- This suggests that XRP’s social dominance has surged, reaching $0.70.

- Technical analysis suggests that the price will fall to $0.50 before rebounding.

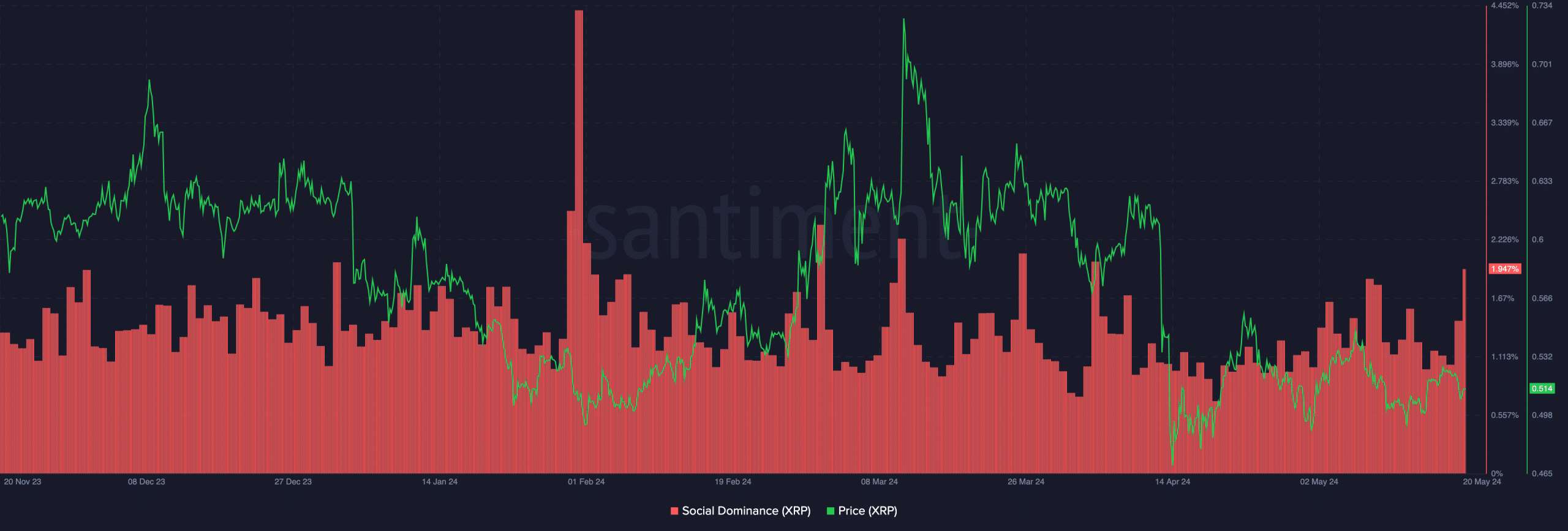

Ripple (XRP) has lost 9.45% in value over the past 90 days. However, discussions about the token reached their peak after April 4, AMBCrypto confirmed.

At press time, Santiment showed that XRP’s social dominance was 1.947%. This indicates that the number of XRP posts is higher compared to other cryptocurrencies.

One thing we observed was that social dominance seemed to be correlated with price. For example, during periods when indicators surge, token prices rise.

One example is December 2023, when XRP surged to $0.67. Another was in March when the price jumped to $0.72.

Looking at this past performance, it appears that XRP has started a move that could push the price up to $0.70.

Source: Santiment

XRP must first break above $0.56.

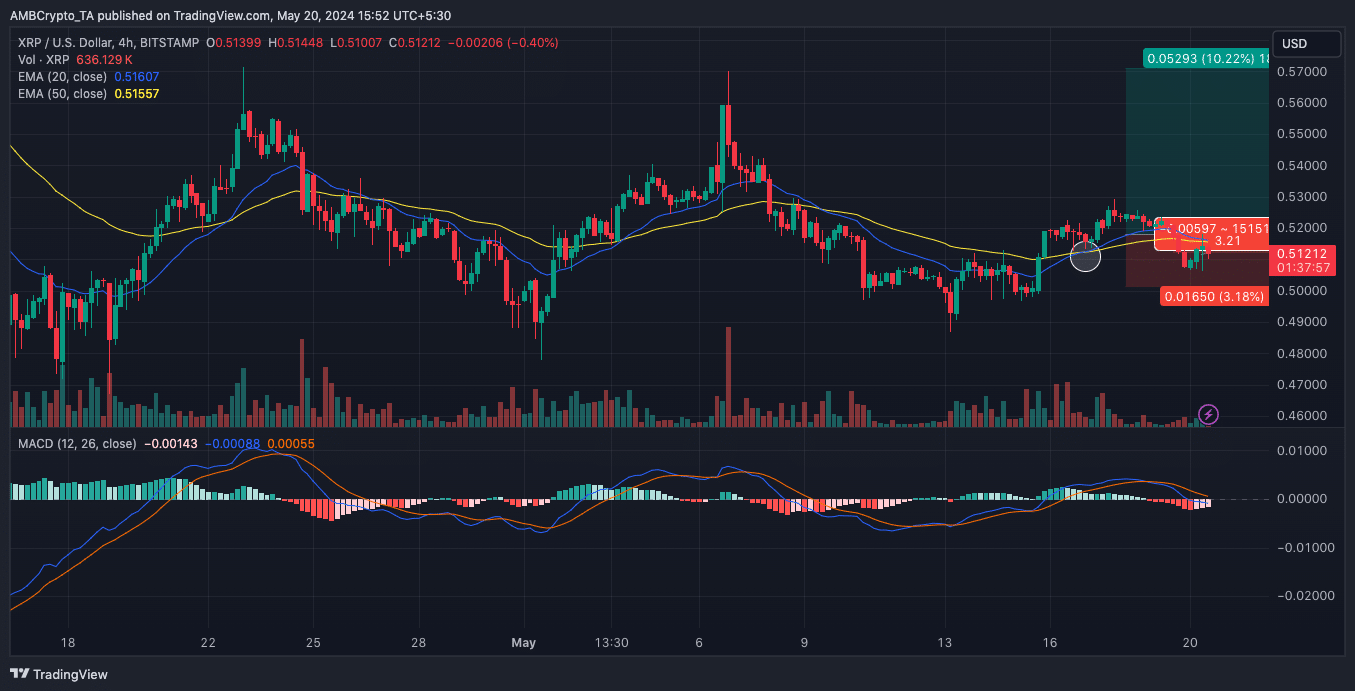

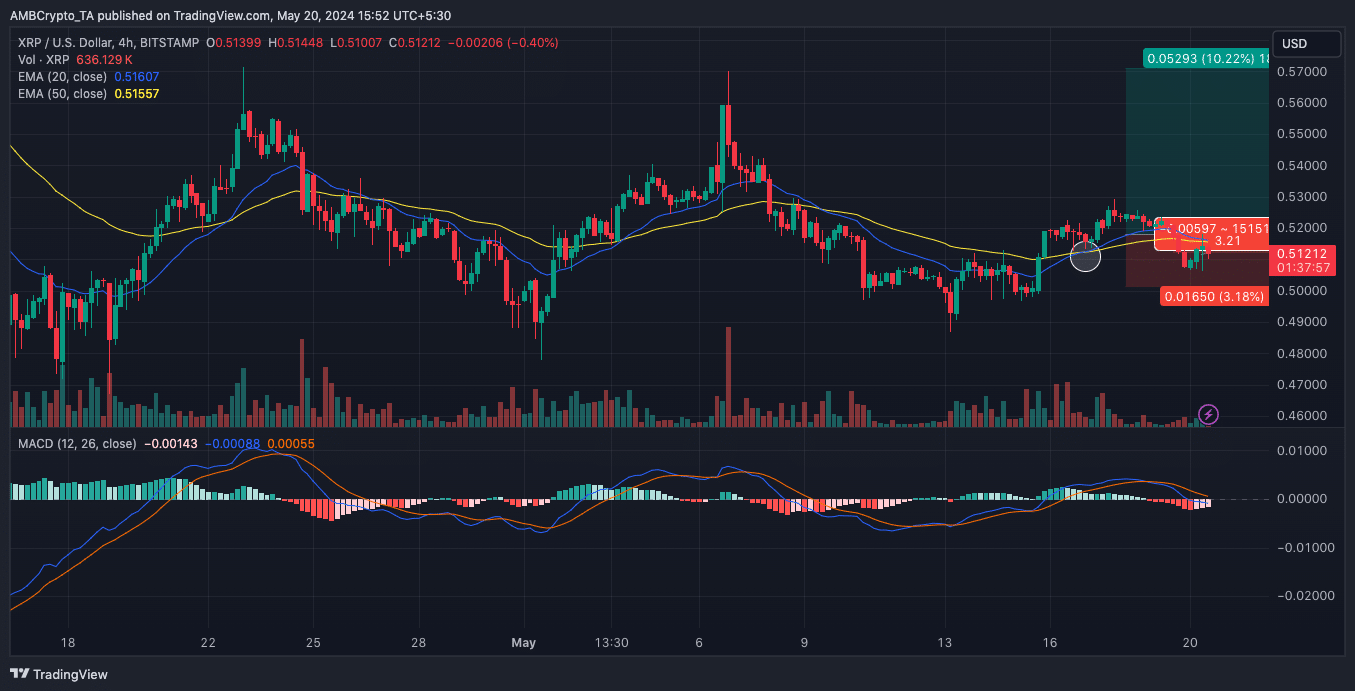

AMBCrypto also analyzed the potential of XRP from a technical perspective. One of the indicators considered was the exponential moving average (EMA).

On May 17, the 20 EMA (blue) crossed the 50 EMA (yellow). This is called a golden cross and is a signal that prices may rise.

Validation of this trend could push XRP above the $0.56 overhead resistance. In this case, the price of the cryptocurrency may rise and reach $0.70.

However, the 4-hour chart showed that XRP is on the verge of falling below both EMAs. When this happens, optimistic claims can become invalid.

The moving average convergence divergence (MACD) was also negative. MACD shows bullish or bearish momentum. If positive, the indicator supports bullish momentum and the possibility of price increases.

On the other hand, a negative reading of the indicator suggests that bulls do not yet have a clear advantage over bears. Therefore, XRP may retreat towards the $0.50 support level before rebounding towards $0.70.

Source: TradingView

What else is happening?

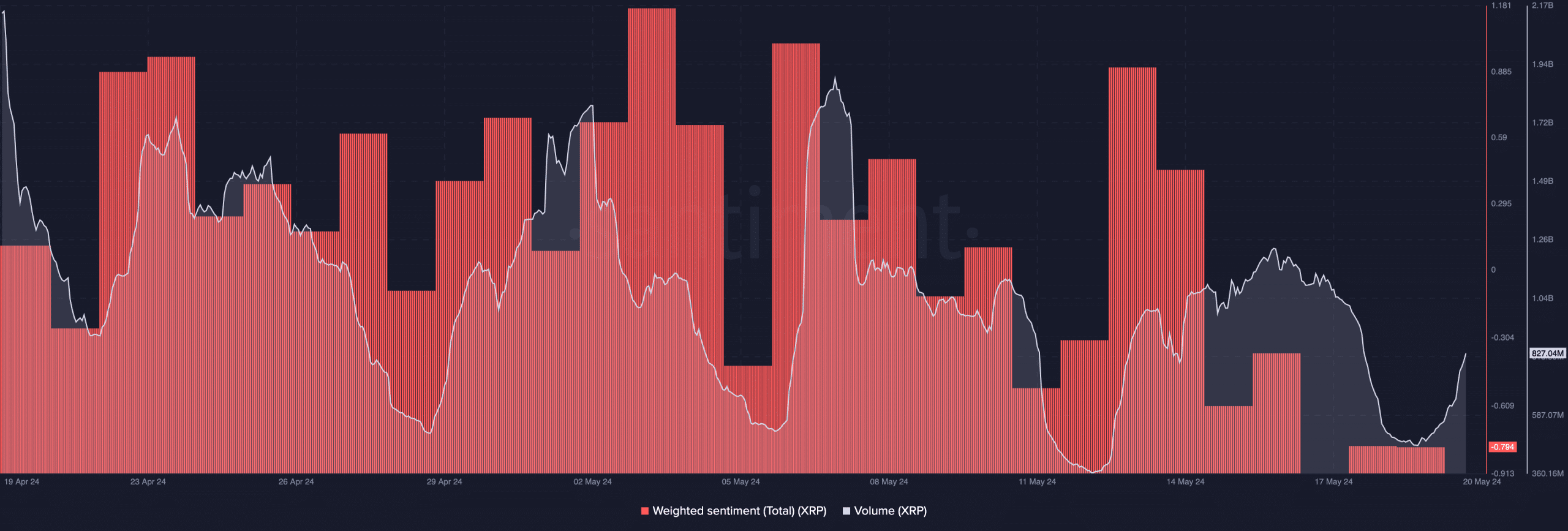

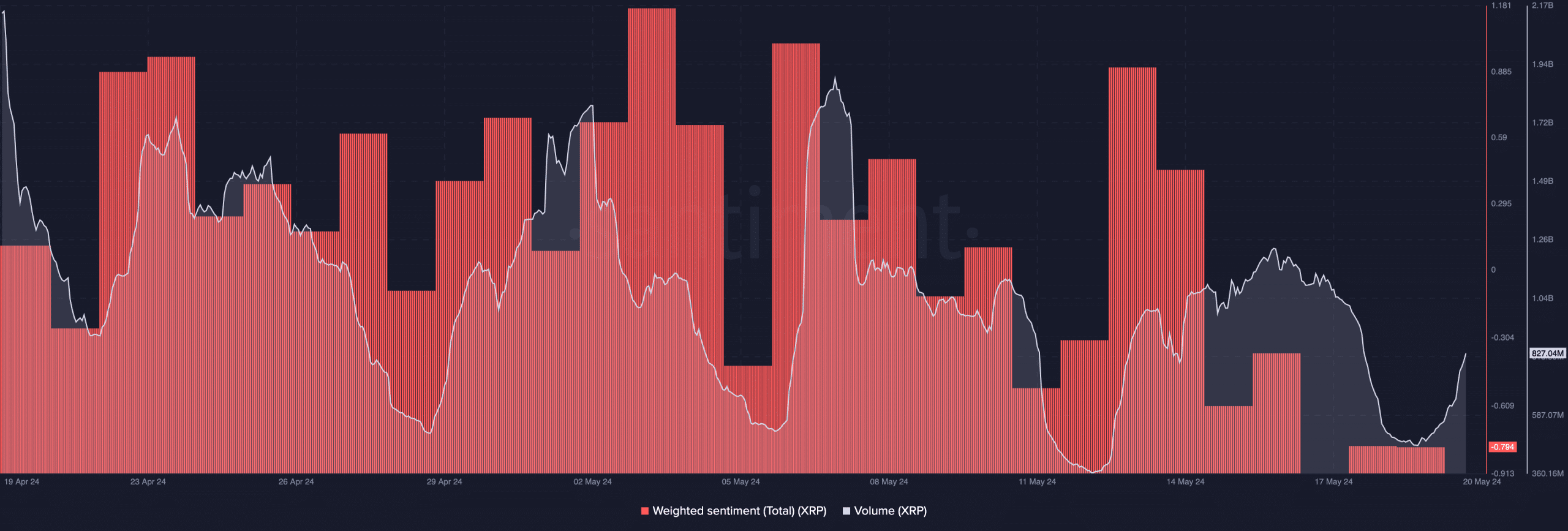

Let’s take a look at the sentiment surrounding the project. According to Santiment’s data, Weighted Sentiment was -0.794.

Weighted Sentiment shows unique social commentary (positive or negative) about a token.

A positive indicator means the broader view is optimistic. A negative reading suggests otherwise. So it appears that only a few participants had good things to say about XRP.

Source: Santiment

If this continues for some time, there is a possibility of a drop below $0.50. However, if the reading falls too low, the stage for a rebound for XRP could be set and validated at $0.70.

Is your portfolio green? Check out our XRP Profit Calculator

Moreover, looking at the trading volume of cryptocurrency, it was found that it actually increased. If trading volume increases while the price is falling, the price of XRP may fall.

However, to validate a rise above the $0.56 resistance, higher volume would need to support upward price action.