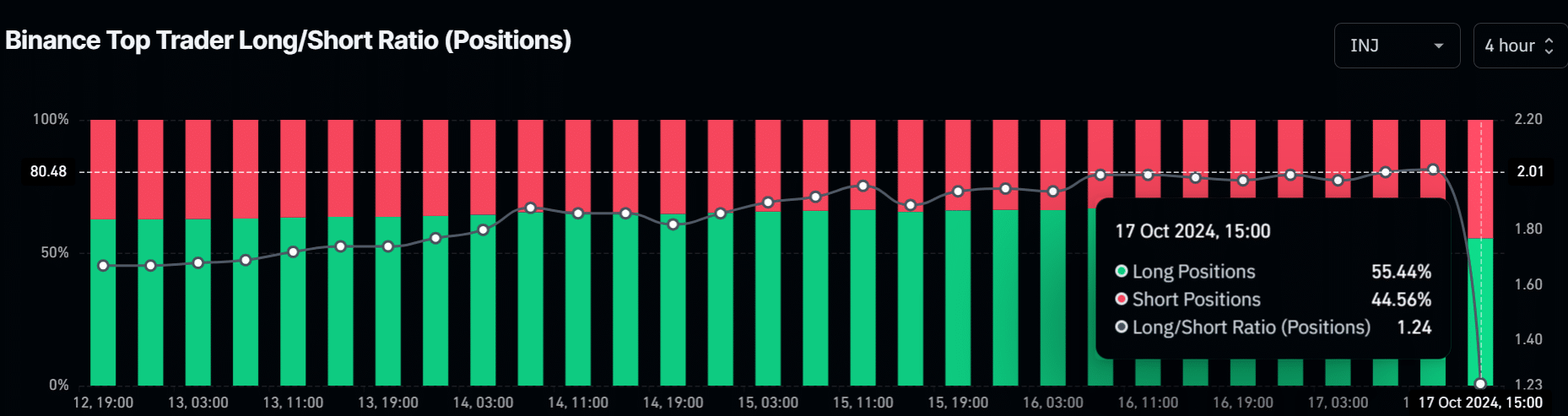

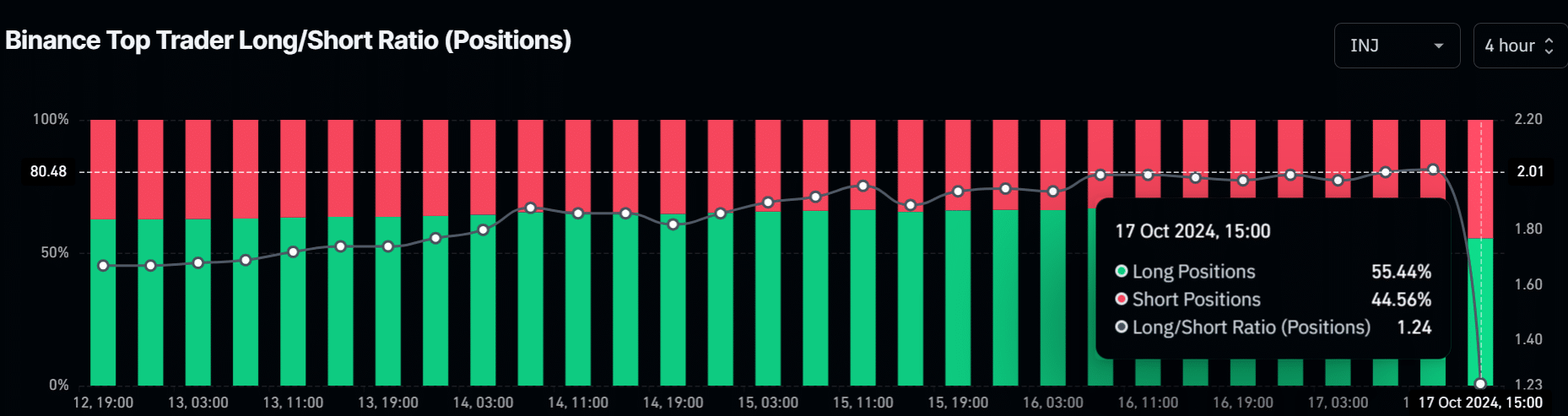

However, it is worth noting that Binance’s smart money was net long the token and 55% of positions were betting on INJ’s price rising.

Source: Coinglass